The emergence of forty-year high inflation readings and also the more and more dire-searching global economy has motivated many financial analysts to recommend purchasing gold to safeguard against volatility along with a possible loss of the need for the U . s . States dollar.

For a long time, crypto traders have known Bitcoin (BTC) as “digital gold,” but could it be really a much better investment than gold? Let’s check out a few of the conventional arguments investors cite when praising gold being an investment and why Bitcoin may be a much better lengthy-term option.

Value retention

Probably the most common good reasons to buy both gold and Bitcoin is they have past holding their value through occasions of monetary uncertainty.

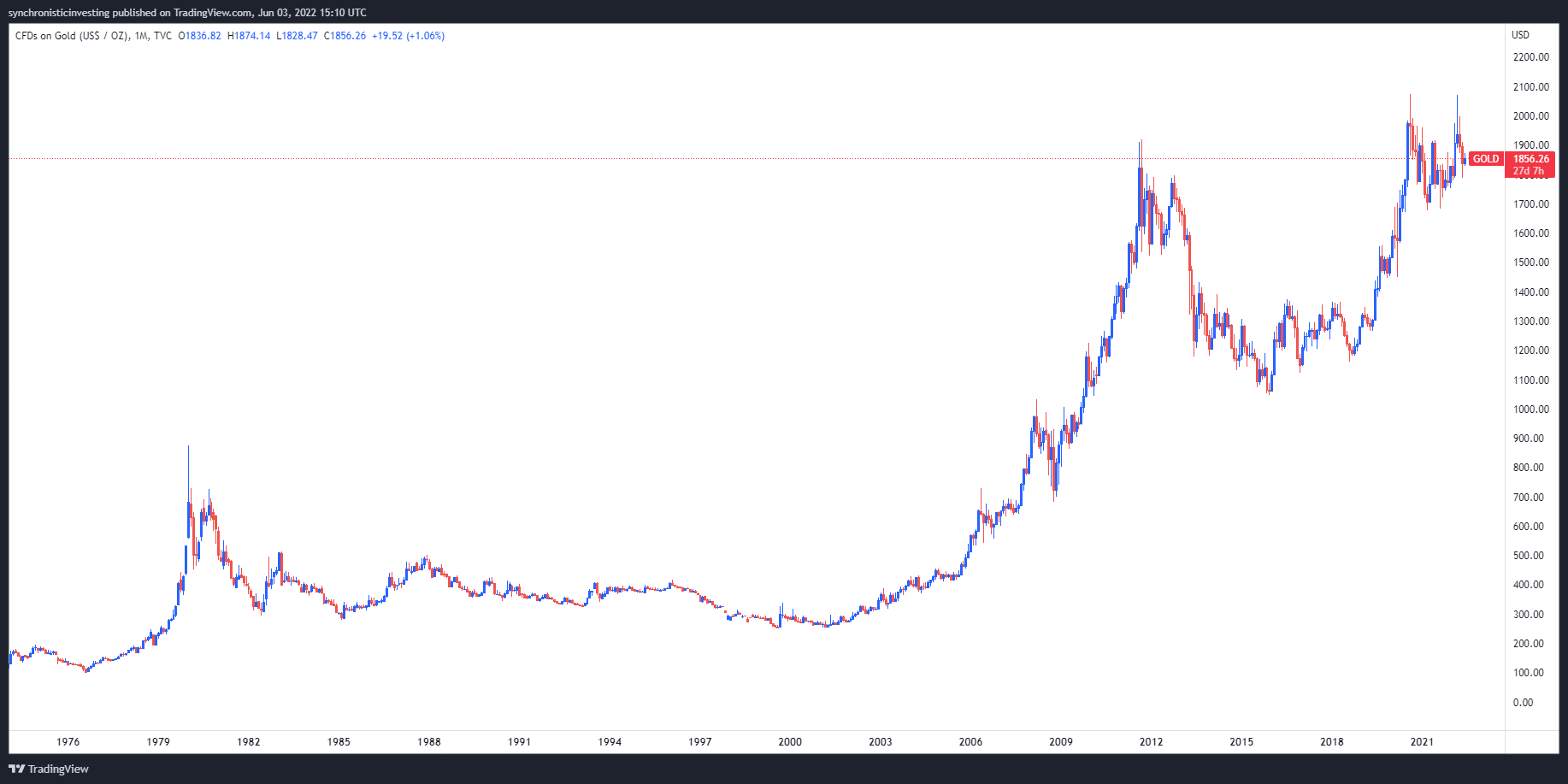

This fact continues to be extensively recorded, and there isn’t any denying that gold has offered the best wealth protection in the past, however it doesn’t always keep value. The chart below implies that gold traders are also susceptible to lengthy bouts of cost declines.

For instance, an individual who bought gold in September of 2011 might have had to hang about until This summer 2020 to obtain during the eco-friendly, and when they ongoing to carry, they’d once more be near even or underwater.

Within the good reputation for Bitcoin, it’s never taken greater than 3 to 4 years because of its cost to get back and exceed its all-time high, suggesting that on the lengthy-term timeline, BTC might be a better store of worth.

Could Bitcoin be considered a better inflation hedge?

Gold has in the past been seen as an good hedge against inflation because its cost tended to increase alongside increases in living costs.

But, a closer inspection in the chart for gold in contrast to Bitcoin implies that while gold has witnessed a modest gain of 21.84% in the last 2 yrs, the cost of Bitcoin has elevated 311%.

Inside a world in which the overall living costs are rising quicker than running out of energy handle, holding a good thing that may outpace the increasing inflation really increases wealth instead of keeping it.

As the volatility and cost declines in 2022 happen to be painful, Bitcoin has still provided considerably more upside to investors having a multi-year time horizon.

Bitcoin could mirror gold during geopolitical uncertainty

Frequently known as the “crisis commodity,” gold is well-recognized to hold its value during occasions of geopolitical uncertainty as individuals have been known to purchase gold when world tensions rise.

Gold is known as the crisis metal so I’d assume when we enter an economic depression again, gold will increase like a commodity

— Scott Hempstead (@scottytrip1) April 22, 2022

Regrettably for individuals situated in conflict zones or any other areas susceptible to instability, transporting valuable objects is really a dangerous proposition, with individuals being susceptible to asset seizures and thievery.

Bitcoin provides a safer choice for people in cases like this simply because they can commit to memory a seed phrase and travel without anxiety about losing their. After they achieve their destination, they are able to reconstitute their wallet and get access to their wealth.

Digital nature of Bitcoin and also the accessibility to multiple decentralized marketplaces and peer-to-peer exchanges like LocalBitcoins supplies a greater chance to get Bitcoin.

The dollar keeps losing value

The U.S. dollar continues to be strong in recent several weeks, but that’s not necessarily the situation. In times in which the dollar’s value falls against other currencies, investors happen to be recognized to flock to gold and Bitcoin.

If various countries still escape from being U.S. dollar centric in support of a far more multipolar approach, there might be a lot of flight from the dollar but individuals funds won’t get into less strong currencies.

While gold continues to be a tight schedule-to asset for millennia, it isn’t broadly used or recognized within our modern digital society and many individuals more youthful generations haven’t even seen a gold gold coin personally.

Of these cohorts, Bitcoin represents a far more familiar option that may integrate into people’s digitally-infused lifestyles, also it doesn’t require extra security or physical storage.

Related: Argentines use Bitcoin among inflation worries: Report

Bitcoin is scare and deflationary

Many investors and finance experts indicate scarcity and offer constraints for gold following many years of declining production like a reason gold is a great investment.

It will take 5 to 10 years for any new mine to achieve production, meaning rapid increases in supply are unlikely and central banks considerably slowed their rate of promoting gold in 2008.

That being stated, it’s believed that there’s still greater than 50,000 metric a lot of gold in the earth, which miners would happily concentrate on removing in case of a substantial cost increase.

Gold won’t ever achieve the guaranteed land of ‘true scarcity’. The greater the cost inches up, the greater it’s found, thus growing supply, which in turn lowers the cost. #bitcoin #gold #goldprice

— DeepSee-er (@ErDeepsee) March 7, 2022

However, Bitcoin includes a fixed way to obtain 21 million BTC which will be created, and it is issuance is going on in a known rate. The general public nature from the Bitcoin blockchain enables for that location of each and every Bitcoin to become known and verified.

There isn’t any method to ever really locate and validate all the gold stores in the world, meaning it is true supply won’t ever be known. Due to this, Bitcoin wins the scarcity debate, hands lower, which is the toughest type of money produced by humankind up to now.

Want more details about buying and selling and purchasing crypto markets?

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.