Since Cointelegraph Markets Pro launched — getting professional crypto market intelligence to each investor — the woking platform helps a large number of subscribers to higher comprehend the possibilities and threats natural in the realm of crypto investing and buying and selling.

Within this brief, you want to highlight some highlights because the platform’s launch, together with a critical consider a number of backtested strategies the Markets Pro team tracks.

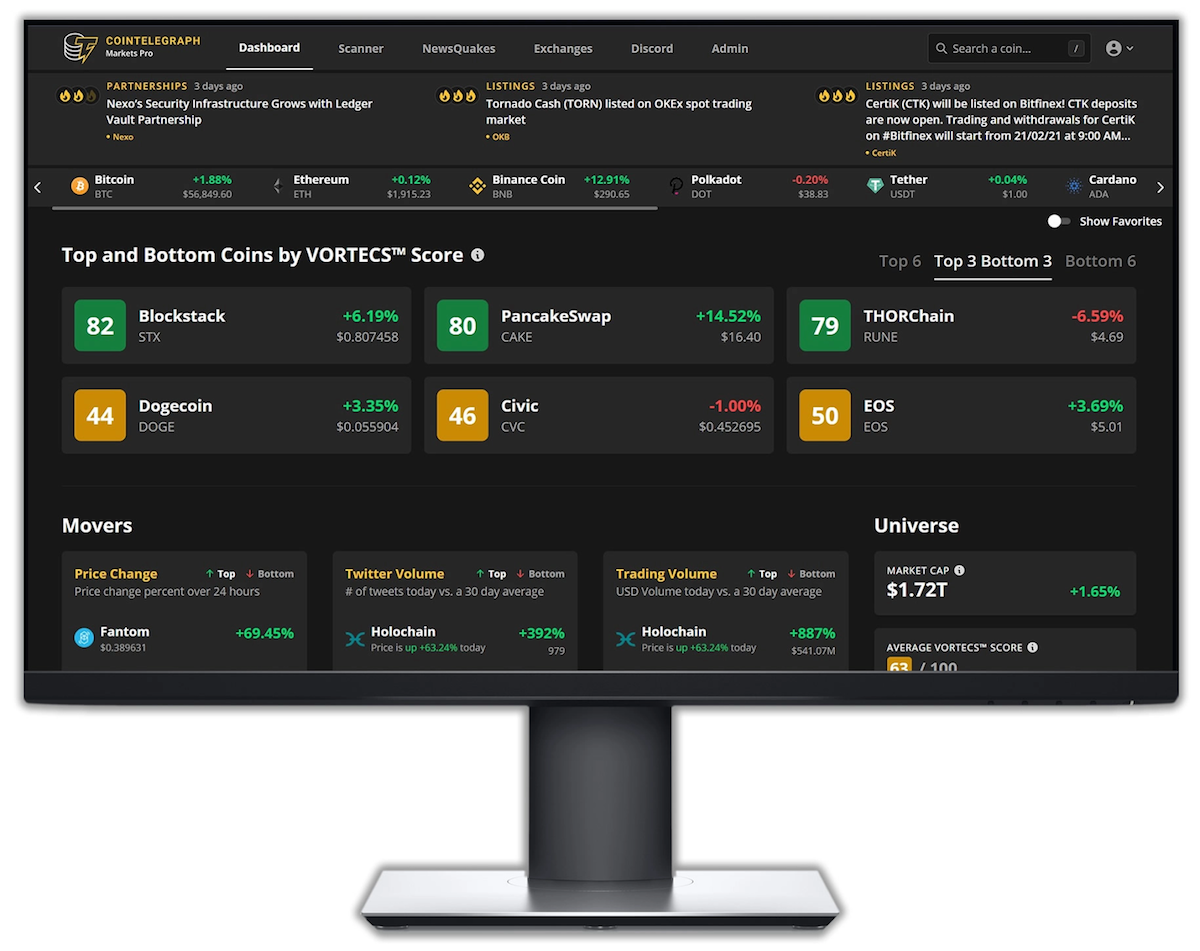

Cointelegraph Markets Pro includes two unique research features — VORTECS™ Score and NewsQuakes™ — additionally to a multitude of market performance metrics and use of an exciting community of crypto enthusiasts on Discord.

VORTECS™ Score

The VORTECS™ Score comes from an formula that examines multiple variables, including sentiment, tweet volume, cost volatility and buying and selling volume, also it compares individuals with in the past similar market conditions.

The formula is capable of doing parsing through countless historic data points every day, evaluating what’s happening at this time with prior conditions for that 418 assets and counting which are presently tracked.

A higher VORTECS™ Score shows that market conditions across all the tracked variables act like conditions previously once the asset appreciated throughout the next a few days. The greater the score, the greater consistent the behaviour from the asset’s cost previously.

History does not repeat, however it frequently rhymes. The VORTECS™ Score was produced to supply every crypto market participant rich in-quality, quantitative analysis which has formerly only been open to major institutional investors.

NewsQuakes™

NewsQuakes™ is definitely an indicator that gives real-time alerts generated by developments that impact gold coin prices probably the most. Included in this are exchange listings, staking bulletins and partnerships.

Our studies have discovered that exchange listings, staking bulletins and partnership bulletins have experienced probably the most consistently positive impact.

NewsQuakes™ are made on the top from the Tie’s proprietary SigDev technology — probably the most comprehensive and actionable digital asset information platform for tracking real-time, market-moving news within the cryptocurrency space.

SigDev can be used by major hedge funds, over-the-counter desks, market makers along with other institutional market participants to achieve an advantage. Additionally to banking institutions, news outlets like Cointelegraph make use of the Tie’s SigDev platform to recognize critical breaking news tales from primary sources.

NewsQuakes™ are delivered in-browser via Discord alerts and straight to your phone through the Markets Pro mobile application. One of the most notable NewsQuakes™ are new exchange listings.

For instance, because the launch in our NewsQuakes™ indicator in Jan. 2021, buying and holding an expression for just one hour after its NewsQuakes™ listing announcement generated an astonishing 12,000% return!

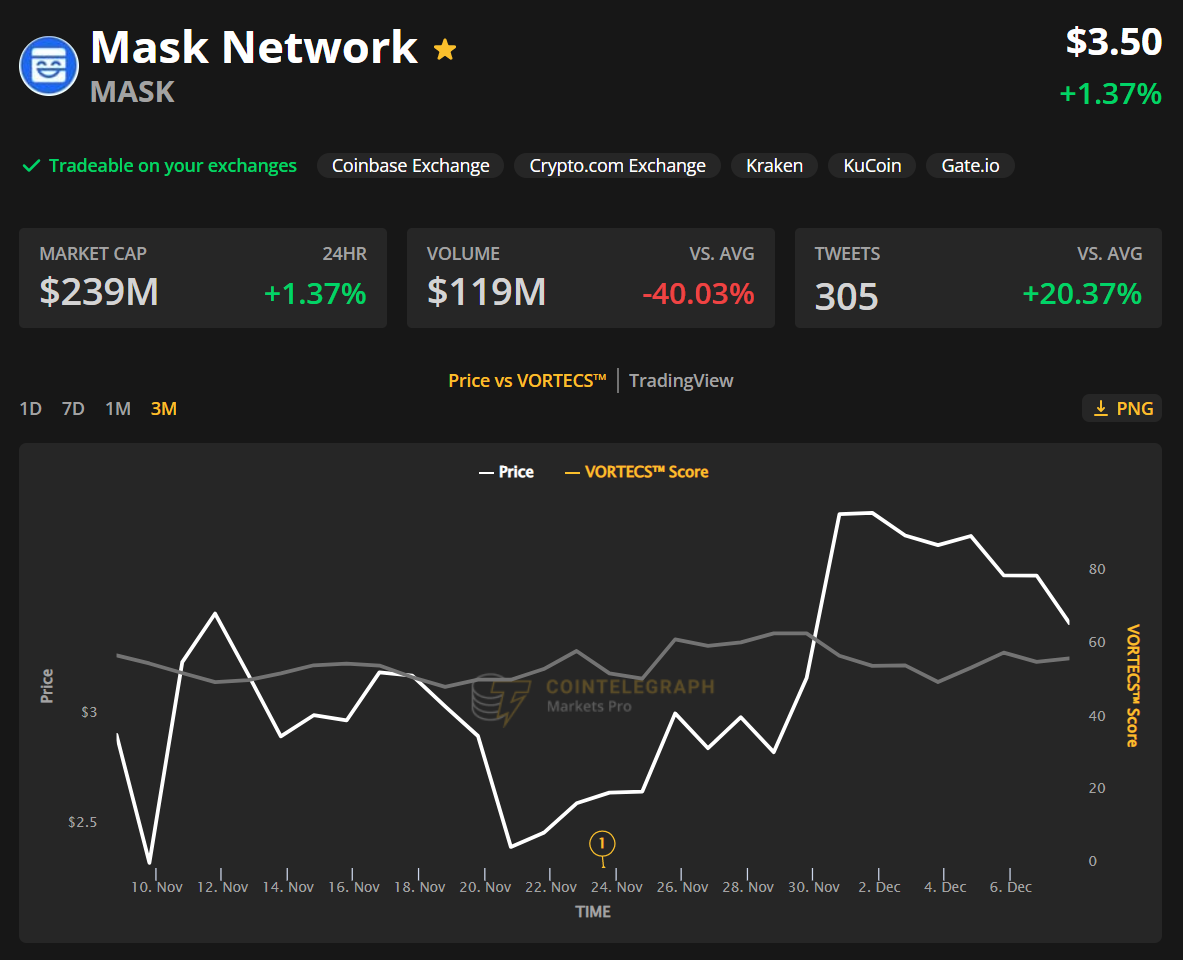

Some notable NewsQuakes™ in the last month include our alert on Mask Network (MASK) following the announcement that MASK could be for auction on Binance.

The yellow us dot illustrates once the alert was delivered to community people…Just four days following the alert, MASK rose from $2.67 to some a lot of $3.93.

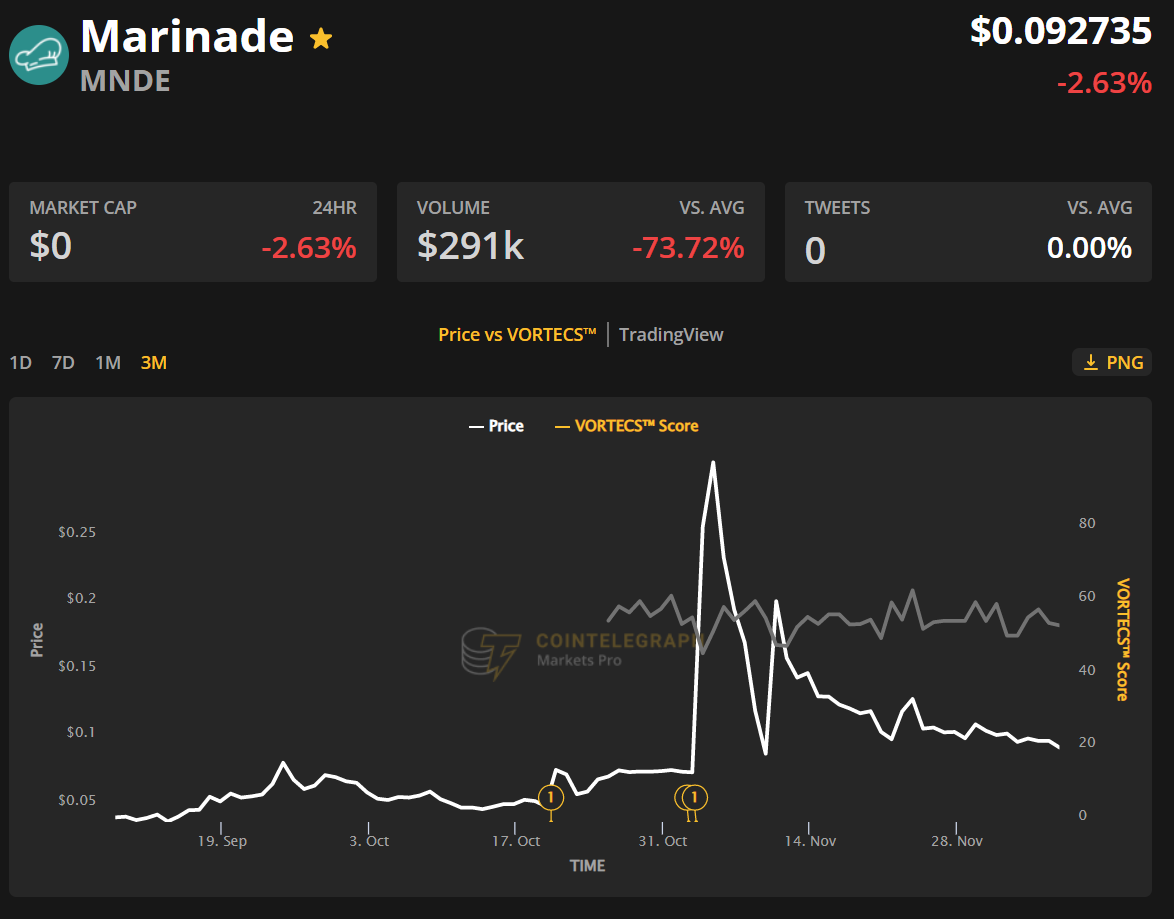

Similarly, three NewsQuake alerts were delivered to our clients about Marinade (MNDE), the final two offered up a 1-day change from $.07 to some a lot of $.30, converting to some 307% intraday move.

Meaning, had you invested $1,000 into this alert, you would’ve had $3,070 through the finish during the day.

$10,000? $30,700!

VORTECS™ performance

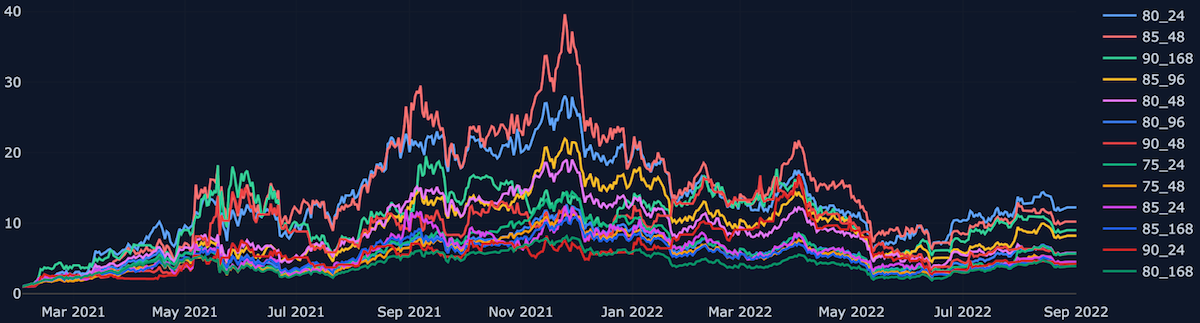

Because the launch from the formula on The month of january 5, 2021, Cointelegraph Markets Pro continues to be tracking the performance of 45 different buying and selling strategies per hour more than a moving week along with a cumulative history.

The buying and selling strategies are split into two groups: time-based and score-based.

In every situation, Markets Pro tracks the performance from the VORTECS™ Score from the U.S. dollar, Bitcoin (BTC) as well as an evenly weighted basket from the best players altcoins — all to make sure that the score is tested for wider market movements.

Time-based strategies

Time-based strategies involve tracking the performance of the crypto asset as soon as its VORTECS™ Score crosses a vital threshold until a particular period of time elapses, for instance, Buy 80/Sell 168 hrs or Buy 90/Sell 24 hrs.

Right from the start of 2021 so far, the 13 winning time-based strategies tracked by Markets Pro have averaged gains of 546.35%. Compared, a BTC buy-and-hold strategy endured a loss of revenue of 39.44%, along with a similar strategy using the best players altcoins acquired coming back of 190.15%.

Probably the most effective of those strategies continues to be the Buy 80/Sell 24 hrs strategy, that has came back 1,123.46% forever of 2021!

The least effective time-based strategy, Buy 80/Sell 168 hrs, came back 290.70%.

Score-based strategies

Scored-based strategies involve tracking the performance of the crypto asset as soon as its VORTECS™ Score crosses a vital threshold until it reaches another key threshold, for instance, Buy 80/Sell 75 or Buy 90/Sell 65.

The 12 winning score-based strategies tracked by Markets Pro produced a typical return of two,895.49%, eclipsing the 190.15% return achieved by purchasing and holding the very best 100 altcoins available on the market with a factor of 15.

Probably the most effective of those strategies continues to be the Buy 80/Sell 20 score, that has came back 21,010.61% forever of 2021!

The least effective score-based strategy, Buy 85/Sell 85, came back 263.63%. Obviously, the worst-performing effective score-based strategy beat the buy-and-hold techniques for BTC but for the best players altcoins available on the market.

Cointelegraph Markets Pro is available solely to people at $99 monthly having a 100% satisfaction guarantee. We’re providing you accessibility only crypto-intelligence platform on the planet that can present you with the very same buying and selling alerts as institutions and hedge funds instantly … before information becomes public understanding.

Cointelegraph is really a writer of monetary information, no investment advisor. We don’t provide personalized or individualized investment recommendations. Cryptocurrencies are volatile investments and bear significant risk including the chance of permanent and total loss. Past performance isn’t suggestive of future results. Figures and charts are correct during the time of writing or as otherwise specified. Live-tested strategies aren’t recommendations. Talk to your financial advisor prior to making financial decisions.

All ROIs quoted are accurate by December 13, 2022.