We research, you receive the alpha!

Get exclusive reports and use of key insights on airdrops, NFTs, and much more! Subscribe how to Alpha Reports or more your game!

Sentiment among investment capital investors for crypto this season is constantly on the improve, having a potential resurgence forecast for that coming several weeks.

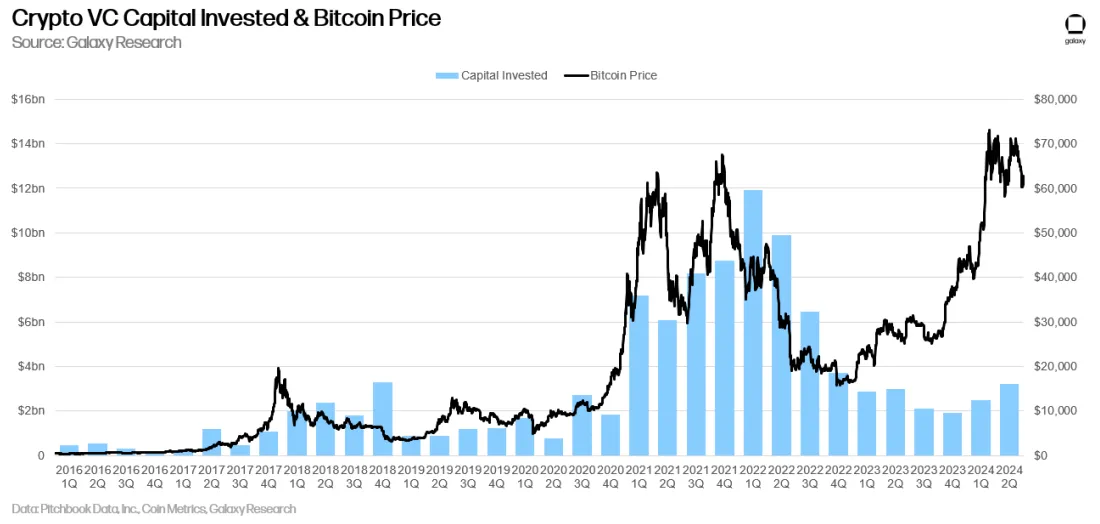

That’s despite a continuing breakdown within the relationship between Bitcoin’s cost and capital committed to crypto startups for Q2, 2024, Universe Digital stated in the latest analysis on Tuesday.

Compiling data from Pitchbook on Monday, Universe required stock of deals conducted within the last three several weeks, which found quarter-over-quarter capital investment rose by 28% to $3.19 billion.

As the total deal count came by roughly 4% in the previous quarter, median valuations of startups before they received new funding surged to close all-time highs, rising from $19 million to $37 million.

Even still, investment capital activity has battled to maintain the increasing cost from the world’s largest crypto. Throughout the previous 2021-2022 bull market, capital invested across early and late-stage startups was at $12 billion, a period when Bitcoin’s cost was hovering near $60,000.

Which has since dropped to simply $3.75 billion, remaining far below levels when compared with bygone years, the study found. Universe suggests several crypto-native catalysts and macroeconomic headwinds for that gap between cost and capital invested.

Individuals range from the launch of Bitcoin exchange-traded funds within the U.S. and greater rates of interest, making borrowing capital for brand new projects more pricey. Emerging sectors, including restaking, blockchain modularity, and Bitcoin layer-2s, also have led to the divergence.

Despite attracting less investment finance than throughout the previous Bitcoin peak, the crypto market rebound from late 2023 is driving competition and investors’ anxiety about really missing out, Universe stated.

“Allocators might be getting ready to return in serious because of the resurgence of liquid crypto,” Alex Thorn, Galaxy’s mind of firmwide research and research analyst Gabe Parker, authored Tuesday.

That’s great news for startups hungry for further funding as interest can lead to elevated investment capital activity within the later stages of 2024, the happy couple authored. That may put this season on the right track to becoming the 3rd-greatest investment finance and deal count behind 2021 and 2022.

As the U.S. is constantly on the lead in deals and capital among startups, regulatory headwinds by means of opaque laws and regulations and hostile regulators could pressure companies to maneuver abroad, Universe stated.

“Policymakers should take heed to how their actions or inactions could change up the cryptocurrency and blockchain ecosystem when the U.S. would be to remain the middle of technological and financial innovation within the lengthy-term,” Thorn and Parker authored.

Daily Debrief E-newsletter

Start every single day using the top news tales at this time, plus original features, a podcast, videos and much more.