Bitcoin (BTC) faced a 7.3% drop between November. 20-21 because it tested the $15,500 support. As the correction appears small, the movement is responsible for $230 million in liquidations in futures contracts. Consequently, bulls using leverage arrived on the scene ill-ready for the $1.14 billion monthly options expiry on November. 25.

Bitcoin investors’ sentiment worsened after Genesis Buying and selling, which belongs to digital Currency Group (DCG) conglomerate, stopped payouts at its crypto lending arm on November. 16. More to the point, DCG owns the fund management company Grayscale, which accounts for the biggest institutional Bitcoin investment vehicle, the Grayscale Bitcoin Trust (GBTC).

Furthermore, Bitcoin miner Core Scientific has cautioned of “substantial doubt” about its ongoing operations within the next 12 several weeks given its financial uncertainty. In the questionnaire filed using the U . s . States Registration (SEC) on November. 22, the firm reported a internet lack of $434.8 million inthe third quarter of 2022.

Meanwhile, New You are able to Attorney General Letitia James addressed instructions towards the people of U.S. Congress on November. 22 recommending barring purchasing cryptocurrencies using funds in IRAs and defined contribution plans for example 401(k) and 457 plans.

Despite bulls’ best efforts, Bitcoin is not in a position to publish a regular close above $17,000 since November. 11. This movement explains why the $1.14 billion Bitcoin monthly options expiry on November. 25 may benefit bears regardless of the 6% rally in the $15,500 bottom.

Most bullish bets are above $18,000

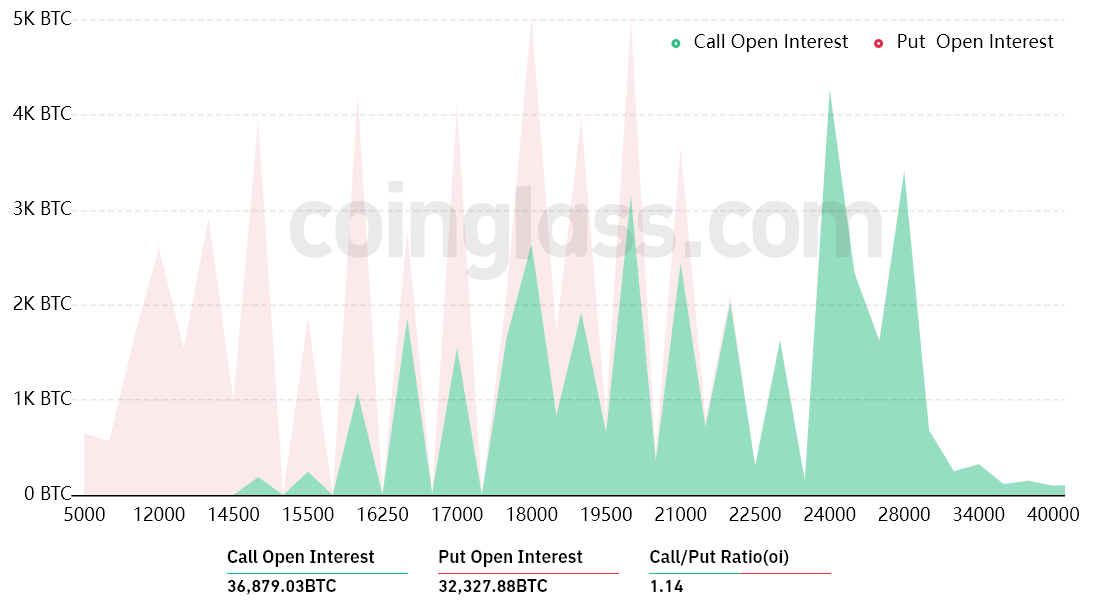

Bitcoin’s steep 27.4% correction after neglecting to break the $21,500 resistance on November. 5 surprised bulls since 17% from the call (buy) choices for the monthly expiry happen to be placed below $18,000. Thus, bears be more effective positioned while they placed less bets.

A wider view while using 1.14 call-to-put ratio shows more bullish bets since the call (buy) open interest is $610 million from the $530 million put (sell) options. Nonetheless, as Bitcoin is lower 20% in November, most bullish bets will probably become useless.

For example, if Bitcoin’s cost remains below $17,000 at 8:00 am UTC on November. 25, only $53 million price of these call (buy) options is going to be available. This difference is really because there’s no use within the authority to buy Bitcoin above $17,000 whether it trades below that much cla on expiry.

Bears could secure a $245 million profit

Here are the 4 probably scenarios in line with the current cost action. The amount of options contracts on November. 25 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $15,000 and $16,000: 200 calls versus. 16,000 puts. The internet result favors bears by $245 million.

- Between $16,000 and $17,000: 3,200 calls versus. 11,900 puts. The internet result favors bears by $145 million.

- Between $17,000 and $18,000: 5,600 calls versus. 8,800 puts. Bears stay in control, profiting $55 million.

- Between $18,000 and $18,500: 9,100 calls versus. 6,500 puts. The internet result favors bulls by $50 million.

Related: BTC cost holds $16K as analyst states Bitcoin fundamentals ‘unchanged’

This crude estimate views the phone call options utilized in bullish bets and also the put options solely in neutral-to-bearish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

Bitcoin bulls have to push the cost above $18,000 on November. 25 to switch the tables and steer clear of a possible $245 million loss. However, Bitcoin bulls lately had $230 million price of liquidated leveraged lengthy futures positions, so that they are less inclined to push the cost greater for the short term. With this stated, probably the most probable scenario for November. 15 may be the $15,000-to-$17,000 range supplying a good win for bears.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.