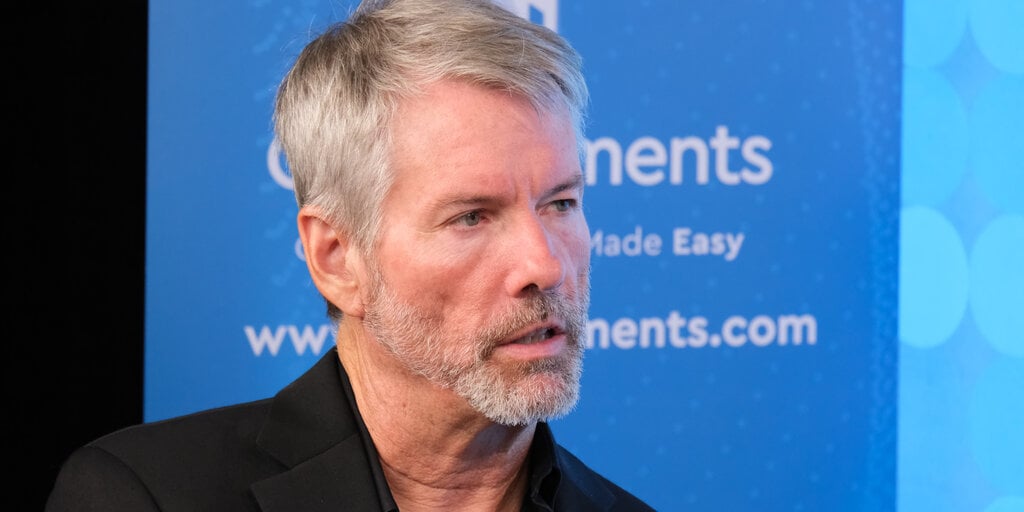

Bitcoin preacher Michael Saylor is more bullish than ever now that the Republican party is set to retake power—and the software entrepreneur plans to have a party when the asset hits $100,000, which he expects by the end of the year.

The billionaire and founder of MicroStrategy—a software firm that holds more BTC in its treasury than any other company—was speaking to CNBC Thursday when he made the prediction that Bitcoin would hit the long-awaited $100,000 mark at some point in December.

Bitcoin shot up following the election of ex-President, now President-elect Donald Trump on November 5. The crypto-friendly candidate promised to help the digital asset industry while on the campaign trail, and soon will have an opportunity to live up to those claims.

The price of Bitcoin now stands at $88,360 after touching $93,477 just two days ago, according to CoinGecko. The new all-time high price mark is nearly $20,000 higher than the previous level, which was breached on Election Day.

“I’m planning the $100K party, and I’m thinking it’s probably going to be New Year’s Eve at my house,” he said when asked whether Bitcoin could drop back to $60,000 or even as low as $30,000.

“I would be surprised if we don’t go through $100K in November or December,” he continued.

Saylor added that the election of Trump was “incredibly auspicious for Bitcoin” and the digital asset industry as a whole.

Trump wasn’t just the Wall Street favorite to win the White House, but also the fast-moving crypto industry’s biggest bet: American companies in the space have faced regulatory struggles, as the Securities and Exchange Commission (SEC) has gone after firms it deems are selling unregistered securities.

But Trump came out as aggressively pro-Bitcoin this year, despite past skepticism around the crypto industry, and even said he would fire the SEC’s notoriously anti-crypto Chair, Gary Gensler.

MicroStrategy, which sells data-analyzing software, has been buying Bitcoin since 2020. Saylor—who co-founded the company and is currently its executive chairman—argues that the biggest digital coin by market cap is the best long-term investment.

His company now is a Bitcoin proxy for investors: those who want to get exposure to the asset buy shares in the company; MicroStrategy uses debt to buy huge amounts of the “digital gold.” The firm recently shared plans to raise another $42 billion over the next three years to continue buying Bitcoin.

The Tyson, Virginia-based company now holds 279,420 Bitcoin—worth about $25 billion at the current price. At a $100,000 price, then, MicroStrategy’s stash would be valued at nearly $28 billion.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.