We research, you receive the alpha!

Get exclusive reports and use of key insights on airdrops, NFTs, and much more! Subscribe how to Alpha Reports or more your game!

Bitcoin millionaire and BitMEX co-founder Arthur Hayes described the historic economic cycles as well as their implications for that market atmosphere in the latest blog publish, quarrelling the present economic landscape is characterised with a local cycle of inflation. Which makes Bitcoin an excellent safe-haven asset when compared with gold because of its independence from national control.

He separates economic cycles into local and global periods. In a nearby period, he authored, government bodies frequently turn to financial repression to finance wars along with other significant expenses, leading to inflation. On the other hand, a worldwide period is marked by deregulated finance and promotes global trade, resulting in deflation.

Hayes believes we’re presently inside a local cycle driven by inflationary pressures and geopolitical tensions.

“The planet is moving from the unipolar US-ruled world to a multipolar world order which contains leaders for example China, South america, Russia, etc,” he authored.

This shift contributes to the present inflationary atmosphere as nations turn inward and prioritize domestic economic stability.

He further elaborated around the investment implications of those cycles, stating, “If you think maybe in neither the machine nor individuals governing it, you purchase gold or any other asset that does not require any vestiges from the condition to exist, like Bitcoin.”

In the view, Bitcoin’s decentralized nature and also the speed of transactions turn it into a more appealing option than gold in the current economic system.

Hayes supplies a historic context, describing how past cycles influenced investment choices.

From 1933 to 1980, the Pax Americana Climbing Local Cycle saw the U.S. economy growing because it financed wars through financial repression. In comparison, the 1980 to 2008 Pax Americana Hegemon Global Cycle was characterised by deregulation along with a more powerful dollar, favoring stock investments over gold.

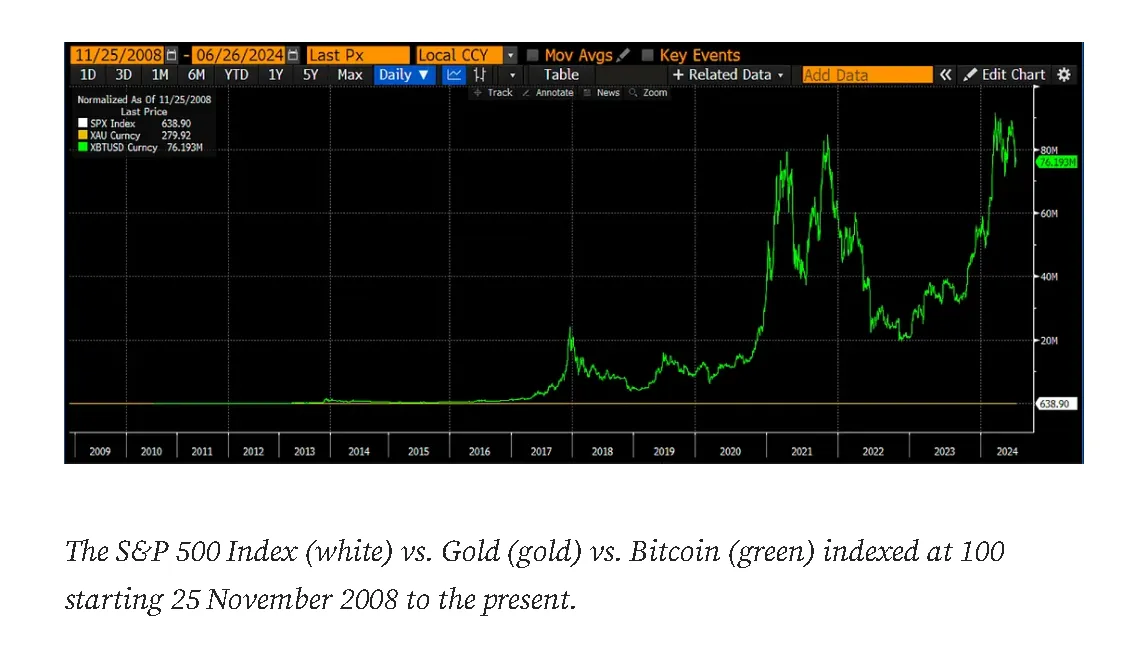

In the present cycle, which started in 2008, Hayes highlights the emergence of Bitcoin like a significant development.

“The wrinkle is the fact that at the beginning of the present local cycle, Bitcoin offered another stateless currency,” he authored.

Unlike gold, Bitcoin is maintained via a cryptographic blockchain, permitting faster and much more secure transactions. This distinction has allowed Bitcoin to outshine gold since its beginning.

Hayes further stated the ongoing local inflationary cycle and geopolitical tensions make Bitcoin a far more reliable store of worth than traditional assets like gold.

He emphasized the significance of understanding these cycles to create informed investment decisions.

“We all know we’re within an inflationary period, and Bitcoin has been doing what it’s designed to: outshine stocks and fiat debasement. However, timing is important. Should you bought Bitcoin in the recent all-time high, you may seem like a beta cuck since you extrapolated past results into an uncertain future,” Hayes authored, highlighting the significance of proper timing in investment decisions.

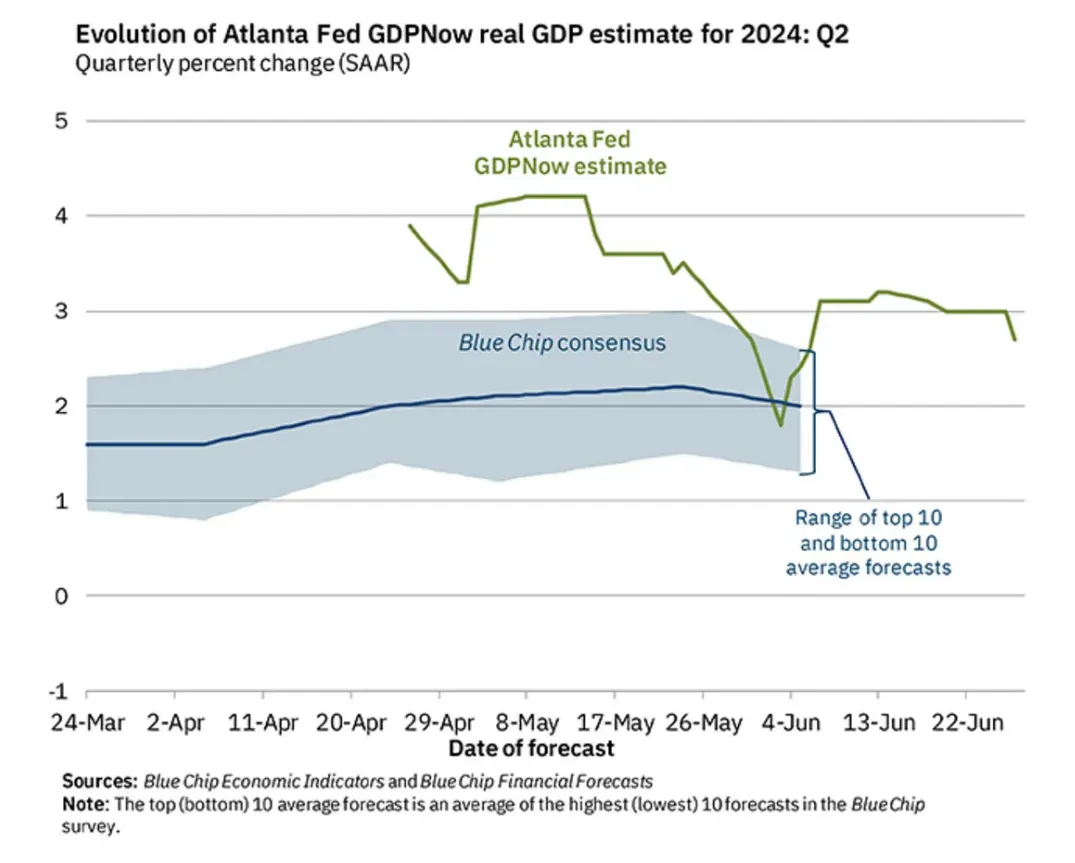

Searching forward, Hayes predicts a transfer of credit allocation, stating, “How Pax Americana and also the collective West allocate credit will resemble the way the Chinese, Japanese, and Koreans get it done.”

He advises investors to watch “fiscal deficits and the quantity of non-financial bank credit” as key indicators.

Edited by Stacy Elliott.

Daily Debrief E-newsletter

Start every single day using the top news tales at this time, plus original features, a podcast, videos and much more.