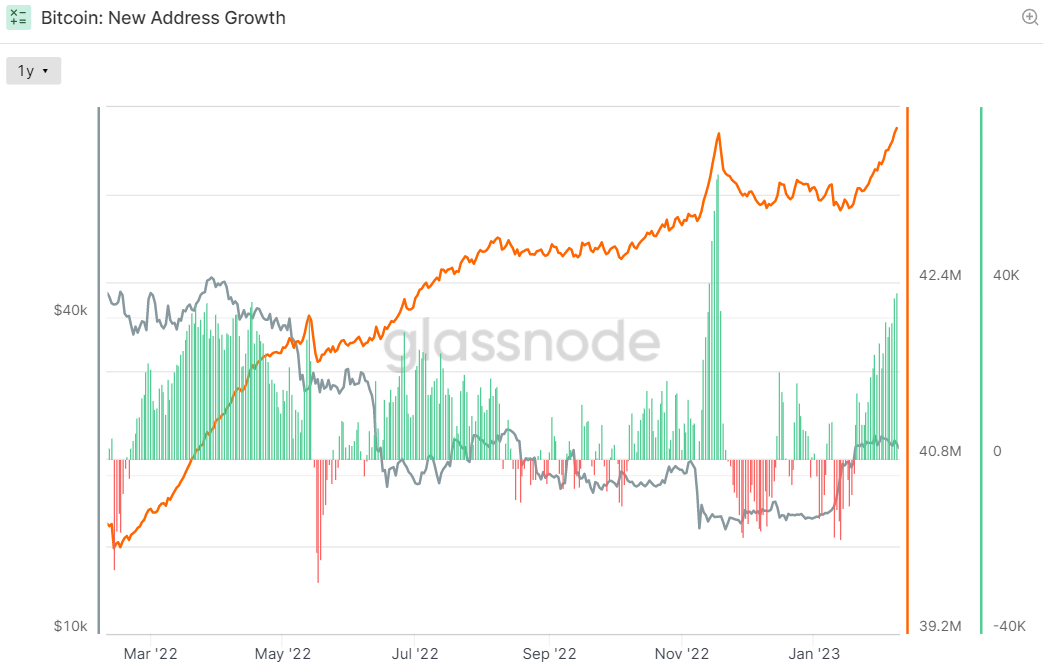

The amount of Bitcoin wallet addresses holding a non-zero balance from the world’s first, most widely used and largest cryptocurrency by market capital hit a brand new record high now, suggesting the Bitcoin network’s global adoption is constantly on the press ahead despite 2022’s challenging bear market along with a tough global economic outlook for 2023.

Based on data presented by crypto analytics firm Glassnode, the amount of Bitcoin addresses having a non-zero balance rose above 43.8 million on Wednesday the 8th of The month of january the very first time. That required the amount of addresses over the previous record high printed in mid-November 2022 of 43.76 million.

In November, the collapse of the items had formerly been among the largest cryptocurrency exchanges on the planet FTX, which led to customers losing use of billions in funds, triggered a shift towards crypto self-child custody. Investors rushed to have their Bitcoin off exchanges, triggering an outburst in address figures at that time.

However, capitulation as Bitcoin’s cost fell to fresh 2022 lows in wake of jitters about contagion from FTX’s personal bankruptcy saw many wallets eliminate all their Bitcoin, triggering a similarly quick pullback in non-zero address figures.

It’s taken a roughly 40% boost in Bitcoin’s cost since the beginning of the entire year among 1) optimism for any better macro backdrop in 2023 and a pair of) elevated on-chain and technical signs the Bitcoin bear marketplace is to lure enough new investors into the Bitcoin market to obtain the non-zero wallet address count to an archive high.

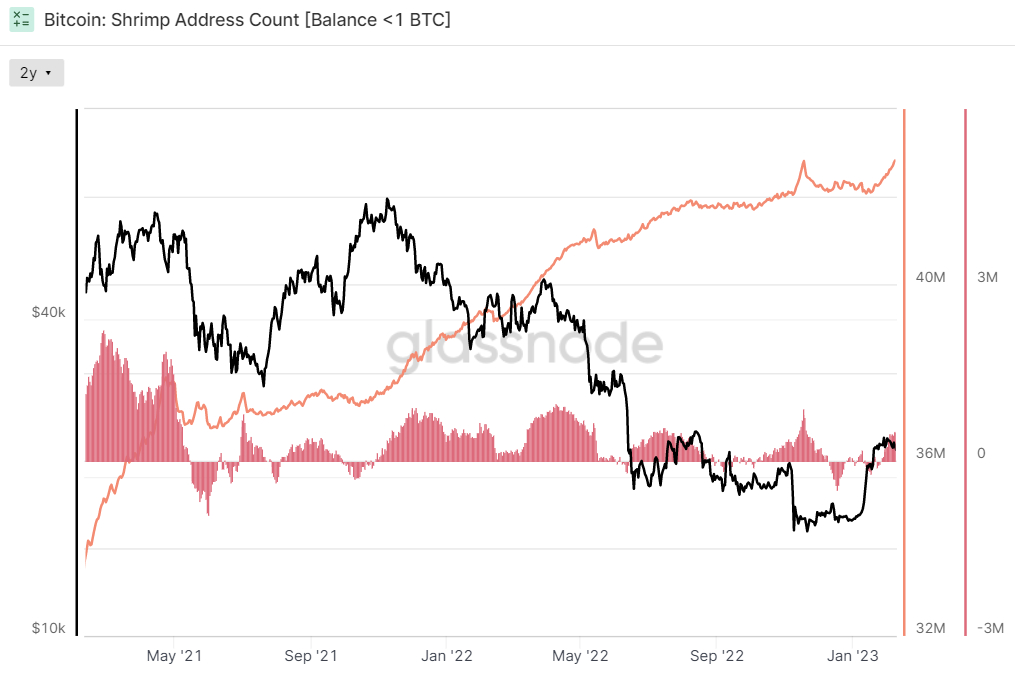

Non-zero Address Growth Driven By Arrival of Small Investors

Based on Glassnode data on Bitcoin wallet address cohorts, the newest boost in non-zero address figures continues to be (unsurprisingly) brought with a boost in wallets holding a tiny bit of BTC. The amount of so-known as Shrimp wallets holding under 1 BTC just hit a brand new record high above 42.827 million.

Simultaneously, the amount of Crab, Fish, Shark and Whale addresses holding 1-10, 10-1K and also over 1K BTC correspondingly have stagnated. Crab, Fish and Shark wallet figures had initially surged in wake from the Bitcoin cost drop following the FTX collapse, with bigger investors while using chance to purchase the dip.

It may thus be figured that the current increase in non-zero wallet address figures has been supported with a rotation in Bitcoin possession from the bigger investors to smaller sized new investors. Bigger investors are more likely to fall within the HODLer camp – individuals who buy and take a seat on their BTC for any prolonged time period given their strong belief within the cryptocurrency’s outlook.

And evidence is gathering the Bitcoin market might be at first phases of the rotation from HODLers to new investors – a pattern that frequently coincides using the birth of the new Bitcoin bull market.

Rotation from HODLers to New Investors Beginning – What This Signifies for BTC

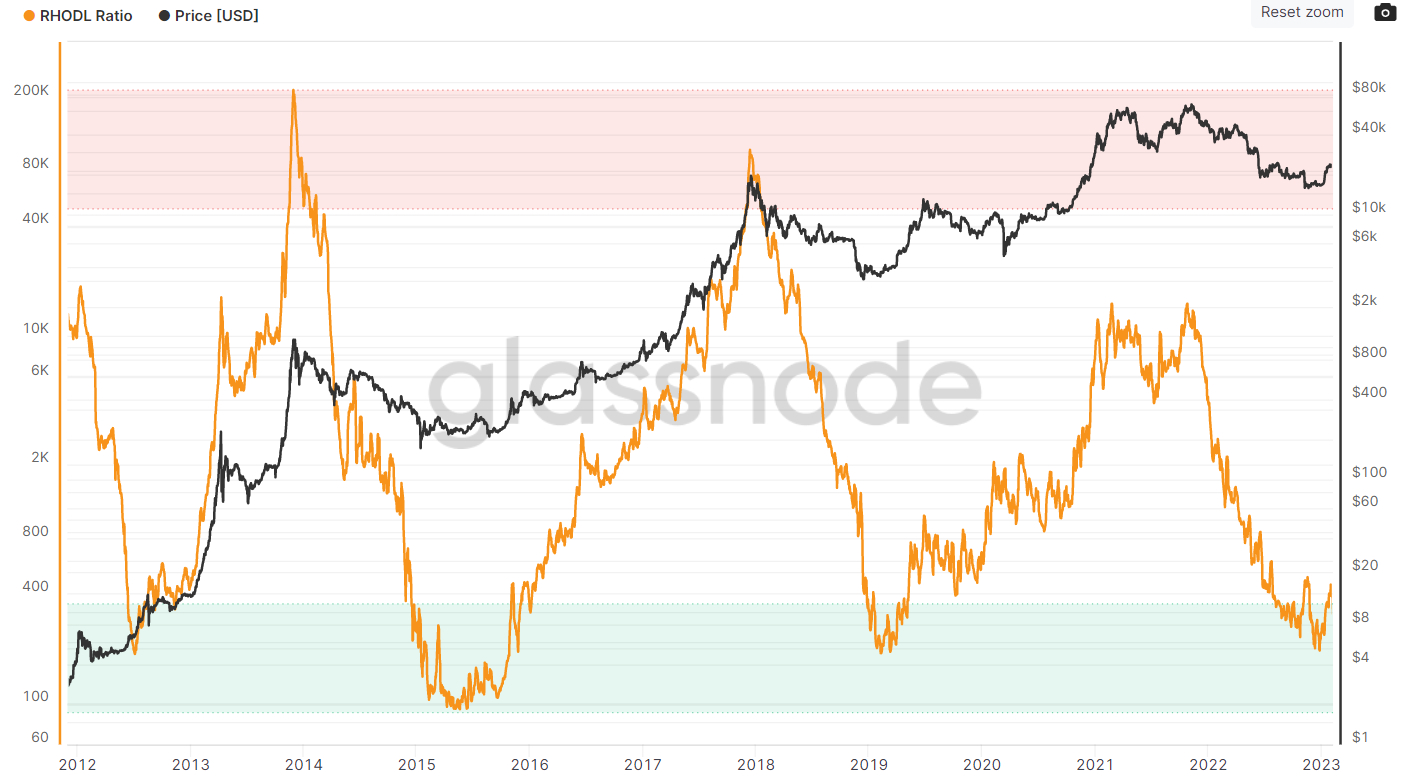

Glassnode’s Recognized HODL Ratio (RHODL), a ratio of these two Bitcoin age bands, looks to become while bottoming. The RHODL is really a gauge from the spread of Bitcoin wealth distribution between experienced and newer investors computed by evaluating the amount of coins that haven’t moved for 1-two year with the amount of coins purchased in the last week.

At the end of December, the RHODL fell to the cheapest because the 2019 bear market but has since seen a good rebound. As are visible in the above mentioned chart, RHODL rebounds usually go hands in hands having a rising Bitcoin cost – the RHODL captures a rise in interest in BTC from new investors, with elevated participation within the Bitcoin market in the past connected with lengthy-term cost appreciation.

The same is true the increase in non-zero wallet addresses mean the Bitcoin cost goes greater came from here? Well, not always. Non-zero address figures rose (gradually) throughout the majority of 2022 which wasn’t enough to avoid the bear market. Demand from new dip-buying investors wasn’t enough to avoid cost downside because of the capitulation of weak-handed short-term investors, as taken by the increase in dominance of older coins within the RHODL ratio.

For rising non-zero address figures to become a bullish sign, it in all probability must also be supported by evidence that BTC wealth can also be rotating towards newer investors, which certainly appears is the situation at this time.