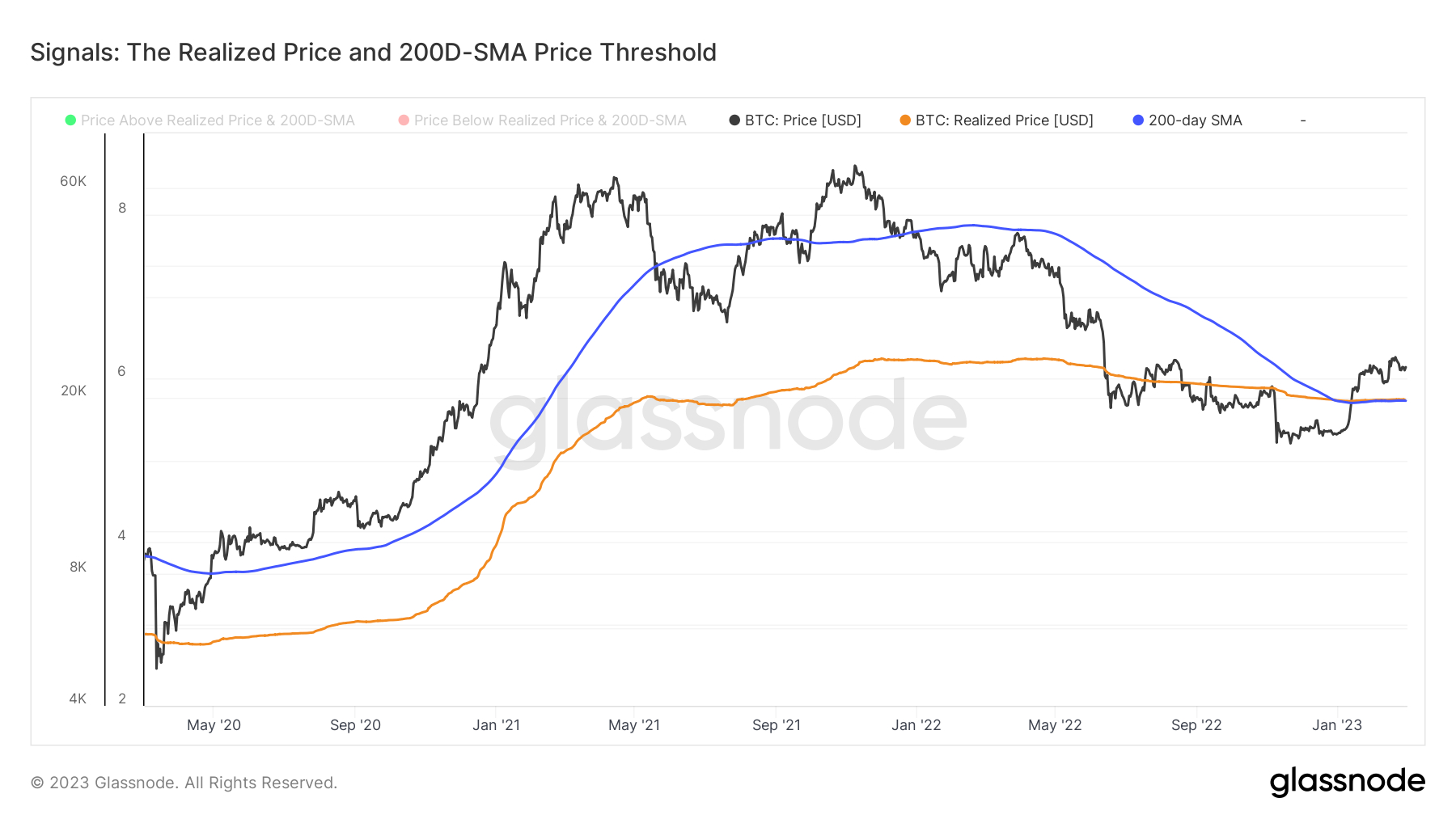

Bitcoin’s ferocious The month of january cost rally launched a lot of the marketplace back to profitability for that first-time several weeks. The Bitcoin market’s go back to profitability is viewed within the resurgence within the cost, last around $23,500, over the so-known as “Realized Price”, the average BTC cost at that time when each BTC token last moved.

Bitcoin’s Recognized Cost was last around $19,850, based on data presented by crypto analytics firm Glassnode. Technicians notice a break over the Recognized Cost like a signal of the significant transfer of the market’s medium-term momentum, much the way they notice a break below or above the 200-Day Moving Averages (which Bitcoin also lately broke decisively above).

However the Bitcoin price’s relationship to the Recognized Cost and what this signifies for that market outlook is much more nuanced. That’s based on analysts at Glassnode, who present numerous more complex mixers consider the differential between your Bitcoin cost and Recognized cost to find out if the marketplace is reaching a bottom or top, or going to attempt an extended bull or bear market.

Which metrics are delivering a unified signal. The medium-lengthy term outlook for that Bitcoin marketplace is searching good, if history is anything to put into practice.

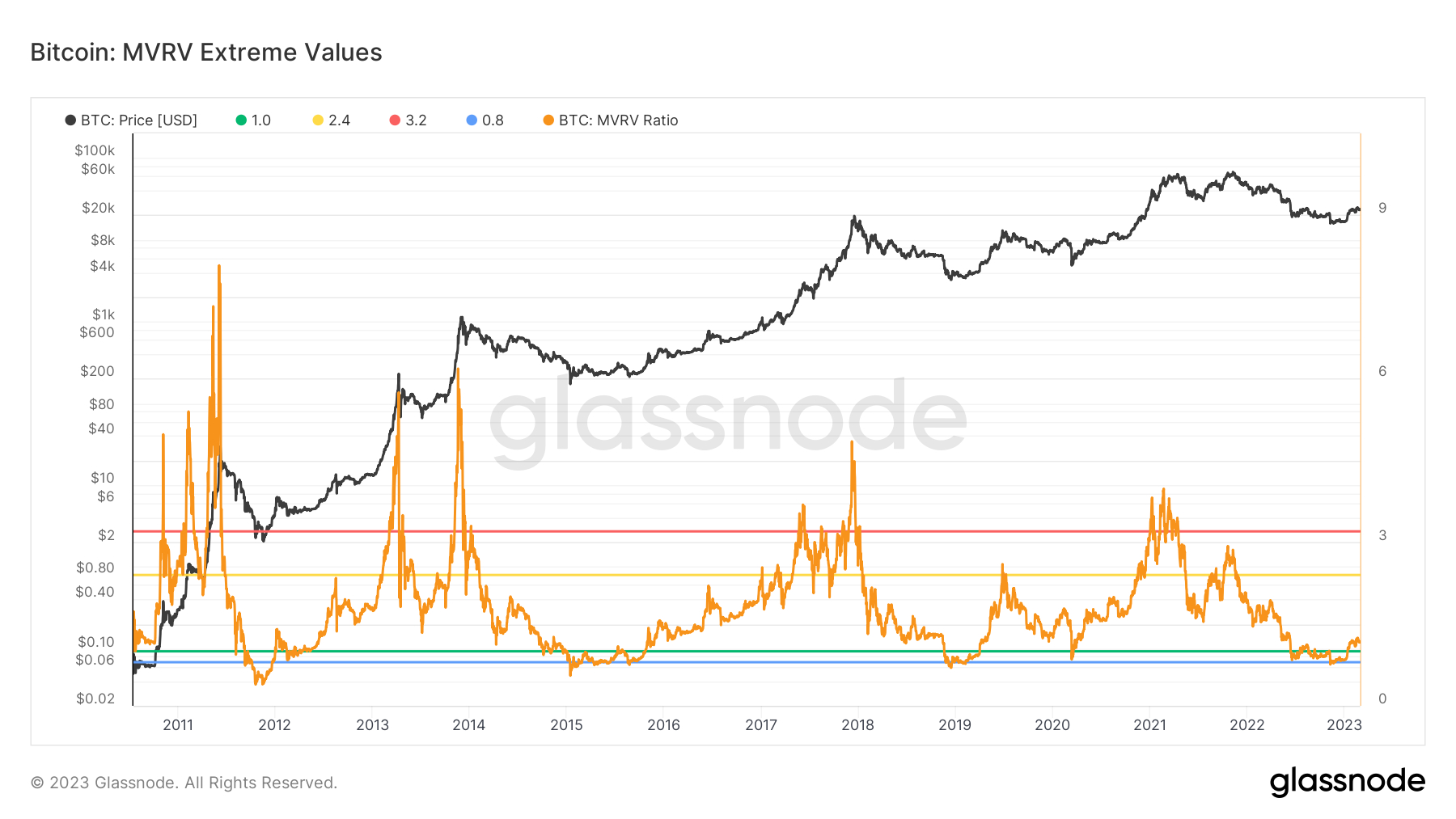

MVRV Ratio is Dealing With In the past Significant Lower Levels

Glassnode presents a metric known as the marketplace Value Recognized Value (MVRV) Ratio – A ratio between your market, or place, cost, and also the Recognized Cost. Then they introduce ratio levels they deem as suggesting the marketplace reaches a serious – .8 and 1., below that the market can be regarded as very weak, and a pair of.4 and three.2, above that the market can be regarded as very strong.

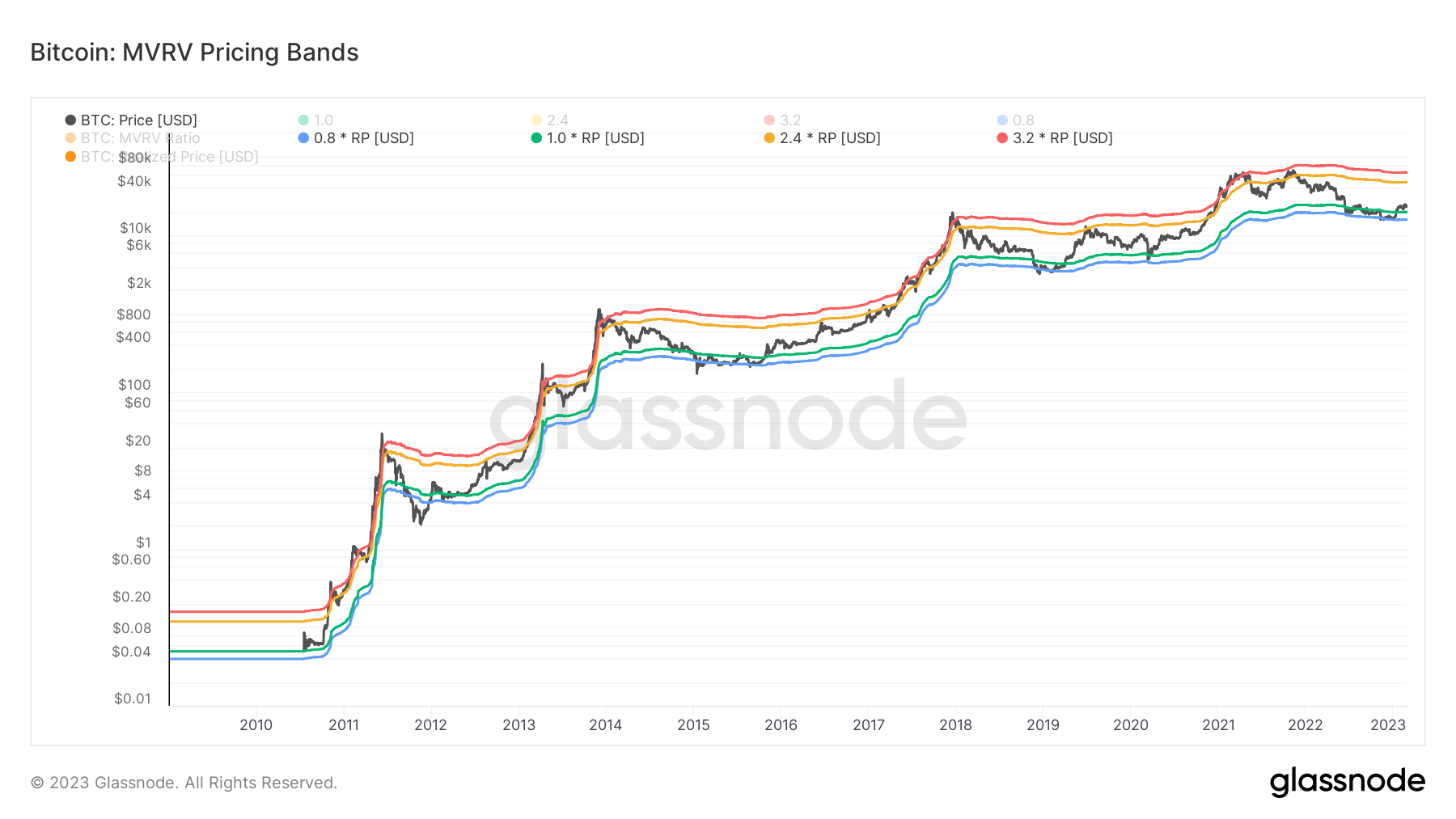

As are visible in the above mentioned graph, the MVRV ratio lately retrieved back above 1. after falling underneath the significant .8 level in wake from the collapse of FTX this past year, an indication of extreme market weakness at that time. A different way to visualize the MVRV ratio is by cost bands that may be plotted around the chart alongside Bitcoin’s place and Recognized Cost. These basically show the amount which are .8 below and a pair of.4 and three.2 occasions over the Recognized Cost.

As are visible in the above mentioned chart, once the Bitcoin prices has fallen to nowhere line (meaning the cost is .8 or fewer of their Recognized Cost), this is a fantastic lengthy-term buying chance. Equally, as the Bitcoin cost has had the ability to exceed its Recognized Cost by 3.two or more occasions for brief amounts of time, sharp pullbacks in the market peak have typically ensued within the medium term.

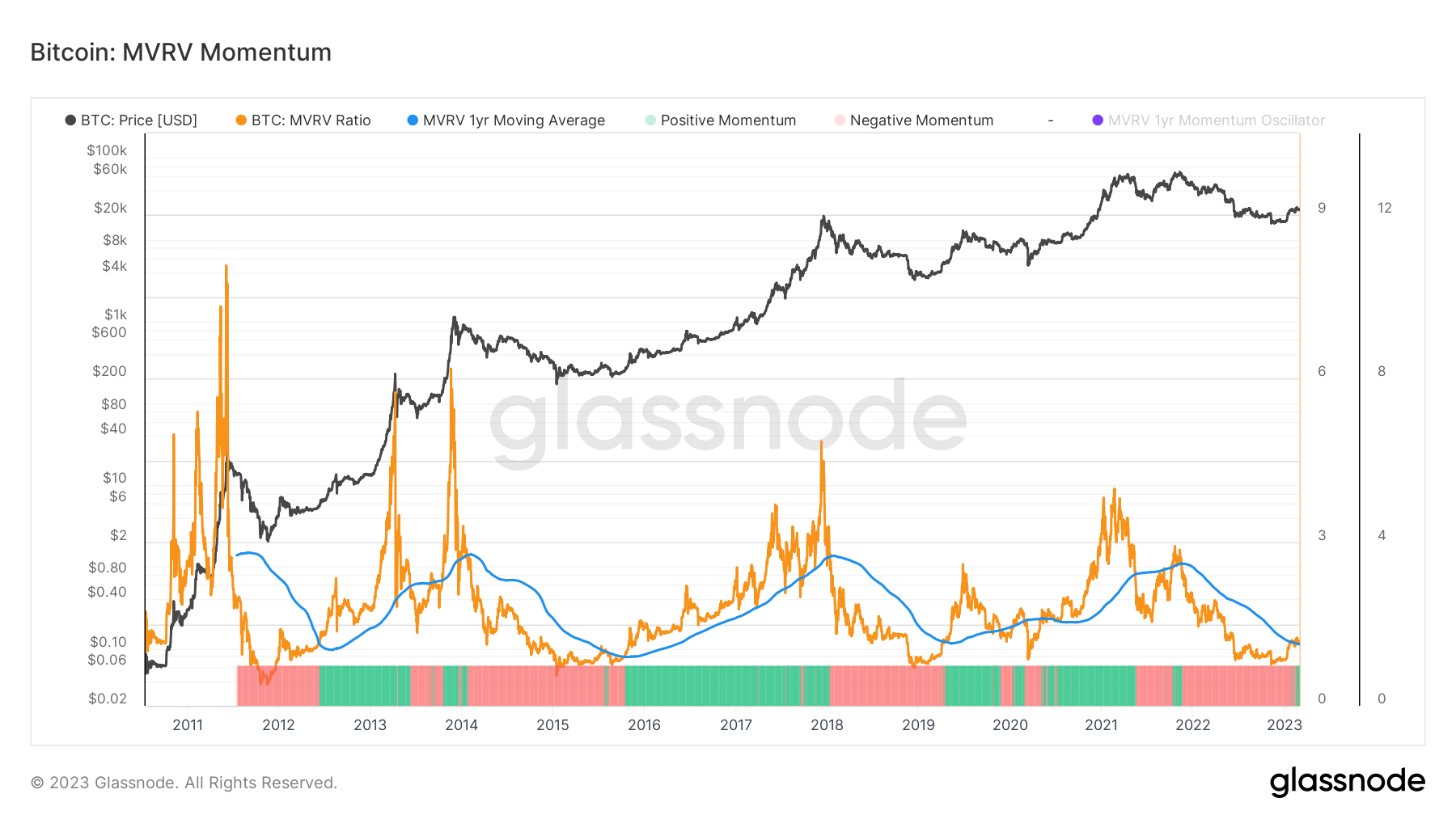

MVRV Momentum Has Additionally Switched Positive

The above mentioned graphics may be used to identify if the Bitcoin cost in accordance with its Recognized Cost has arrived at extremes. Glassnode also presents MVRV oscillator that may be useful in figuring out if the Bitcoin market is going to mind via a prolonged bearish or bullish period.

Within the below graphic, Glassnode also plot the 100-Day Simple Moving Average (SMA) from the MVRV Ratio. They observe that, in the past, the MVRV ratio being above its 100-Day SMA means the Bitcoin cost is within a bull market, while once the MVRV continues to be below its 100-Day SMA, it has typically meant a bear marketplace is occurring.

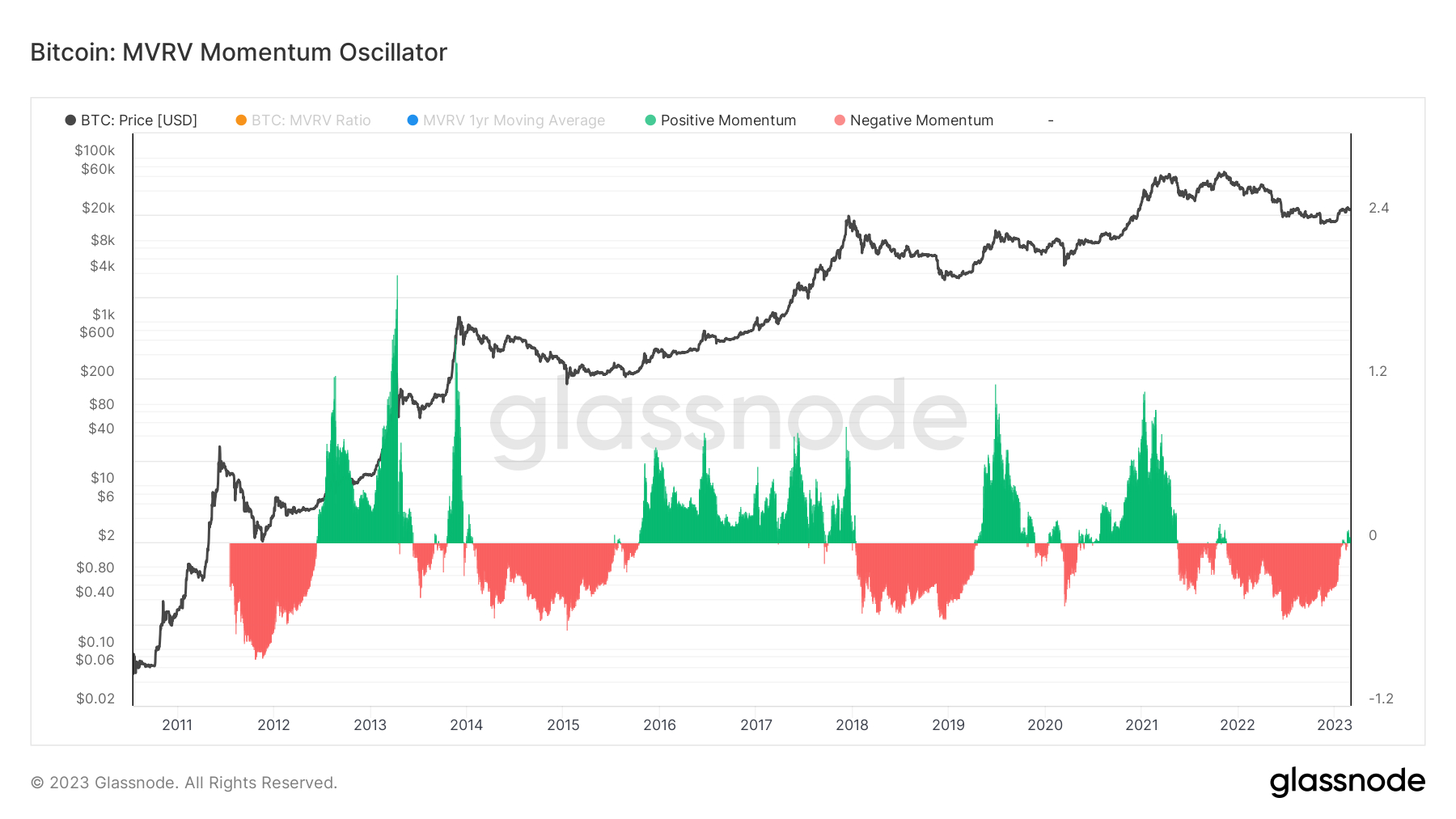

Within the graphic below, Glassnode improves around the above oscillator if you take the ratio between your MVRV Ratio, its 100-Day SMA after which subtracting one. Negative scores equal negative momentum within the MVRV Ratio and the other way around. Transitions from an occasion when MVRV momentum continues to be negative for a while, as with 2012, 2015 and 2019 and 2020, have been obvious indicators of the incoming and frequently prolonged Bitcoin bull market.

Meanwhile, transitions from the prolonged duration of positive MVRV momentum to negative have in the past also happened at the beginning of prolonged bear markets. As are visible in the above mentioned chart, MVRV Ratio momentum just switched positive (i.e. the ratio moved above its 100-Day SMA). If history is anything to put into practice, this can be a big bullish sign for that Bitcoin cost.