Perils of a brief-term pullback within the Bitcoin (BTC) cost seem to be rising, based on chart analysis.

Bitcoin was last altering hands near to $27,500, about 6% underneath the nine-month highs it hit on Friday within the $29,300s.

The cryptocurrency’s repeated failure to carry above resistance by means of the late-May 2022 lows within the low-$28,000s now has become some traders worried that the short-term pullback to key support within the mid-$25,000s may be incoming.

And Bitcoin’s failure to carry above $28,000 isn’t the factor suggesting an elevated chance of a brief-term pullback.

In recent days, Bitcoin’s 14-day Relative Strength Index (RSI) has experienced bearish divergence.

This is when despite a ongoing increase in the Bitcoin cost, the RSI continues to be falling. Some technicians view this as suggestive of an incoming correction.

Furthermore, Bitcoin’s latest push in to the upper-$20,000s pressed an indication of cost momentum to in the past high levels, signifying a potentially overheating market.

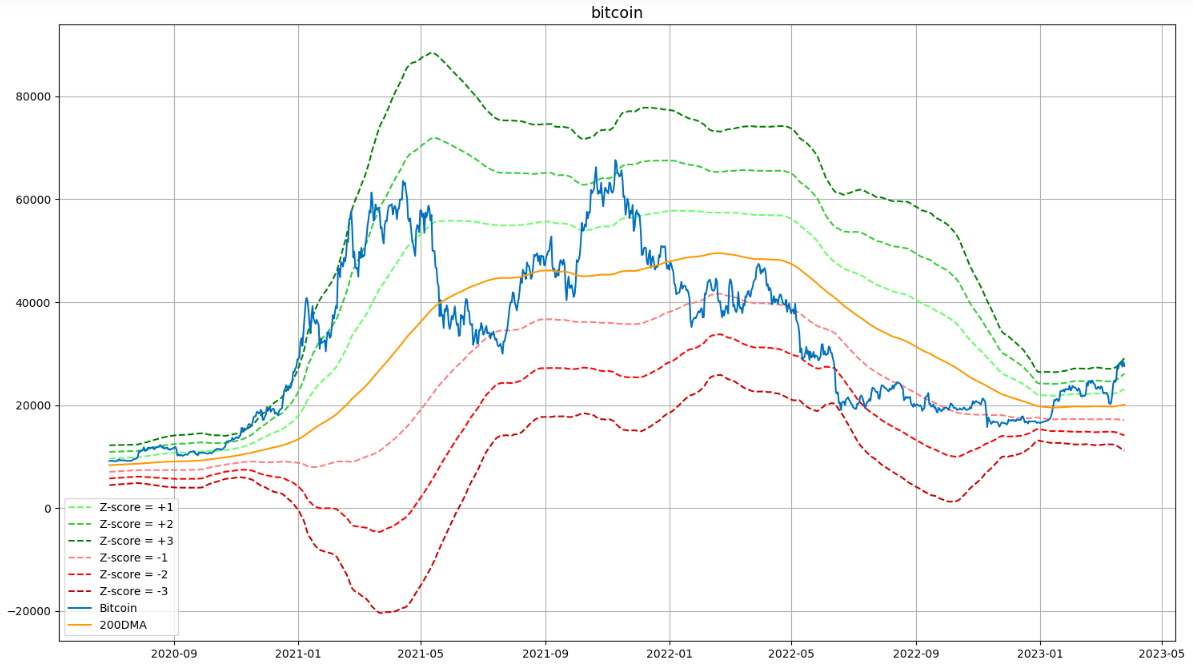

The 2009 week, Bitcoin’s Z-score to the 200-Day Moving Average (DMA) rose above 3..

Which means the cost was greater than three standard deviations above its average in the last 200 days, a very rare event that may signal that upside momentum gets overstretched.

Bitcoin’s Z-score to the 200DMA was last around 2.5, still high by historic standards and it is greatest since early 2020.

Dip-buying Demand to stay Elevated

So, the chance of a brief-term pullback seems to possess risen. But Bitcoin bulls shouldn’t fret an excessive amount of.

That’s since the fundamental narratives that drove the astounding bounce from mid-March lows under $20,000 will probably remain tailwinds for that near future.

Readers will recall that three US banks went under earlier this year, sparking concerns in regards to a broader global banking crisis and pushing traders to strongly pare back on bets on more tightening in the US Fed.

Not surprisingly, the Given delivered a dovish pivot in the rate guidance at its meeting now (despite still lifting rates of interest by another 25 bps), with investors now betting that the cutting cycle will commence within the other half of the season.

The mixture of economic crisis concerns and bets on simpler financial policy have provided Bitcoin the twin tailwind of safe-haven demand (like a fiat currency alternative) and interest in assets that succeed inside a lower rate of interest atmosphere (which Bitcoin typically has).

Bank contagion risks remain high and also the US economic outlook has darkened substantially, and therefore these tailwinds should remain strong.

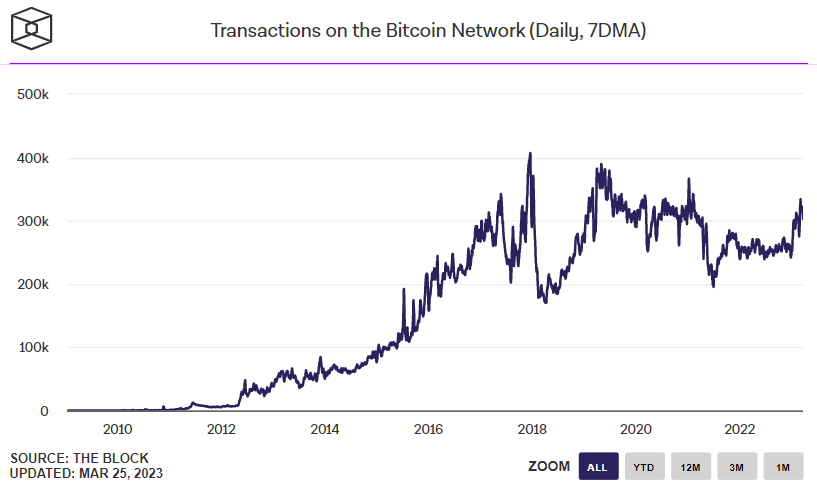

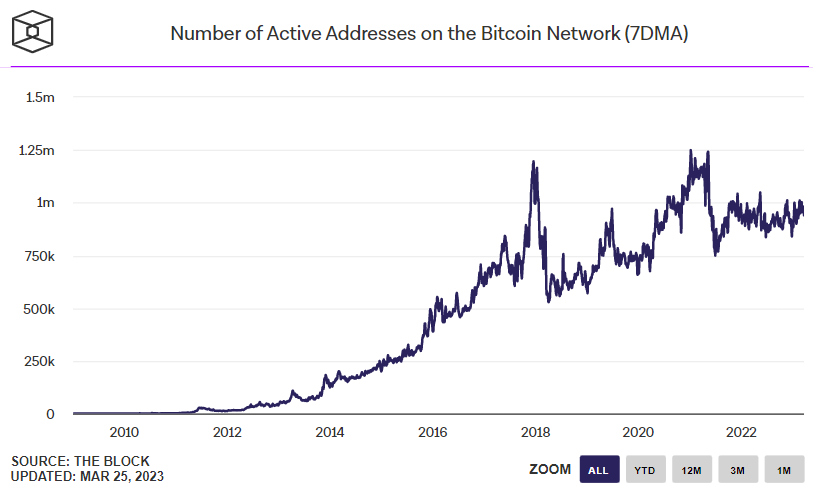

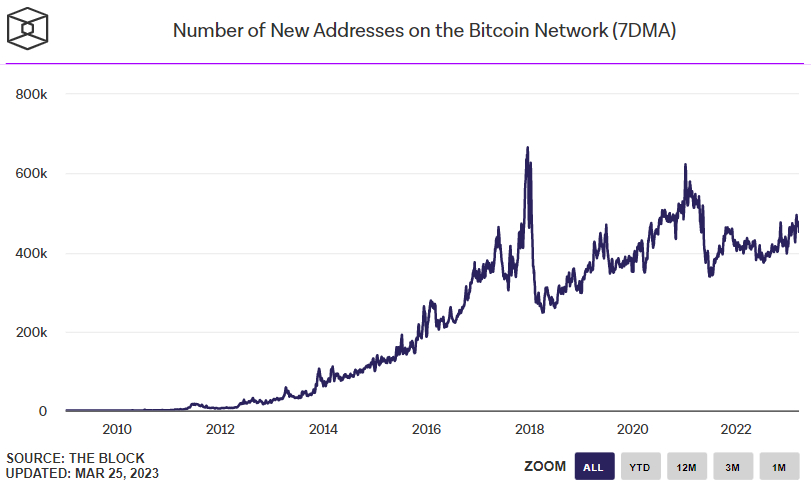

Bitcoin can also be prone to continue deriving longer-term tailwinds from positive on-chain trends.

Included in this are a stable but sustained increase in daily transactions, non-zero balance wallet addresses, the speed of recent address creation and daily active wallets getting together with the blockchain.

Any fall to the $25,000 area within the Bitcoin cost would probably be met with aggressive dip buying demand.

Longer-term risks remain tilted perfectly into a push in to the $30,000s within the coming days and several weeks.

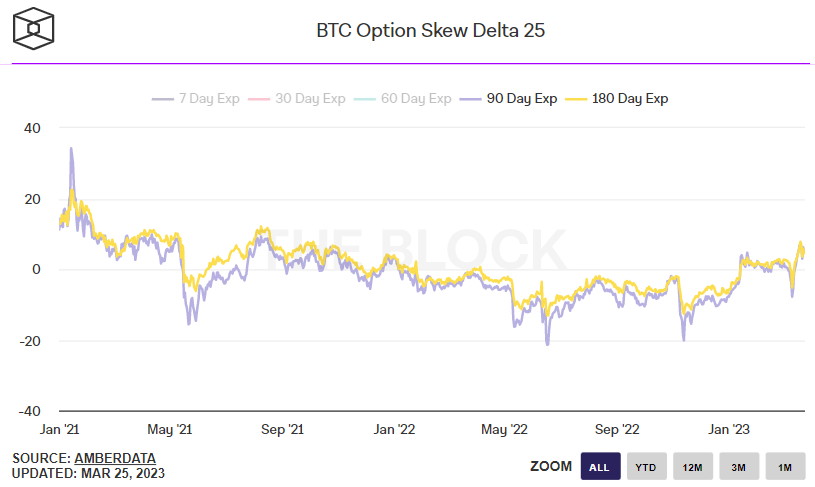

A minimum of, that’s the content from Bitcoin options markets – The 25% delta skew of Bitcoin options expiring in 90 and 180-days remain near to their greatest levels since late 2021 when Bitcoin hit all-time highs above $69,000.