We research, you receive the alpha!

Get exclusive reports and use of key insights on airdrops, NFTs, and much more! Subscribe how to Alpha Reports or more your game!

The Bitcoin Halving is simply days away! Count lower with Decrypt.

Bitcoin, the earth’s most prominent cryptocurrency, has received significant attention because of its extreme cost volatility, presenting both substantial risks and potential rewards for investors. But a couple of things know in the realm of crypto: Halvings are bullish, and crypto winters follow halvings.

To higher understand these terms, within the Bitcoin ecosystem the “halving,” is really a pre-programmed occurrence that cuts down on the rate where new bitcoins are produced or found by half. The wedding has in the past been considered bullish for lengthy-term holders, with 3,230% gains within twelve months after each halving based on Coingecko (yay). But soon after this spike, Bitcoin’s cost usually notice a significant downward correction, plunging into what’s frequently known as crypto winter since it’s cost drops by greater than 80% typically (ouch).

The Bitcoin network undergoes this halving event—a mechanism to manage its inflation rate and keep its scarcity over time—approximately every 4 years. The newest halving happened on May 11, 2020, lowering the block reward for Bitcoin miners from 12.five to six.25 BTC. The following halving will drop the mining reward to three.123 BTC.

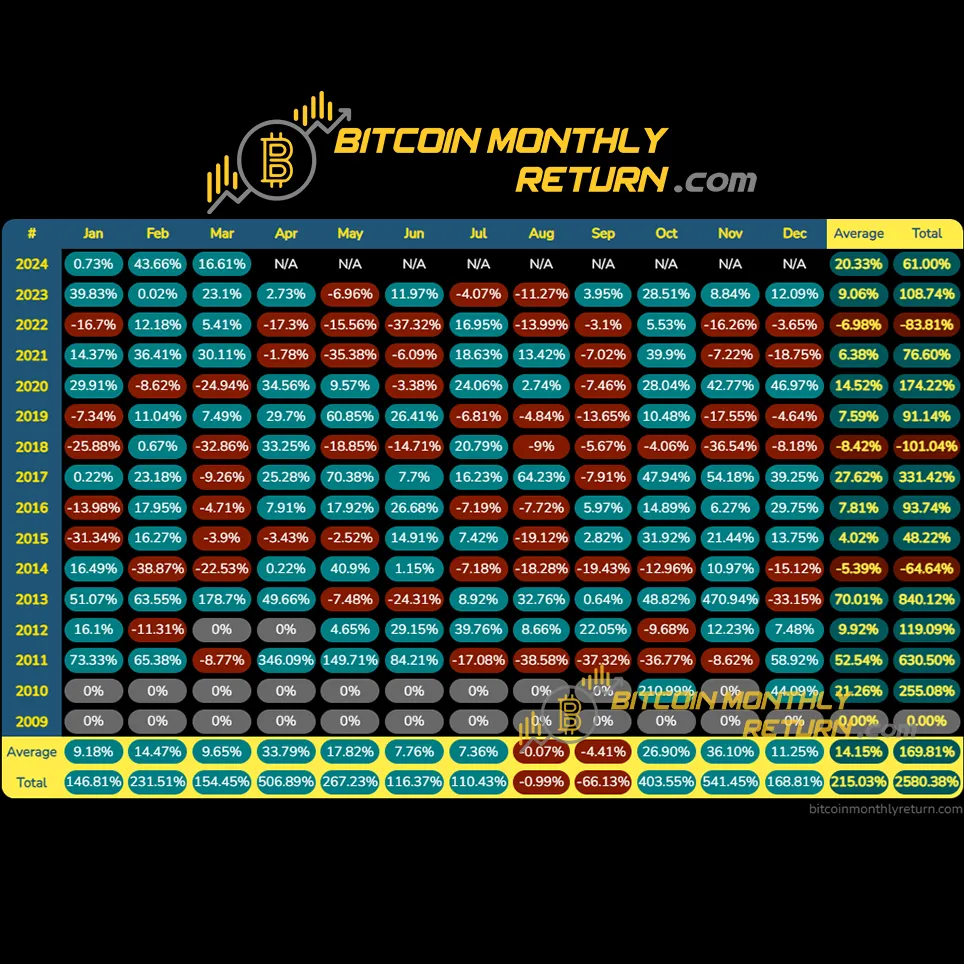

Generally, the halving hype has a tendency to continue for about twelve months, adopted with a major correction the next year. The very first halving happened on November 28, 2012, by November 2013, Bitcoin possessed a significant decline, plummeting from $1,130 to $170 inside the same year—a staggering 85% drop. The 2nd halving in This summer 2016 exhibited an identical trajectory, with Bitcoin reaching $20,000 in November 2017 before crashing to $3,191 within the following months—an 84% decline. Most lately, the 3rd halving in May 2020 propelled Bitcoin for an all-time a lot of $68,789 in November 2021, however it subsequently stepped to $15,600 by June 2022—a 77% correction.

How come Bitcoin crash following the halving?

Some occasions have affected Bitcoin’s cost performance in a fundamental level, such as the launching of Bitcoin futures contracts, China’s attack around the crypto industry, or perhaps Tesla’s tweets about ditching Bitcoin. But unlike these one-off occasions, the Bitcoin halving is really a regularly scheduled occurance.

One potential cause of the publish-halving crashes is profit-taking by investors who’ve held their positions to have an longer timeframe, frequently motivated through the “The month of january Effect.”

Investors think that stock values have a tendency to increase in the very first month of the season because of elevated buying activity after cost drops in December. This really is frequently related to tax-loss harvesting, where investors sell losing stocks in December to offset capital gains tax obligations after which repurchase them in The month of january, driving up demand and costs.

It’s possible that investors consider rebalancing their portfolios by selling dangerous assets like Bitcoin in December and reinvesting in stocks in The month of january, that is typically a bullish month for equities.

Another critical factor may be the “mining capitulation” phenomenon.

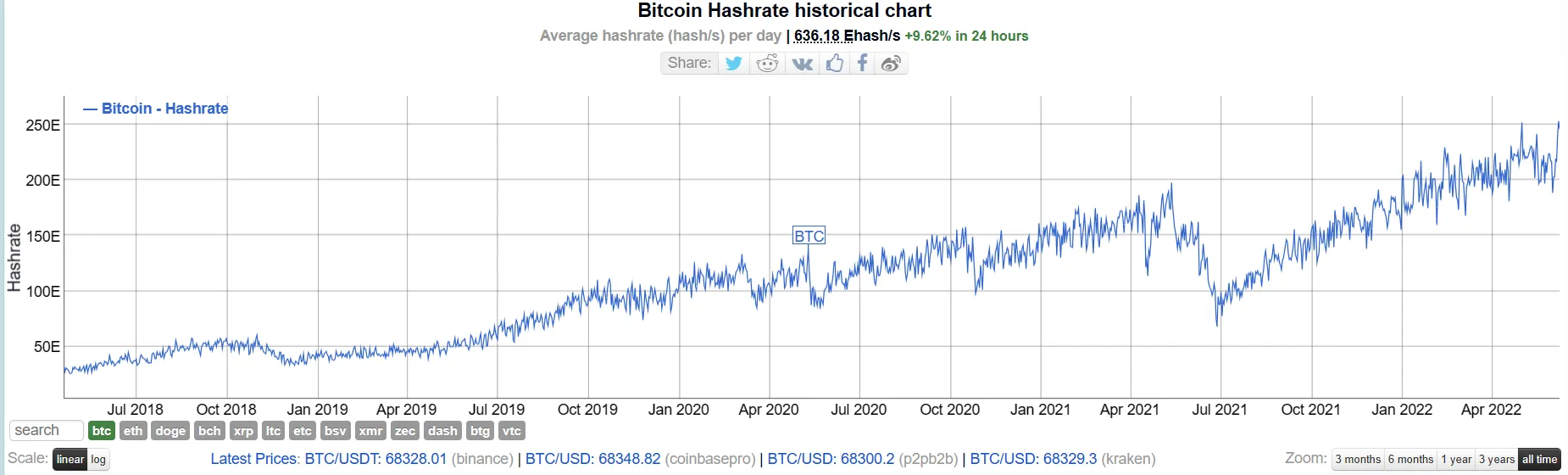

Throughout their lucrative season, miners accumulate Bitcoin while increasing the network’s hashrate. However, a place comes when miners have to sell their holdings to upgrade or purchase more equipment and turn into competitive or even more lucrative because the network grows more powerful. While not always coinciding with cost performance, this selling pressure—coupled along with other bearish market sentiments—can trigger a snowball effect that can result in mining capitulation along with a subsequent cost crash. When this happens, miners sell their reserves and equipment to not remain competitive, but to stay operational.

Based on data from Bitinfocharts, the Bitcoin hashrate dropped over the past two halvings.

Despite these cyclical corrections, Bitcoin has consistently shown its resilience and skill to recuperate from significant drawdowns.

How can Bitcoin traders cope?

As MicroStrategy founder and chairman Michael Saylor, most likely probably the most prominent Bitcoiner throughout Wall Street, mentioned within an interview with Emily Chang on Bloomberg’s Studio 1. in 2022, “If you are going to purchase Bitcoin, a short while horizon is 4 years, a [medium] time horizon is 10 years. The best time horizon is forever.” Saylor maintains that Bitcoin is a great investment for individuals prepared to hold not less than one halving to another.

“Should you look during the period of 4 years, nobody has ever lost money holding Bitcoin for 4 years,” he stated.

Similarly, Bitcoin’s ultra-bullish periods adopted by major crashes and subsequent bullish periods suggest that it’s not really a speculative bubble. Rather, it is a volatile asset class progressively finding mainstream acceptance. Quite simply, these major corrections are relatively healthy for Bitcoin because they balance the atmosphere among investors and steer clear of bubble-like scenarios that crash the costs to utter uselessness.

Now, you are able to the finish of the season following each halving has in the past marked the start of a crypto winter, but searching in a shorter time period, September is an especially bearish month for Bitcoin.

This poor performance in September coincides concentrating on the same downturns in the stock exchange, using the S&P 500 experiencing a typical decline of .7% in September during the last 25 years—well before Bitcoin even existed. The “September effect” is related to investors exiting market positions after coming back from summer time vacations to secure gains or tax losses in front of the year’s finish.

So, for which it’s worth, investors might want to avoid buying BTC in September or around Christmas exactly the same year like a halving.

Because the 4th Bitcoin halving approaches, using the cost getting lately reclaimed $71,000, investors and enthusiasts eagerly anticipate the potential implications. History suggests a publish-halving correction might be coming the coming year, however the conditions today vary from the occasions that affected Bitcoin being an asset previously. Rules are clearer, Wall Street has put vast amounts of dollars into Bitcoin ETFs, countries have committed to the gold coin, and also the network is more powerful than ever before.

Wall Street traders have a tendency to state that time on the market beats timing the marketplace. As well as the Bitcoin community, HODL is a means of existence. Deciding when you should buy depends upon you, but whatever decision you are taking, be quick: The halving is simply two days away.

Edited by Stacy Elliott.