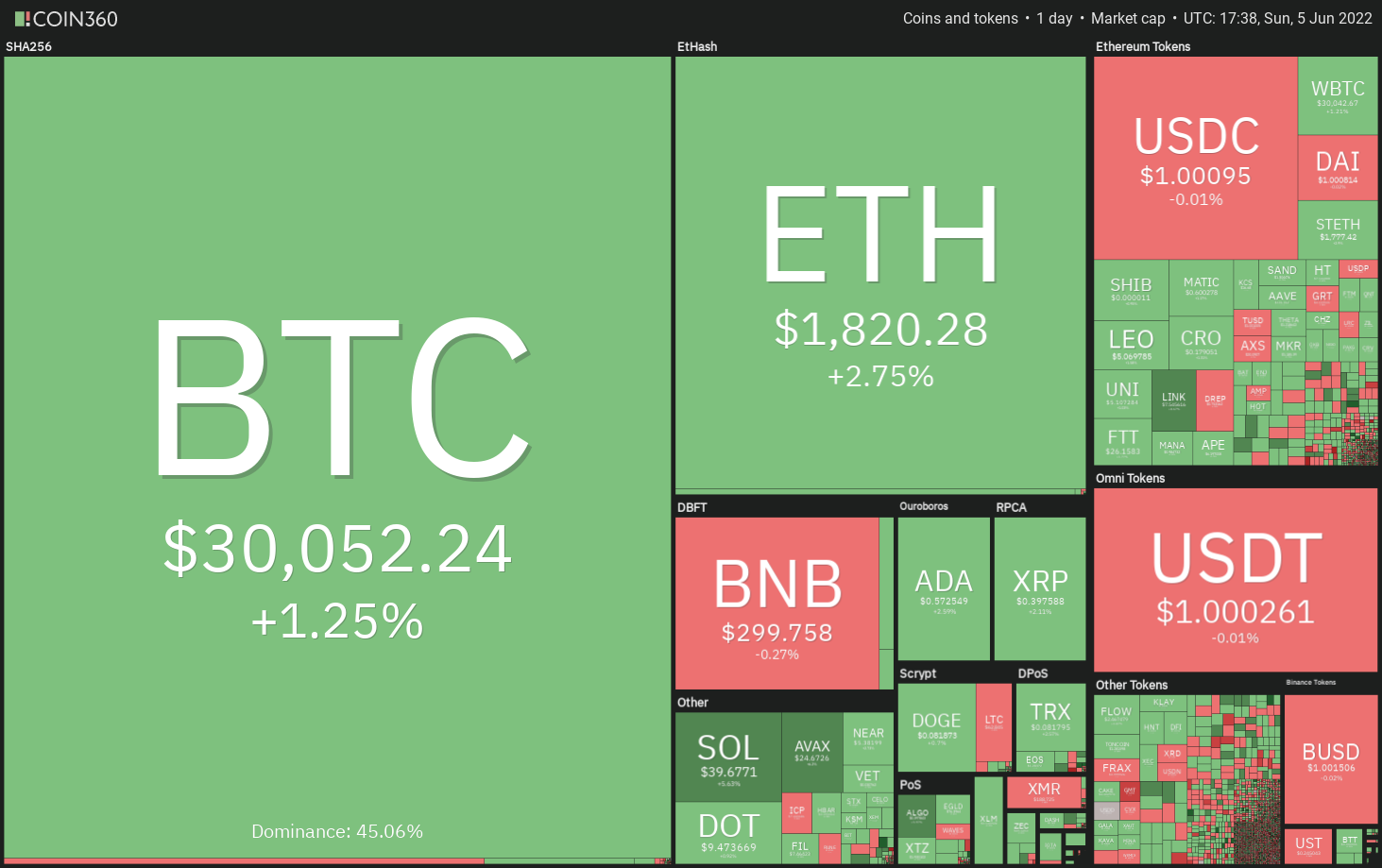

The bears are attempting to extend Bitcoin’s (BTC) record of nine consecutive red weekly candle lights to 10 days, however the bulls are attempting to avert this negative occurrence. Although sentiment remains negative, Arthur Hayes, former Chief executive officer of derivatives giant BitMEX, anticipates Bitcoin to bottom out in the plethora of $25,000 to $27,000.

On-chain data from Glassnode implies that smart money might have began accumulating Bitcoin. The internet outflows from major cryptocurrency exchanges arrived at 23,286 Bitcoin on June 3, the greatest since May 14.

Another positive manifestation of accumulation is the fact that investment into Bitcoin exchange-traded products (ETPs) was strong in May and it has only risen further within the first couple of times of June, based on an Arcane Research report. The ETPs hold 205,000 Bitcoin under management, that is a new record.

Could Bitcoin show up and begin a recovery? In the event that happens, could select altcoins stick to the leader? Let’s read the charts from the top-5 cryptocurrencies that could lead the relief rally.

BTC/USDT

Bitcoin stepped underneath the 20-day exponential moving average ($30,459) on June 1. The bulls tried to push the cost back over the 20-day EMA on June 2 and June 3 however the bears didn’t relent.

The bears will attempt to drag the cost underneath the strong support at $28,630. When they manage to achieve that, the BTC/USDT pair could drop towards the vital support at $26,700. The buyers are anticipated to protect this support zone with all of their might if they fail to achieve that, the downtrend may resume.

Around the upside, the bulls will need to push and sustain the cost above $32,659 to point out that the new upward trend might be beginning. The bullish momentum could detect a rest and shut over the 50-day simple moving average ($33,778). The happy couple could then rally towards the pattern target of $36,688 and after that to $40,000.

Some-hour chart implies that the cost action gets squeezed. Although bulls pressed the cost over the 20-EMA, they’re facing stiff resistance in the 50-SMA. This means that bears are active at greater levels.

A small positive in support of the bulls is they haven’t permitted the cost to interrupt underneath the support at $29,282.

When the cost increases in the current level and breaks over the downtrend line, the bulls will endeavour to push the happy couple towards the 200-SMA. On the other hand, when the cost breaks below $29,282, the following stop might be $28,630.

ADA/USDT

Cardano (ADA) broke over the downtrend line on May 31 however the bulls couldn’t sustain the greater levels as seen in the lengthy wick around the day’s candlepower unit.

Even though the bears have effectively defended the downtrend line, a small positive would be that the bulls have held the ADA/USDT pair over the 20-day EMA ($.56). This increases the potential of a rest over the downtrend line.

In the event that happens, the happy couple could rally towards the 50-day SMA ($.67) in which the bears may again pose a powerful challenge. A rest and shut above this level will advise a potential alternation in trend. The happy couple could then rally towards the breakdown degree of $.74.

Unlike this assumption, when the cost turns lower and plummets below $.53, the bears will attempt to drag the happy couple to $.50 and then to $.44.

Some-hour chart implies that the cost continues to be squeezed between your 200-SMA and also the 50-SMA however this tight range buying and selling is not likely to carry on for lengthy. If bulls propel the cost over the 200-SMA, the happy couple could chance a rally to $.64. A rest and shut above this level could open the doorways for any possible rally to $.69.

On the other hand, when the cost turns lower and breaks below $.53, the selling could get momentum. The happy couple will then decline to $.50 and then to $.47.

XLM/USDT

Stellar (XLM) rallied over the 20-day EMA ($.14) on May 30, that was the very first indication the selling pressure might be reducing. The bears stalled the up-move close to the 50-day SMA ($.15) however they haven’t had the ability to sink and sustain the cost underneath the 20-day EMA.

This means the bulls are purchasing the dips towards the 20-day EMA. If bulls drive the cost over the 50-day SMA, it’ll suggest the beginning of a sustained recovery. The XLM/USDT pair could then chance a rally to $.18 and then towards the 200-day SMA ($.21).

This positive view will invalidate for the short term when the cost turns lower and breaks below $.13. This type of move will claim that demand dries up at greater levels. That may pull the happy couple lower to $.12. If the support also gives way, the bears will attempt to resume the downtrend by sinking the happy couple underneath the mental degree of $.10.

Some-hour chart shows the cost is buying and selling in the symmetrical triangular. If bulls push the cost over the resistance type of the triangular, the happy couple could rally to $.15 and after that chance a rally towards the pattern target of $.17.

Alternatively, when the cost turns lower in the current level, the bears will attempt to sink the happy couple underneath the support type of the triangular. When they do this, the selling could intensify and also the pair may slide towards the strong support at $.13.

Related: three reasons Ethereum cost risks 25% downside in June

XMR/USDT

Monero’s (XMR) failure to increase over the 50-day SMA ($202) might have enticed short-term traders to reserve profits. Which has pulled the cost lower towards the 20-day EMA ($189).

The bulls are trying to defend the 20-day EMA but the possible lack of a powerful bounce off it suggests weak demand. When the cost sustains underneath the 20-day EMA, the following stop may be the upward trend line. A rest and shut below this support could pull the cost lower to $167.

On the other hand, when the cost rebounds from the current level, the buyers will endeavour to beat the resistance zone between your 50-day SMA and $210. When they manage to achieve that, the XMR/USDT pair could extend its rally to $230.

The happy couple continues to be declining in the climbing down funnel, suggesting a small benefit to sellers. If bears sink the cost underneath the funnel, the negative momentum may get and also the pair could slide to $167.

Alternatively, when the cost rebounds from the support line, the buyers will attempt to propel the happy couple over the funnel. When they manage to achieve that, the happy couple could again chance a break over the overhead resistance at $210.

MANA/USDT

Decentraland (MANA) has unsuccessful to interrupt over the 20-day EMA ($1.06) within the last a few days however a minor positive would be that the bulls haven’t quit much ground. This means the bulls are purchasing on dips because they anticipate moving greater.

If bulls propel the cost over the 20-day EMA, it’ll claim that the bears are losing their grip. The MANA/USDT pair could then rise towards the overhead resistance at $1.36. It is really an important level to keep close track of just because a break and shut above it might signal that the bottom might be in position. The happy couple could then rally to $1.68.

On the other hand, when the cost turns lower and breaks below $.90, it’ll claim that the bears have been in no mood to surrender their advantage. The happy couple could then retest the important support at $.60. The bears will need to pull the cost below this support to point the resumption from the downtrend.

Some-hour chart implies that the happy couple continues to be buying and selling in the tight range from $.94 and $1.04. The progressively downsloping 20-EMA and also the RSI within the negative territory advise a slight benefit to sellers. If bears pull the cost below $.94, the happy couple could drop to $.90.

On the other hand, if bulls push the cost above $1.04, it’ll claim that demand exceeds supply. That may open the doorways for any possible rally towards the stiff overhead resistance at $1.15.

When the cost turns lower out of this level, the happy couple may oscillate between $.90 and $1.15 for many additional time. A rest and shut above $1.15 could claim that buyers possess the upper hands.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.