The biggest Bitcoin (BTC) institutional investment vehicle is originating under suspicion because it trades in a record discount.

The Grayscale Bitcoin Trust (GBTC) may be the latest Bitcoin industry entity to have the heat in the debacle over the defunct exchange FTX.

FTX woes see Coinbase pledge rely upon GBTC owner

With contagion and fears more than a much deeper market rout everywhere in Bitcoin and altcoins at the moment, misgivings are impacting every-known — and reliable — crypto industry names.

In recent days, it had been the turn of GBTC, the lengthy-embattled Bitcoin investment fund, among problems in a related crypto firm, Genesis Buying and selling.

As Cointelegraph reported, parent company Digital Currency Group (DCG), in addition to operator Grayscale itself, quickly searched for to reassure investors and also the market that it is flagship product was financially water tight.

This didn’t appear enough to fulfill nerves, however, resulting in additional public declarations of belief in DCG and GBTC.

Included in this was Coinbase Institutional, the institutional investment arm of major exchange Coinbase.

“Nothing is much more important than making certain our clients’ assets are secure,” it tweeted on November. 17:

“With ten years of expert knowledge creating a secure and compliant child custody solution, Coinbase Institutional is proud to supply segregated cold storage child custody services with this Qualified Custodian.”

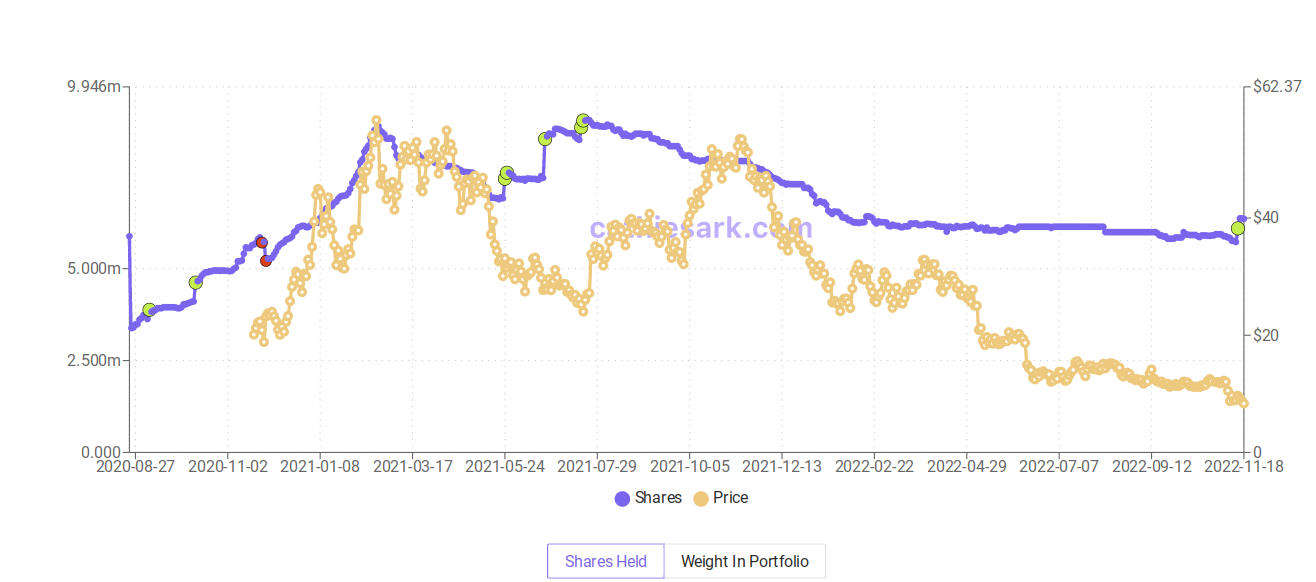

GBTC’s image continues to be under strain for a while. Since 2021, it’s traded for a cheap price towards the BTC place cost, a price reduction that is now approaching 50%.

Among too little demand, speculation has elevated because of rumors that Grayscale may finish up being bought should Genesis Buying and selling fail.

This transformation of tack might have implications for GBTC, as Grayscale notionally remains set on converting it for an exchange-traded fund (ETF).

“Though this can be a difficult moment for a lot of in crypto, I’m deeply positive about the way forward for this industry, Grayscale’s business, and also the chance for investors,” Grayscale Chief executive officer, Michael Sonnenshein, tweeted on November. 19.

Investor Lepard: “I happen to be buying more” GBTC shares

Consensus around the $10.5 billion GBTC potentially being intentionally offered remains weak.

Related: Grayscale cites security concerns for withholding on-chain evidence of reserves

“Genesis might have to go under, however i discover the likelihood of GBTC trust being liquidated to become highly unlikely just because of the cash cow that it’s been,” Lyle Pratt, creator of messaging platform Vida Global, reacted:

“More likely that somebody like Fidelity buys it and keeps it operating.”

The steepening discount following a FTX saga has meanwhile made GBTC a rather ironic “buy” for names for example ARK Invest and Lawrence Lepard, investment manager at Equity Management Associates.

“Lots of questions and DM’s. Lepard take on Grayscale and GBTC Spoiler alert: I purchased it,” he started a passionate Twitter thread by saying over the past weekend:

“I happen to be buying more. It’s still under 5% of my BTC holdings in situation I’m wrong. Self sovereign key possession is essential. And main concern.”

Around the subject of methods bad the contagion might be for DCG and it is group of firms, Leopard nevertheless acknowledged it “is impossible to understand just how much distress they’re in.”

He ongoing to evaluate the fallout if the worst should-situation scenario — personal bankruptcy — ensue.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.