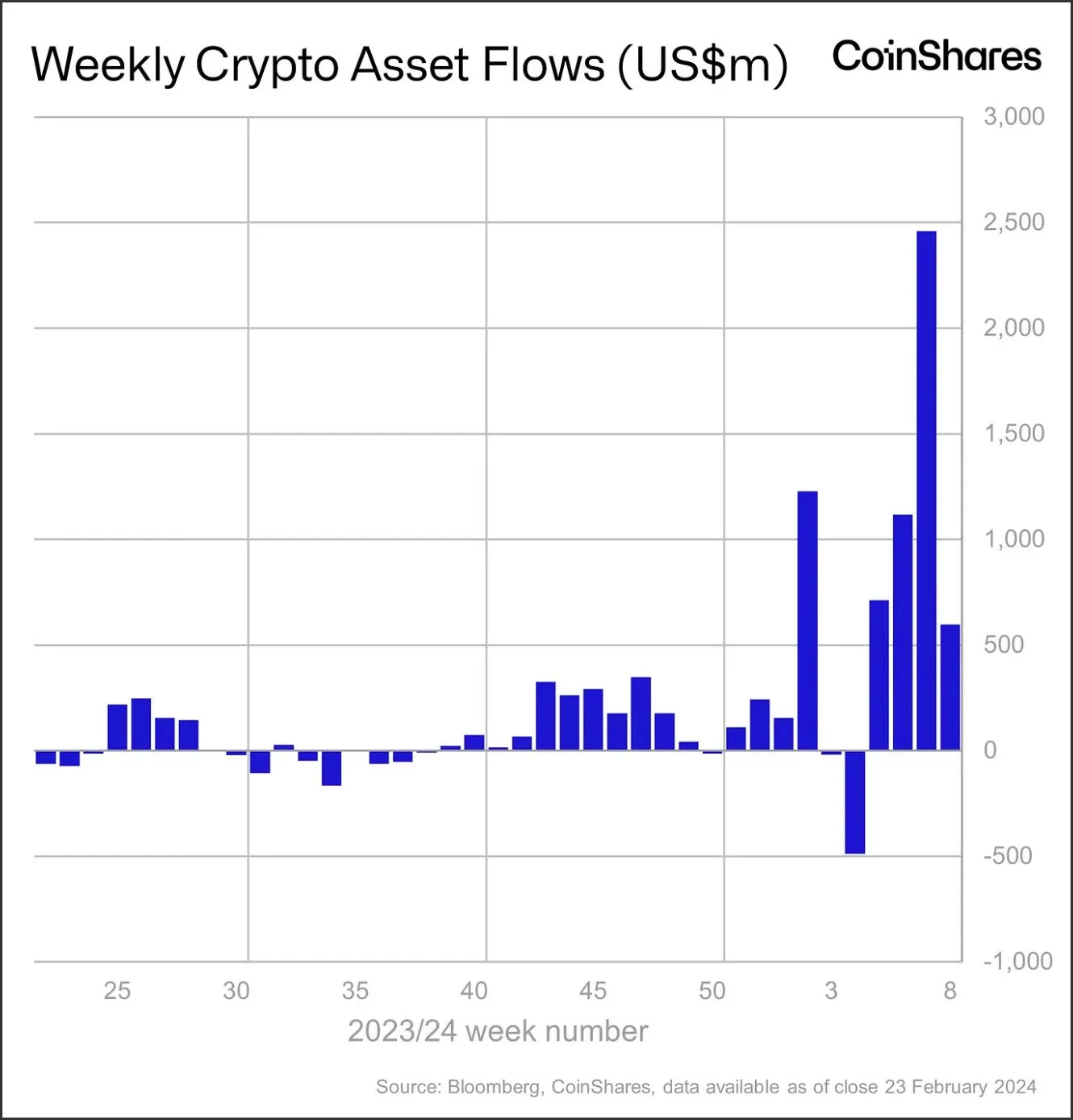

The inflows have stored coming—albeit away from the attention-popping pace from the previous week. While there’s been a slowdown in the record $2.45 billion logged earlier this year, a considerable amount of cash was again connected to crypto funds a week ago, explains a brand new report.

Digital asset manager CoinShares stated Monday that $598 million hit funds giving investors contact with virtual coins and tokens a week ago.

The majority of that cash hit the red-hot place Bitcoin exchange-traded funds (ETFs)—specifically, BlackRock’s iShares ETF and Fidelity’s Wise Origin Bitcoin Trust, the report demonstrated.

The Registration on The month of january 10 approved 10 place Bitcoin ETFs. Nine are actually buying and selling and also have been very effective, using the curiosity about the derivative products pushing the cost of actual Bitcoin up.

The obvious flow dip the next week doesn’t mean ETF hype is cooling. CoinShares’ mind of research James Butterfill, who authored the report, told Decrypt that “weaker than expected macro data” most likely brought to some slow in inflows. Data emerged earlier this year showing that inflation was greater than expected in The month of january.

He added that investors still weren’t considerably cashing out—except for Grayscale’s new ETF.

Following a approval of place Bitcoin ETFs, Grayscale’s product—which converted from operating just like a closed-finish fund for an ETF—experienced significant outflows, leading the cost of Bitcoin to decrease.

And investors continue to be cashing out—albeit under before—with $436 million departing the fund a week ago.

“The new issuer inflows greater than offset house outflows,” Butterfill stated. “That’s to become expected and Grayscale outflows are slowing still,” he stated, adding there were rumors of “big buying today.”

Although the majority of the inflows a week ago were centered on the greatest cryptocurrency, Bitcoin, $17 million hit Ethereum funds, while funds giving contact with Chainlink and XRP received $1.8 million and $1.a million, correspondingly.

Bitcoin’s cost expires today—and just touched a higher not experienced since 2021. It’s now buying and selling for $53,418 per gold coin, a virtually 4% 24-hour rise, according to CoinGecko.

Edited by Ryan Ozawa.