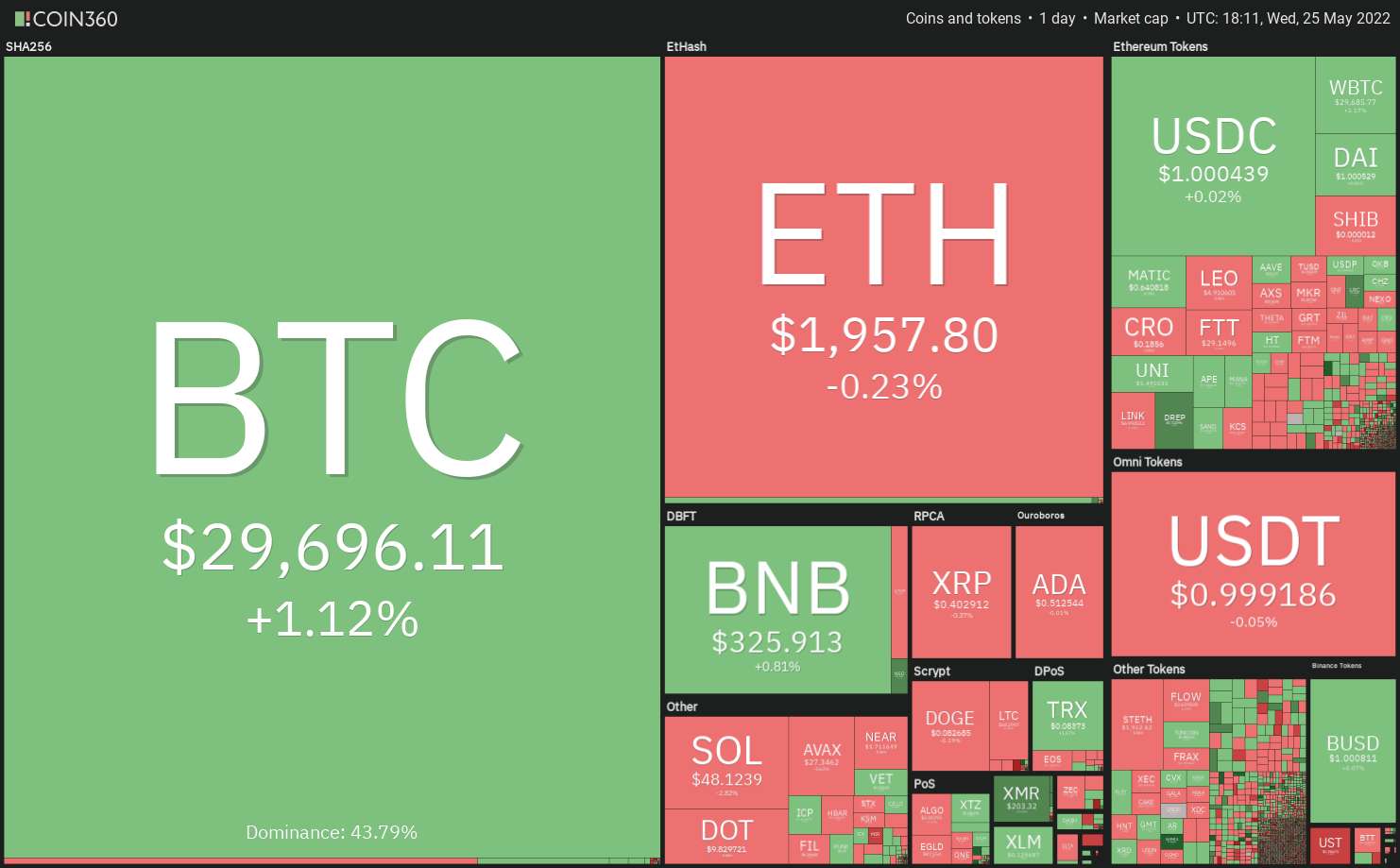

Bitcoin (BTC) continues to be battling to sustain above $30,800 since May 16, suggesting that demand dries up at greater levels. Similarly, U.S. equity markets haven’t stopped to say no because of uncertainty regarding the amount of rate hikes that’ll be required to bring inflation in check.

Because the crypto bear market deepens, analysts have become extra bearish on their own projections for that extent from the fall. Trader and analyst Rekt Capital stated that Bitcoin might be at chance of falling to $19,000 to $15,500 before a bottom is created.

However, Arcane Research lately noticed that buying when Bitcoin’s Fear and Avarice Index reaches a score of 8 had led to an average median 30-day return of 28.72%. Interestingly, the index hit 8 on May 17.

Could Bitcoin slide further and pull altcoins lower or are you ready for any recovery? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin rose over the downtrend line on May 23 however the bulls couldn’t sustain the greater levels. The cost switched lower and dipped towards the strong support at $28,630 on May 24 however a minor positive would be that the bulls effectively defended this level.

The bulls are again trying to push and sustain the cost over the downtrend line. When they succeed, the BTC/USDT pair could rally towards the 20-day exponential moving average (EMA) ($31,286).

In downtrends, the bears have a tendency to sell the rallies towards the 20-day EMA. Hence, this level may behave as a stiff resistance. The bulls will need to obvious this hurdle to point out that the bottom might be in position.

Around the downside, $28,630 may be the important support to keep close track of just because a break below it could cause a drop towards the May 12 intraday low at $26,700.

ETH/USDT

Ether (ETH) dipped underneath the upward trend line on May 24 however the bulls purchased at ‘abnormal’ amounts and pressed the cost back over the upward trend line. This means that bulls are attempting to defend the upward trend line with vigor.

However, the bears haven’t quit and they’re again trying to pull the cost underneath the upward trend line on May 25. If bulls thwart this attempt, the ETH/USDT could rise towards the overhead resistance at $2,159.

Unlike this assumption, when the cost breaks and sustains underneath the upward trend line, it’ll suggest benefit to bears. The happy couple could then decline to $1,903. A rest and shut below this support could pull the happy couple towards the May 12 intraday low at $1,800.

BNB/USDT

BNB climbed over the 20-day EMA ($323) on May 24 however the lengthy wick around the May 25 candlepower unit shows that the bears are trying to defend the overhead resistance at $350.

The flattish 20-day EMA and also the relative strength index (RSI) close to the midpoint tendency to slack a obvious advantage with the idea to the bulls or even the bears.

If bulls push the cost above $350, the benefit could tilt in support of the buyers. This type of move could obvious the road for any potential rally towards the 50-day simple moving average (SMA) ($368) and then to $413.

On the other hand, when the cost turns lower and breaks below $320, it’ll claim that bears are strongly selling at greater levels. The BNB/USDT pair could then slide to $286.

XRP/USDT

The bulls are protecting the immediate support at $.38. Although Ripple (XRP) bounced off $.39 on May 24, the bulls couldn’t sustain the greater levels.

The bears are again trying to sink the cost underneath the support at $.38 however the lengthy tail around the candlepower unit suggests strong buying at ‘abnormal’ amounts. When the demand sustains at greater levels, the bulls will endeavour to push the cost over the downtrend line and challenge the 20-day EMA ($.46).

On the other hand, when the cost turns lower in the current level or even the downtrend line, the bears may again attempt to sink the XRP/USDT pair below $.38. Whether they can accomplish it, the happy couple could drop towards the vital support at $.33.

ADA/USDT

Cardano (ADA) continues to be buying and selling inside a tight range from $.49 and $.56 since May 19. This means that bulls are trying to form a greater low but they are facing stiff resistance in the bears at greater levels.

When the cost rebounds from the support at $.49, the ADA/USDT pair may remain stuck within the range for any couple of more days. The bulls will need to push and sustain the cost over the 20-day EMA ($.58) to point the beginning of a powerful relief rally that could achieve the breakdown degree of $.74.

Rather, if bears sink the cost underneath the strong support at $.49, the selling may intensify and also the pair could slide toward the May 12 intraday low at $.40.

SOL/USDT

Solana’s (SOL) make an effort to rally on May 23 fizzled out at $54. The failure from the bulls to push the cost towards the 20-day EMA ($58) signifies that demand dries up at greater levels.

The bears are attempting to sink the cost underneath the immediate support at $47. When they manage to achieve that, the SOL/USDT pair could drop to $43 and after that towards the critical support at $37. The downsloping moving averages and also the RSI close to the oversold territory indicate benefit to sellers.

Unlike this assumption, when the cost rebounds off $47, the bulls will attempt to propel the happy couple over the 20-day EMA and challenge the breakdown level at $75.

DOGE/USDT

Dogecoin (DOGE) continues to be stuck in the tight range from $.08 and $.09 within the last couple of days. The bulls attempted to push the cost above $.09 on May 23 but unsuccessful. This might have attracted selling through the bears who are attempting to sink the cost underneath the immediate support at $.08.

When they succeed, the DOGE/USDT pair could slide towards the crucial support at $.06. It is really an important level for that bulls to protect just because a break and shut below it might resume the downtrend. The happy couple could then drop to $.04.

On the other hand, when the cost rebounds off $.08, the happy couple will continue to trade within the range for any couple of more days. The bulls will need to push and sustain the cost over the mental degree of $.10 to point the downtrend might be weakening.

Related: Singapore venture firm launches $100M Web3 and metaverse fund

Us dot/USDT

Polkadot (Us dot) continues to be clinging towards the $10.37 level within the last couple of days. The bulls pressed the cost above $10.37 on May 23 but tend to not sustain the greater levels. This means that bears can sell on rallies towards the 20-day EMA ($11.23).

The bears may attempt to pull the cost towards the immediate support at $9.22. If the support cracks, the Us dot/USDT pair could drop to $8 and after that to $7.30. The bulls are anticipated to protect the zone between $8 and $7.30 strongly.

Around the upside, the buyers will need to push and sustain the cost over the 20-day EMA to point the sellers might be losing their grip. The happy couple could then rally towards the breakdown level at $14 in which the bears may again mount a powerful defense.

AVAX/USDT

Avalanche (AVAX) broke underneath the pennant formation on May 24 however the lengthy tail around the day’s candlepower unit implies that bulls bought the dip. They attempted to push the cost into the pennant but unsuccessful.

The bears are attempting to build upon their advantage and pull the cost underneath the immediate support at $26.87. When they do this, the AVAX/USDT pair could slide towards the crucial support at $23.51. It is really an important level for that bulls to protect if they fail to achieve that, the downtrend could resume. The following support on however $20.

To invalidate this bearish view for the short term, the bulls will need to push the cost over the pennant and also the 20-day EMA ($37.23).

SHIB/USDT

Shiba Inu (SHIB) tried to break over the immediate resistance at $.000013 on May 23 however the lengthy wick around the day’s candlepower unit implies that bears still sell at greater levels.

The failure from the bulls to push the cost greater could attract selling by aggressive bears who’ll attempt to pull the SHIB/USDT pair underneath the immediate support at $.000010. When they manage to achieve that, the happy couple could slide towards the May 12 intraday low at $.000009.

Alternatively, when the cost rebounds from the support at $.000010, it’ll claim that bulls are purchasing on dips. That may keep your pair stuck within the $.000010 to $.000014 range for any couple of more days.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.