Because the crypto community still attempts to decipher Terra’s ongoing pegging-de-pegging fiasco with regards to its stablecoin offering TerraUSD (UST), major crypto exchange Binance temporarily suspended the withdrawals for Terra (LUNA) and UST on Tuesday.

The marketplace worth of UST, Terra’s stablecoin offering, lately fell underneath the expected $1.00 cost point as LUNA’s cost observed a sharp decline because of a significant selloff. Simultaneously, the BTC/UST buying and selling pair on Binance arrived at highs in excess of $42,000, while other Bitcoin dollar markets battled to preserve $30,000, reported by Cointelegraph.

That has caused an enormous boost in BTCUST (Not Bitcoin valued in dollars, but valued within the UST stablecoin). pic.twitter.com/Xn7qcy4VMZ

— Blockchain Backer (@BCBacker) May 10, 2022

Like a reactionary measure from the ongoing uncertainty inside the Terra ecosystem, Binance suspended all withdrawals for LUNA and UST tokens for six hrs (between night time to six:00 AM EST), citing a higher amount of pending withdrawal transactions.

Withdrawals for $LUNA and $UST around the Terra network have finally started again on Binance.

We continuously monitor the network conditions and supply further updates here if needed.

— Binance (@binance) May 10, 2022

Based on Binance, our prime amount of pending UST transactions is a result of network slowness and congestion. While acknowledging the potential inconvenience to the investors, Binance mentioned:

“Binance will reopen withdrawals of these tokens after we deem the network to become stable and the level of pending withdrawals has reduced. We won’t inform users inside a further announcement.”

Crypto Twitter, however, reacted to Binance’s announcement by questioning the natural values of decentralization the crypto community means — evaluating the proceed to a centralized approach usually sported by traditional finance.

Hmm… jogs my memory many of our shitty legacy economic climate. https://t.co/yF11hj4i5N

— Ergo Whale (@ergo_whale) May 10, 2022

As users around the world get barred from withdrawing their very own funds, the city reiterated the saying “not your keys not your coins,” and highlighted Binance’s funds’ suspension among the major cons of the centralized crypto exchange.

However, some people from the community supported the move by proclaiming that Binance Chief executive officer Changpeng “CZ” Zhao helped many investors from liquidating themselves by selling a stablecoin at $.70.

While Terra continues to locate a permanent means to fix the shedding worth of UST, numerous crypto entrepreneurs including Polygon co-founder Sandeep Nailwal demonstrated support for that co-founder and Chief executive officer of Terraform Labs, Do Kwon.

I haven’t adopted LUNA/UST ecosystem or community discourse much BUT in a founder to founder level, I’m able to sense of @stablekwon

He’s in the epicentre of the industry wide event, handling a lot pressure & responsibility at this type of youthful age.

Best of luck to him & Luna community!— Sandeep – Use Stripe on Polygon (@sandeepnailwal) May 10, 2022

Related: Terra’s UST flips BUSD to get third-largest stablecoin

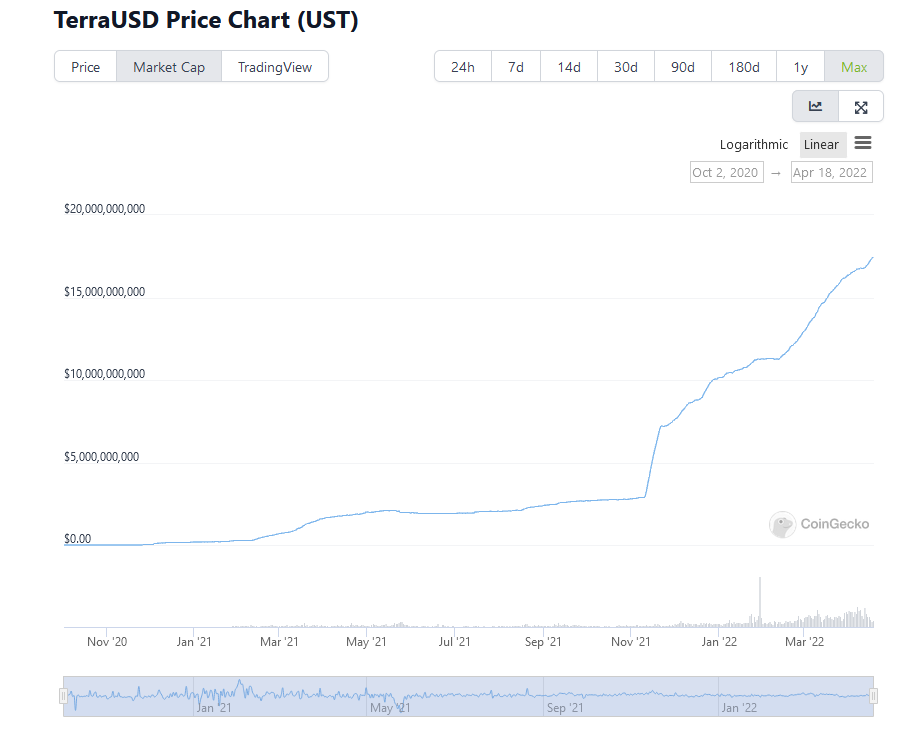

On April 18, UST flipped Binance USD (BUSD) to get the 3rd-largest stablecoin available on the market after Tether (USDT) and USD Gold coin (USDC) according to market capital.

Cointelegraph’s report according to data collected from CoinGecko demonstrated that UST’s total market capital had surged 15% in the last thirty days to sit down at roughly $17.5 billion, that was slightly greater than BUSD’s market cap of $17.46 billion.

However, the current turbulence over the Terra ecosystem has led to BUSD regaining its position because the ninth-largest cryptocurrency when it comes to market capital. During the time of writing, UST maintains tenth position within the list with roughly $16.5 billion in market cap.