Like the majority of new-age systems, Solana was created to solve major issues confronting the blockchain industry. As the network has addressed a few of these issues because of its nature, it’s also experienced a couple of unique problems.

From resource exhaustion to some halt in block confirmation, the Solana network has endured numerous setbacks that led to repeated power outages, resulting in the network to seal lower for hrs on several occasions.

The network went lower on December 4, 2020, around three years after Solana was introduced, causing confusion locally.

The chain seems to possess stopped validating new blocks at slot 53,180,900, stopping transaction confirmations. The network engineers discovered and glued the issue, but it absolutely was lower for roughly six hrs.

In addition, on September 14, 2021, the state Solana Support Twitter handle revealed the network have been experiencing “intermittent instability” for roughly forty-five minutes.

Based on the report, resource exhaustion would be a likely reason for the problem that led to a denial and services information. Based on the support handle, the engineers were focusing on the problem and searching into the potential of a restart whether it endured.

The network lately experienced another outage, which makes it the seventh who’s continues to be disrupted. This time around, the issue was brought on by bots initiating a lot of transactions on Metaplex, a nonfungible token (NFT) marketplace built on Solana. The outage lasted roughly seven hrs.

Presently, the Solana validators are now being slowed lower, based on George Harrap, co-founding father of Step Finance — a Solana portfolio manager — because bots are spamming NFT mint and arbitrage transactions. These have immense bandwidth needs, so a substantial number comes with an impact.

“Solana isn’t a centralized entity with one individual who are able to decide. It’s to the 1700+ validators to determine how to proceed. Most of them are applying fixes and reaching consensus on which will be completed in the very best interests from the network,” Harrap told Cointelegraph. He stated:

“According to Nansen research, you will find frequently 10-occasions more transactions on Solana than Ethereum. What this means is Solana is coping with demands not faced by other blockchains which is new territory. So, hiccups are anticipated.”

While Ethereum’s OpenSea continues to be probably the most well-known NFT marketplaces so far, Metaplex, built around the Solana network, is progressively gaining traction and allowing users to mint then sell NFTs around the Solana blockchain.

Because of the recent marketplace issue and Solana’s persistent blackouts, however, it wouldn’t come as a surprise if quite a few users start to reconsider.

Harrap added that “there are presently some validator node updates within the pipeline and under research to repair this. This really is mainly by means of new communication protocols between nodes (like QUIC) and changes towards the Chocolate Machine contract utilized by NFT minters where unsuccessful transactions get in a fee.”

Solana seeks to deal with the blockchain trilemma

Solana went fully operational 2 yrs ago. The network is regarded as among the Ethereum killers through the crypto community. These Ethereum killers are systems that try to outshine the Ethereum blockchain when it comes to adoption by addressing some problems that have come to light because of the Ethereum blockchain’s current heavy reliance upon the proof-of-work (Bang) consensus mechanism.

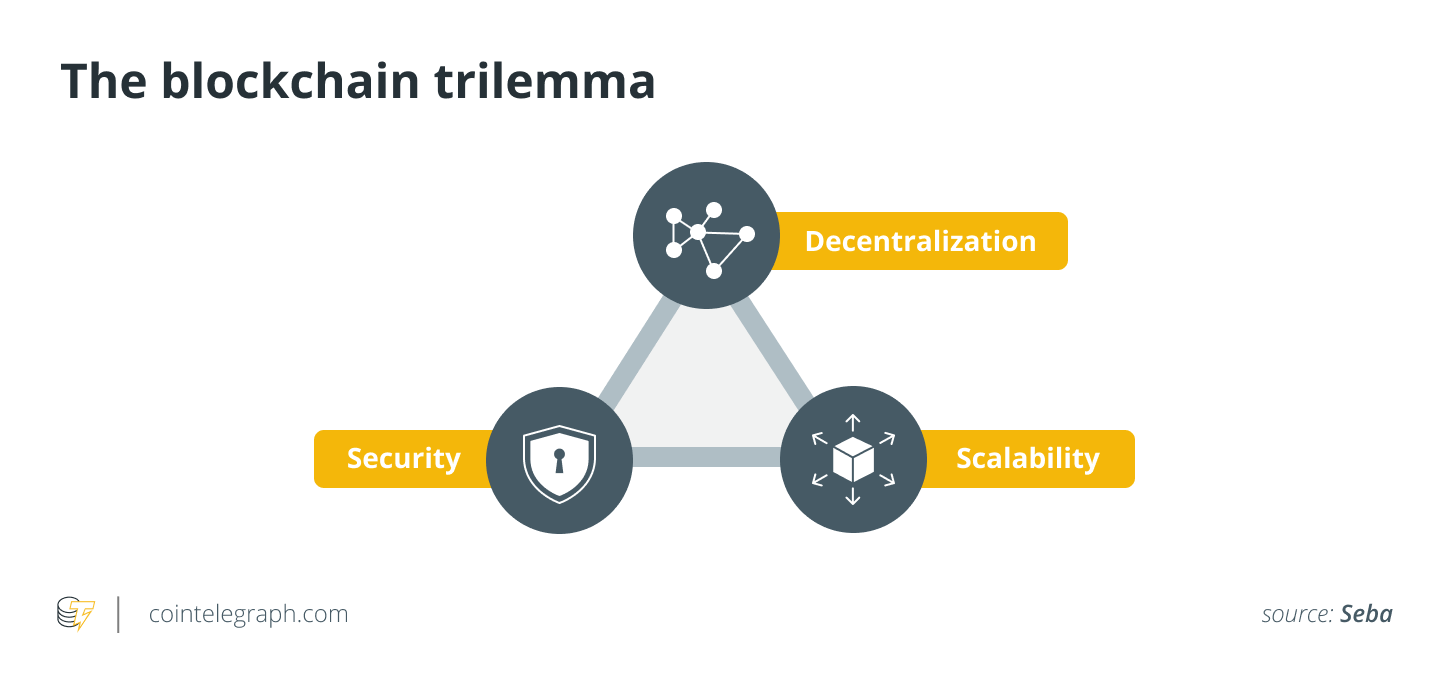

Solana was designed using the blockchain trilemma in your mind, an idea suggested by Vitalik Buterin, a Canadian-Russian programmer and co-founding father of Ethereum.

Based on the blockchain trilemma, while decentralization, security and scalability would be the three primary options that come with a effective blockchain, an average blockchain would only have the ability to provide a couple of them while sacrificing one.

The Solana network aims to deal with this by an evidence-of-history (PoH) mechanism right into a proof-of-stake (PoS) blockchain. With PoH, the network delegates a main node to find out a transaction time the entire network can agree with. This accelerates transactions, however it sacrifices decentralization, that is a key feature of the blockchain.

Based on Hisham Khan, founder and Chief executive officer of Aldrin, users have switched to layer 2s along with other layer 1s like Avalanche in addition to temporary methods to Ethereum. But, it doesn’t really solve the present scalability issues, transaction costs and speed. He told Cointelegraph:

“If you consider the transactions per second, Solana ranks consistently within the top 5. To gauge how promising an ecosystem is, consider the quantity of developers. Unsurprisingly, Solana keeps growing most abundant in developers joining.”

“Scalability and stress exams are essential for the procedure to shape the ecosystem to maturity — we’re not just coping with financial transactions but initial DEX choices, NFTs, bots plus much more,” Khan stated, “All these problems may not appear in 5 years. And, similar to the beginning from the internet, the consumer experience and backend still fit improvement. While users might not spot the difference, you will see an easier process as underlying smart contracts and technology remains developed.”

Concerns happen to be elevated about if the Solana network is really decentralized. Some crypto enthusiasts acknowledge the network’s low charges and notable scalability, they reason that the network isn’t completely decentralized, citing its reliance upon PoH, nearly 50% token allocation to insiders and reliance upon the Solana Foundation for core node development.

And, despite all of this, its scalability still seems to stay in doubt. At the begining of The month of january 2021, the state Solana Support Twitter page acknowledged home loan business performance, which means home loan business transaction throughput over the network. Based on the tweet, the network capacity was reduced to “several 1000 transactions per second,” causing some users’ transactions to fail.

Related: The birth of ‘Ethereum killers’: Would they take Ethereum’s throne?

Solana employs the proof-of-stake mechanism, meaning users can stake their native gold coin Solana (SOL) within the pool to earn rewards. These coins will be commissioned to validators to be able to improve their polling influence within the blockchain consensus. This rapidly confirms the transaction sequence created through the ongoing PoH generator, selects new PoH generators and penalizes mischievous validators.

Even though many users have cheated the Solana staking chance, particularly like a side earnings source, a couple of users around the official Solana Reddit funnel have reported issues staking their SOL using Moonlet wallet and Solana’s Phantom wallet.

A lengthy approach to take

The Solana ecosystem has created numerous decentralized applications (DApps), including lending protocols for example Apricot Finance and Francium, decentralized finance (DeFi) projects for example Orca, Saber, and Raydium, NFT marketplaces for example Metaplex and Solanart and Web3 apps for example Audius and also the Brave Browser.

However, with simply 71 projects, the ecosystem falls far lacking major environments for example Ethereum’s, that has roughly 3,249 projects.

Orca, a decentralized exchange around the Solana blockchain, continues to be the most famous DApp around the Solana ecosystem within the last 7 days. Orca includes a users list of 272,000 people, while NFT Marketplace Magic Eden is available in second place with 121,000 users.

In comparison, while typically the most popular DApp around the Ethereum ecosystem within the last 7 days continues to be NFT Marketplace OpenSea with roughly 148,000 users, the Ethereum ecosystem’s total value locked (TVL) is way above its rival’s having a value of $113 billion, based on DeFi TVL aggregator platform DeFiLlama. Solana includes a TVL of $6 billion.

The reduced charges the Solana network promises have tempted developers and users alike, but frequent network outages have hampered full network utilization and scared away some potential stakeholders which have stunted the ecosystem’s growth.

Promising upgrades ahead

As a result of these concerns, Solana Labs — we’ve got the technology firm behind the Solana blockchain — has revealed plans for “flow control” upgrades which will potentially address these growing network outage concerns.

Austin Federa, mind of communications of Solana Labs, located Chief executive officer Anatoly Yakovenko along with other people from the Solana team of developers on Twitter captured inside a Twitter Spaces session to discuss possible solutions. This came following the network experienced several blackouts in The month of january alone, causing users to get concerned.

Yakovenko mentioned throughout the session that plans have been in the whole shebang to apply upgrades to assistance with coping with these problems and they’re folded in the approaching days. Also, he noticed that a number of them had recently been implemented.

Recent: Largest NFT mint ever: Making feeling of Yuga Lab’s ‘virtual’ land bonanza

It wouldn’t be unnatural to anticipate a substantial improvement in Solana chain stability within the coming several weeks, owing largely that it’s still in the infancy and really should get serious amounts of develop. However, the issues seem to be majorly unique towards the network, raising questions regarding whether they’ll be ultimately resolved inside the crypto space.

Inside a more technical sense, you could reason that the present release continues to be within the beta phase which the entire release includes upgrades to deal with these problems. However, as a result of a Reddit publish, a Solana moderator revealed the “beta” attached is “just a thing that may be removed anytime.”

In April 2021, there have been proposals to implement an on-chain governance protocol to permit gold coin holders to help the chain’s upgrade democratically. This could assisted in the delegation of upgrade decisions to holders and stakers.

Solana is expanding, with an industry cap of $30 billion, the native gold coin SOL has risen to sixth place one of the most valuable digital assets.

Based on a current Finder poll, the cost of SOL is expected to achieve $222 through the finish of the season. Regardless of the outages that seem to be unique towards the network, the rapid development of the ecosystem has provided need to think that Solana could eventually become among the dominant PoS chains. Harp concluded:

“Solana isn’t strictly a PoS consensus like other PoS systems, rather it’s trying something totally new. Whether or not this will stand the ages and scale remains seen.”