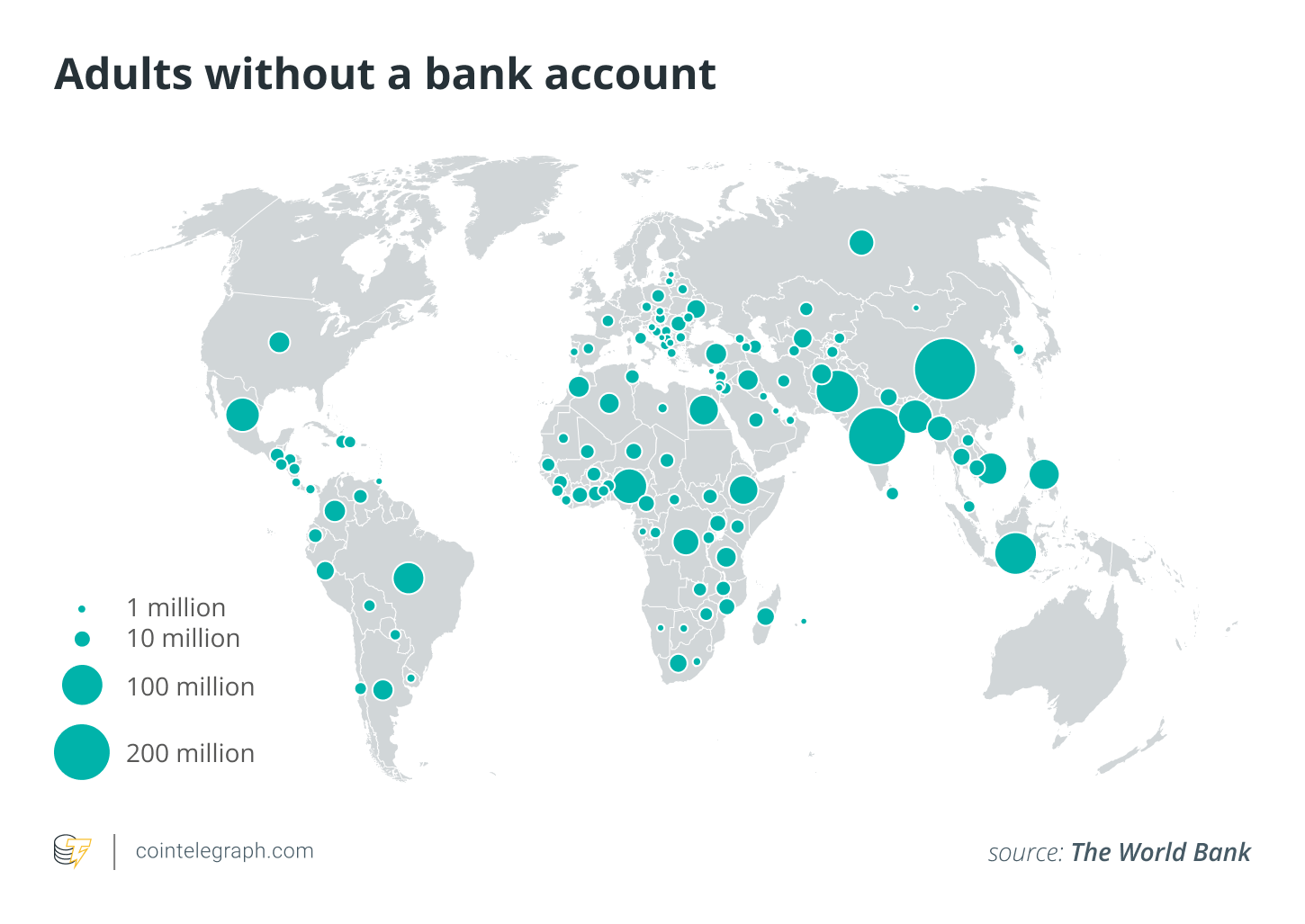

In modern occasions of rapid globalization and digitization, technological developments have finally arrived at such proportions that using cryptocurrencies isn’t any new phenomenon. We’ve got the technology behind blockchain opens the web for financial services by replacing trust, a simple element of the economic climate for hundreds of years, with transparency built-into a decentralized network. Therefore, blockchain bears the possibility to assist achieve the U . s . Nations’ Sustainable Development Goals (SDG) by empowering the unbanked, predominantly women, reducing transaction charges in addition to creating an resource for renewable liquidity.

Only 57.7% of adults in Ghana in 2021 were built with a banking account. Not able to pay for participation within the formal economic climate, poor people end up having to pay probably the most for fundamental financial services. Furthermore, there’s a multiplier effect natural using the economic participation of ladies that can take wide-varying effects respecting numerous SDGs.

Related: The UN’s ‘decade of delivery’ needs blockchain to achieve success

Financial inclusion may alleviate poverty, improve health insurance and well-being, gender equality, have a positive impact on children’s education, and much more. Use of affordable financial services thus turns into a catalyst for economic growth and chance. To put it simply, there’s a great deal on the line here. Let’s dig in it.

West Africa’s economic powerhouse: Ghana

Discussing borders using the Ivory Coast, Burkina Faso and Togo, Ghana lies in the middle of West Africa. The populace is all about 32 million, and besides various tribal languages, British is among the recognized national languages. Frequently viewed as West Africa’s economic powerhouse, in 2020, the country’s purchasing power parity (gdp per person) was around $5,744 U . s . States dollars. Until it had been hit with a severe banking crisis spanning from 2017 to 2020, Ghana’s economic growth have been astounding — the epitome of the items many countries in the area must achieve. Shaken just by another crisis, going through the name COVID-19, the economy is while recovery.

Ghana’s wealthy remain concentrated within the south’s cities minimizing-earnings households spread over the countryside, the place to find the majority of the population. Consequently, banking services are largely situated in cities. Despite the fact that, a 2010 research figured that physical use of banks isn’t the central barrier to banking but instead Know Your Customer (KYC) needs that lots of the unbanked are not able to satisfy. Also, 64% from the respondents mentioned inadequacy of earnings as the prime reason behind not getting a financial institution account. Even though this study may appear outdated, new research from 2021 showed up at similar conclusions everything about the that among the primary hardships of opening a financial institution account resides in the possible lack of financial sources.

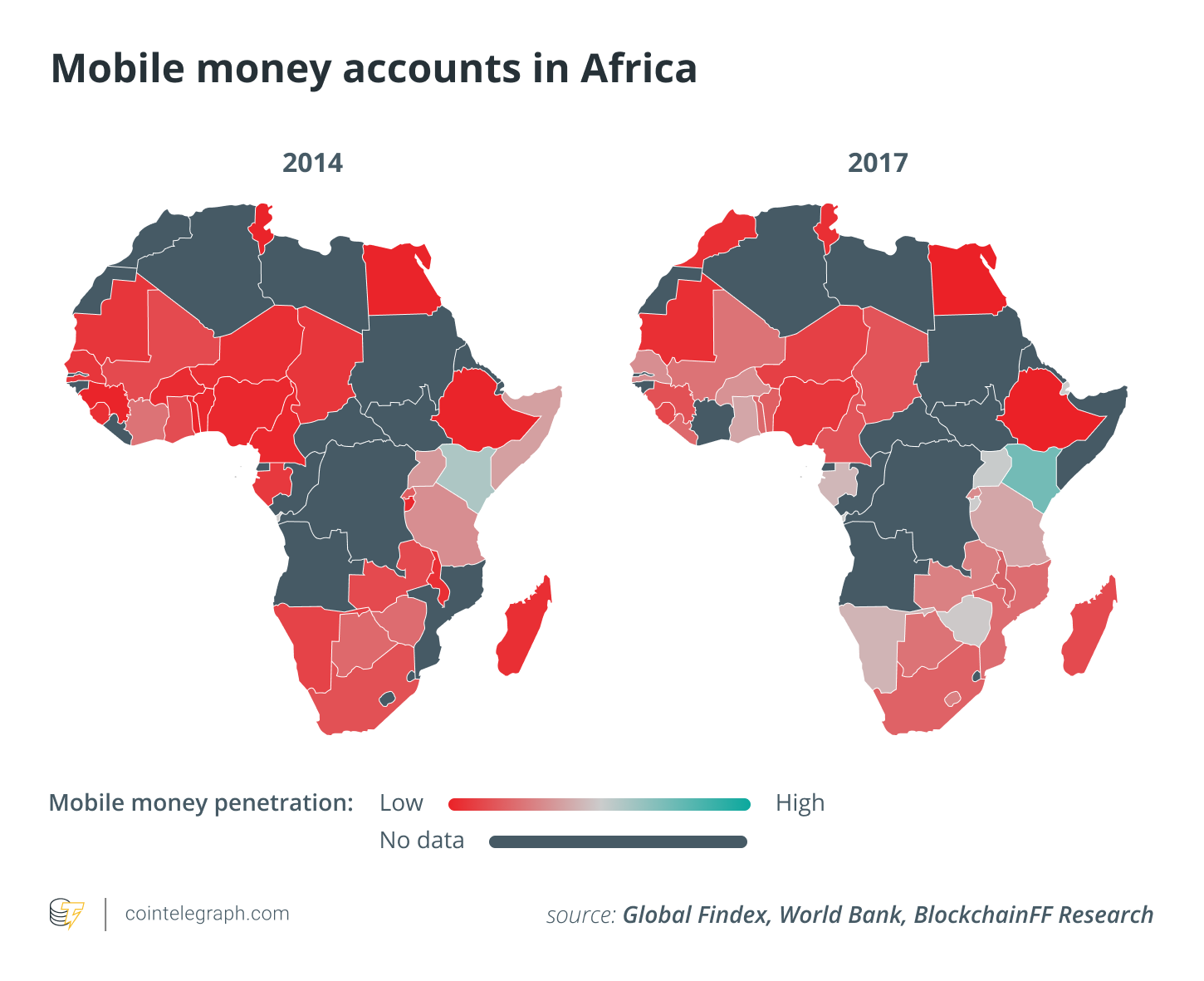

Necessary to the country’s financial services infrastructure is mobile money, which comes with the everyday existence of countless Ghanaians — roughly 38.9% of people in 2021 had registered a mobile money account. Mobile money, introduced in ’09, is really a financial service that allows individuals to transfer money and take care of payments with no need of getting a financial institution account. Everything is needed to accomplish a transaction is really a cell phone able to delivering SMS.

Determined by the mobile phone network provider, mobile money enables customers to gain access to credit and other sorts of lending options. Her benefit that it is KYC needs are poor in contrast to those of banks. Generally, one “only” needs evidence of identity to spread out a free account. Taken together, this has come about as yet another hindrance to financial inclusion (not everybody could have a phone or identification documents), but this is because little as the barrier will get. A couple of its distinct disadvantages, however, are transaction and withdrawal charges. MTN, for instance, charges for mobile money transfers as much as 5%. Charges that could appear minor but develop with time.

Related: Here’s what’s happening in Web3 across Africa

On November. 17, 2021, the Ghanaian government announced the enactment of the e-transaction levy of just one.75%, planning to fill condition coffers. Initially suggested arrive at go by Feb, the e-levy remains postponed because of fierce opposition. Yet it’s been stated that regardless of the electronic tax, many people could keep using mobile money.

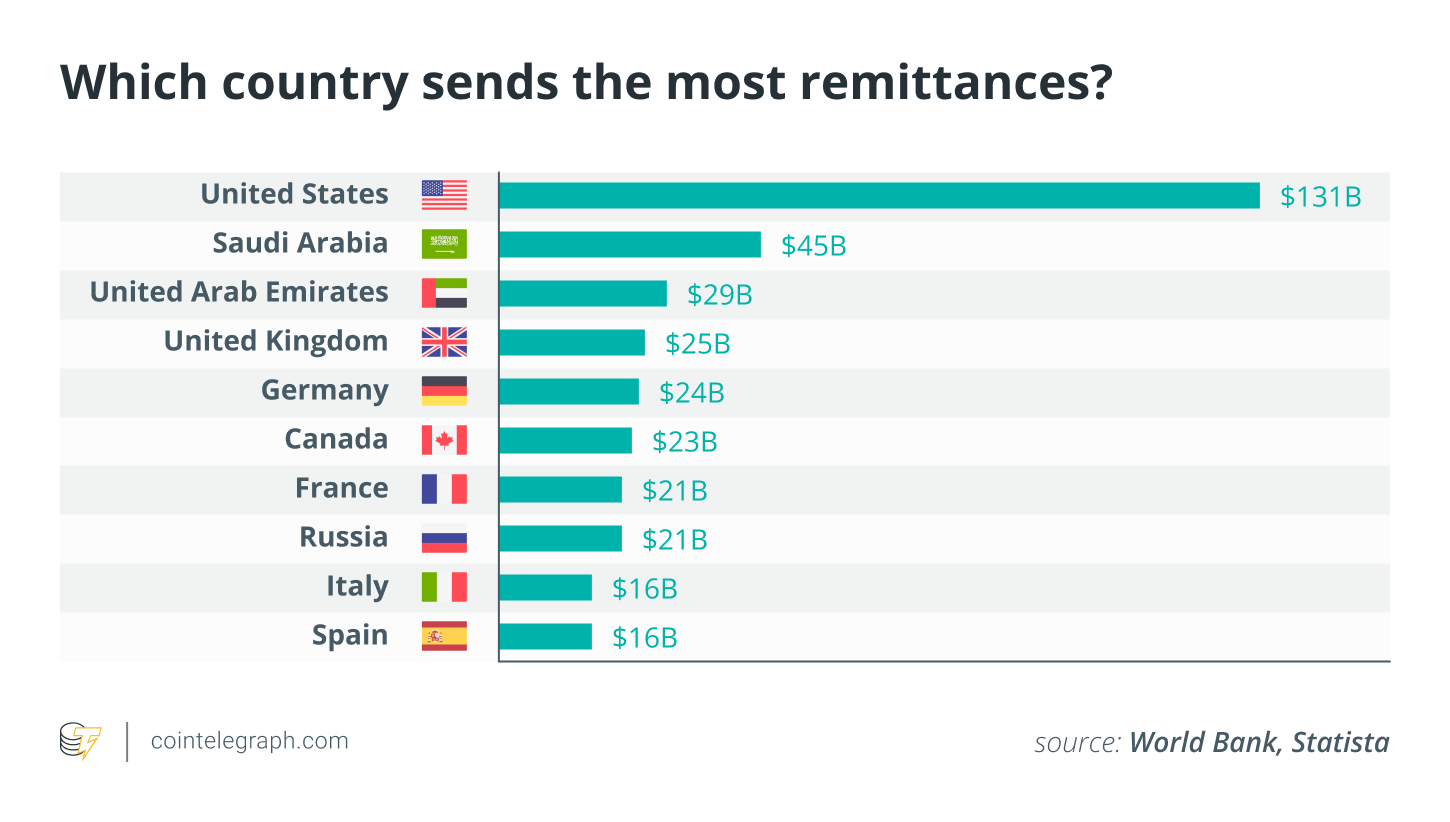

Lastly, foreign remittances is really a subject that can’t be overlooked when discussing the problem of monetary services in Ghana. Receiving remittances makes up about an obvious area of the country’s GDP, because it does in a number of developing countries.

In 2018, Ghana was the 2nd-largest person receiving remittances in West Africa after Nigeria. With increased Ghanaians moving to Europe and The United States, a considerable quantity of households depend on remittances to pay the bills. While banks are generally probably the most costly option for worldwide transactions, cash transfer services provide the money to some bank, cash pickup location or mobile account cheaper.

Cryptocurrency includes a edge against your competitors over mix-border transactions. Oftentimes, because of less middlemen, delivering money worldwide cost less and faster via blockchain. As reported through the World Bank, the typical cost of delivering $200 was 6.8% within the third quarter of 2020. Actually, facilitating worldwide remittances was pivotal for El Salvador’s policy decision of launching Bitcoin like a legal tender in September 2021. The SDGs also recognize substantial costs for remittances like a component that impedes financial inclusion and, thus, have set the goal of reducing these to 3% by 2030.

Related: The planet doesn’t need banks, policymakers or NGOs

Blockchain for sustainable development

Blockchain’s options that come with being incorruptible and without any intermediaries might help to better serve the unbanked. Consequently, this might also result in a diversification from the financial services market, that has typically been covered with banks. Without delving into reams of technological gobbledygook, blockchain-based cryptocurrencies could do all (and much more) that financial institutions can perform, but with no third-party controlling user data and charging people stupendous charges for fundamental services.

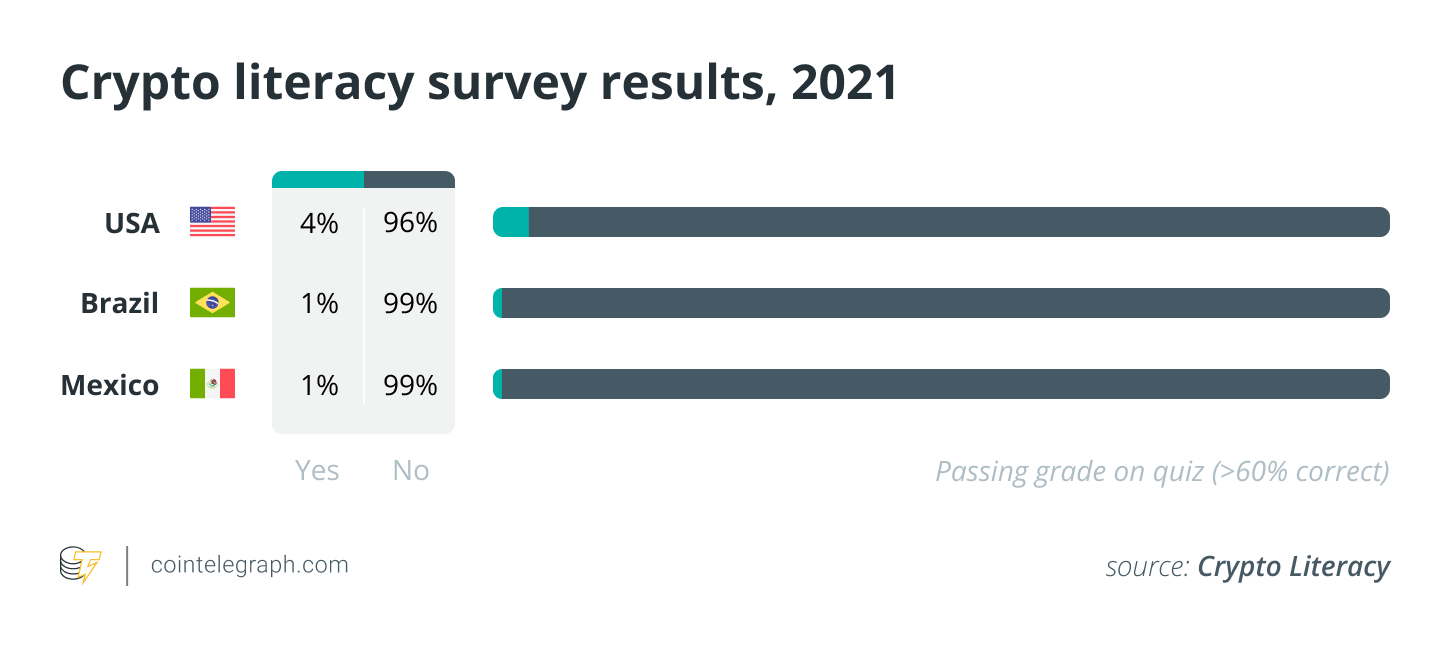

Besides everything crypto can perform, greater than ten years following the first Bitcoin (BTC), it hasn’t yet achieved wide consumer adoption. Applying quantitative surveys conducted with individuals residing in the higher Accra Region, the country’s most urbanized region and placement of their capital, the findings indicate too little rely upon cryptocurrencies’ future: Could it be an economic bubble, or does it replace national currencies, gaining trust along the way? No-one can tell without a doubt. Nevertheless, the findings also reported a high probability for cryptocurrencies to get steam and enrich the financial services market, particularly if they’d be simpler to make use of, more stable, and recognized by shops for use for daily purchases.

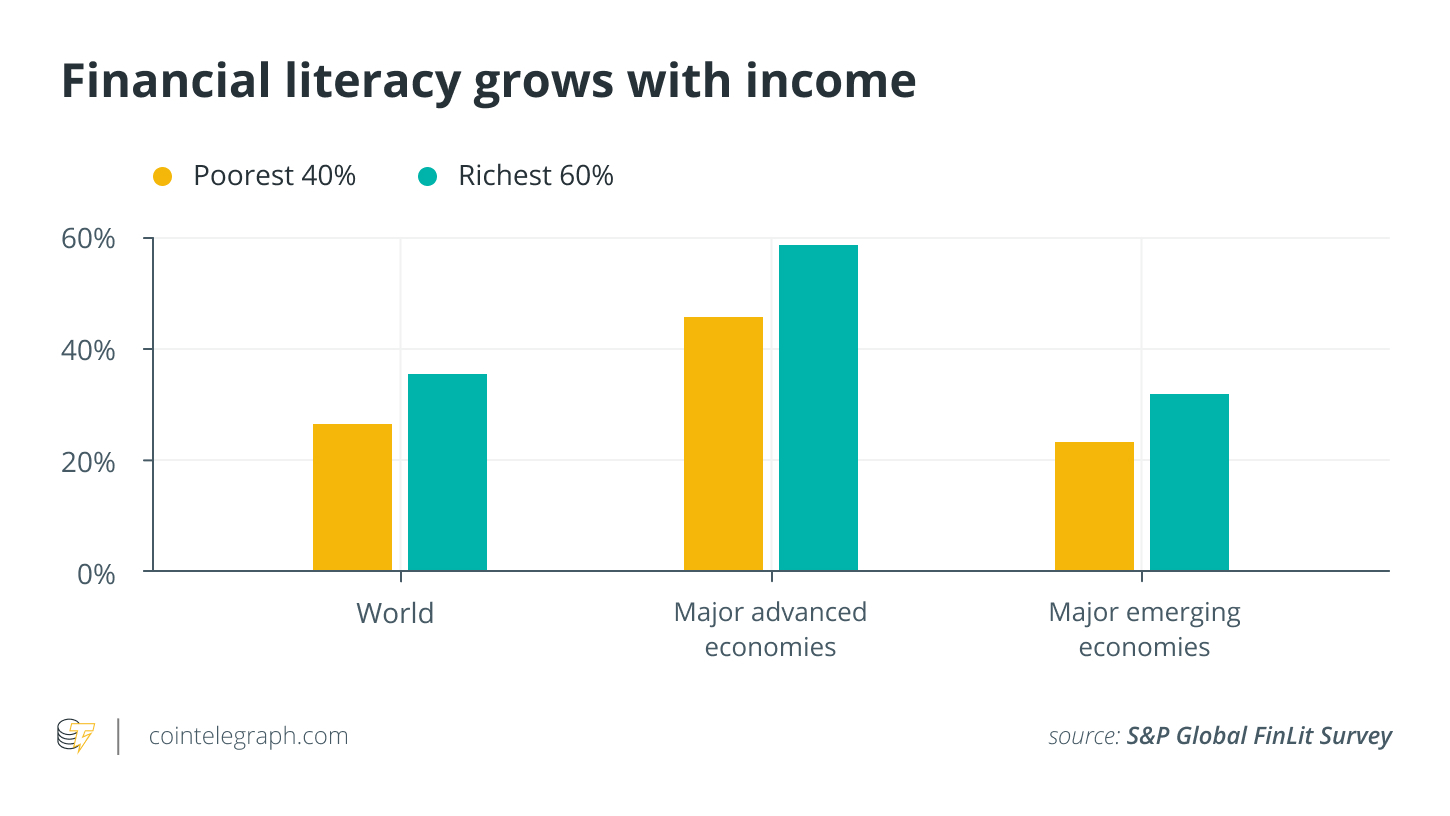

It seems that people don’t yet possess the understanding needed to do cryptocurrency transactions (not just in Africa, as other surveys show). Indeed, it requires a lot of time to obtain your mind around it.

Related: Crypto education may bring financial empowerment to Latin Americans

Insufficient trust endures insufficient understanding that impedes crypto’s adoption — the demonizing means by which this financial tool is frequently portrayed by a lot of the press doesn’t do good either. It’s a vicious circle that can’t be disentangled unless of course there is a simple-to-use financial service that both of these individuals and shop proprietors may use. When there’s this type of platform, possibly that it’s possible to transfer funds via SMS (thus built with an existing infrastructure a large amount of Ghanaians understand), this cycle might be challenged and cryptocurrency’s adoption faster. That being stated, you will find companies focusing on SMS-based blockchain transactions. Although it doesn’t mean replacing other kinds of financial tools, it might diversify the financial services sector and can include people who have to date been overlooked.

Only at that juncture, it’s important to note the fluctuation within the cost of some cryptocurrencies could be overcome by using stablecoins, cryptocurrencies which are pegged to fiat — i.e., government-issued currencies — or gold and silver. While critics are quick to indicate that individuals coins aren’t decentralized as, when it comes to fiat, their value heavily depends upon the performance from the currency they mirror. Some firms within the crypto space have been successful in developing relatively decentralized stablecoins — e.g., MakerDAO’s Dai).

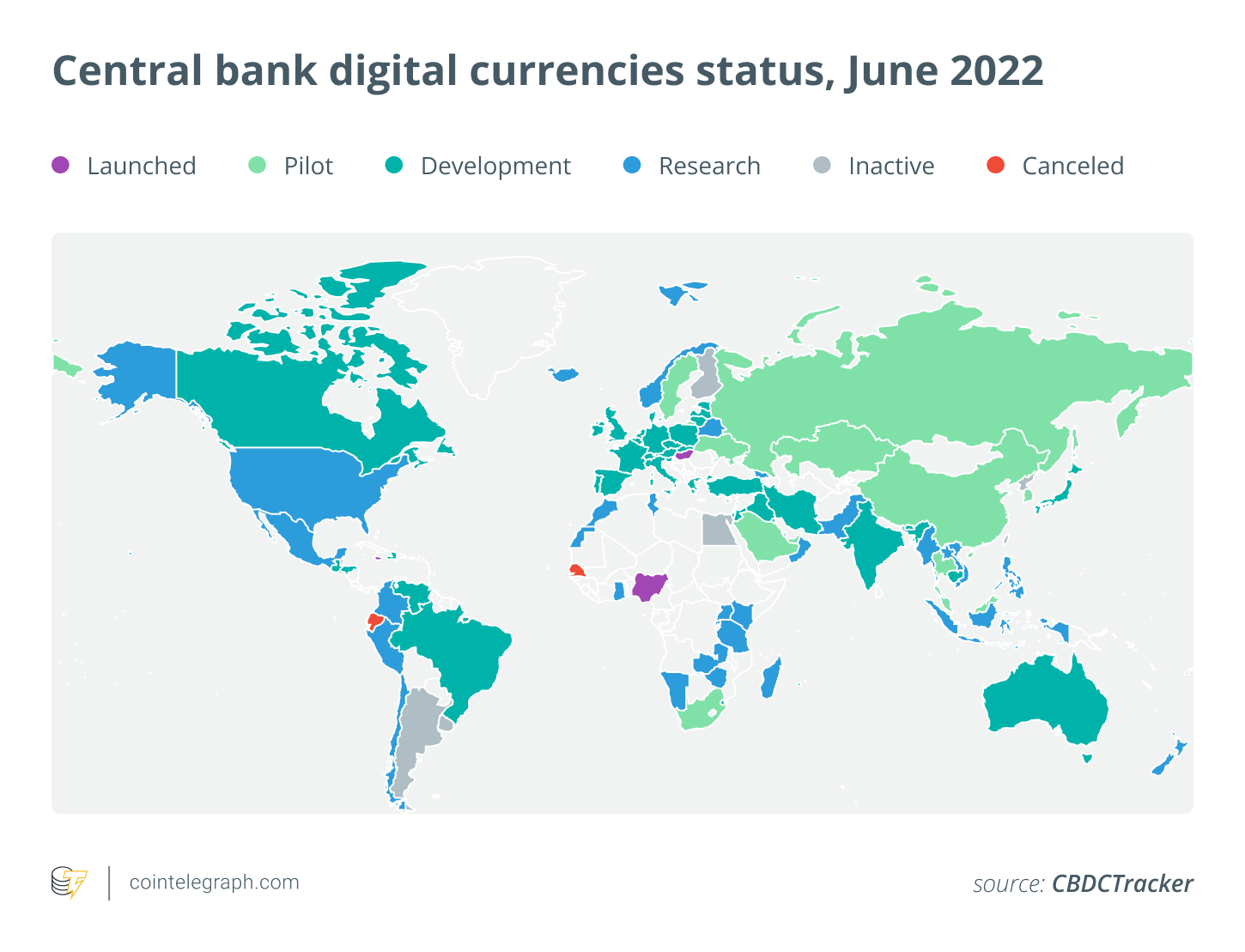

Also, greater than 70 countries are presently focusing on creating an electronic same as their national currencies. Known as central bank digital currencies (CBDC), an electronic same as national currencies provided by central banks may amp up consumer protections and spark a regulatory framework, entailing fiscal and financial policy, for an essential part from the economic climate, that has to date broadly eluded government bodies. Obviously, you will find drawbacks: Users would need to quit some extent of privacy and control, while central banks could be outfitted with impossible power letting them go as far back transactions, render them un-tied, etc. — away using the “tamper-proof” quality of decentralized finance. It’s an excellent chance for that model authoritarian government that desires to consolidate its grip over financial transactions, and citizens. Ergo, cryptocurrency and blockchain can be a medium of freedom or perhaps be misused for dystopian outcomes.

However, by supplying an easy infrastructure for kickstarting crypto, CBDCs became a member of having a user-friendly platform may be the beginning point and gateway by which people can find out about cryptocurrency and be empowered. Henceforth, people may go through asked to scout the cosmos surrounding cryptocurrency, boost their financial literary muscle, and move savings to decentralized solutions.

Training obtained from El Salvador may help propel financial inclusion through crypto in other areas around the globe. Although this article cannot explore all of the arguments around CBDCs, they might be one method to generate trust, incite financial inclusion, and accelerate the adoption of crypto. Acknowledging the immense potential of cryptocurrency, I’ve found that it’ll in all probability rise in relevance. What concerns use is rather the length of time it takes for cryptocurrency to achieve ground, thinking about that lots of individuals in power hold an interest in keeping things because they are. Glancing at history, I’m confident its adoption is going to be faster compared to change from cowrie shells to fiat.

Once more about inclusion

By providing a fairer and much more transparent economic climate, cryptocurrencies and blockchain pose an alternative choice to conventional financial services. Recognizing cryptocurrency and blockchain for financial inclusion and searching beyond mobile money and banking infrastructures are important to serving people’s requirement for use of affordable financial services. A person-friendly platform is required to facilitate the usage for people and companies. With this particular, anybody could connect to the benefits without extensive understanding of blockchain. Crypto would probably be recognized by shops, helping promote the delivery of monetary inclusion on area of the U.N.’s Sustainable Development Goals. Nonetheless, regulatory frameworks and financial education shouldn’t be understated when tackling financial exclusion.

Ultimately, it might be apparent that what blockchain threatens to exchange may be the very nature from the economic climate by bypassing the problem of trust. Because of its brevity, the content overlooked many technical facets of blockchain, for example custodial and noncustodial wallets, decentralized and centralized exchanges, and various kinds of blockchains, cryptocurrencies and consensus mechanisms, however i encourage everybody to create on your way of exploring (“googling”) these along with other concepts. Getting done research about this matter for a great deal of time, although it’s a tiresome undertaking, You can be assured it’s a thought-provoking and understanding-enhancing one. Since a lot of blockchain continues to be in the infancy, it’s a great time to begin studying about this now.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Dustin Jung is really a blockchain enthusiast. He holds two master’s levels within the fields of social science and management studies in the College of Freiburg, Worldwide Business School Budapest, and also the College of Buckingham. Getting resided in Ghana from 2018 to 2019, Dustin rapidly grew to become enthusiastic about how blockchain can drive sustainable rise in developing countries.