Bitcoin (BTC) upended buy trends through May 10 as BTC/USD sank below $30,000 the very first time since This summer 2021.

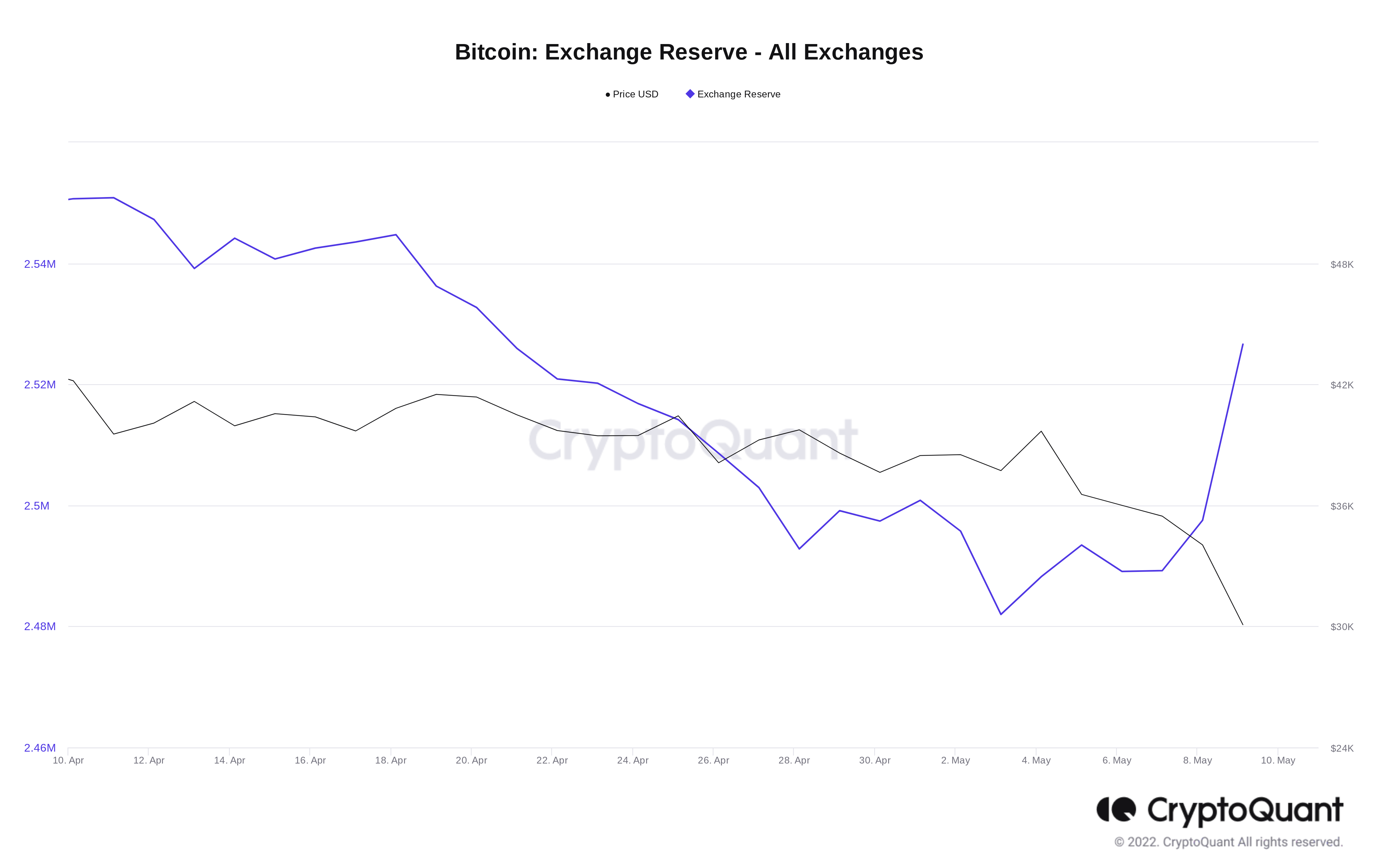

Data from on-chain analytics firm CryptoQuant demonstrated exchange reserves start growing as panic gripped crypto markets.

BTC flows to exchanges

Having seen a sustained downtrend, the quantity of BTC on major exchanges has started to improve again.

Based on CryptoQuant, which tracks the total amount of 21 major exchanges, sellers sent as many as 37,537 BTC to accounts from May 6 to May 9 inclusive.

The deposits came as BTC cost action fell from $36,000 to $29,700, subsequently recovering to close $32,000 during the time of writing on May 10.

Privately comments to Cointelegraph, CryptoQuant mind of promoting, Hochan Chung, stated the sell-off didn’t just involve speculators, but created the next thing of the more concerted need to reduce BTC exposure from Bitcoin’s greatest token holders.

“The massive inflow wasn’t beginning just yesterday. It’s began since May,” he stated.

“Bitcoin cost declines on whale selling. Since early May, growing exchange reserves happen to be more and more covered with whale deposits. As whales move their coins to exchanges it puts downward pressure to bitcoin cost.”

Other sources, as Cointelegraph reported, also observed altering whale behavior, this nevertheless occurring easily above Bitcoin’s recognized cost of around $24,000.

Longs get punished across crypto

Simultaneously, other traders were less fortunate.

Related: ‘Kwontitative easing’ — BTC cost hits $43K in UST as Terra empties $2.2B BTC bag

Based on figures from on-chain monitoring resource Coinglass, Bitcoin’s fall below $30,000 triggered a part of crypto market liquidations worth over $1 billion.

Nearly all individuals were lengthy positions originating from altcoins. Within the 24 hrs towards the duration of writing, BTC taken into account around $330 million from the liquidations total, along with the rest from altcoin tokens.

When it comes to short-term cost targets, however, the weekend’s CME futures gap dedicated to $35,000 was gathering recognition among traders at the time.

“Bitcoin appears like it’s on the pursuit to recover that CME gap,” popular Twitter account IncomeSharks stated.

“The individuals who offered $34,000 to purchase back at $37,000 will finish up buying back above $40,000. Happens each time at bottoms. Bears getting greedy.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.