We research, you receive the alpha!

Get exclusive reports and use of key insights on airdrops, NFTs, and much more! Subscribe how to Alpha Reports or more your game!

Bitcoin miners are more and more facing off against a brand new foe to deal with in front of this week’s halving: the AI boom.

Analysts at investment firm AllianceBernstein, Gautam Chhugani and Mahika Sapra, stated that miners are actually rivaling AI data centers in places like Texas.

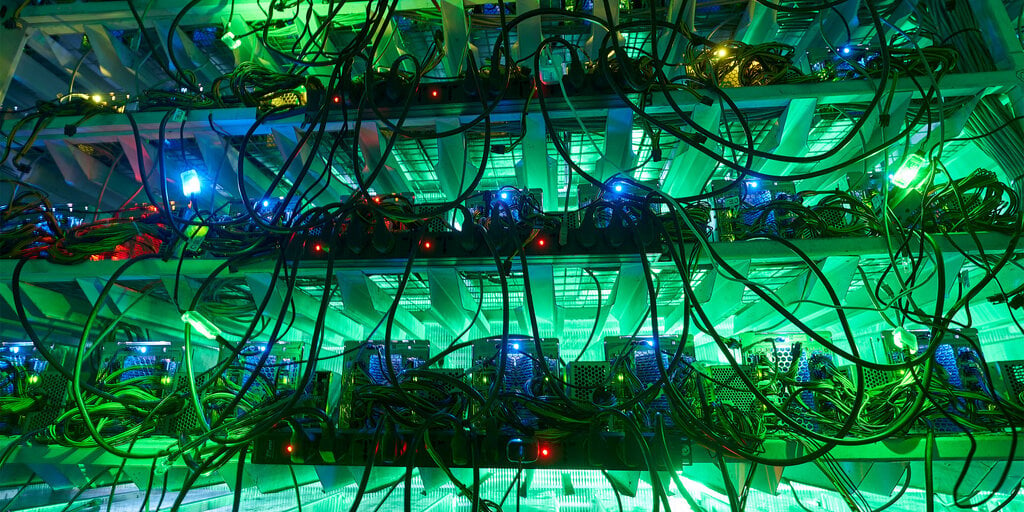

Bitcoin miners are largely centralized operations that mint new digital coins. To do this, a Monday report explains, they have to use lots of computers and for that reason energy. Meanwhile, the booming AI market is also power-hungry. Both industries turn to places like Texas, that has cheap energy and a lot of land to construct data centers.

Today’s report stated the growing competition using the AI industry “has made land acquisition with power contracts relatively competitive for miners.”

The report also added the AI hype may also help miners who’ve spare income, however.

“Bitcoin ASIC chips have experienced to contend with strong AI chips demand this cycle, and therefore manufacturers happen to be interested in bulk contracts/purchase options with miners who’re flush with cash” from capital raises.

The analysts added that miners happen to be in a “relative advantage” using the approaching halving.

Miners are rewarded with Bitcoin for minting new coins however this week’s event—which occurs every four years—will cut individuals rewards in two from 6.25 BTC to three.125 BTC. What this means is miners happen to be getting ready to work more proficiently in which to stay the race.

The Bernstein analysts also stated that CEOs of mining companies have claimed their firms have been in a comparatively comfortable budget in front of the halving—despite Bitcoin’s current cost dip.

“The CEOs also indicate relatively low debt around the balance sheet and additional no equipment financing pledging mining rigs,” the report added.

Bitcoin’s cost has dipped well below its March all-time a lot of nearly $74,000 per gold coin. The asset has become buying and selling for $63,145, based on CoinGecko—below its previous all-time a lot of $69,044 it touched in 2021.

Edited by Ryan Ozawa.