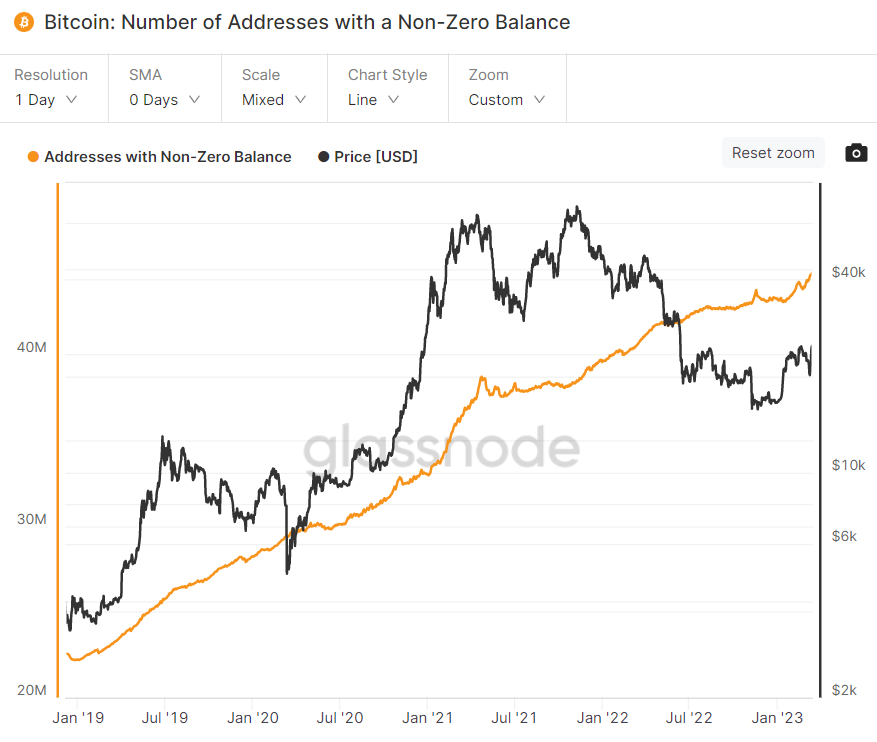

In under 30 days, the Bitcoin network has added nearly a million wallets that hold a non-zero balance. Based on data presented by Glassnode, at the end of Feb, the amount of non-zero wallets around the network dipped from around 44.two million close to 43.8 million by Feb the 23rd. However, this metric has since enjoyed a ferocious recovery to a different record a lot of 44.778 million by Wednesday the 15th of March.

Analysts view the amount of wallets around the Bitcoin address having a non-zero balance like a crude proxy for that network’s adoption. More wallets having a non-zero balance is assumed to match more individual people that use the network and investors in Bitcoin. An increasing quantity of addresses having a non-zero balance theoretically signifies rising interest in Bitcoin, that ought to (over time) boost its value.

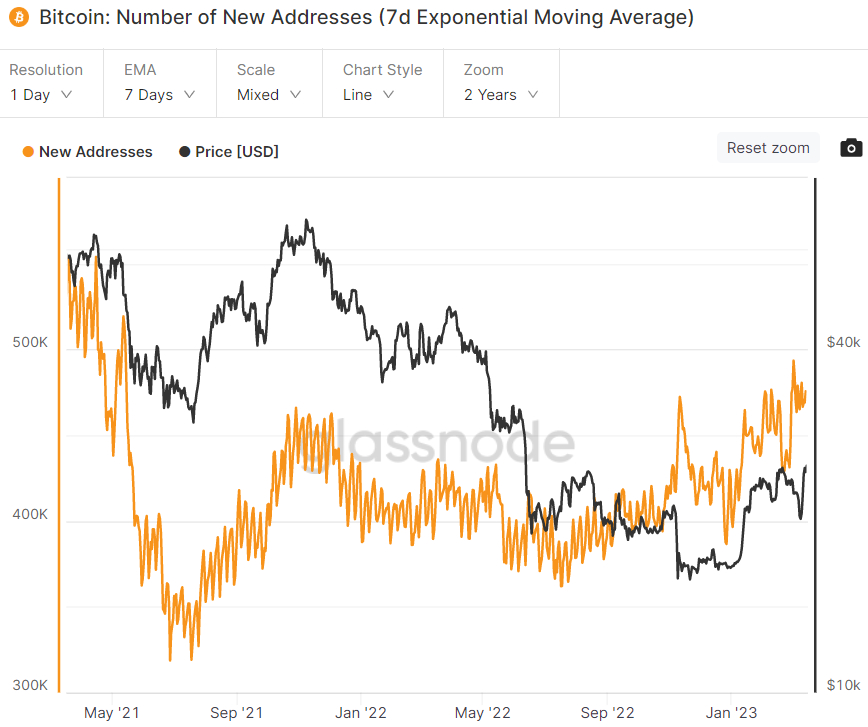

The sharp increase in the amount of wallets having a non-zero address isn’t the only real on-chain proxy for Bitcoin demand that’s trending inside a positive direction. Based on Glassnode, the seven-day Exponential Moving Average (EMA) of recent Addresses getting together with the Bitcoin network continues to be trending greater since last summer time striking its greatest level earlier this year since mid-2021.

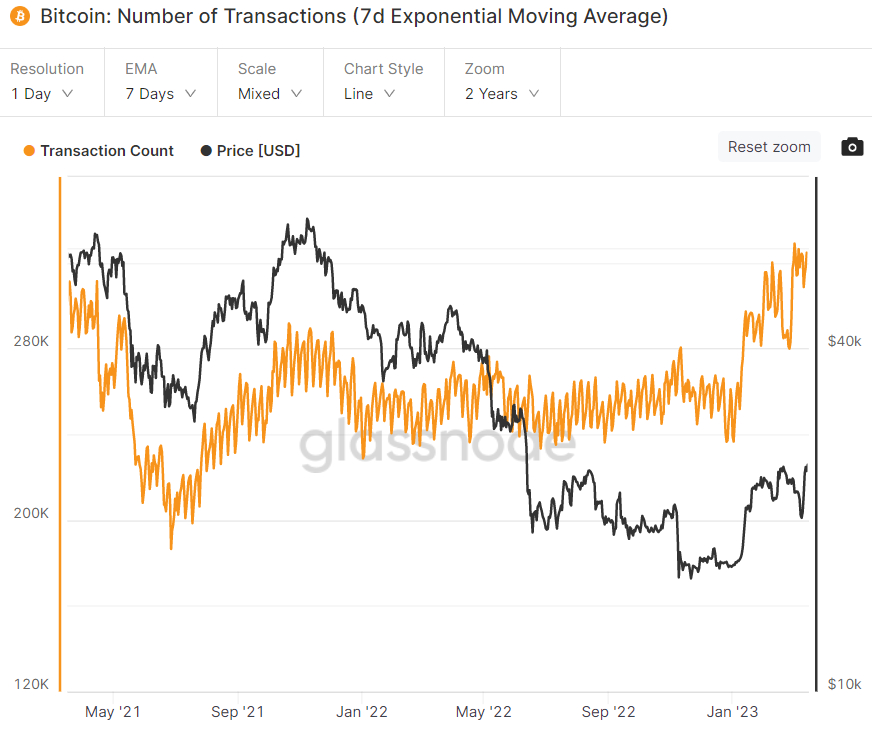

The seven-day EMA of the amount of daily transactions happening around the Bitcoin network has additionally been obtaining because the finish of this past year, lately hitting its greatest level in over 2 yrs.

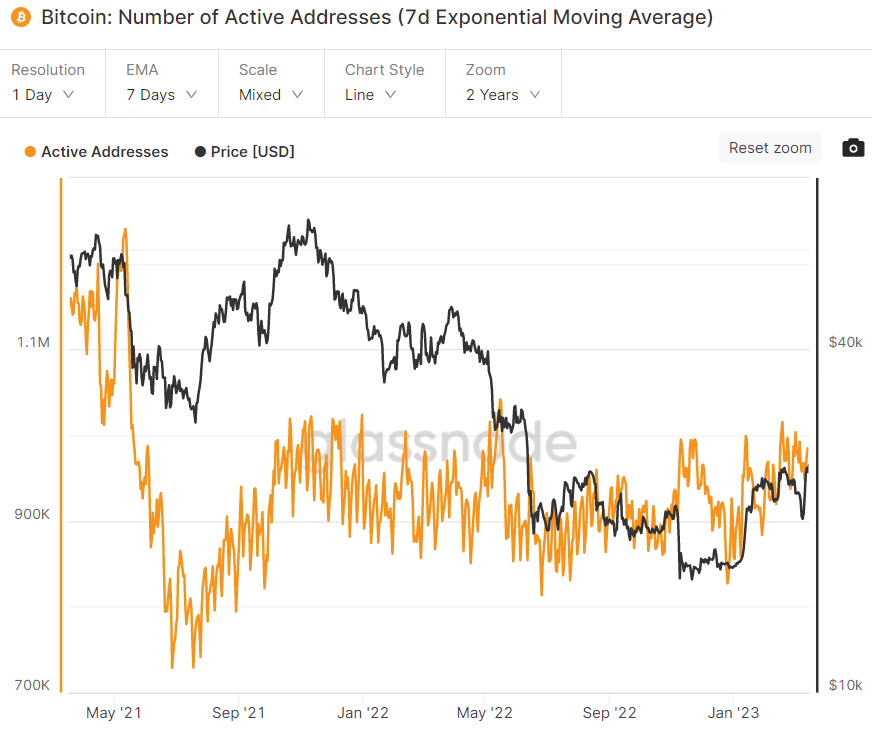

The pick-in the seven-day EMA of the amount of active addresses is a little less impressive, however it nevertheless also lately hit multi-month highs in excess of a million, which seems to possess been a ceiling since around the center of 2021.

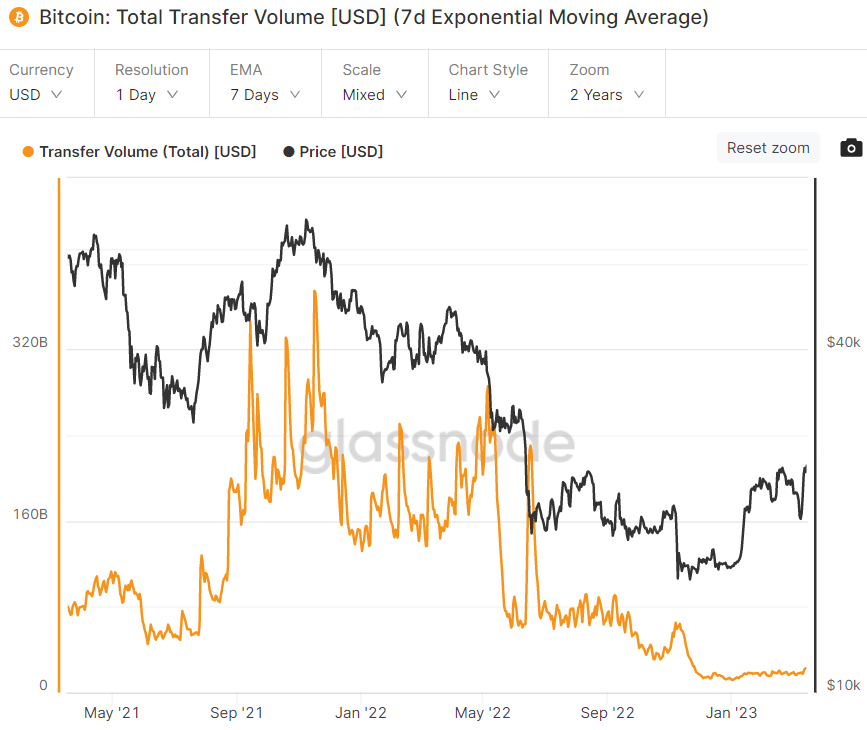

Finally, the seven-day EMA from the USD-denominated Total Transfer Volume happening around the network is showing some very tentative indications of obtaining from very covered up (by recent historic comparison) levels.

Other On-Chain Metrics Suggest Bitcoin is Transitioning to a different Bull Market

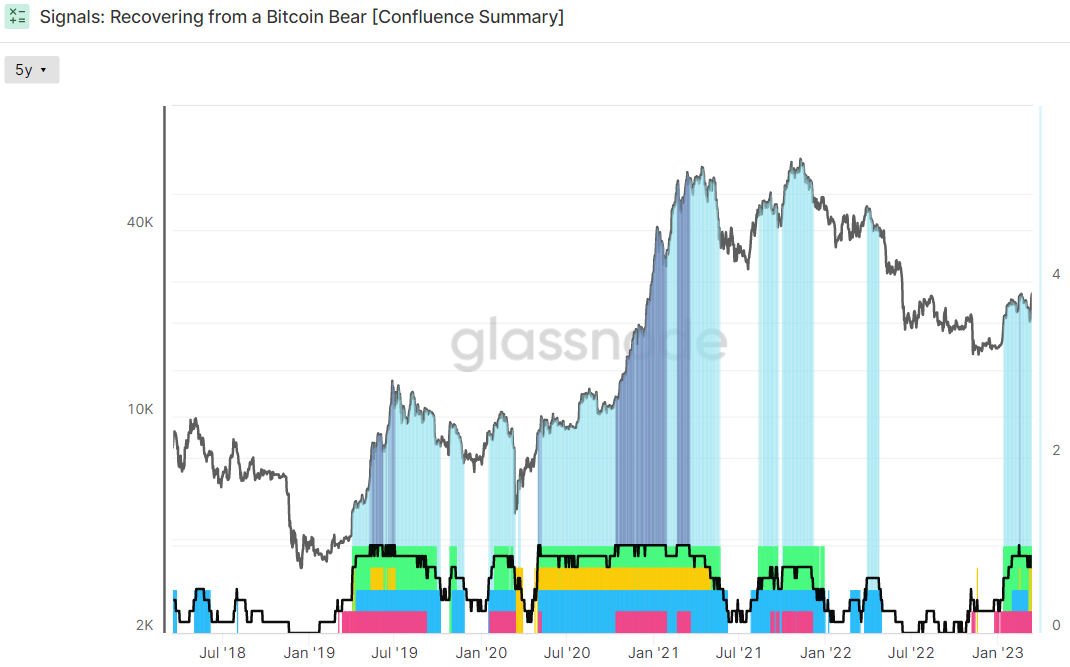

As discussed inside a recent article, the majority of the on-chain and technical indicators monitored by Glassnode within their broadly adopted “Recovering from the Bitcoin Bear” dashboard are flashing eco-friendly and shortly, all eight most likely is going to be. Glassnode produced this popular dashboard to assist identify whether Bitcoin is transitioning from the bear market into a time period of recovery/new bull market.

The Dealing with a Bitcoin Bear dashboard tracks eight indicators to determine whether Bitcoin is buying and selling above key prices models, whether network utilization momentum is growing, whether market profitability is coming back and if the balance of USD-denominated Bitcoin wealth favors the lengthy-term HODLers.

When all eight are flashing eco-friendly, it has in the past been a powerful bullish sign for that Bitcoin market. Right now, seven of eight indicators are flashing eco-friendly. The above mentioned chart is shaded light blue when five from eight indicators are flashing eco-friendly and fast when all eight are flashing eco-friendly.

Where Next for that BTC Cost?

After a powerful couple of times of volatility in the finish of a week agoOrstarting of the week, Bitcoin is consolidating near to the $25,000 level as market participants mull what’s next for that world’s largest cryptocurrency by market cap. Bitcoin’s recent decoupling to all of us equities has some believing that if concerns regarding financial stability in america and elsewhere still rise, this might still raise the Bitcoin cost.

Bitcoin, a decentralized, independent peer-to-peer payments network is observed by many people like a safe option to the fiat-based, central bank-centered fractional reserve system. Another potential tailwind for Bitcoin might be if next week’s Given meeting is decisively dovish (presuming that Given officials fear a hawkish message could further roil the banking system).

Meanwhile, BTC’s recent strong bounce from the 200DMA and Recognized Cost underneath the $20,000 level is yet another tailwind. The truth that Bitcoin were able to crack above key lengthy-term resistance within the $25,200-400 area the 2009 week means the doorway is available to a run greater for the next resistance area surrounding $28,000 and possibly a test of $30,000.