Bitcoin place and derivative buying and selling volumes happen to be surging previously couple of days together using the cryptocurrency’s aggressive rally from early monthly lows under $20,000.

That implies there’s lots of conviction behind the current move greater, which saw Bitcoin eclipse $28,000 now the very first time in nine several weeks.

At current levels within the mid-$28,000s, Bitcoin expires over 3Percent within the last 24 hrs, 13.5% within the last 7 days and 19% within the last thirty days based on CoinGecko.

Bitcoin’s cost continues to be supporting since mid-March among concerns about US (and global) financial stability following a number of highly publicized bank failures, in addition to because of an connected dovish pivot in the US Fed.

Despite still raising rates of interest by another 25 bps now given inflation continues to be raging well above target, the united states central bank softened its tone around the outlook for more rate of interest hikes, and financial markets are betting strongly on the beginning of an interest rate-cutting cycle beginning within the other half of 2022.

Place & Derivative Volumes Boost in Bull Market Tell

The most recent boost in Bitcoin buying and selling volumes increases the good reasons to believe that a brand new Bitcoin bull market has showed up.

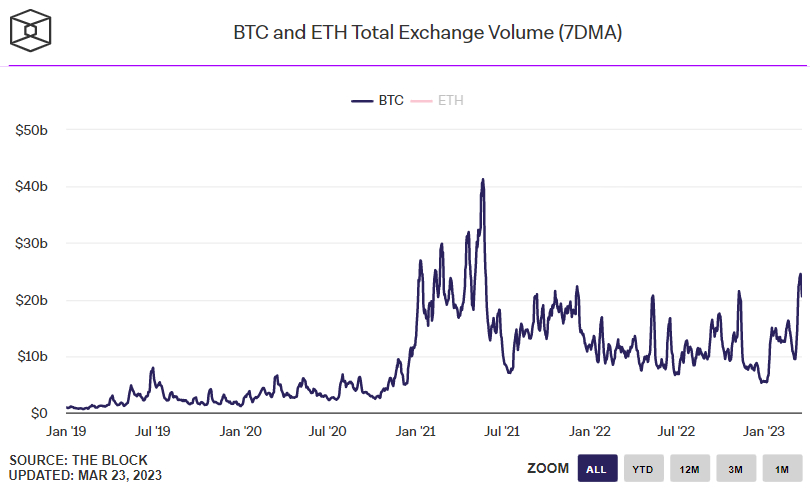

Based on data presented through the Block, the 7-day Moving Average of Bitcoin buying and selling volumes on exchanges rose close to $24 billion the 2009 week, its greatest level since mid-2021.

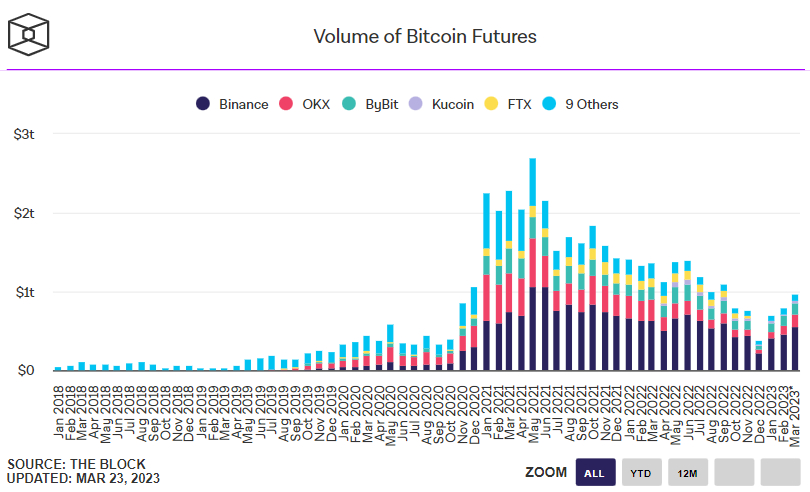

Meanwhile, despite March not over yet, the level of Bitcoin futures traded across exchanges this month to date has already been at its greatest since last September at near to $1 trillion.

It’ll most likely finish the month at its greatest since last This summer or June. Bitcoin futures really are a derivative from the underlying place Bitcoin asset.

Futures represent an assurance that the asset is going to be delivered at some point later on. Industrial companies trade commodity futures to secure their way to obtain recycleables, but futures will also be employed for speculation, as with the situation of Bitcoin.

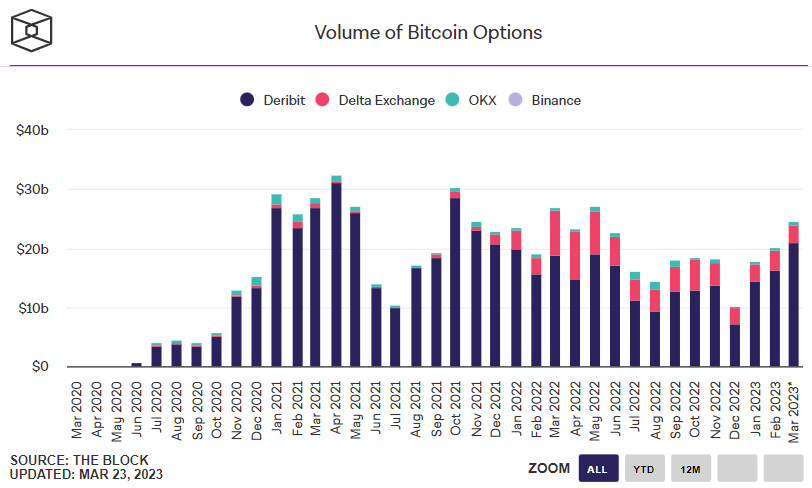

Bitcoin options market volumes are also surging this month. Regardless of the month not being over, March has seen more Bitcoin options trade than any month since last May (at nearly $25 billion).

Investors use Bitcoin choices to bet on or hedge against cost swings. Given they’re a more elaborate asset class to know and trade, institutions and professional buying and selling desks constitute a larger proportion of overall buying and selling volumes.

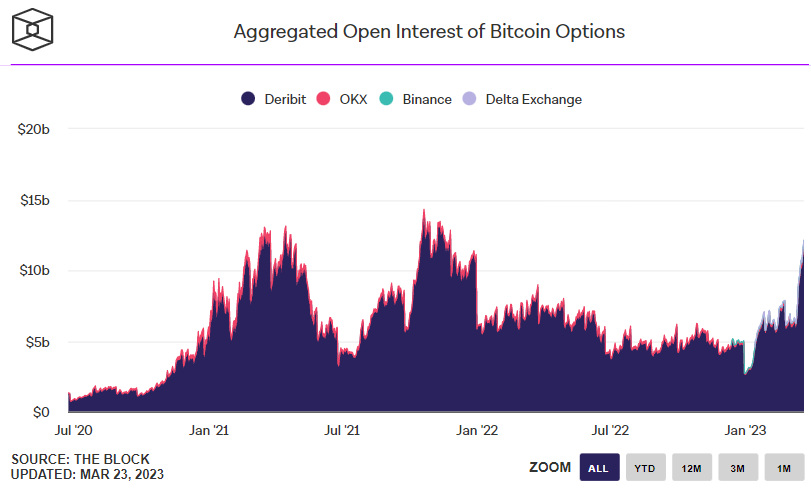

Surging Bitcoin options volumes could thus signify that institutional buying and selling activity is rising. Another tell that institutions are walking in in greater figures/dimensions are the current spike in Bitcoin option open interest.

By Wednesday the 22nd of March, open interest had spiked to $12.14 billion, its greatest level since November 2021, when Bitcoin was last whatsoever-time highs.

What This Signifies for BTC?

Surging volumes across place and derivative markets send a powerful signal the latest Bitcoin rally, that has seen prices surge an astounding greater than 70% around the year, is a lot more than only a flash within the pan.

Indeed, the boost in Bitcoin buying and selling activity goes hands in hands with an array of positive on-chain signals that have a powerful history of predicting when Bitcoin will transition from the bear to some bull market, as discussed in the following paragraphs.

Even just before US bank troubles and also the Fed’s resultant dovish shift adding further spice towards the 2023 rally, many investors were already from the conclusion that 2022’s bear market was over.

Analysts have flagged $30,000 because the next major hurdle, while technicians have cautioned that 10% pullbacks remain a constantly-present risk. Things will certainly be choppy within the several weeks ahead.

But positive fundamental trends (rising interest in Bitcoin instead of fiat currency and among expectations for Given easing), positive on-chain signals (like rising network activity) and positive trends in buying and selling (suggesting more investors walking directly into buy) should remain a tailwind for that near future.