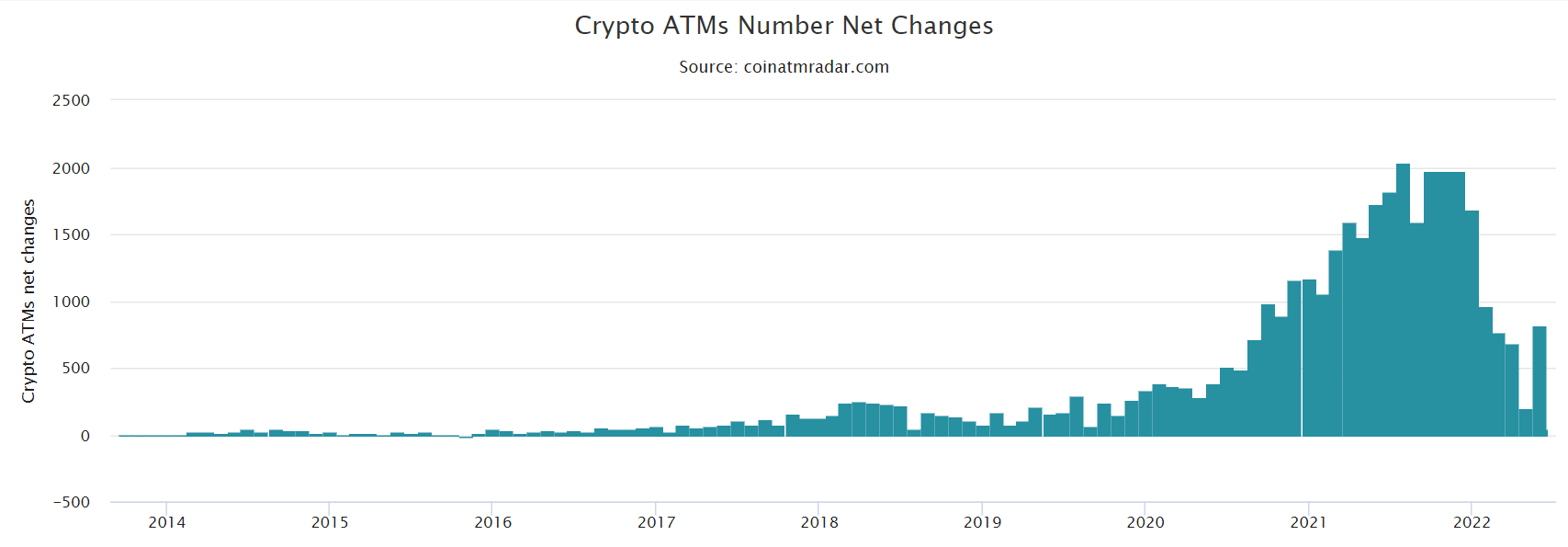

Bitcoin (BTC) ATM installations around the world have experienced a high decline all year round 2022, with May recording just 202 new BTC ATMs, a variety last seen three ago in 2019.

In the last five several weeks since The month of january, Bitcoin ATM installations saw a gentle slowdown, eventually falling lower 89.75% from December 2021’s 1971 new installations. However, data from Gold coin ATM Radar reveal an apparent comeback within the installation figures because the world saw 817 Bitcoin ATMs getting set up in June — in only the very first 5 days.

A few of the important aspects adding towards the slowdown of crypto ATM installations include geopolitical tensions around the globe, unclear or anti-crypto rules, market saturation and business impact because of the ongoing coronavirus pandemic.

Gold coin ATM Radar’s data confirms the U . s . States hosts 87.9% from the total 37,826 crypto ATMs worldwide. Europe, like a continent, houses a network of just one,419 ATMs — representing 3.8% from the global ATM installations.

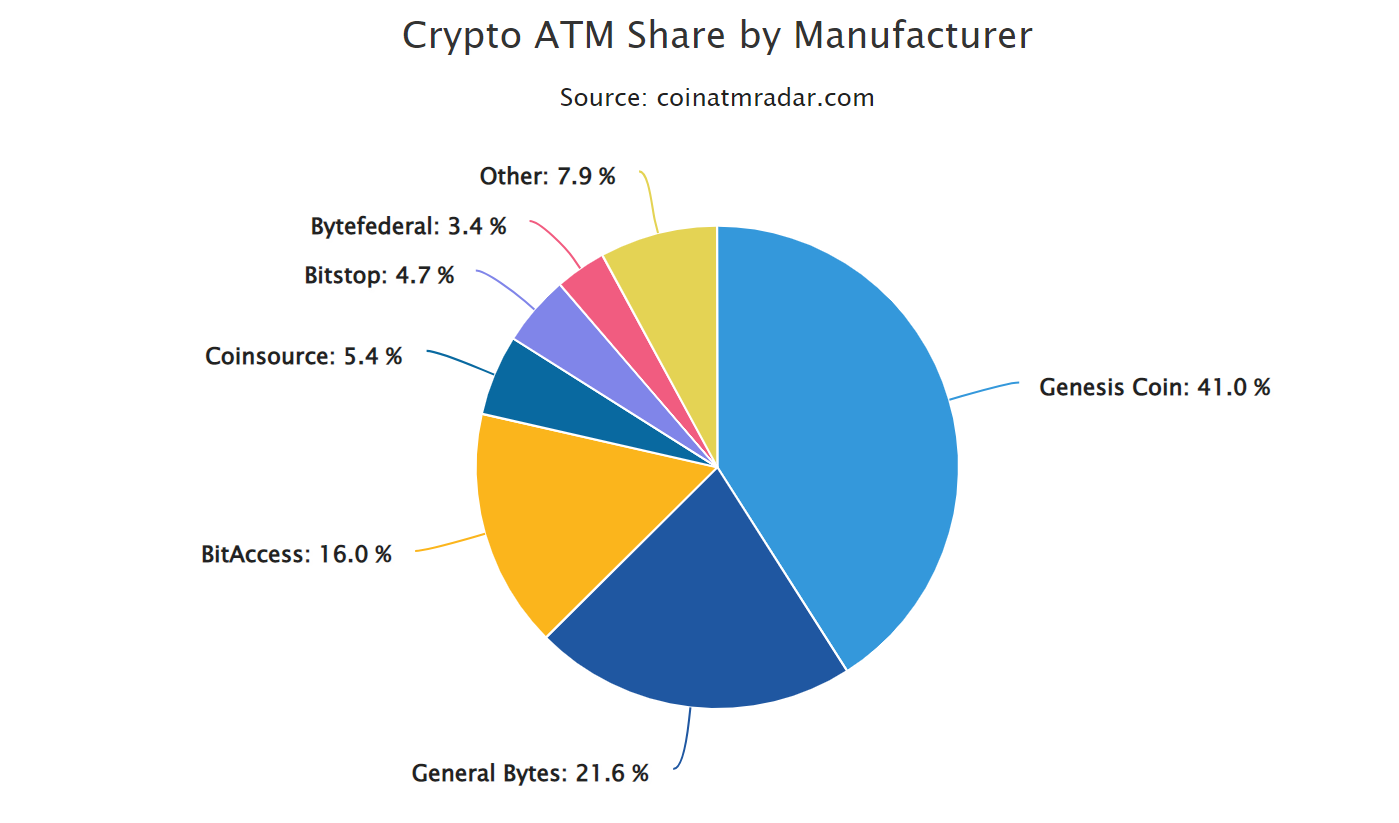

Crypto ATM manufacturer Genesis Gold coin maintains its position because the leader with regards to the share of the market, representing 41% from the total operational crypto ATMs around the world. Other manufacturers with prominent share of the market include General Bytes (21.6%), BitAccess (16%), Coinsource (5.4%) and Bitstop (4.7%).

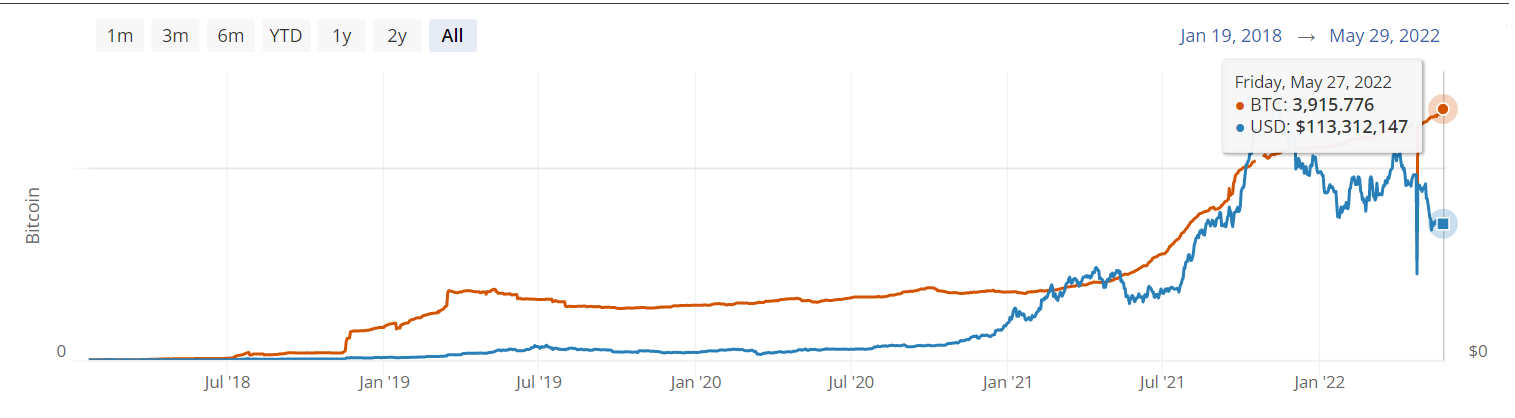

Related: Bitcoin Lightning Network capacity crosses 3900 BTC marking a brand new ATH

While real-world challenges could have a momentary effect on Bitcoin’s physical expansion via ATMs, at its core, the Bitcoin network is constantly on the outshine its previous records in securing, decentralizing and accelerating the impenetrable peer-to-peer (P2P) network.

As Cointelegraph reported according to data from Bitcoin Visuals, the Bitcoin Lightning Network (LN) capacity achieved an exciting-time a lot of 3915.776 BTC — further improving BTC transaction speeds and reducing charges within the layer-2 protocol. The Bitcoin LN was initially implemented in to the Bitcoin mainnet in 2018 to deal with Bitcoin’s infamous scalability issues.