We research, you receive the alpha!

Get exclusive reports and use of key insights on airdrops, NFTs, and much more! Subscribe how to Alpha Reports or more your game!

The Apecoin ecosystem, from the Bored Ape Yacht Club (BAYC) NFT collection, continues to be battling. Despite recent Bitcoin-brought bullish trends within the crypto market, Apecoin ($APE) has unsuccessful to get back significant traction, having a 66% cost drop within the last one year along with a 24% reduction in 2024 alone.

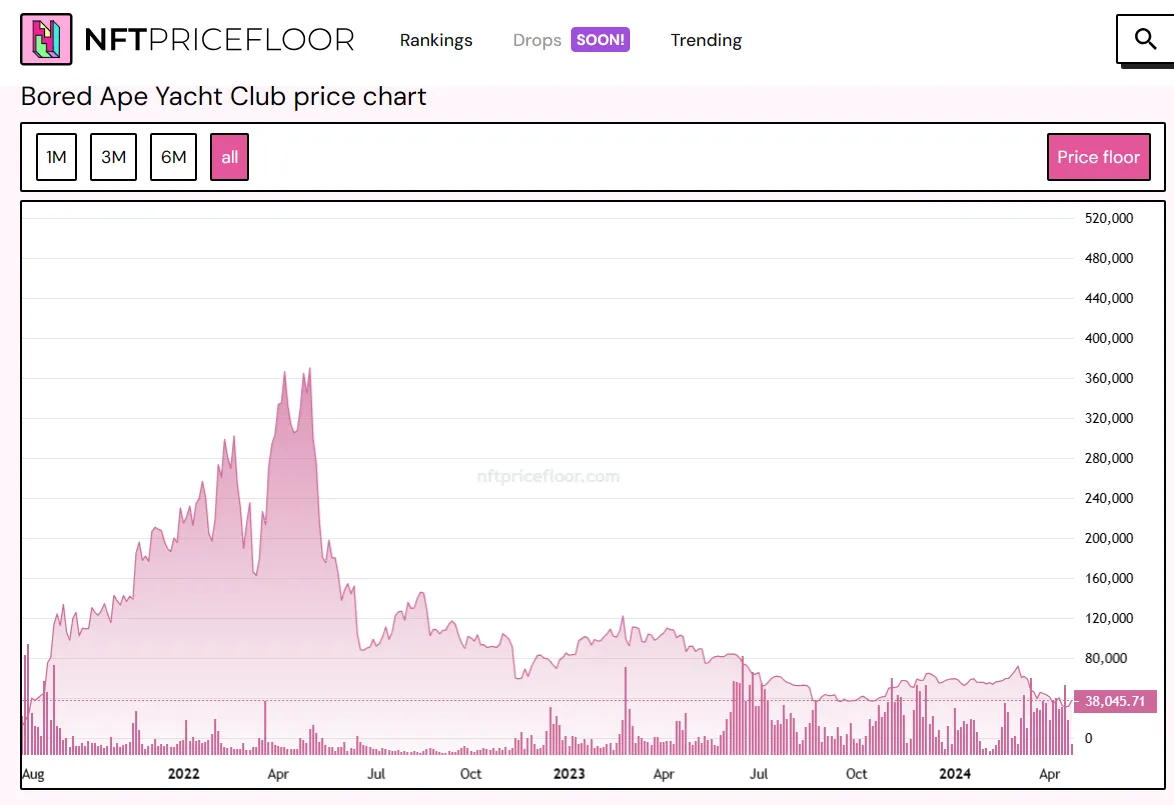

Compounding this, the cost floor of BAYC NFTs continues to be on the volitile manner since last April, falling from the peak of $369K to the current $38K per token, based on NFT Cost Floor.

There now appears to become a glimmer of expect Apecoin, however. After hitting an exciting-time low of $.989 on April 13, the gold coin has possessed a 35% recovery, reaching its current cost of $1.334. Within the last 24 hrs, Apecoin has surged by 4.82% and it is up 12.5% within the last 7 days—although will still be lower by 27.93% within the last thirty days, with the majority of the crash happening at the begining of April.

A part of Apecoin’s recovery might be related to the current efforts from the Apecoin DAO to locate new methods to boost engagement while increasing use cases for his or her tokens.

One particular initiative is AIP-397, an offer to produce an “NFT Launchpad” operated by Apecoin. This platform would let the creation and buying and selling of NFTs using Apecoin. The woking platform would introduce Puffles, “a user-friendly, no-code tool” that people mint NFTs on various blockchain systems, using Apecoin rather of other cryptocurrencies.

The proposal does not appear to become gaining much traction, however, with simply 30% of Apecoin holders supporting it at this moment. Voting is live until May 1, 2024 with lots of people criticizing the proposal for too little details that will make implementation difficult.

Another proposal was enthusiastically approved, however: AIP-405, which may launch ApeSwap, a local ApeChain DEX by which 50% of charges are came back towards the ApeCoin DAO treasury. This initiative has greater than 80% approval by having an allocation close to 750,000 Apecoin —just over $1M in the current prices.

From the technical analysis perspective, Apecoin’s cost action does not look promising. The gold coin has hit a significant volume zone at its cheapest level, and also the recent 35% spike might encourage swing traders to assert their gains. The gold coin is meanwhile presently testing the EMA10 zone, that is underneath the EMA55, indicating the cost from the last ten days is decelerating faster as time progresses.

The Squeeze Momentum Indicator shows that a rebound might be beginning, however the Average Directional Indez (ADX) at 36 implies that the bearish trend continues to be strong. The Relative Strenght Indicator (RSI) implies that the gold coin is oversold, with bears dominating 60% from the trades.

If Apecoin remains bearish, it might lose its recent 35% gains and retest its all-time lower in the $1 to $1.10 zone. However, whether it maintains its momentum, it might spike yet another 35% until it tests the resistance set through the EMA55 around $1.66.

Edited by Ryan Ozawa.