Cryptocurrencies have unsuccessful to interrupt the $1.1 trillion market capital resistance, that has been holding strong within the last 54 days. The 2 leading coins held back the marketplace as Bitcoin (BTC) lost 2.5% and Ether (ETH) retraced 1% in the last 7 days, but a number of altcoins presented a strong rally.

Crypto markets’ aggregate capital declined 1% to $1.07 trillion between This summer 29 and August. 5. The marketplace was negatively impacted by reports on August. 4 the U.S. Registration (SEC) is investigating every U.S. crypto exchange following the regulator billed an old Coinbase worker with insider buying and selling.

As the two leading cryptoassets were not able to print weekly gains, traders’ appetite for altcoins wasn’t affected. Investors were positively influenced by the Coinbase exchange partnership with BlackRock, the world’s largest financial asset manager, accountable for $10 trillion price of investments.

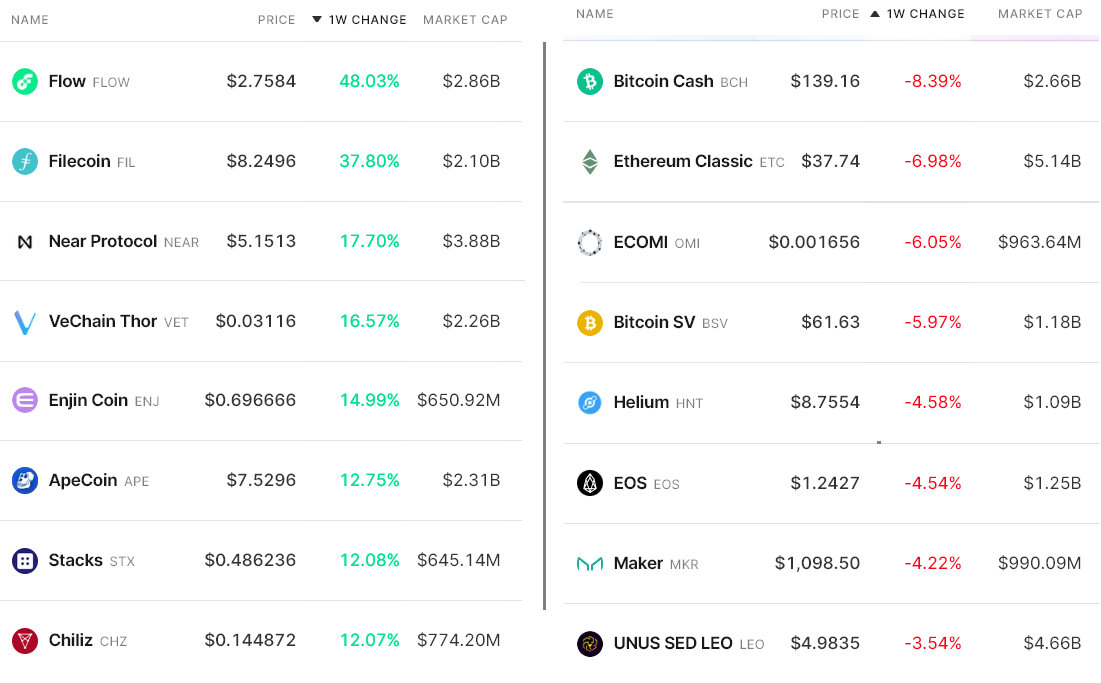

Coinbase Prime, the service provided to BlackRock’s clients, is definitely an institutional buying and selling solution that gives buying and selling, child custody, financing and staking on over 300 digital assets. Consequently, evaluating the winners and losers one of the top-80 coins provides skewed results, as 10 of individuals rallied 12% or even more in the last 7 days:

FLOW rallied 48% after Instagram announced support for that Flow blockchain via Dapper Wallet. The social networking controlled by Meta (formerly Facebook) is expanding nonfungible token integration.

Filecoin (FIL) acquired 38% following the v16 Skyr replace on August. 2, which hardened the protocol to prevent vulnerabilities.

VeChain (VET) acquired 16.5% after a little news sources incorrectly announced an Amazon . com Web Services (AWS) partnership. VeChain Foundation described the AWS reference was initially reported inside a May 9 situation study.

Tether premium deteriorated slightly

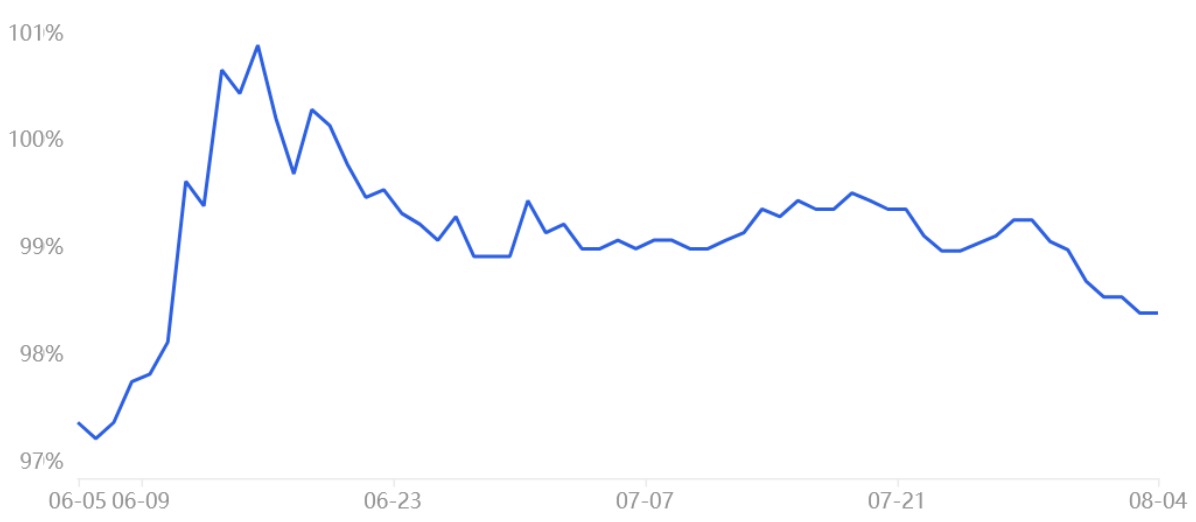

The OKX Tether (USDT) premium is a great gauge of China-based crypto retail trader demand. Its dimensions are the main difference between China-based peer-to-peer trades and also the U . s . States dollar.

Excessive buying demand has a tendency to pressure the indicator above fair value at 100%, and through bearish markets, Tether’s market offers are flooded, creating a 4% or greater discount.

Presently, the Tether premium is 98.4%, its cheapest level since June 10. While distant from retail panic selling, the indicator demonstrated a modest degeneration in the last week.

However, less strong retail demand isn’t worrisome, because it partly reflects the entire cryptocurrency capital being lower 69% year-to-date.

Futures markets show mixed sentiment

Perpetual contracts, also referred to as inverse swaps, come with an embedded rate usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

As portrayed above, the accrued seven-day funding rates are either slightly positive or neutral for that largest cryptocurrencies by open interest. Such data signifies a well-balanced demand between leverage longs (buyers) and shorts (sellers).

Thinking about the lack of Tether demand in Asia and mixed perpetual contract premiums, there’s too little confidence from traders because the total crypto capital struggles using the $1.1 trillion resistance. So, presently, bears appear to achieve the upper hands thinking about the uncertainties brought on by the SEC pressing charges against an old Coinbase manager.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.