Bitcoin (BTC) remained still in the November. 1 Wall Street open as traders rooted for clues more than a possible direction.

About an outbreak remain despite BTC sell wall

Data from Cointelegraph Markets Pro and TradingView demonstrated a narrow range in position for BTC/USD overnight, your day seeing local highs of $20,681 on Bitstamp.

Markets were acutely waiting for news in the U . s . States Fed on rates of interest, that is scheduled for just two:00 pm Eastern Time on November. 2.

For now, it’ a situation of “wait and find out,” during-chain monitoring resource Material Indicators noted sell-orders already growing.

“The binance order book is beginning to resemble a bet on Tetris,” it summarized.

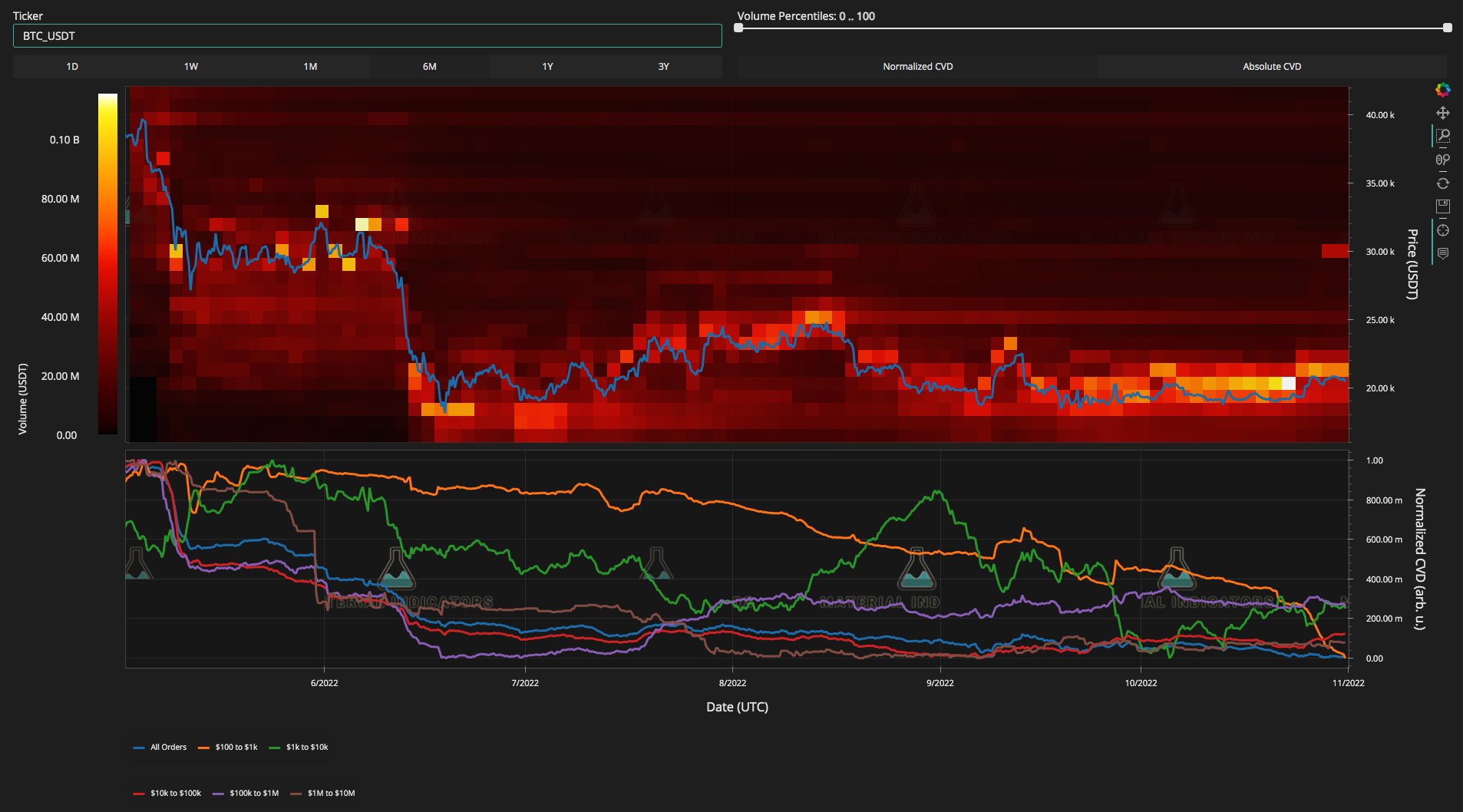

A chart demonstrated resistance being added just beneath $30,000 in the March. 31 monthly close.

“If that $46M block at ~$30k drops in to the active buying and selling range, it’s likely to hammer cost lower. On the contrary, whether it will get lifted BTC should run,” Material Indicators ongoing.

“Signaling in the Given on Wednesday might be a catalyst.”

Trader Crypto Tony, meanwhile, highlighted the opportunity of upside to reenter according to recent performance.

“Bulls walked in in the proper time to protect the support zone,” he tweeted alongside an illustrative chart.

“Now now you ask , will we obtain a power up came from here, or dip to get the liquidity lows then pump.”

The monthly close arrived around $20,500 for Bitcoin, marking a modest increase over September and October’s gains of 5.6%, based on data from Coinglass.

DOGE divides with ongoing bull run

The primary story centered on altcoins at the time as Bitcoin ranged.

Related: BTC cost sees ‘double top’ before FOMC — 5 items to know in Bitcoin now

Ongoing a lift received thanks to Tesla Chief executive officer Elon Musk, Dogecoin (DOGE) furthered gains at the time, reaching its greatest since late April in U.S. dollar terms and greatest since June 2021 priced in BTC.

“A test of $.17 EQ level appears inevitable at this time,” Crypto Tony predicted in separate analysis.

“No doubt we’ll continue seeing more Doge tweets in the master themself Elon Musk.”

Others were less convinced, with fellow popular trader Anbessa cautioning on adding DOGE exposure at current levels.

“Caution, particularly if you Fomo now & haven’t caught the entire move,” a part of Twitter comments read.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.