The VeChain Foundation has released its financial report for Q1 2022 showing the project accumulated a remarkable $1.2 billion war chest only spent about $4.a million within the quarter.

VeChain (VET) is really a blockchain project made to enhance logistics management..

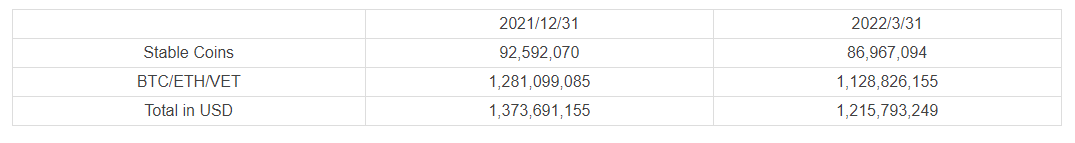

The Foundation’s May 10 financial report for Q1 2022 outlines its balance sheet by March 31 and just how it spent funds with the quarter. Even though the treasury opened up the entire year with $1.37 billion in assets between stablecoins, Bitcoin (BTC), Ether (ETH), and VET, it ended with $1.2 billion. The report claims that the majority of the losses were incurred “due to crypto market fluctuations along with other VeChain Foundation outgoings.”

The BTC cost has fallen 34% since, ETH has fallen 36%, and VET has fallen 54% since 12 ,. 31, 2021 once the project marked the start of its Q1 tracking through March 31.

Within the interest of ongoing transparency concerning the holdings and expenses from the #VeChain Foundation, we’re pleased to share the Q1 2022 Financial Report:https://t.co/eJzc3NmBAx#SmartContracts #Blockchain #Finance #Cryptocurrency #VeChainThor $VET $VTHO

— VeChain Foundation (@vechainofficial) May 10, 2022

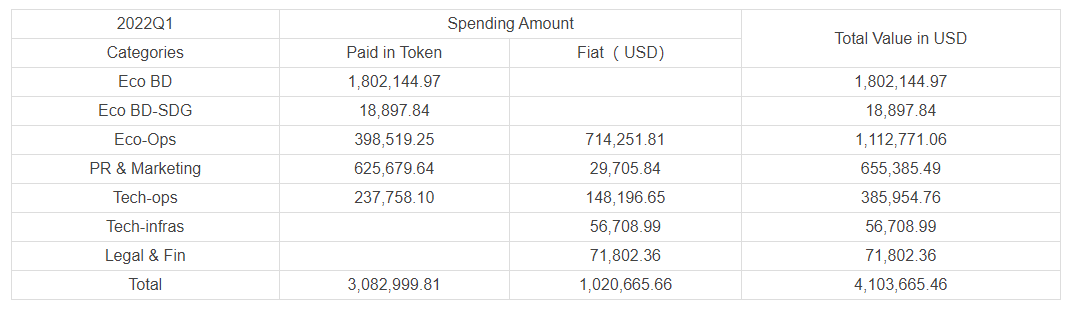

From the $4.a million outlaid within the first quarter the building blocks spent $1.8 million on ecosystem business development, that was the greatest expense. Which includes partnerships, custodians, wallet providers, brokers, community occasions, and ecosystem project cooperation.

Next was $1.a million on ecosystem operations for example team costs, work place, utilities, talking to charges, and exterior services.

As the report claims that the treasury will be employed to “ensure the lengthy term growth and development of the VeChainThor blockchain,” it’s unclear if the foundation will open the tap on its treasury for additional expenses on investments.

Also absent in the report is how much cash the building blocks earned with the first quarter. The VeChainThor blockchain collects charges for transactions which are distributed between validators along with other stakeholders within the ecosystem. However, data on the quantity of charges accrued isn’t obvious in the financial report.

VeChain’s carbon emissions data management system and VeCarbon’s partnership with cement industry players were announced within the financial report.

Related: VeChain can be used payment in 2M stores — and VET bridged to BNB chain

During Q1, VeChain launched its very own stablecoin with the Stably stablecoin issuer referred to as VeUSD. Additionally, it created a partnership with Amazon . com Web Service (AWS) to construct the VeCarbon emission keeper like a service (SaaS) system for China.

VET includes a market cap of $2.6 billion and it is lower about .6% in the last 24 hrs, buying and selling at $.04 based on Coingecko data.