Cryptocurrencies broke the $1 trillion market capital resistance on March. 26, this was holding strong for that previous 41 days. Despite Bitcoin’s (BTC) modest 5.5% weekly gains, the mixture worth of 20,000 listed tokens elevated by 8.5% between March. 24 and 31.

The cryptocurrency market was positively influenced by a 6.3% weekly rally within the Russell 2000 mid-capital stock exchange index. Some encouraging news supported the positive tailwinds from traditional markets.

For example, 55,000 BTC was withdrawn from Binance on March. 26, an archive high. Typically, analysts think about the reduced quantity of coins deposited on exchanges a bullish indicator, because the immediate selling pressure eases.

Furthermore, exchange and wallet provider Blockchain.com partnered with payment processing giant Visa to produce a crypto card. The cryptocurrency company revealed on March. 26 there could be no sign-up or annual charges, no transaction charges and users would earn 1% of purchases in digital assets.

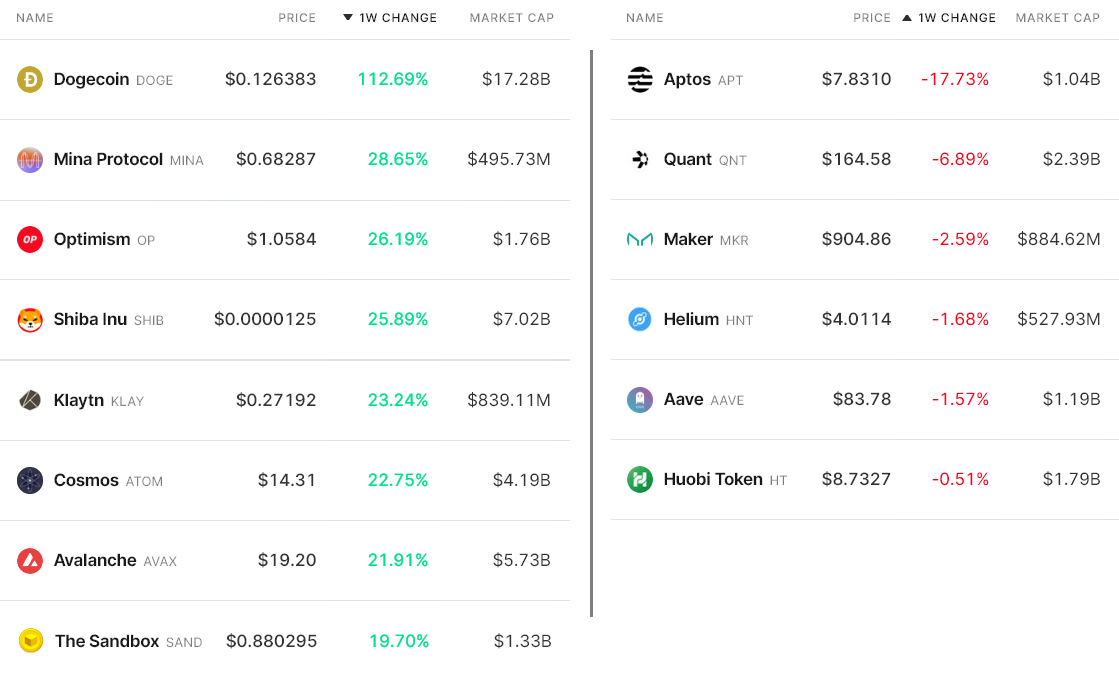

Rather of concentrating on Bitcoin, cryptocurrency traders have spread their bets across altcoins. Consequently, evaluating the winners and losers one of the top 80 coins provides skewed results, as seven rallied 20% or even more in the last week.

Dogecoin (DOGE) rallied 112% after Elon Musk, the millionaire Chief executive officer of SpaceX and Tesla, completed his purchase of the Twitter social networking network. Musk’s broadly known desire for the memecoin inspired traders to boost expectations of potential payment integrations.

Mina Protocol’s MINA token acquired 28% following its ecosystem update set of March. 27, which highlighted its zero-understanding testnet. The protocol promises efficient layer-1 smart contract zkApps, adding unique privacy features and the opportunity to connect with exterior data sources.

The native tokens of smart contract systems Klaytn, Cosmos and Avalanche — KLAY, ATOM (ATOM) and AVAX (AVAX), correspondingly — rallied following Ether’s (ETH) 16.5% gains. Furthermore, the Ethereum network has continued to be clogged, with average transaction charges above $3 within the last three days.

Stablecoin demand continued to be neutral in Asia

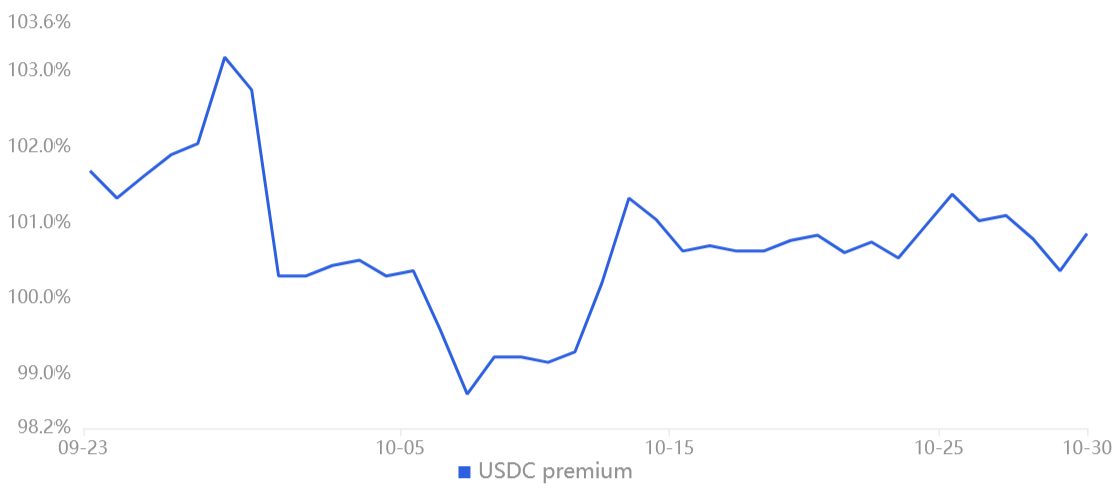

The USD Gold coin (USDC) premium is a great gauge of China-based crypto retail trader demand. Its dimensions are the main difference between China-based peer-to-peer trades and also the U . s . States dollar.

Excessive buying demand has a tendency to pressure the indicator above fair value at 100%, and through bearish markets, the stablecoin’s market offers are flooded, creating a 4% or greater discount.

Presently, the USDC premium is 100.8%, flat in comparison to the previous week. Therefore, regardless of the 8.5% cryptocurrency market capital increase, no additional demand originated from Asian retail investors. However, such data shouldn’t be worrisome, because it partly reflects the entire capital being lower 56% year-to-date.

Futures markets show mixed sentiment

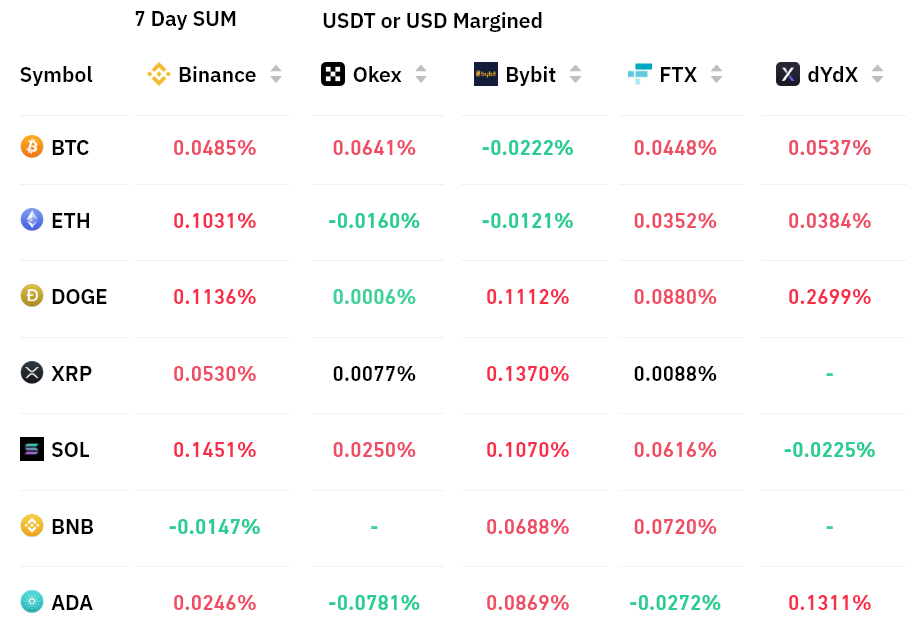

Perpetual contracts, also referred to as inverse swaps, come with an embedded rate usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

As portrayed above, the accrued seven-day funding rates are either slightly positive or neutral for that largest cryptocurrencies by open interest. Such data signifies a well-balanced demand between leverage longs (buyers) and shorts (sellers).

Thinking about the lack of stablecoin demand in Asia and mixed perpetual contract premiums, traders lack confidence although the total crypto capital broke over the $1 trillion mark.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.