The world’s most well-known Bitcoin millionaire states the brand new Bitcoin ETFs from BlackRock and Fidelity have proven more effective than even he’d imagined.

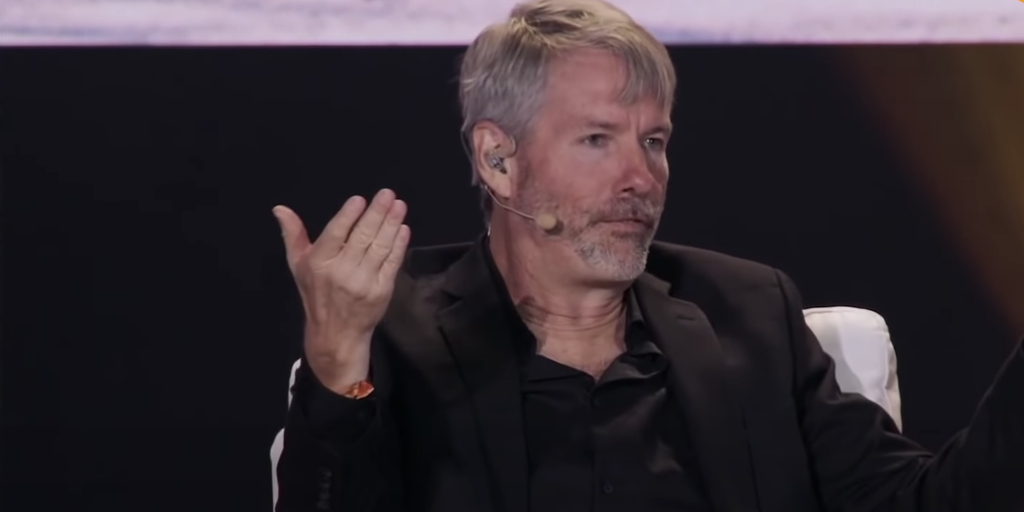

“We believed that maybe Bitcoin would be a competitor to gold, however it has really increase the leaderboard, and today it’s beginning to puppy nip in the heels from the S&P 500 Index ETFs,” MicroStrategy Chief executive officer Michael Saylor stated throughout an interview in the Madeira Bitcoin conference.

Saylor stated gold ETFs, which remain the biggest commodity ETFs within the U . s . States, is going to be surpassed by their Bitcoin counterparts in “not too lengthy a period.”

Since launching under two several weeks ago, Bitcoin ETFs have with each other absorbed $8.5 billion in internet inflows, based on BitMEX Research—even when offset by massive outflows in the converted Grayscale Bitcoin Trust (GBTC) in that time.

The following largest funds, such as the iShares Bitcoin Trust (IBIT) and Fidelity Wise Bitcoin Origin Trust (FBTC), both experienced the biggest inflows associated with a ETF ever inside their first thirty days of launch.

Such money is now consistently placing inside the top 20 most positively traded ETFs every day. With each other, the Bitcoin ETFs traded with more than $6 billion in volume on Tuesday—more than Microsoft (NASDAQ:MSFT).

When they continue this pace and add $10b per month (that is pretty insane but very poss if btc cost complies) they’ll pass gold ETFs this summer time

— Eric Balchunas (@EricBalchunas) March 5, 2024

Saylor characterised ETFs really are a “universal API” for investors to simply trade interior and exterior different funds, by which they are able to now access BTC. A Credit Card Applicatoin Programming Interface (API) is really a standardized conduit to data that streamlines interactions between personal computers.

“That’s even the global protocol for buying and selling volatility or issuing credit,” he described.

Before ETFs, getting financing against one’s Bitcoin could be slow and also have a far greater rate of interest. Now, you could potentially publish shares of the ETF like a lower payment on the mortgage through their reliable broker-dealer, like J.P. Morgan or Merrill Lynch.

“These ETFs opened up up a whole financial realm of awareness, chance, and functionality towards the 99% of mainstream investors,” Saylor ongoing. “You really can’t underestimate precisely how profoundly essential that would be to the whole network.”

Saylor’s company MicroStrategy may be the world’s largest corporate holder of Bitcoin, presently holding 193,000 BTC on its balance sheet. Overall, the firm is up over 100% on its investment, but still intends to buy more BTC using funds from your approaching $700 million convertible note purchase.

Edited by Ryan Ozawa.