On May 30, the cryptocurrency market possessed a much-needed bounce that saw Bitcoin (BTC) climb above $30,900 and Ether (ETH) rally 5.84% to $1,930, but analysts warn that could be too soon to anticipate a reversal.

Here’s a glance at what several analysts say concerning the outlook for Ether continuing to move forward and also the major support and resistance levels to keep close track of.

A bounce from major support

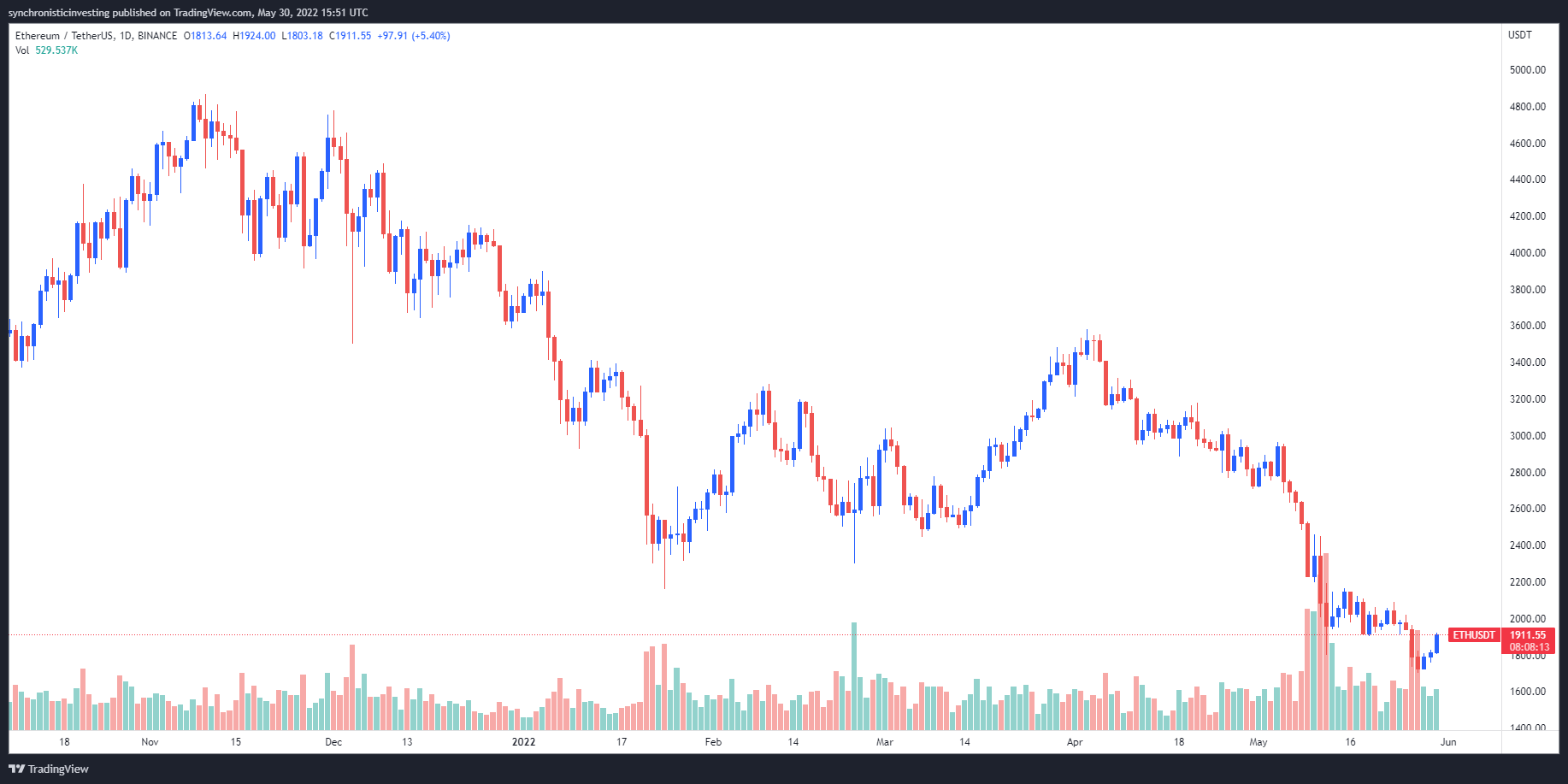

The May 30 bounce in Ether came as “no surprise” to promote analyst and pseudonymous Twitter user Rekt Capital, who published the next chart, proclaiming that “It’s much more about just how much #ETH will change from here.”

Rekt Capital stated:

“Technically, #Ethereum could rally up to ~$2269 to switch it into new resistance. General gist is the fact that whatever this rally becomes, it’ll be less strong than mid-2021.”

Possible recovery to $2,700

Understanding of the potential cost trajectories for Ether was provided by crypto trader Ace of Alts, who published the next chart showing ETH “currently holding the number lows again for that fourth time.”

Ace of Alts stated:

“IF we have the ability to hold this around the 3D I saw a bounce towards the $2,700 region over summer time. El born area will likely behave as another LH [lower high] within the lower trend. However, the R/R [risk/reward] is excellent for this level.”

Related: Market-cleansing bear cycles are healthy, say skillfully developed

Searching for “one more leg down”

As the bounce in Ether cost would be a welcome sight to traders, Crypto Tony offered a thing of caution, posting the next chart and warning to “never forget the larger picture.”

Crypto Tony stated:

“Yes situations are searching nice right now, but in my experience this is just a relief rally. We’ve no damaged market structure around the time period and until proven otherwise I’m still searching for an additional pair leg lower.”

In line with the chart provided, another leg lower can drop the cost of Ether in to the $1,500 range.

The general cryptocurrency market capital now is $1.271 trillion, and Bitcoin’s dominance rates are 45.9%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.