We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

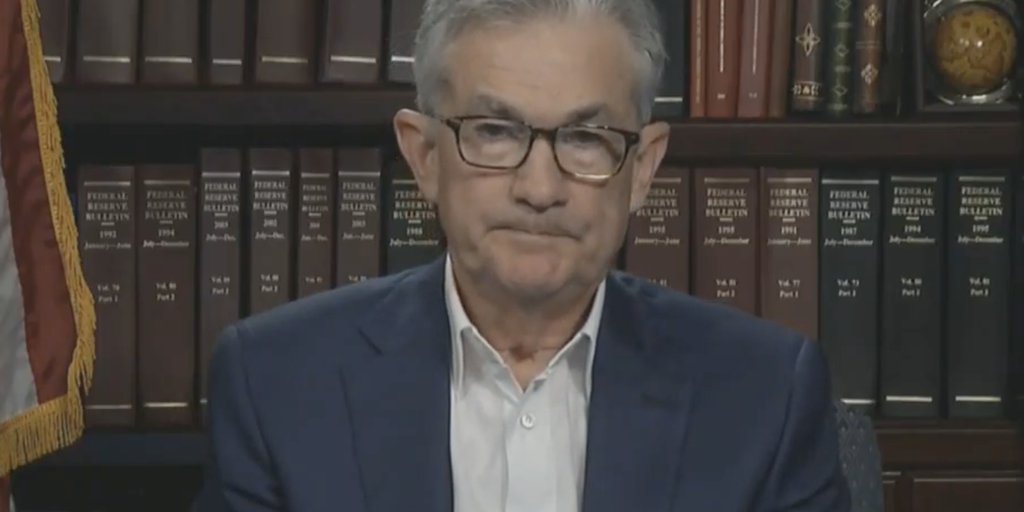

Federal Reserve Chair Jerome Powell is set to testify before Congress later today. His words will likely carry significant weight for Bitcoin and the broader cryptocurrency market.

Powell’s appearances before the Senate Banking Committee on Tuesday and the House Finance Committee on Wednesday come at a time when the relationship between monetary policy and digital assets is under increasing scrutiny.

Last month, Powell made headlines in the crypto world when he acknowledged the staying power of cryptocurrencies.

“We do see payments stablecoins as a form of money,” Powell said at the time, indicating a potential shift in the Fed’s stance on digital assets.

This recognition from one of the world’s most influential financial figures has not gone unnoticed by crypto enthusiasts and investors.

As Powell delivers the Fed’s semiannual report on monetary policy, crypto investors will be listening closely for any hints about future interest rate decisions.

The Fed’s recent report emphasized caution, stating, “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

This cautious approach to monetary policy has direct implications for Bitcoin.

In recent years, Bitcoin has become increasingly correlated with macroeconomic factors, behaving more like a risk asset sensitive to monetary policy changes.

Any indication of potential interest rate cuts could spark a rally in Bitcoin prices, as lower rates typically encourage investment in higher-risk assets.

Valentin Fournier, an analyst at BRN, told Decrypt that the Fear and Greed Index stands at 28, indicating that many investors fear the end of the bull run.

However, Fournier also sees a potential buying opportunity.

“Buying when other investors are fearful often generates higher yields, especially during times when most news is positive for cryptocurrencies and other risky assets,” Fournier wrote. “We believe that the bottom is either behind us or very close and recommend progressively increasing exposure as Bitcoin gains momentum.”

The growing connection between Bitcoin and traditional financial markets is evident in how it responds to macroeconomic news.

An interest rate cut, for instance, could potentially trigger a significant uptick in Bitcoin prices.

This is because lower interest rates often lead to increased liquidity in financial markets, prompting investors to seek alternative assets like Bitcoin as a hedge against potential currency depreciation or as a higher-risk, higher-reward opportunity.

As Powell testifies this week, crypto market will be analyzing his words for any indications of future monetary policy decisions.

While the Fed maintains a cautious stance, even subtle shifts in Powell’s tone could have far-reaching implications for Bitcoin and the broader cryptocurrency market.

The upcoming release of the Bureau of Labor Statistics’ Consumer Price Index report, coupled with Powell’s testimony, makes this a crucial week for crypto investors.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.