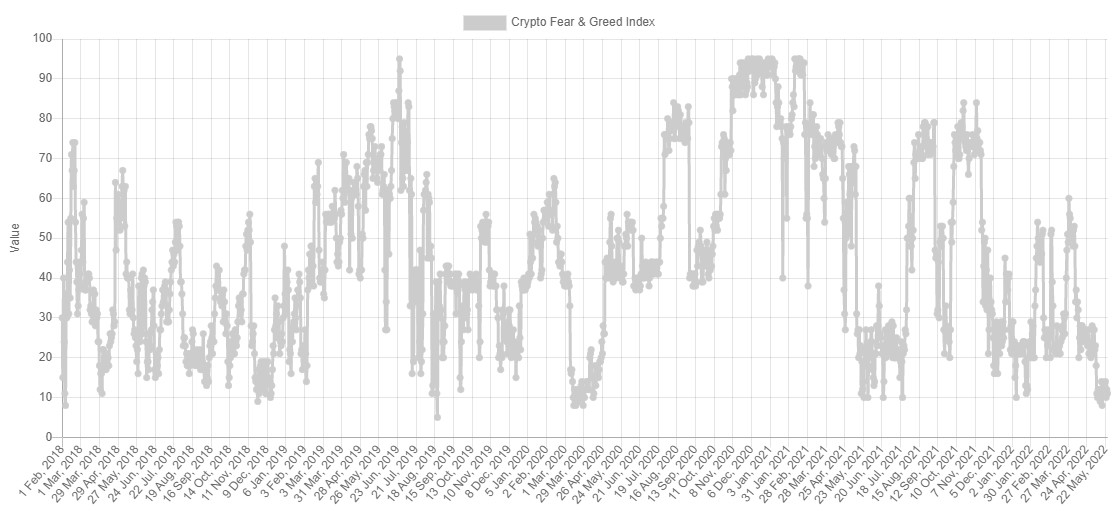

The cryptocurrency market settled right into a holding pattern on May 25 after traders opted to sit down around the sidelines in front of the mid-day Federal Open Market Committee (FOMC) meeting in which the Fed signaled it promises to carry on its road to raising rates of interest. Based on data from Alternative.me, the worry and Avarice Index seeing its longest run of maximum fear because the market crash in Mach 2020.

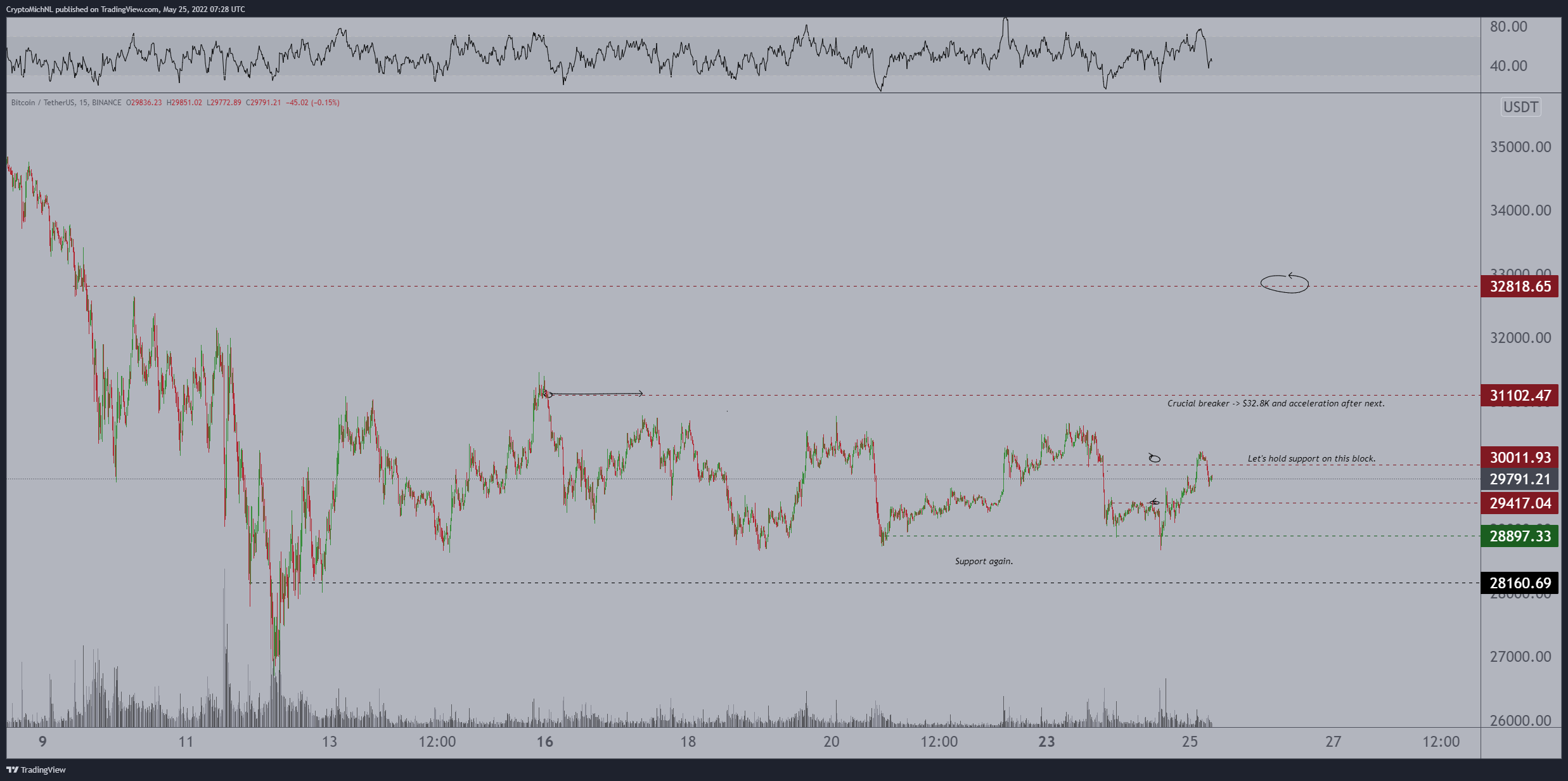

Data from Cointelegraph Markets Pro and TradingView implies that the cost action for Bitcoin (BTC) has ongoing to compress into an more and more narrow buying and selling range, but technical analysis indicators aren’t supplying much insight on which direction a potential breakout might take.

Here’s a glance at what analysts think could come next for Bitcoin cost.

Whales accumulate as Bitcoin battles to reclaim $30,000

According to promote analyst Michaël van de Poppe, “#Bitcoin broke through $29.4K and ran for the next resistance zone. When we hold $29.4K, i will be good towards $32.8K. Finally.”

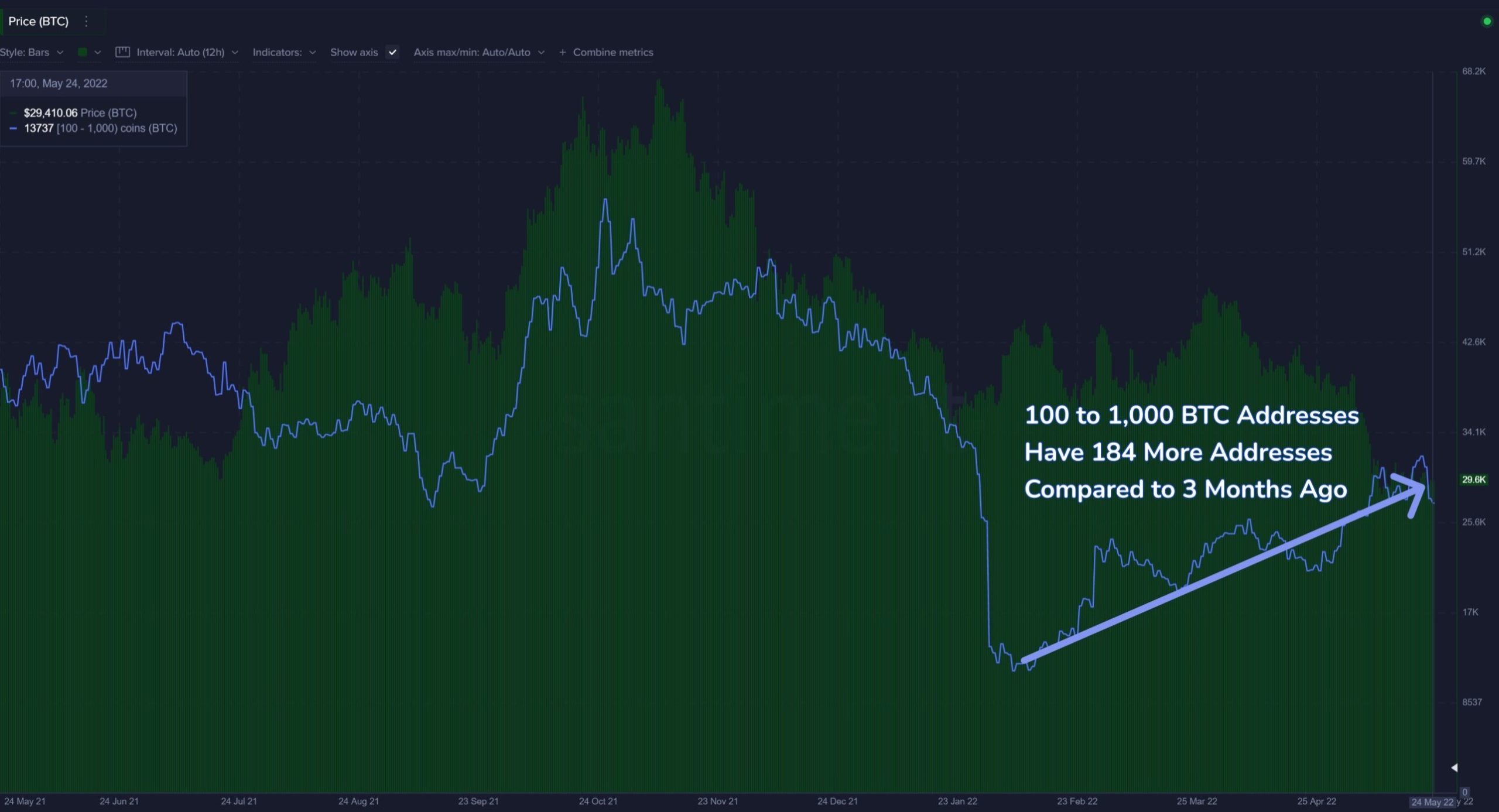

One interesting factor to notice at these cost levels is the fact that as the predominant sentiment is extreme fear, on-chain intelligence firm Santiment pointed out that whale wallets took this being an chance to amass some well-priced BTC.

Santiment stated,

“As #Bitcoin continues treading water at $29.6K, the quantity of key whale addresses (holding 100 to 1k $BTC) continues rising following the massive dumping from late The month of january. We have in the past seen a correlation between cost & this tier’s address quantity.”

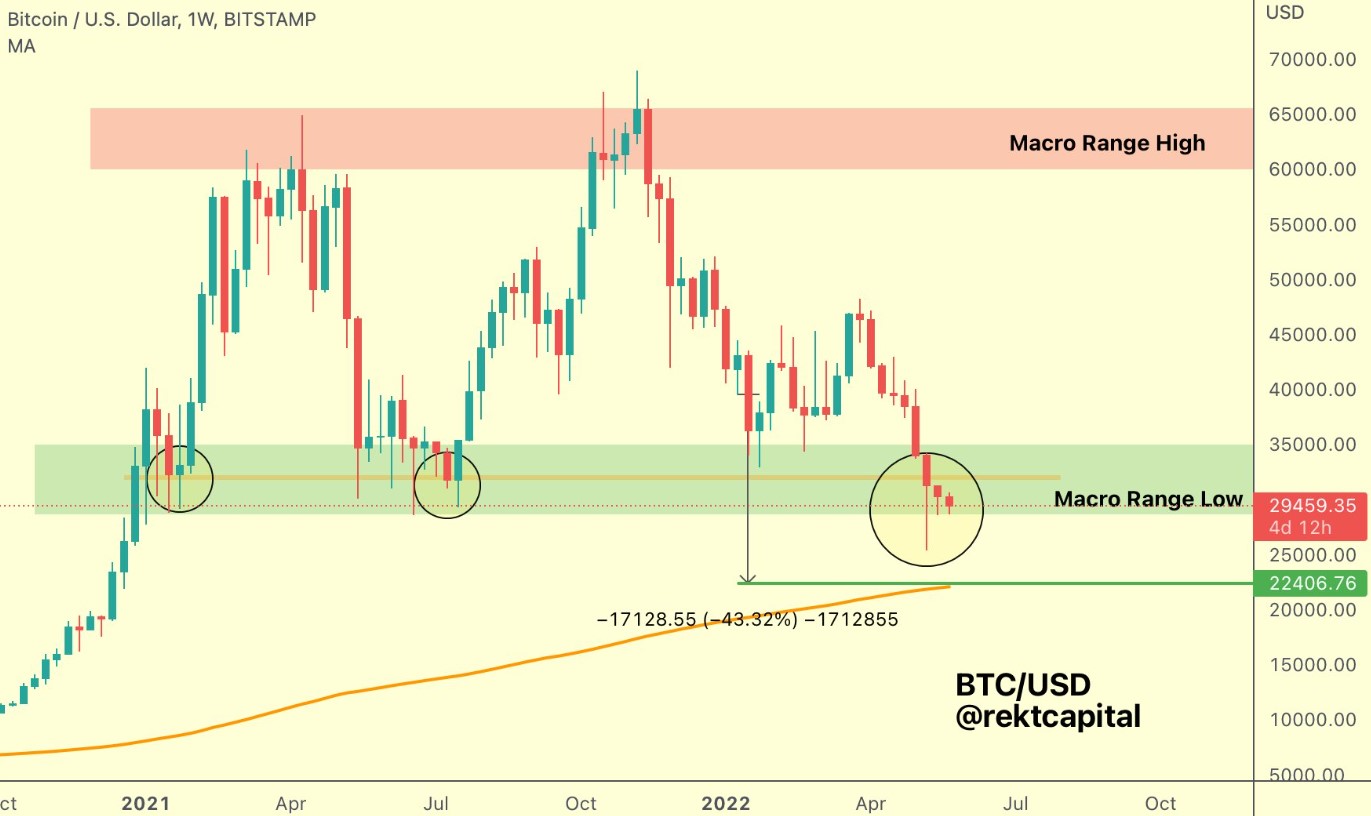

Cost could still withdraw to $22,500

A macro perspective about how Bitcoin performs following the look of a dying mix was provided by pseudonymous Twitter user Rekt Capital, who published the next chart outlining what to anticipate when the “historical cost habits concerning the #BTC Dying Mix repeat […]”

Rekt Capital stated,

“$BTC will breakdown in the Macro Range Low support & continue its drop to accomplish -43% downside. The -43% mark is confluent using the 200-Week MA at ~$22500.”

Related: Scott Minerd states Bitcoin cost will drop to $8K, but technical analysis states otherwise

“A pivotal retest”

The significance of the present cost level for Bitcoin was touched upon by economist Caleb Franzen, who published the next chart searching in the lengthy-term performance of BTC versus its weekly moored volume-weighted average cost (AVWAP) noting that “This is really a pivotal retest, like the dynamics in March 2022.”

Franzen stated,

“A rebound around the weekly AVWAP in the COVID low could increase bullish odds. A failure below it might drastically increase bearish odds, foreshadowing a retest from the gray range, $13.8k-19.8k.”

The general cryptocurrency market cap now is $1.265 trillion and Bitcoin’s dominance rates are 44.8%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.