On June 13, cryptocurrency prices stepped much deeper into bear market territory after Bitcoin (BTC) sliced through its current buying and selling range and briefly touched $22,600, its cheapest level se since December 2020.

Based on BTC historic data, the marketplace has arrived at valuation metrics that demonstrate the cost is seriously oversold and possibly near a bottom. Bitcoin has fallen below its recognized cost, addressing the typical cost of each and every gold coin in supply in line with the time that it was last allocated to-chain.

As the discomfort this newest capitulation has wrought over the ecosystem can’t be understated, the main one glimmer of hope it provides weary crypto traders would be that the worst from the decline might have happened. The approaching days will confirm this theory and proof could be institutions and retail traders walking directly into purchase the dip.

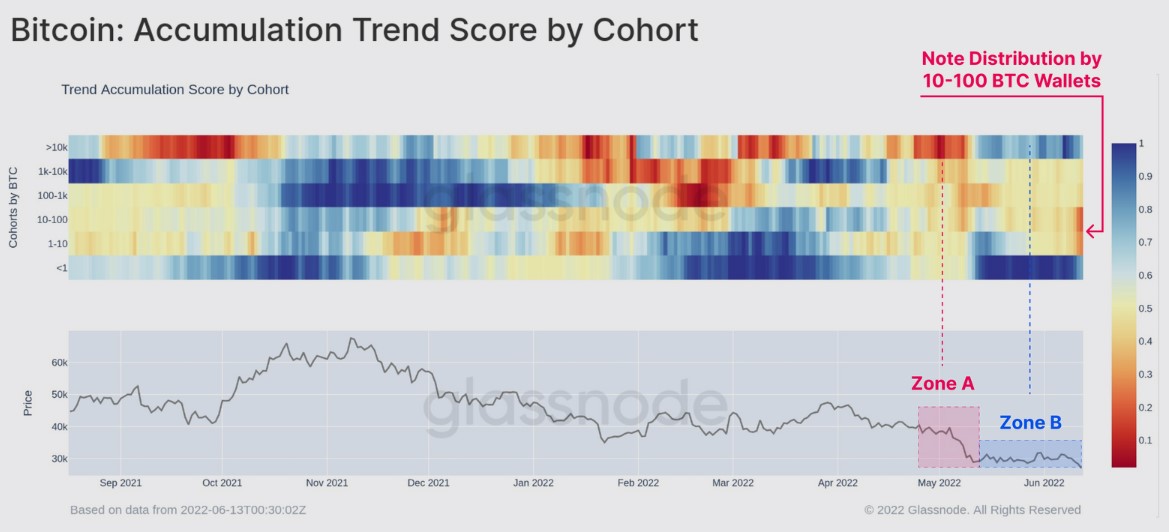

“Shrimps and whales” accumulate

On-chain data implies that not every traders feel devastated about Bitcoin at yearly lows. Shrimp wallets, wallets that hold under 1 BTC, and whale wallets using more than 10,000 BTC will be in accumulation mode because the old Terra (LUNA), now referred to as Luna Classic (LUNC), collapsed at the begining of May.

According to data from blockchain intelligence provider Glassnode, shrimp wallets “have seen a internet balance development of +20,863 because the May ninth Luna crash,” along with a total increase of 96,300 BTC since November’s all-time high (ATH).

Whale wallets have likewise been busy during this time period of your time as “this cohort includes a monthly position change peak of ~140k BTC/month” and it has added as many as +306,358 BTC since its all-time full of November.

Related: Bitcoin analysts are watching these BTC cost levels as key trendline looms

Support is restricted within the mid-$20,000 range

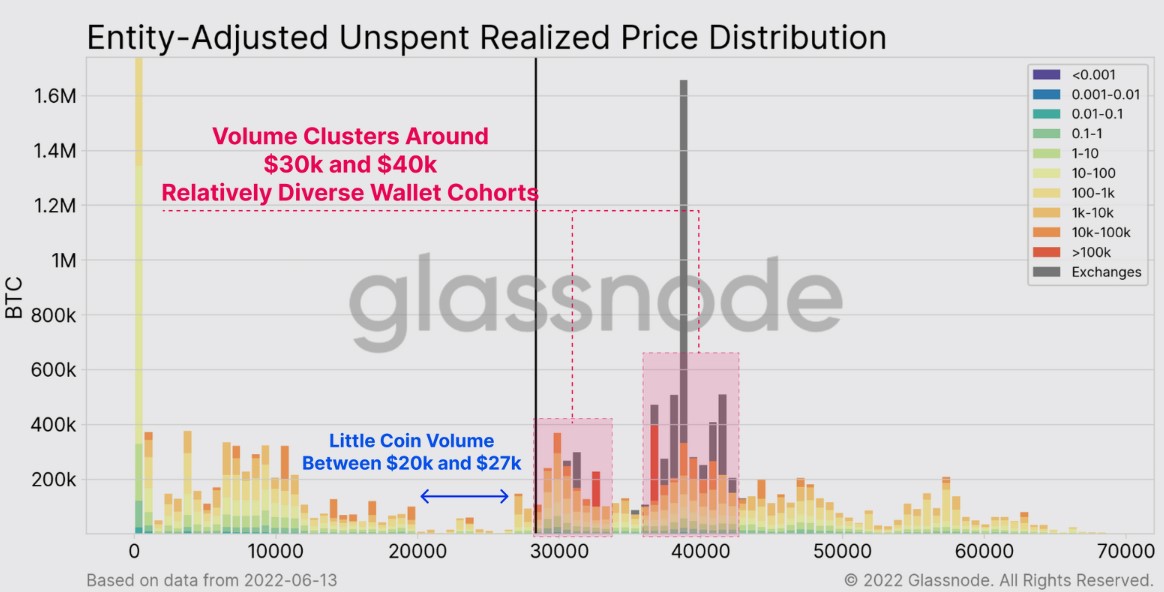

One of the reasons for that rapid sell-off on June 13 was the possible lack of demand within the $20,000 to $27,000 range as proven around the following entity-adjusted unspent recognized cost distribution chart.

While there’s huge quantity of demand close to the $30,000 and $40,000 cost ranges, a few of the cheapest volumes put together between $20,000 and $27,000, which left little support because the cost of BTC crashed in early hrs on June 13.

Relief might be around the corner, however, as they say “it’s always darkest prior to the dawn” which could apply to the present condition from the crypto market according to several metrics.

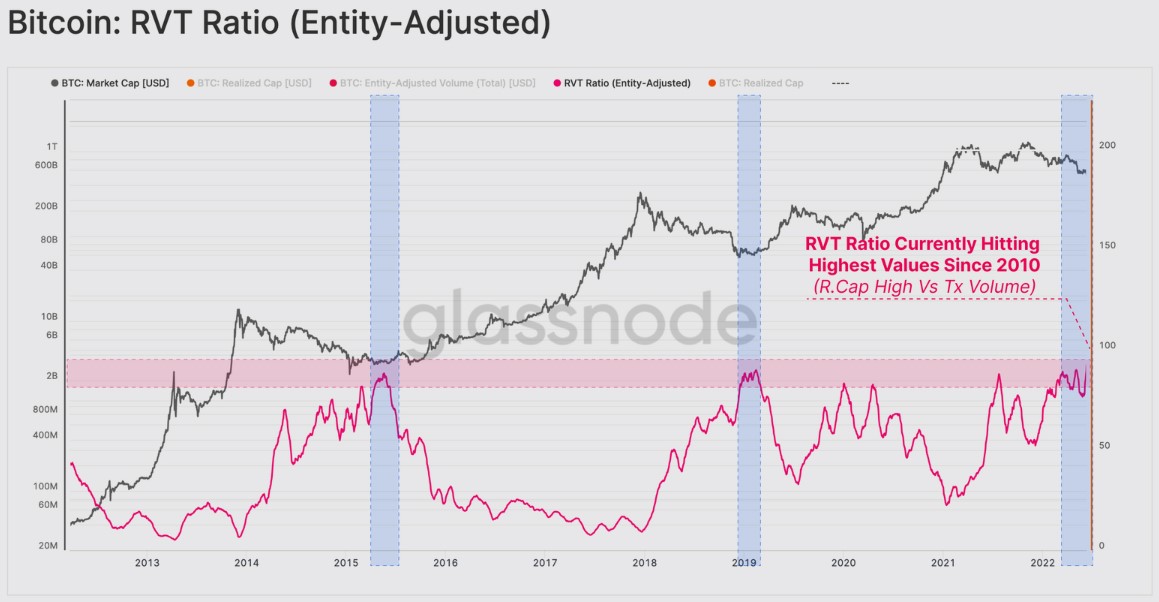

Based on the RVT ratio, which blogs about the recognized capital from the daily volume chosen-chain, “the network valuation has become 80 occasions bigger compared to daily value settled,” which signifies a minimal quantity of on-chain activity.

Glassnode stated,

“In past bear cycles, an underutilized network provides confluence with bear market bottoms.”

The RVT ratio is presently at its greatest level since 2010, which might claim that the marketplace has arrived at the purpose of max discomfort and may see enhancements soon, but the potential of further weakness cannot be eliminated.

The general cryptocurrency market cap now is $980 billion and Bitcoin’s dominance rates are 46.3%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.