Bitcoin (BTC), typically the most popular cryptocurrency and cryptoasset, dropped below USD 20,000 the very first time since December 2020, as the second-largest cryptoasset, ethereum (ETH), broke the USD 1,000 level the very first time since The month of january 2021.

At 08:19 UTC, BTC trades at USD 19,161 and it is lower 10% per day and 34% per week, ETH trades at USD 996 and it is lower 11% per day and 40% per week. Other cryptoassets in the top ten club are lower 10%-12%.

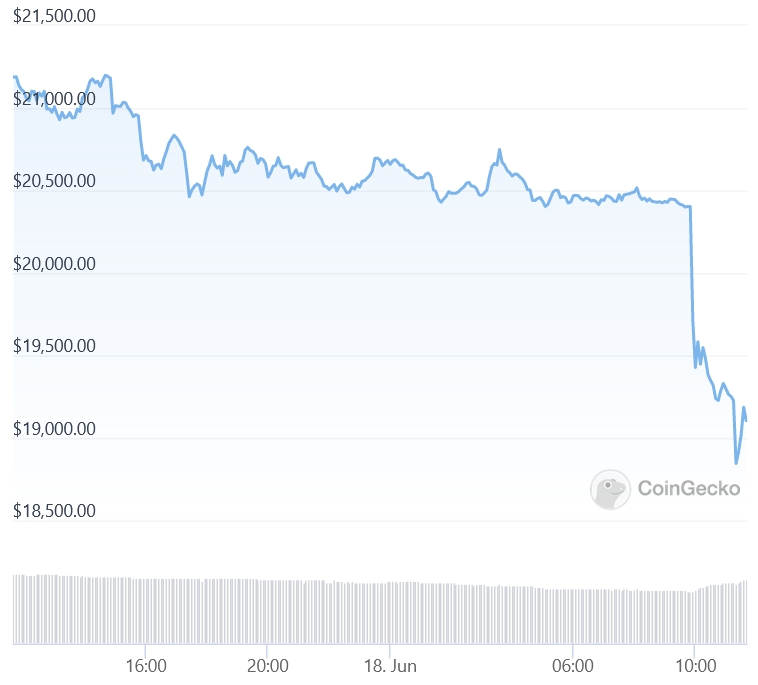

BTC cost chart:

As reported, analysts considered the USD 20,000 for BTC and USD 1,000 for ETH levels as key prices to look at.

A rest underneath the USD 19,511 level may lead to numerous hodlers capitulating along with a wind-lower of leverage and the majority of the open curiosity about BTC options is dependant on the USD 20,000 strike cost, “which could lead to selling pressure within the place market if the cost fall below,” Vetle Lunde and Jaran Mellerud at Arcane Research stated an email, per Bloomberg.

To date, liquidations within the crypto market neared USD 170m previously 4 hrs, per Coinglass data.

If these levels break, “massive sell pressure” should be expected in place markets as dealers hedge themselves, which may even cause some unhedged over-the-counter dealers to “go belly up,” former BitMEX Chief executive officer Arthur Hayes cautioned now.

“So far as the charts go, you best escape your Lord Satoshi prayer book, and hope god shows kindness around the soul from the #crypto markets. [Because] if these levels break, you may as well shut lower your pc [because] your charts is going to be useless for some time,” he stated.

However, historic data reveal that BTC might find key support around USD 20,000, as previous selloffs demonstrate in which the token usually finds points of resilience, Mike McGlone, an analyst for Bloomberg Intelligence, stated, adding that BTC may “develop a base around USD 20,000 because it did at approximately USD 5,000 in 2018-19 and USD 300 in 2014-15.”

However, Universe Digital Chief executive officer Mike Novogratz stated he believes BTC and ETH are “much nearer to the underside” than stocks that they stated could fall another 15% to twentyPercent, but investors should continue but be careful anyway.

Either in situation, per Ainsley To, Noelle Acheson, and Konrad Laesser of Genesis Buying and selling, “sentiment in crypto markets would be that the unknown unknowns are the most important at this era.”

“The resurgence of counterparty risk is really a indication that does not exactly what matters in risk management could be precisely quantified. Risk is remaining once you think you’ve considered everything,” these were quoted as saying by Bloomberg.

____

Find out more:

– Bitcoin, Ethereum & Crypto Test New Lows as Market Braces for Bigger Rate Hike on Wednesday

– Bitcoin, Ethereum & Crypto Dive as Celsius Adds Fuel towards the Given Fire Now

– Bitcoin Historic Performance isn’t any Guide for future years in 2022

– Bitcoin Undervalued, Crypto Now Much Better Than Property – JPMorgan

– As inflation ‘Mellows Out’, a Bottom in Crypto is probably in ‘The Back 1 / 2 of 2022’ – VC Investor

– Crypto & Stocks ‘Decoupling’ Conjecture Flops there is however Still Hope