The entire crypto market capital continues to be holding a rather climbing trend within the last 3 several weeks and also the $1.75 trillion support was most lately tested on April 27 as Bitcoin (BTC) bounced at $38,000 and Ether (ETH) at $2,800 on April 27.

The crypto market’s aggregate capital demonstrated a 3.5% decrease within the last seven days and notable losers were a 18.8% loss from XRP, a ten.2% loss from Cardano (ADA), and 9.7% stop by Polkadot (Us dot) cost.

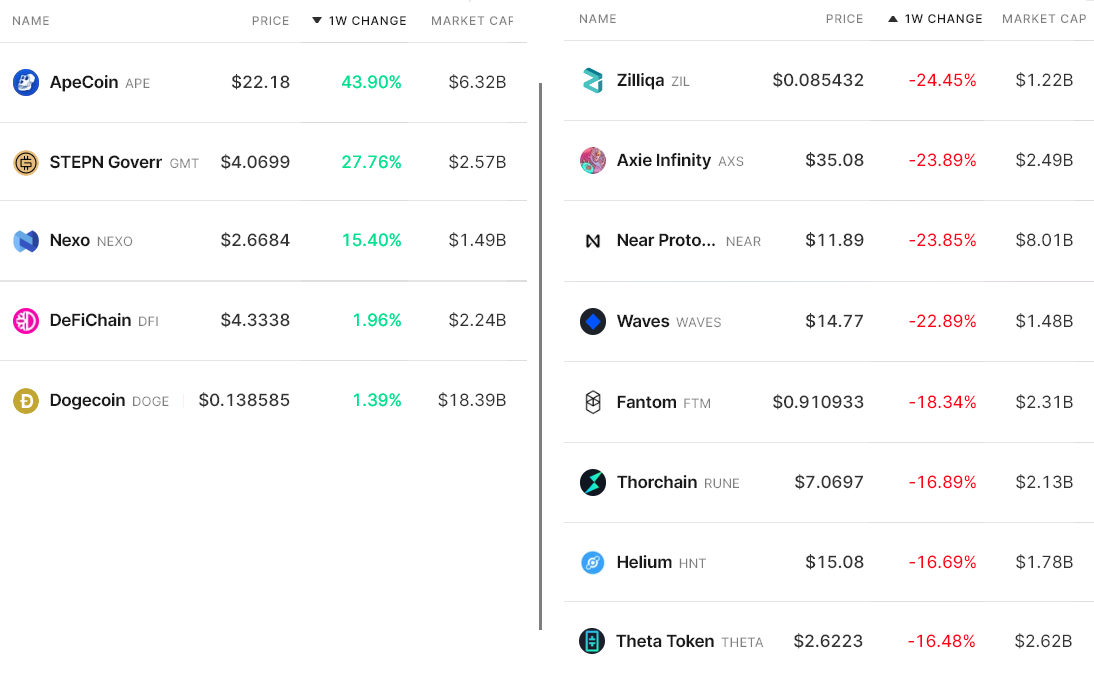

Analyzing a wider selection of altcoins supplies a more balanced picture, which includes 25% gains from some gaming and Metaverse projects in the same time frame period.

Apecoin (APE) rallied 44% because of the approaching Otherside metaverse land auction scheduled for April 30. The Otherside has been produced by Yuga Labs, Animoca Brands and also the Bored Ape Yacht Club NFT team and NFT investors have high expectations for that project.

The native tokens of move-to-earn lifestyle application STEPN (GMT) rallied 28% following the U.S.-based crypto exchange Coinbase announced intends to list the token.

Nexo acquired 15% after crypto and derivatives exchange Binance announced its listing on April 29 and Nexo also revealed intends to issue a charge card that accepts crypto as collateral instead of selling the holders’ assets.

Zilliqa (ZIL) cost continues to be modifying following the token pumped 380% at the end of March which follows the project’s March 25 announcement of the metaverse service which will utilize Nvidia technology.

Meanwhile, data from DappRadar implies that play-to-earn unicorn, Axie Infinity (AXS) stepped to the cheapest level in 9 several weeks after the amount of users and transactions declined by 15% during the last 30.

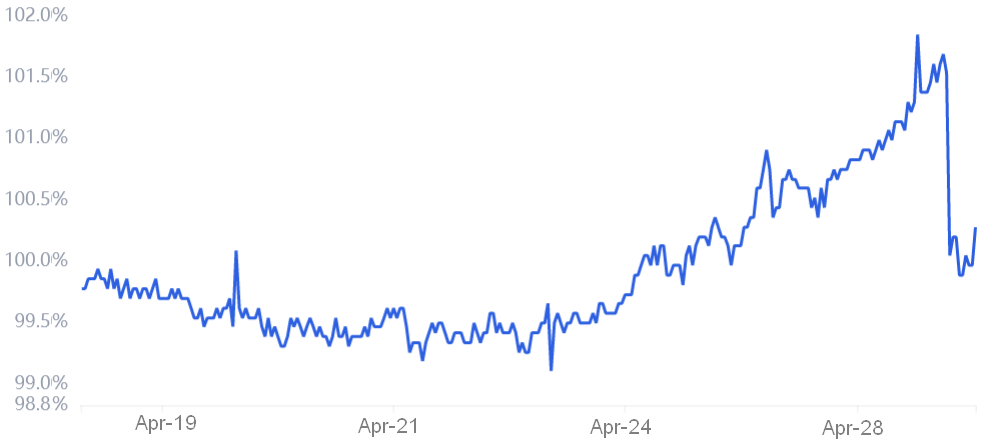

The Tether premium shows insufficient demand from buyers

The OKX Tether (USDT) premium gauges China-based retail demand also it measures the main difference between your China-based peer-to-peer trades and also the U . s . States dollar.

Excessive buying demand puts the indicator above fair value at 100%. However, Tether’s market offers are flooded during bearish markets, creating a 4% or greater discount.

The OKX Tether premium peaked at 2% on April 28, its greatest level in 2022. The movement coincided with Bitcoin breaking above $40,000, nevertheless its cost reverted later on that day. Presently, the Tether premium is %, signaling an unbiased sentiment from retail traders.

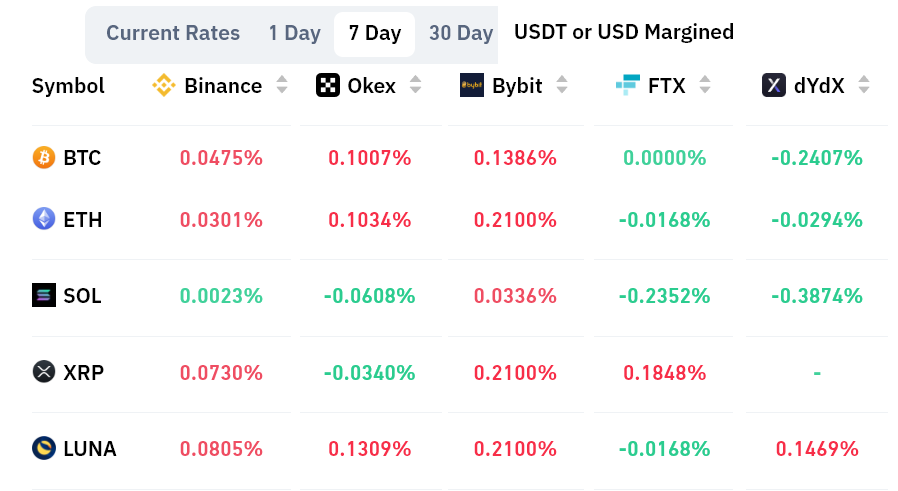

Futures markets show mixed sentiment

Perpetual contracts, also referred to as inverse swaps, come with an embedded rate that’s usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

As proven above, the accrued seven-day funding rates are slightly positive for Bitcoin and Ether. Data signifies slightly greater demand from longs (buyers), but nothing that will pressure traders to shut their positions. For example, Luna’s positive .15% weekly rate equals .6% monthly, that ought to not concern most futures traders.

The lack of the Tether premium in Asia and also the flattish perpetual contract premiums signal too little demand from retail traders right because the total crypto market capital struggles to sustain the $1.75 trillion support.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.