Based on Glassnode data, the amount of Bitcoin wallet addresses holding a non-zero balance could soon hit an exciting-time high, using the latest cost rally which has seen the need for the world’s largest cryptocurrency jump nearly 40% this season apparently attracting new investors.

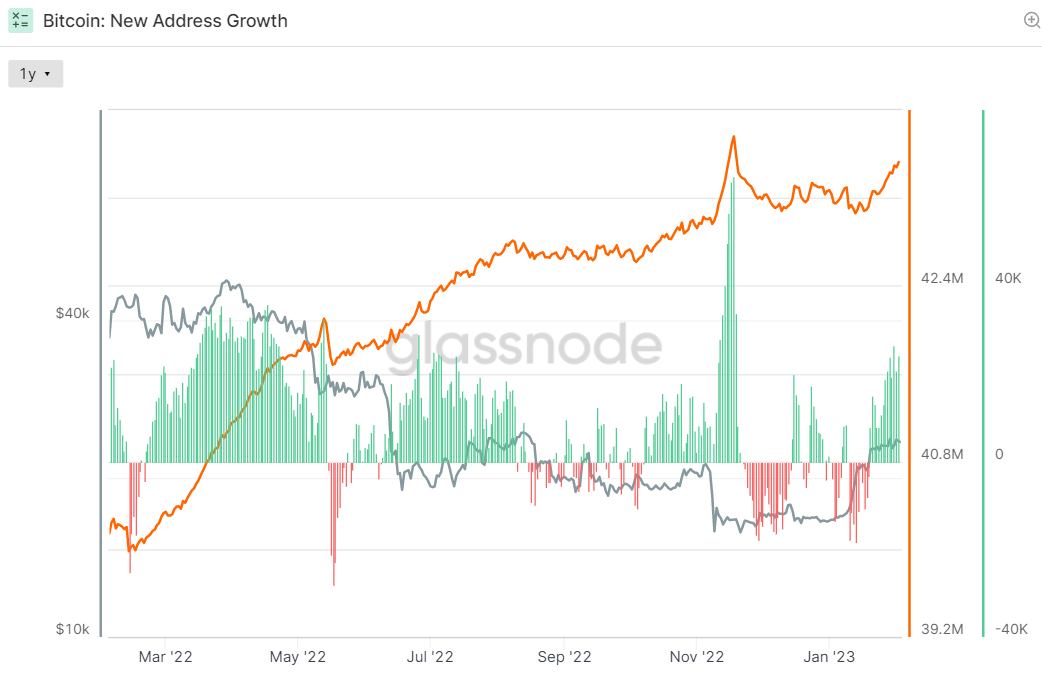

Based on the crypto analytics firm, there have been 43,525,546 Bitcoin addresses having a non-zero balance around the second of Feb, nearly 300,000 up versus this time around recently. The record large number of non-zero addresses of 43,759,663 was hit within the immediate aftermath from the collapse of the items had formerly been among the world’s largest cryptocurrency exchanges FTX last November.

At that time, this triggered a hurry to withdraw crypto from exchanges, with lots of Bitcoin proprietors apparently developing a self-child custody wallet the very first time. However, capitulation as prices fell during the period of later led to non-zero address Bitcoin wallet figures rapidly declining to their pre-FTX collapse levels.

However the recent recovery in non-zero address figures shows that, among Bitcoin’s impressive rally since the beginning of the entire year, investors are once more coming back towards the Bitcoin market in greater figures compared to what they are departing it. If the amount of non-zero wallet addresses continues rising in the pace it’s during the last couple of days, a brand new all-time high might be hit through the finish from the month/by early March.

Exactly What Does This Suggest for BTC?

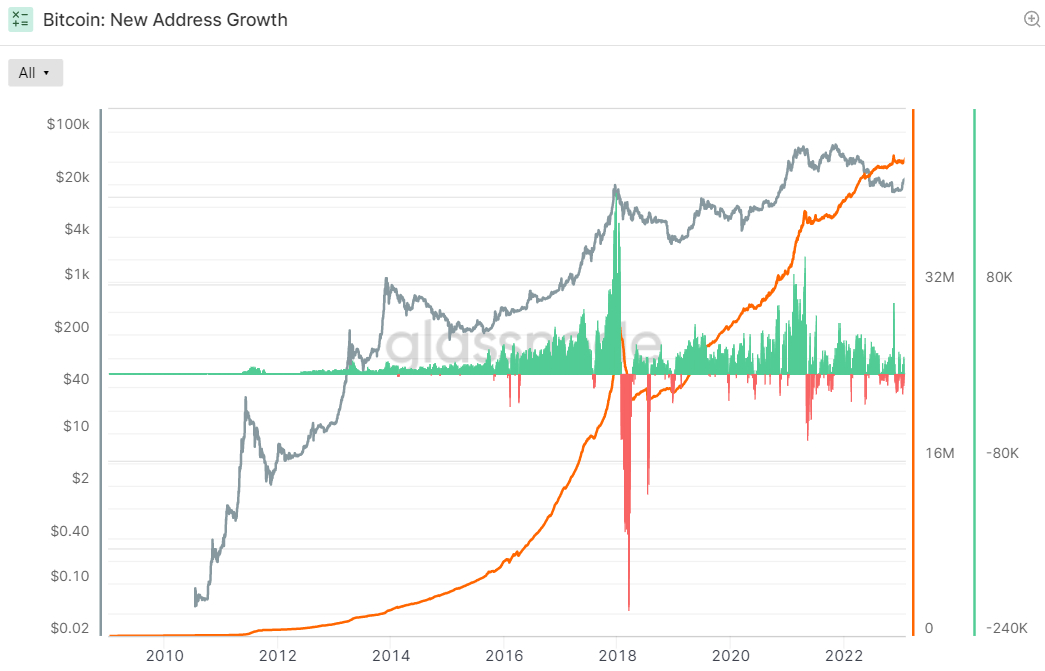

Regardless of the bear market of 2022, the amount of non-zero Bitcoin addresses ongoing to continuously rise. However, in past bull market cycles, for example within the run-to the 2017 peak as well as in late-2020/early-2021, the interest rate of recent non-zero address creation continues to be much greater.

Even without the sustained rapid development in the amount of non-zero wallets, a sign that new investors are entering the marketplace to function prices, Bitcoin may find it difficult to gain further ground. Bitcoin bulls will thus be wishing the latest increase in non-zero address figures represents the beginning of a sustained increase, which the possibilities of Bitcoin being in early stages of the new bull market continues attracting new buyers.

Indeed, multiple separate on-chain leading indicators are flashing bullish signs. As discussed inside a recent article, seven from eight key on-chain and technical indicators tracked by crypto analytics firm Glassnode’s “Recovering from the Bitcoin Bear” are actually signaling the next Bitcoin bull market may be here. Glassnode’s dashboard analyses whether Bitcoin is buying and selling above key prices models, whether network utilization momentum is growing, whether market profitability is coming back and if the balance of USD-denominated Bitcoin wealth is in support of the lengthy-term HODLers.

However, things might be bumpy for Bitcoin soon. Bitcoin initially rallied in wake of the not-as-hawkish-as-feared Given policy announcement on Wednesday, however a super-strong just released The month of january US jobs report has rekindled bets the US economy could eventually avoid recession this season. That may mean the Given lifting rates of interest greater for extended, a prospect that may trigger some short-term profit-consuming Bitcoin.