Bear financial markets are typically marked with a capitulation event where frustrated investors finally abandon their positions and asset prices either consolidate as inflows towards the sector decrease or perhaps a bottoming process begins.

Based on a current report from Glassnode, Bitcoin (BTC) hodlers are actually “the only ones left,” and they seem like “doubling lower as prices correct below $30K.”

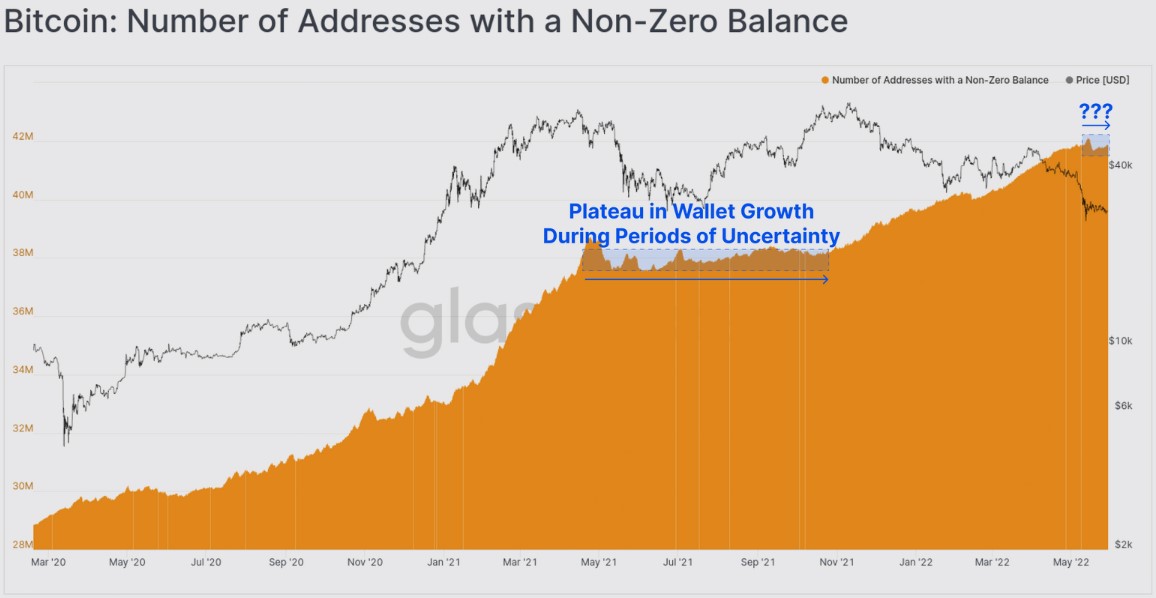

Proof of the possible lack of new buyers are available searching at the amount of wallets with non-zero balances, that has plateaued in the last month, a procedure which was seen following the crypto market sell-off in May of 2021.

Unlike the sell-offs that happened in March 2020 and November 2018, that have been adopted by the increase in on-chain activity that “initiated the following bull runs,” the newest sell-off has yet to “inspire an increase of recent users in to the space.” Glassnode analysts say this means the current activity is predominantly being driven by hodlers.

Indications of heavy accumulation

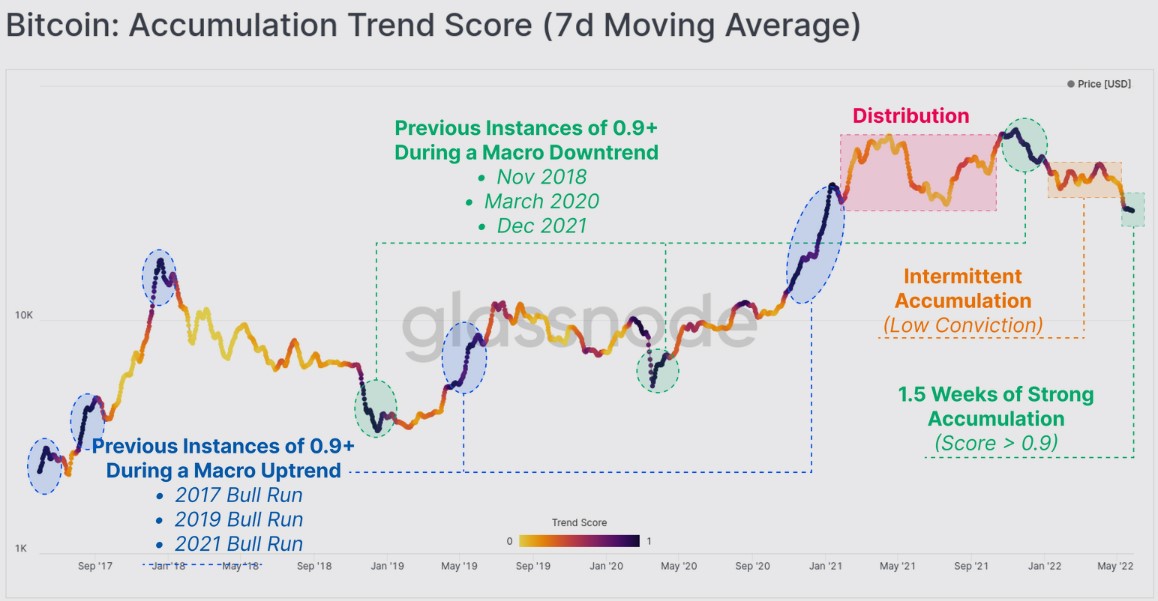

Even though many investors are disinterested in BTC’s sideways cost action, contrarian investors notice being an chance to amass, a place evidenced through the Bitcoin accumulation trend score which “has came back an almost perfect score above .9” within the last two days.

Based on Glassnode, high scores about this metric during bearish trends “generally trigger following a very significant correction in cost as investor psychology shifts from uncertainty to value accumulation.”

The concept that Bitcoin is presently within an accumulation phase seemed to be noted by CryptoQuant Chief executive officer Ki Youthful Ju, who published the next tweet asking his Twitter supporters, “Why not purchase?”

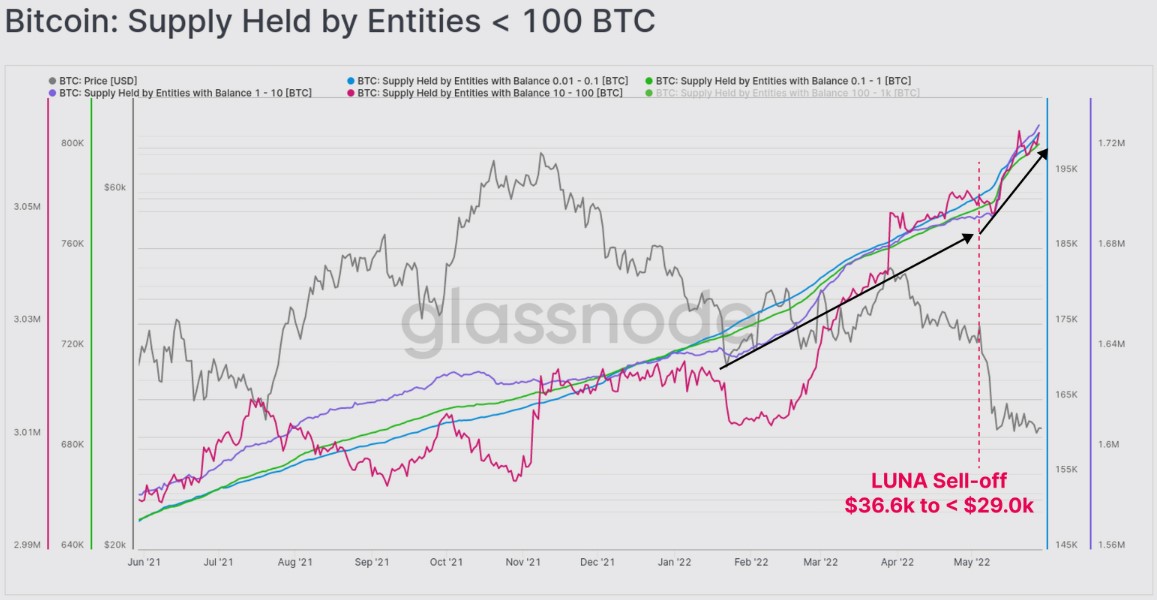

A closer inspection in the data implies that the current accumulation continues to be largely driven by entities with under 100 BTC and entities using more than 10,000 BTC.

Within the recent volatility, the mixture balance of entities holding under 100 BTC elevated by 80,724 BTC, which Glassnode noted was “remarkably like the internet 80,081 BTC liquidated through the LUNA Foundation Guard.”

Entities with holdings more than 10,000 BTC added 46,269 BTC for their balance in this same period of time, while entities holding 100 BTC to 10,000 BTC “maintained a far more neutral rating around .5, suggesting relatively little internet switch to their holdings.”

Related: Bitcoin’s recent gains have traders calling a bottom, but various metrics remain bearish

Lengthy-term hodlers continue to be active

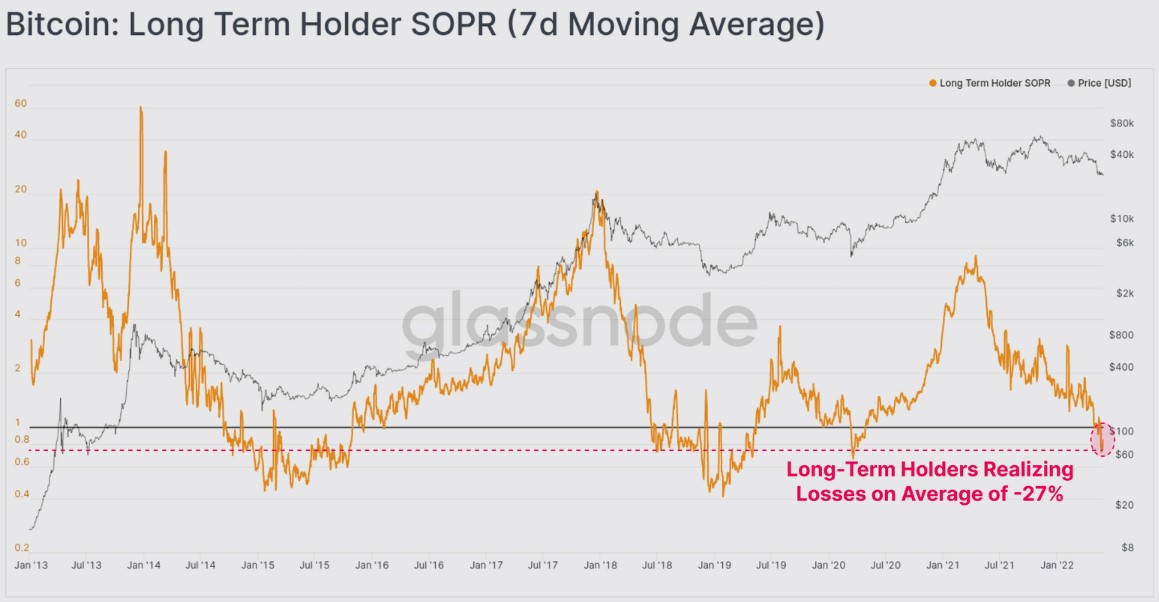

Lengthy-term Bitcoin holders seem to be the primary driving pressure behind the present cost action, with a few positively accumulating yet others realizing losses at typically -27%.

Regardless of the selling observed by a few within the lengthy-term holder cohort, the entire supply held by these wallets lately came back to the all-time a lot of 13.048 million BTC.

Glassnode stated:

“Unless significant gold coin redistribution occurs, we are able to therefore expect this supply metric to commence climbing during the period of the following 3-4 several weeks, suggesting HODLers still progressively take in, and keep supply.”

The current volatility might have pressed out probably the most dedicated Bitcoin holders, however the data shows that the majority of serious holders are reluctant to invest their supply “even if it’s now held baffled.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.