Bitcoin (BTC) firms’ shares really are a major “buy” for asset manager ARK Invest in the middle of the FTX meltdown.

The latest data confirms that ARK is constantly on the up its holdings of both exchange Coinbase (Gold coin) and also the Grayscale Bitcoin Trust (GBTC).

Cathie Wood buys the dip

With FTX contagion still rippling with the crypto industry, ARK’s decision to include contact with two firms caught within the firing line sticks out.

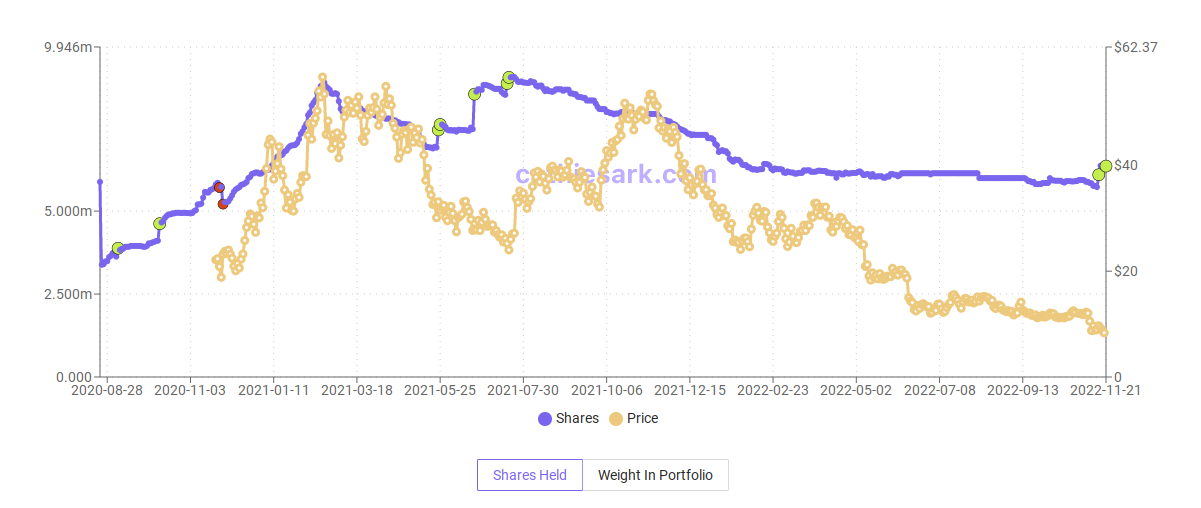

Based on figures provided by Chief executive officer Cathie Wood’s dedicated tracking resource, Cathie’s Ark, the firm added 176,945 GBTC shares on November. 21.

These enroll in a bigger tranche of 273,327 shares from November. 15, that purchase completed only a week after FTX fell apart.

Since that time, GBTC has belong to the spotlight as parent company Digital Currency Group (DCG) battles FTX problems of their own.

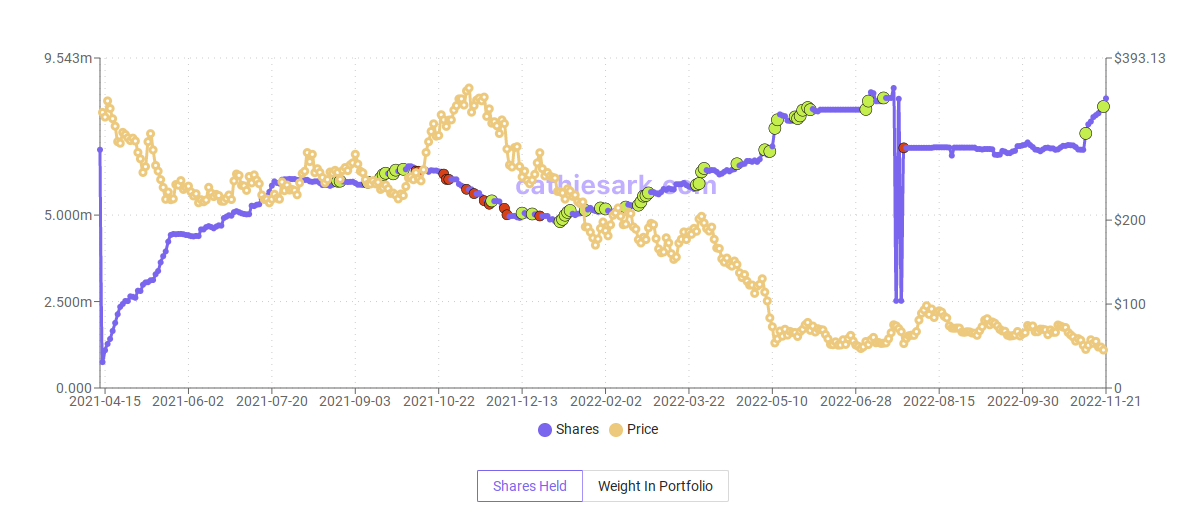

Coinbase is meanwhile another target for ARK. Since the beginning of November, the firm has added 1.3 million Gold coin shares, taking its total stake to eight.374 million — near all-time highs.

Gold coin shares now take into account ARK’s twelfth-largest position.

Commenting around the FTX debacle in the latest e-newsletter, ARK acknowledged the possibility implications for DCG company Genesis Buying and selling, and cautioned that other “counterparty” entities might be next.

“That stated, our conviction in decentralized and transparent public blockchains is really as strong as always,” it nevertheless added.

“In this situation yet others, decentralization and transparency are vital as antidotes towards the gross mismanagement connected with centralized intermediaries, as well as fraudulent centralized intermediaries.”

BTC cost hits new two-year lows

Bitcoin cost action meanwhile is constantly on the decline, two days after problems at FTX spiraled unmanageable.

Related: Bitcoin cost levels to look at as traders bet on sub-$14K BTC

BTC/USD hit fresh two-year lows on November. 21, data from Cointelegraph Markets Pro and TradingView shows.

The happy couple dipped to $15,479 on Bitstamp following the Wall Street open, recovering only slightly to circle $15,750 during the time of writing.

Gold coin itself hit an archive low simultaneously, while equally embattled GBTC retained nearly all its discount at over 40% in comparison to the Bitcoin place cost despite ARK’s buy-in.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.