In wake of Bitcoin’s latest slide underneath the $21,000 level on Thursday as traders mull headwinds together with a growing liquidity crisis among major crypto-friendly banks and continuing macro headwinds because the US Fed signals risks, Bitcoin options have switched their most pessimistic around the cryptocurrency’s near-term cost outlook this season.

BTC/USD was last buying and selling within the $20,700s, lower by over 5.% within the last 24 hrs based on CoinMarketCap and today lower roughly 18% from earlier yearly highs within the low-$25,000s. Simultaneously, the 25% delta skew of Bitcoin options expiring seven days to any extent further Thursday fell close to -6, the cheapest since late December 2022.

The 25% delta options skew is really a popularly monitored proxy for that degree that buying and selling desks are gone or undercharging for upside or downside protection through the put and call options they’re supplying investors. Put options give a trader the best although not the duty to market a good thing in a predetermined cost, while a phone call option gives a trader the best although not the duty to purchase a good thing in a predetermined cost.

A 25% delta options skew above shows that desks are charging more for equivalent call options versus puts. This means there’s greater interest in calls versus puts, which may be construed like a bullish sign as investors tend to be more wanting to secure protection against (or bet on) a boost in prices.

Longer-Term Cost View Holding Firm for the time being

As the 25% delta skew of options expiring in 30-days and 60-days also fell for their cheapest quantity of a year close to -3 and -2 correspondingly, the 25% delta skew of options expiring in 90 and 180-days happen to be supporting, with remaining negligable. That implies that investors take the vista the current headwinds faced through the market (crypto banks falling, US regulators upping scrutiny and also the Fed’s ongoing tightening efforts) are unlikely to transmit Bitcoin lower on the sustained basis from current levels.

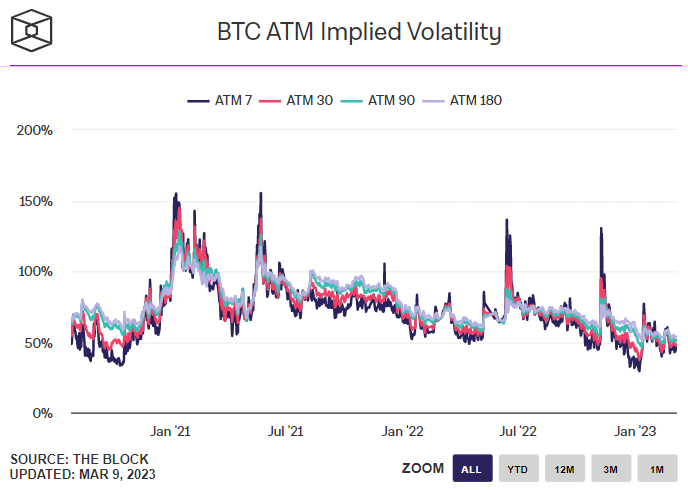

Options financial markets are also delivering the content that Bitcoin investors remain fairly sanguine on cost volatility risks. Implied Volatiltiy based on At-The-Money (ATM) options expiring in 7, 30, 90 and 180-days are broadly unchanged during the period of the final month.

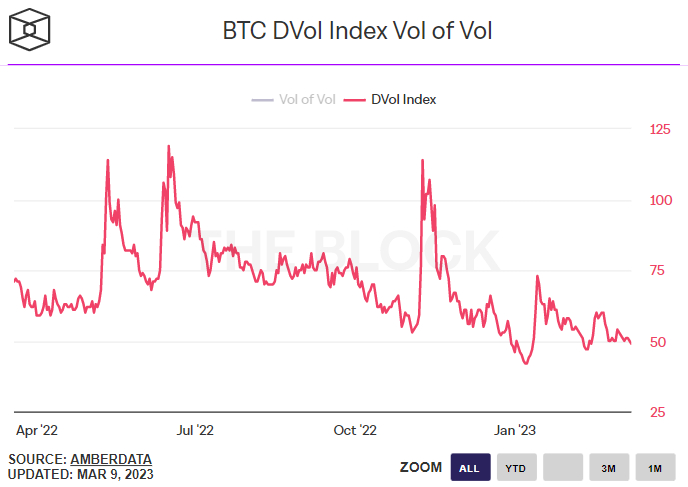

Meanwhile, Deribit’s Bitcoin Volatility Index (DVOL) can also be broadly unchanged versus recent days at 49, but still a little way over the record lows of 42 it hit captured.

Where Next for Bitcoin (BTC)?

Bitcoin’s latest cost collapse has opened up the doorway to the drop back underneath the $20,000 level. But traders is going to be eyeing near-term support within the $19,700-800 region by means of the 200-Day Moving Average and Recognized Cost, level which, if retested, could attract significant dip-buying interest.

Searching at Bitcoin on the broader time horizon, Bitcoin’s latest drop still leaves rid of it inside the ranges of history eight several weeks. While further downside might be instore, with Bitcoin getting only erased 50% of their rally from the November 2022 lows, it remains far to soon to bet on new bear-market cycle lows for that world’s largest cryptocurrency by market capital.

Within the near-term, US jobs data for Feb scheduled for release on Friday and then week’s US CPI report is going to be type in figuring out near-term momentum. Bulls is going to be wishing for downside surprises that may ease concerns about Given tightening and supply the BTC cost with a few space for any recovery.