Bitcoin, that has more and more been known as “digital gold,” flipped silver’s market capital coming past $71,000 and setting a brand new all-time high.

It is a milestone that Bitcoin has witnessed frequently forever of March.

On Friday mid-day, Bitcoin broke above $70,000 for that very first time ever. Then early Monday morning, the Bitcoin cost started climbing and it was $71,239.37 during the time of writing. It’s acquired 2.7% since yesterday and 11.4% because this time a week ago.

Out of the box normally the situation, the all-time high cost depends upon which exchange or cost aggregator you check. At roughly 9:20 Central European Time the BTC cost was $71,700 on Coinbase $71,560 on CoinGecko and $71,607 on CoinMarketCap.

It had been only three several weeks ago—when anticipation for that approval of place Bitcoin ETFs began to build—that Bitcoin were able to switch Elon Musk’s electric vehicle company Tesla, Facebook, Instagram, and WhatsApp parent company Meta, and acclaimed Bitcoin hater Warren Buffett’s multinational conglomerate Berkshire Hathaway.

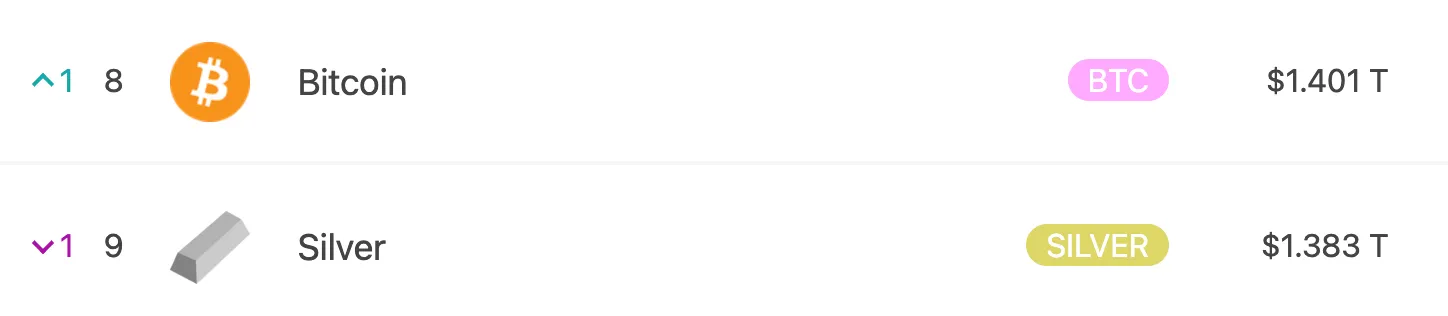

Which makes Bitcoin the recently minted eighth-largest asset due to its $1.4 trillion market cap. Besides gold, that has lengthy held the very best place using its $14.7 trillion market cap, will still be trailing behind Microsoft, Apple, Nvidia, Saudi Aramco, Amazon . com, and Google parent company Alphabet.

Why the bullish cost rally? One big reason may be the approaching Bitcoin halving. The most recent estimate would be that the halving will exist in roughly 35 days, on April 15, based on NiceHash.

The Bitcoin halving cuts down on the reward compensated to Bitcoin miners for process new blocks around the network. It’s happened three occasions already since Bitcoin originated. This 4th halving might find the Bitcoin reward reduced from 6.25 BTC to three.125 BTC.

Meanwhile, Ethereum today reclaimed $4,000 after first seeing it on Friday the very first time since 2021. During the time of writing, ETH seems to possess met a little bit of resistance. The Ethereum cost is $3,992.13, getting acquired 1.3% since yesterday and 13.6% since a week ago.

When it comes to market cap, Ethereum’s $480 billion causes it to be bigger compared to SPDR S&P 500 ETF Trust which is fast closing in on Walmart’s $484 billion market cap, based on Infinite Market Cap.

ETH has some bullish news of their own like a tailwind now. In only two days’ time, Ethereum devs will unveil the Dencun upgrade. It’s likely to make Ethereum layer-2 transactions dramatically cheaper, devs told Decrypt a week ago.

Edited by Andrew Hayward

Editor’s note: This story was updated to fix the Bitcoin reward following a halving.