Bitcoin (BTC) investment vehicles are seeing “gargantuan” inflows this month, that is a fresh sign that traders’ appetite for BTC exposure is mounting.

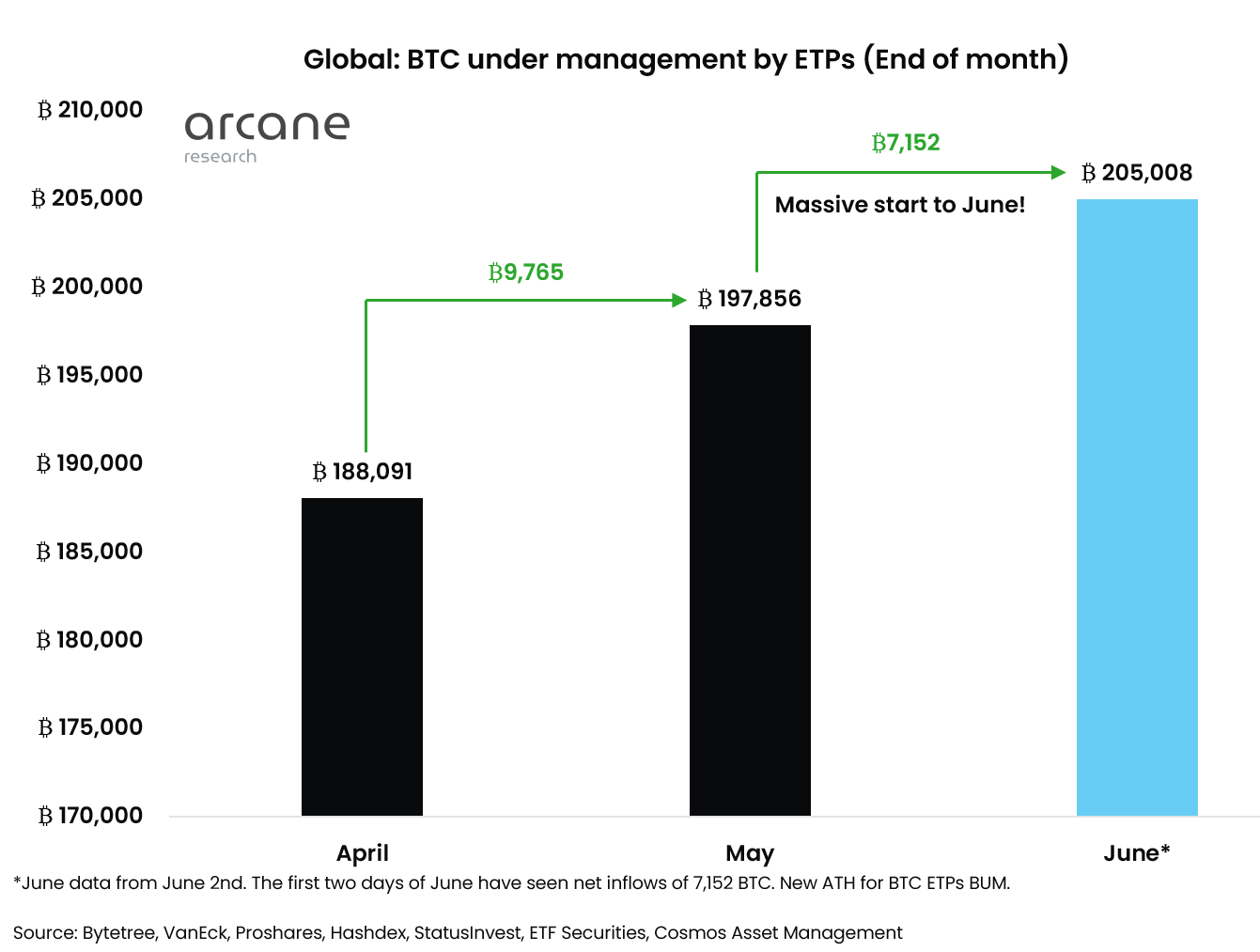

Data from monitoring firm Arcane Research printed now implies that Bitcoin exchange-traded products (ETPs) are in possession of record high BTC under management.

“More happy days” for Bitcoin ETPs as buyers pile in

Despite BTC cost action failing to draw buyers in excess of 50% below all-time highs, not everybody is feeling risk-off.

Based on Arcane’s data, Bitcoin ETPs have experienced a flurry of great interest from institutional investors both this month and last.

As a whole, Bitcoin ETPs, including products like the ProShares Bitcoin Strategy exchange-traded fund (ETF), are in possession of 205,000 BTC under what they can control — a brand new record.

“While the May recovery was strong in ETPs, June has witnessed even more happy days!” Arcane analyst Vetle Lunde told Twitter supporters while uploading the figures on June 2.

“The first couple of times of June have experienced gargantuan internet inflows to Purpose, 3iQ Coinshares, and BITO, pushing the worldwide BUM to a different all-time a lot of 205,008 BTC.”

Within the first couple of times of June alone, greater than 7,000 BTC ran to ETPs, almost around for that whole of May, which, itself, saw a remarkable 9,765 BTC rise.

“Massive $BTC inflows into Bitcoin ETFs in June already,” Zhu Su, cofounder of asset manager Three Arrows Capital, reacted.

Little reprieve for GBTC

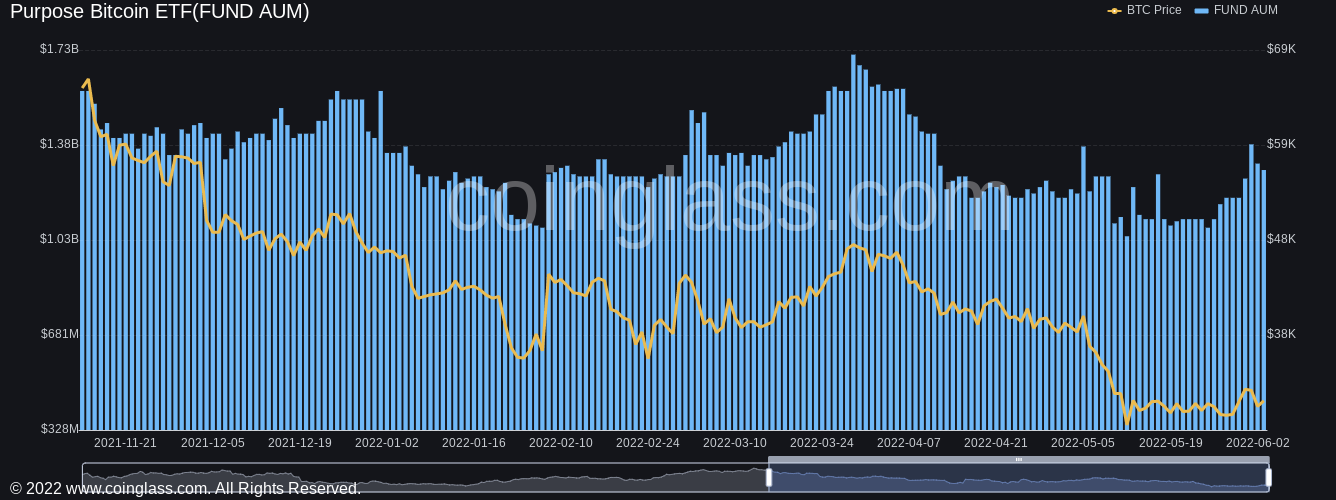

The Reason Bitcoin ETF, the very first Bitcoin place cost ETF to produce all over the world, meanwhile had $1.294 billion price of assets under management by June 3, data from on-chain monitoring resource Coinglass confirmed.

Related: Bitcoin bounces to $30.7K as analyst presents Stock-to-Flow BTC cost model rehash

Things continued to be somewhat less rosy for industry stalwart the Grayscale Bitcoin Trust (GBTC), however.

Based on Coinglass data, GBTC is constantly on the trade near an archive discount towards the Bitcoin place cost, presently 28.68% by June 3.

Formerly, Cointelegraph reported on Grayscale’s ongoing fight to transform GBTC to some Bitcoin place ETF.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.