Throughout the European session, the Bitcoin cost conjecture remains bullish following a Federal Reserve’s rate of interest decision. After three consecutive “jumbo” rate hikes of .75 percentage points each, the Fed finally announced another rate increase on Wednesday, that one a complete .75 percentage points greater in order to slow inflation.

While a boost in rates of interest can help to eliminate inflation by discouraging consumers from dealing with new debt, it will likewise boost the debt service payments of american citizens who’re already battling to maintain the the cost of living, including food, clothing, and shelter.

Fed’s Powell: There Is No Indication That Inflation Is Decreasing

The Fed has elevated rates of interest by .75 percentage points in the ongoing combat inflation.

The markets reacted negatively when Given Chair Jerome Powell indicated a rationale for halting the increases by saying it had been “very premature” to go over a pause.

Consumer Cost Index figures reveal that year-over-year inflation has continued to be persistently high, falling from the June a lot of 9.1% to eight.2% by September. That’s way over the twoPercent inflation target set through the government.

Important thing to remember:

At its December 2022 meeting, the Given could choose to make lesser rate of interest hikes compared to quick three-quarter point moves. However, it’s prone to increase rates greater than expected.

Furthermore, Mr. Powell makes it obvious that as inflation has shown surprisingly persistent, the path toward a fiscal soft landing is becoming narrower.

The market’s takeaway from his statement was obvious: “I’d like folks to understand our dedication to it.”

Bitcoin Cost Conjecture –

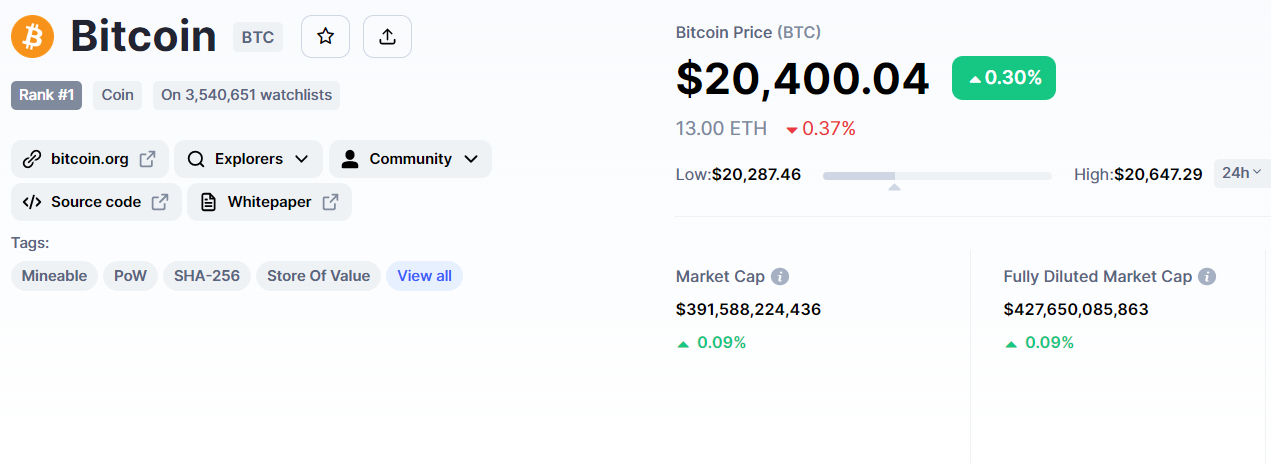

Bitcoin’s response to the speed hike continues to be quite mixed, with BTC surging to check a powerful level of resistance of $20,800 but neglecting to break above this level. It eventually fell to trade at $20,200. CoinMarketCap is presently first, having a $427 billion live market capital, lower from $431 billion throughout the Asian session.

The BTC/USD pair is buying and selling within an upward funnel within the 4-hour time-frame, with support near $20,300 and resistance near $20,700. The 50-day moving average is extending support close to the $20,400 level, and candle lights closing above this line indicate a bullish trend in Bitcoin.

The RSI and MACD continue being bearish, indicating a small weakness within an upward trend. Consequently, a bearish breakout from the $20,300 support level could extend the selling trend before the next support level at $19,950.

Around the plus side, elevated interest in Bitcoin may let it break with the $20,800 resistance zone and achieve the $21,000 level. An additional bullish breakout over the $21,000 level might take BTC to $21,450.

Top Gold coin Alternative – Dash 2 Trade

In recent days, numerous new altcoins have outperformed the marketplace, with pre-purchase tokens showing especially advantageous for traders who may be unable to wait a couple of more several weeks for big returns.

Dash 2 Trade, a cryptocurrency analytics and intelligence platform for traders and investors, is presently in pre-purchase. It’s best referred to as something like a Bloomberg terminal for individuals thinking about cryptocurrencies.

D2T has piqued the eye of crypto investors worldwide, raising over $4 million per week during its pre-purchase. Furthermore, pre-sales happen to be brisk lately, and D2T is well-positioned to take advantage of the popularity.

Get The Best Cost to purchaseOrMarket Cryptocurrency