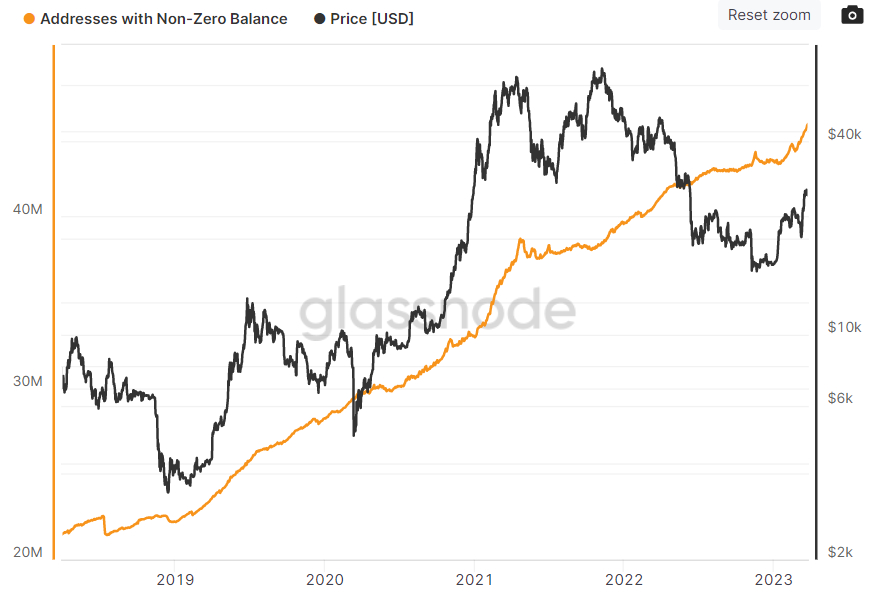

The amount of Bitcoin wallets holding a non-zero BTC balance is constantly on the rocket greater, hitting a brand new all-time a lot of 45.388 million on Sunday, according to data presented by crypto analytics firm Glassnode.

That’s an increase well over two million since the beginning of 2022 and it is the quickest rate where the Bitcoin network has added non-zero wallet addresses since early 2021.

That’s great news for that Bitcoin cost, like a greater quantity of wallets having a non-zero balance implies more investors are walking in to the Bitcoin market, or, in simpler terms, that demand keeps growing.

However, a couple of other broadly adopted metrics relating to activity around the Bitcoin blockchain have weakened within the last couple of days, in wake of Bitcoin’s failure to check $30,000 a week ago.

If Bitcoin would be to blast past $30,000, a pickup during these metrics will probably be needed.

Bitcoin Network Activity Weakens

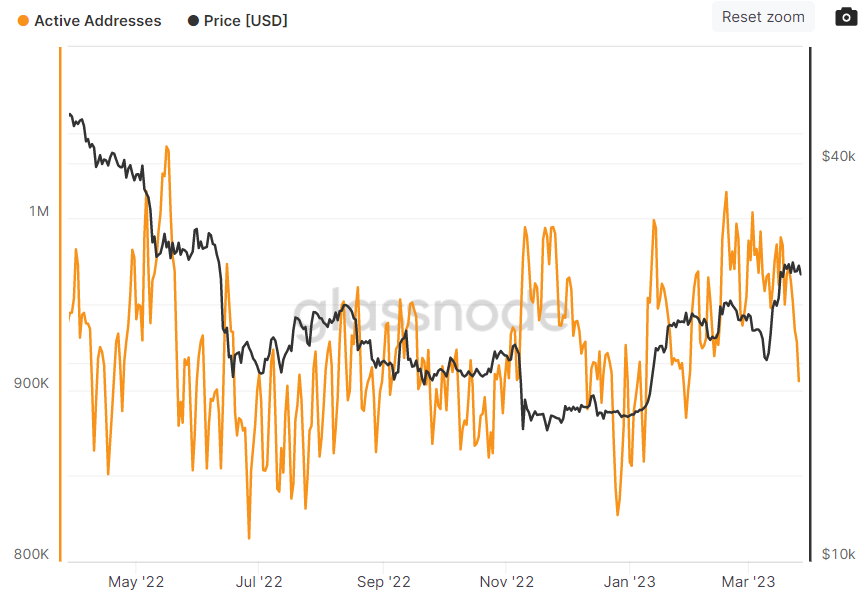

The seven-day moving average of the amount of active addresses getting together with the Bitcoin network every day lately fell to the cheapest level since late The month of january.

Less activity between wallets around the Bitcoin systems shows that Bitcoin buying and selling volumes have fallen versus their levels during the last couple of days, implying demand weakness.

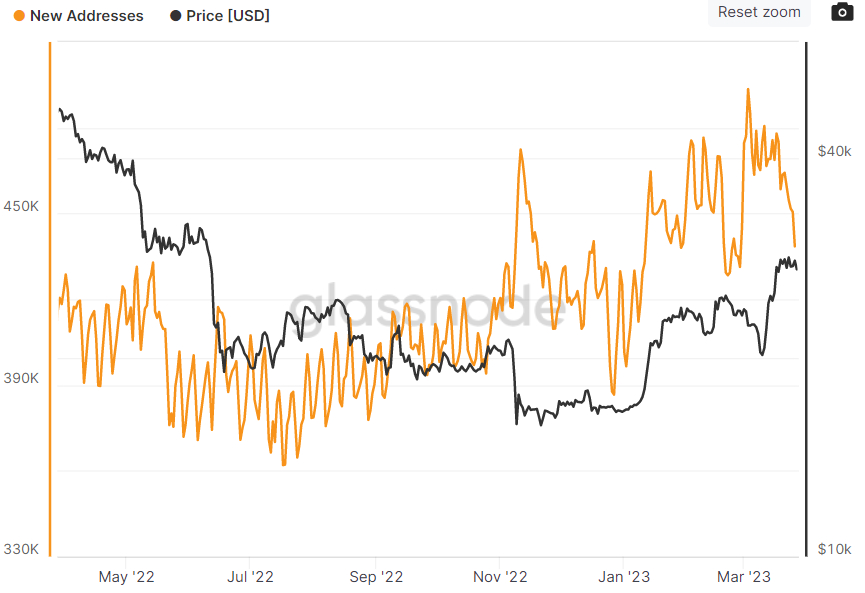

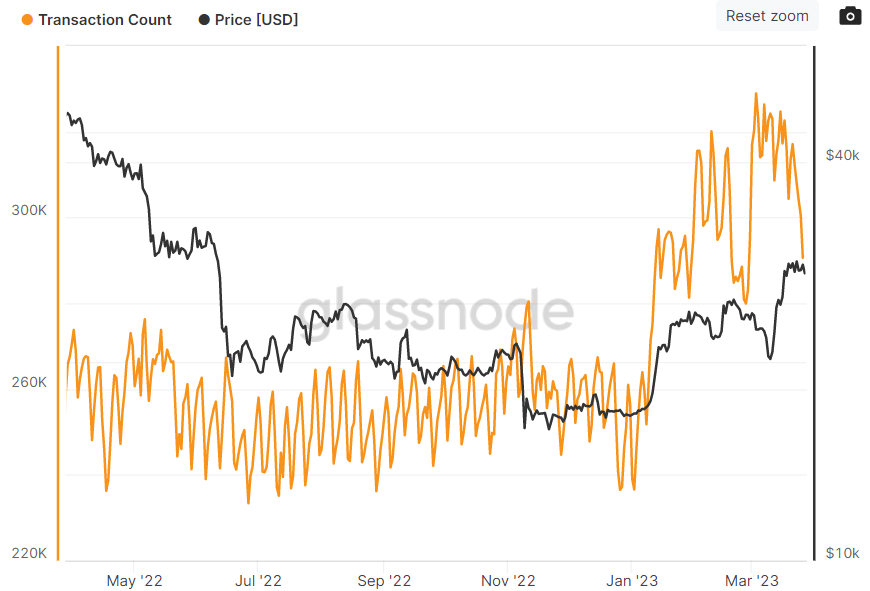

Meanwhile, the seven-day moving average of the amount of new addresses getting together with the Bitcoin network lately fell to 1-month lows, as did the seven-day moving average quantity of transactions happening around the Bitcoin network.

As above, this weakness in key metrics calculating network activity, utilization and growth suggests a small weakening of interest in Bitcoin.

But Bulls Shouldn’t Panic

Bitcoin bulls shouldn’t panic. Despite some modest weakness during these metrics, the 3 stay in an upward trend for that year and really should, at the minimum, stay at elevated levels when compared with where these were for a lot of 2022 presuming the Bitcoin cost can at any rate hold within the upper $20,000s.

While Bitcoin does look vulnerable to a drop back towards key support within the $25,000 given some technical indicators also have pointed towards the March rally being a little overstretched, analysts expect dips to become bought and cost predictions remain, typically, upbeat.

That’s since the fundamental narratives that drove the astounding bounce from mid-March lows under $20,000 will probably remain tailwinds for that near future.

Readers will recall that three US banks went under earlier this year, sparking concerns in regards to a broader global banking crisis and pushing traders to strongly pare back on bets on more tightening from the united states Fed.

Not surprisingly, the Fed delivered a dovish pivot in its rate guidance at its meeting now (despite still lifting rates of interest by another 25 bps), with investors now betting that the cutting cycle will commence within the other half of the season.

The mixture of financial crisis concerns and bets on simpler financial policy have provided Bitcoin the twin tailwind of safe-haven demand (like a fiat currency alternative) and interest in assets that succeed inside a lower rate of interest atmosphere (which Bitcoin typically has).

Despite some recent positive developments, such as the SVB buyout and reports of action by US government bodies made to save First Republic, bank contagion risks remain high.

Meanwhile, the united states economic outlook has darkened substantially, and also the mixture of these 4 elements implies that Bitcoin’s tailwinds should remain strong.

As prices increase in the approaching several weeks, on-chain metrics should still follow, adding further authenticity towards the rally.