The cost of Bitcoin tucked below $70,000 early Monday morning, as volatility elevated in front of this month’s much-anticipated block reward halving.

Bitcoin is presently lower 1.1% at the time, buying and selling around $69,565, per data from CoinGecko, although it remains up almost 4% around the week.

Using the Bitcoin halving set to occur around or on April 20, one measure for tracking the cryptocurrency’s volatility has leaped in recent days.

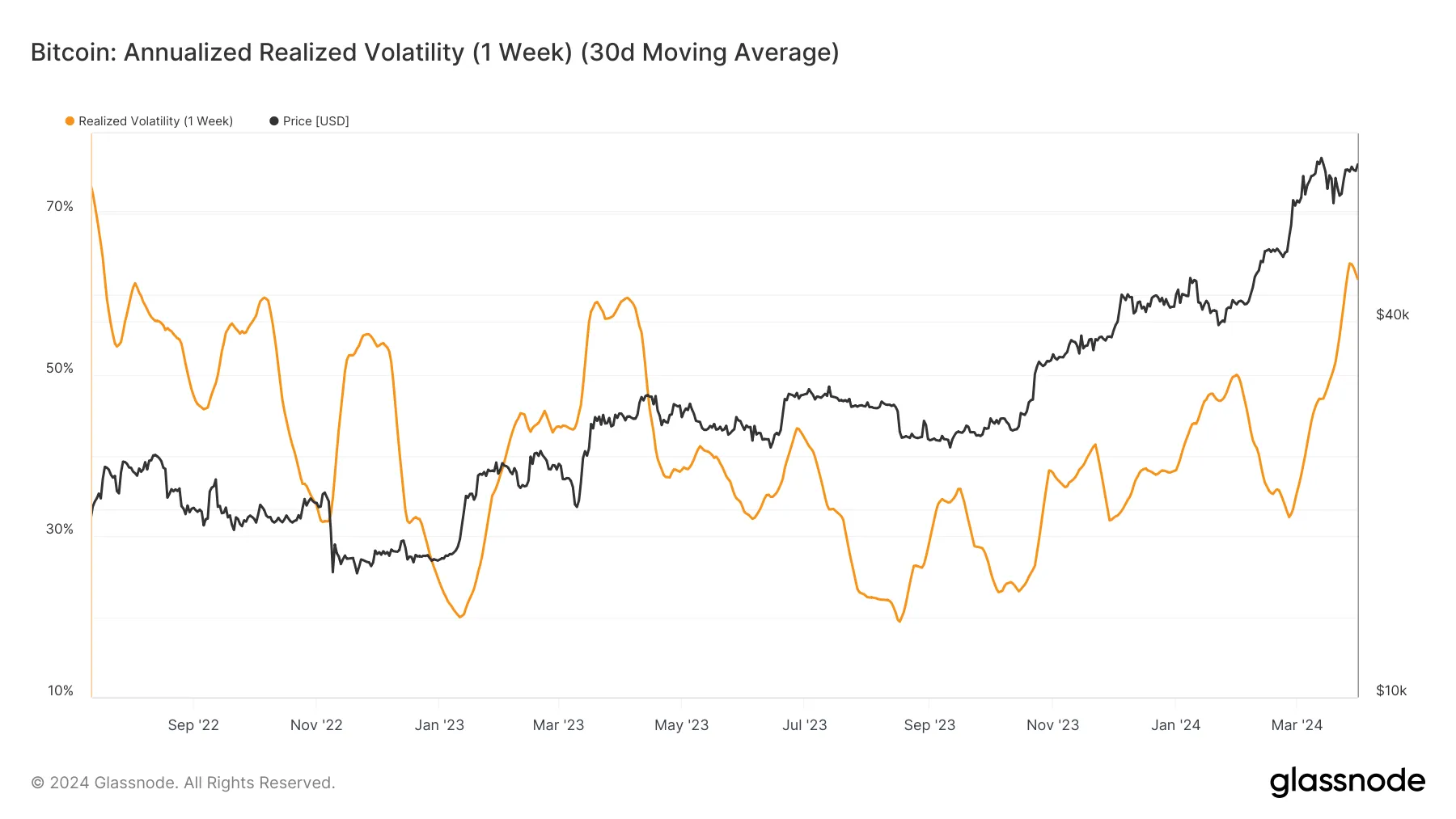

Bitcoin’s 30-day annualized recognized volatility hit a higher of 63.76% a week ago, and continued to be over 60% through the close each week, per data from Glassnode—its greatest level since August 2022. Recognized volatility tracks the conventional deviation in returns in the mean more than a period of time, with greater values reflecting elevated cost risk over the period.

Bitcoin volatility jumps in front of April halving

Late recently, Beam Chief executive officer Andy Bromberg told Decrypt that Bitcoin’s recent volatility reflects a “crisis of belief” among traders in front of the block reward halving.

Happening every 4 years, the Bitcoin halving sees the block reward allotted to miners slashed in two as a way of manipulating the distribution of their fixed 21 million supply. The 2024 halving might find mining rewards drop from 6.25 BTC to three.125 BTC.

While in the past, each Bitcoin halving continues to be adopted with a boost in the cryptocurrency’s cost, some analysts have cautioned that it could cost in. A current report from Coinbase, meanwhile, noticed that previous cost rallies also correlated with wider macro occasions like the coronavirus pandemic and lockdown, leading to “extraordinarily loose financial policy and in the past strong fiscal stimulus.”

The 2024 halving can also be atypical because Bitcoin’s cost hit an exciting-time high ahead from the halving, propelled through the approval of multiple U.S. place Bitcoin ETFs in The month of january. Using the ETFs scooping up Bitcoin in the market, and also the halving set to slash the availability of recent Bitcoin, the end result might be a supply crunch—which some analysts indicate like a bullish indicator because the halving approaches.