Bitcoin (BTC) bulls may need a set of simple moving averages (SMAs) to find out when the bottom is within this halving cycle.

Inside a Twitter thread on June 2, Checkmate, add-chain analyst at crypto analytics firm Glassnode, flagged the Investor Tool metric hitting “buy the dip” territory.

“Generational zone” enters for Bitcoin’s Investor Tool

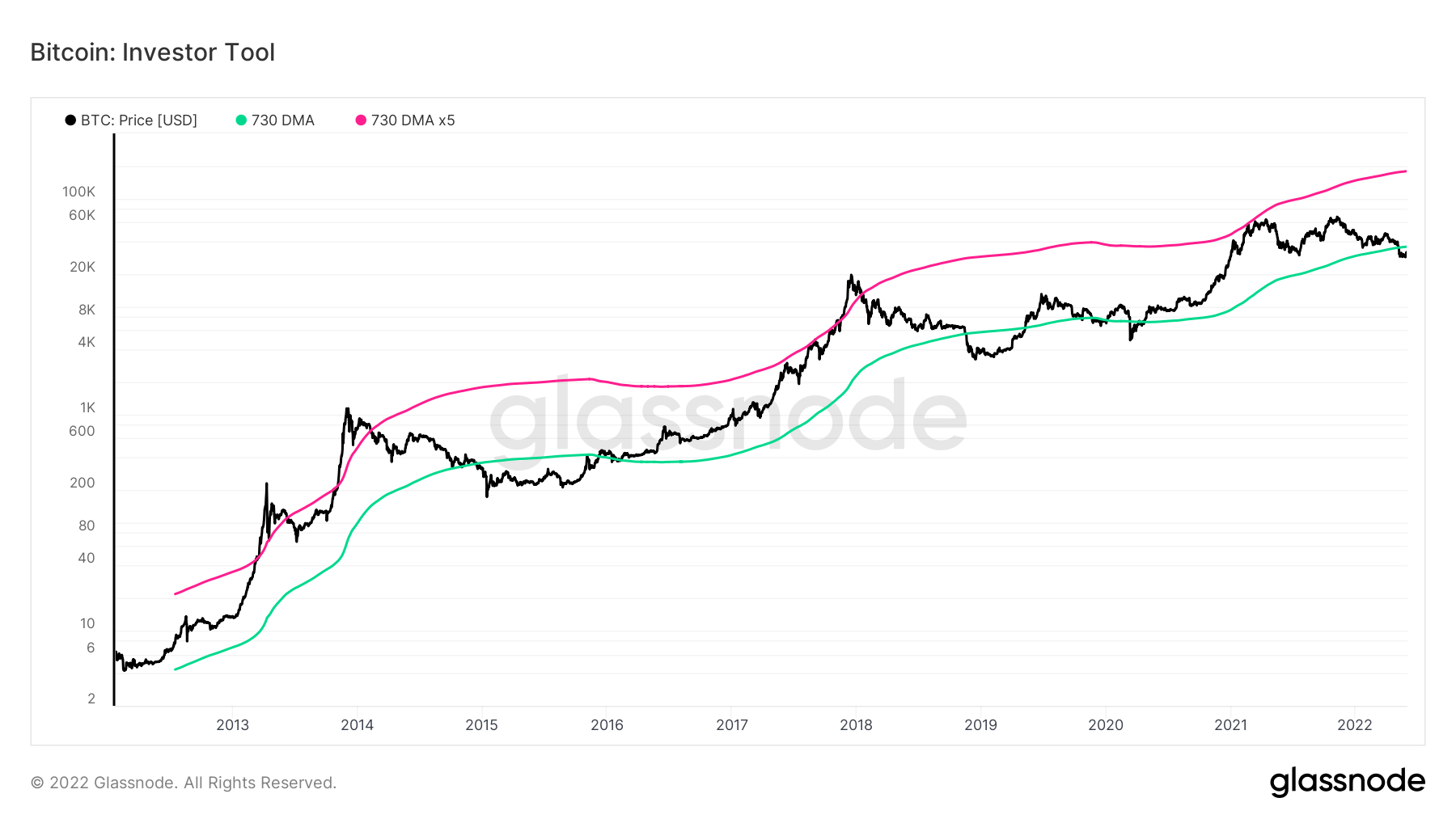

The Investor Tool is a powerful BTC cost metric showing the opportunity of buyers to savor “outsized” returns.

Its creator, LookIntoBitcoin founder Philip Quick, aimed to deduce when BTC/USD is probably overbought or oversold.

The metric uses the 2-year SMA and it is 5x multiple. The 2 line is plotted against place cost and also have in the past performed well at catching both generational tops and bottoms.

Now, BTC/USD is underneath the two-year SMA the very first time since March 2020, getting entered the road around 1 week prior to the Terra LUNA, now referred to as Luna Classic (LUNC), debacle sent Bitcoin to 10-month lows.

“Bitcoin Simple Moving Averages are edge when navigating bear markets,” Checkmate commented, adding it had “entered the generational zone.”

Hayes “well informed” of $25,000 bottom after LFG BTC sales

While Bitcoin bulls are hardly from the forest at $30,000, the Investor Tool’s readings strengthen a story that’s only just starting to emerge among analysts.

Related: $32K Bitcoin cost could turn the tides in Friday’s $160M BTC options expiry

As Cointelegraph reported, Arthur Hayes, former Chief executive officer of derivatives giant BitMEX, now recommended that May’s Terra-inspired visit to $23,800 may actually mark a lengthy-term BTC cost floor in the end.

Despite a many predictions with an accident to as little as $14,000, historic patterns may yet lead to securing Bitcoin at or near current levels.

The Terra episode, itself, by which nonprofit the Luna Foundation Guard (LFG) liquidated 80,000 BTC, might have cemented solid support, Hayes authored.

“At the end, a typically impervious strong hands can have to sell due to uneconomical plans festering within their buying and selling books. The LFG is really selling real estate. To puke 80,000 physical Bitcoin is a reasonably task,” he described.

“After contemplating the character by which these Bitcoins were offered, I’m much more certain that the $25,000 — $27,000 zone for Bitcoin is that this cycle’s bottom.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.