Now, Bitcoin’s (BTC) cost required a tumble like a hotter-than-expected consumer cost index (CPI) report demonstrated high inflation remains a persistent challenge despite a wave of great interest rate hikes in the U . s . States Fed. Interestingly, the market’s negative response to a higher CPI print appeared priced in by investors, and BTC’s and Ether’s (ETH) prices reclaimed all their intraday losses to shut your day within the black.

A fast take a look at Bitcoin’s market structure implies that despite the publish-CPI print drop, the cost is constantly on the exchange exactly the same cost range it’s been in within the last 122 days. Contributing to this dynamic, Cointelegraph market analyst Ray Salmond reported on the unique situation where Bitcoin’s futures open interest rates are in a record high, while its volatility can also be near record lows.

These 4 elements, as well as other indicators, have in the past preceded explosive cost movements, but history may also reveal that predicting the direction of those moves is almost impossible.

So, apart from multiple metrics meaning that the decisive cost move is brewing, Bitcoin continues to be doing a lot of same factor it’s done within the last 4.5 several weeks. With this to be the situation, it’s possibly time for you to start searching elsewhere for emerging trends and possible possibilities.

Listed here are a couple of data points that I’ve ongoing to become intrigued by.

New rotations will emerge

ETH’s cost has lost its luster within the now publish-Merge era, and also the asset now reflects the bearish trend that dominates all of those other market. Because the Merge, ETH’s cost is lower 30% from the $2,000 high, and it’s likely a large amount of the speculative capital that backed the bullish Merge narrative has become in stablecoins searching for the following investment chance.

Apart from ETH becoming an asymmetrical artist within the last four several weeks, Cosmos (ATOM) also defied the marketplace downtrend by posting a monster rally from $5.40 to $16.85. As covered completely by Cointelegraph, oversold conditions, combined with the hype of Cosmos 2., backed the bullish cost action observed in the altcoin, however this chart is constantly on the capture my imagination.

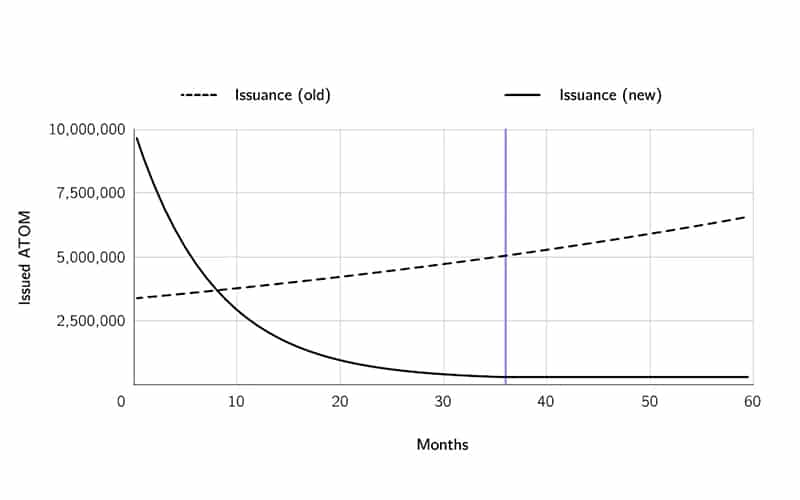

Based on the revised Cosmos white-colored paper, the present way to obtain ATOM will dynamically adjust in line with the demand and supply of their staking. As proven within the chart above, when Cosmos 2. “kicks in” for that first 10 several weeks, issuance of recent ATOM tokens is high, but following the 36th month, the asset becomes deflationary.

In the standpoint of technical analysis, ATOM’s cost seems to possess hit a nearby top because the several weeks prior to Cosmos 2. were a “buy the rumor, sell the news” kind of event, but it’ll be interesting to determine what occurs ATOM’s cost because the market approaches month 20 within the diagram above.

Related: Cost analysis 10/14: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

Keep close track of Ethereum Network activity

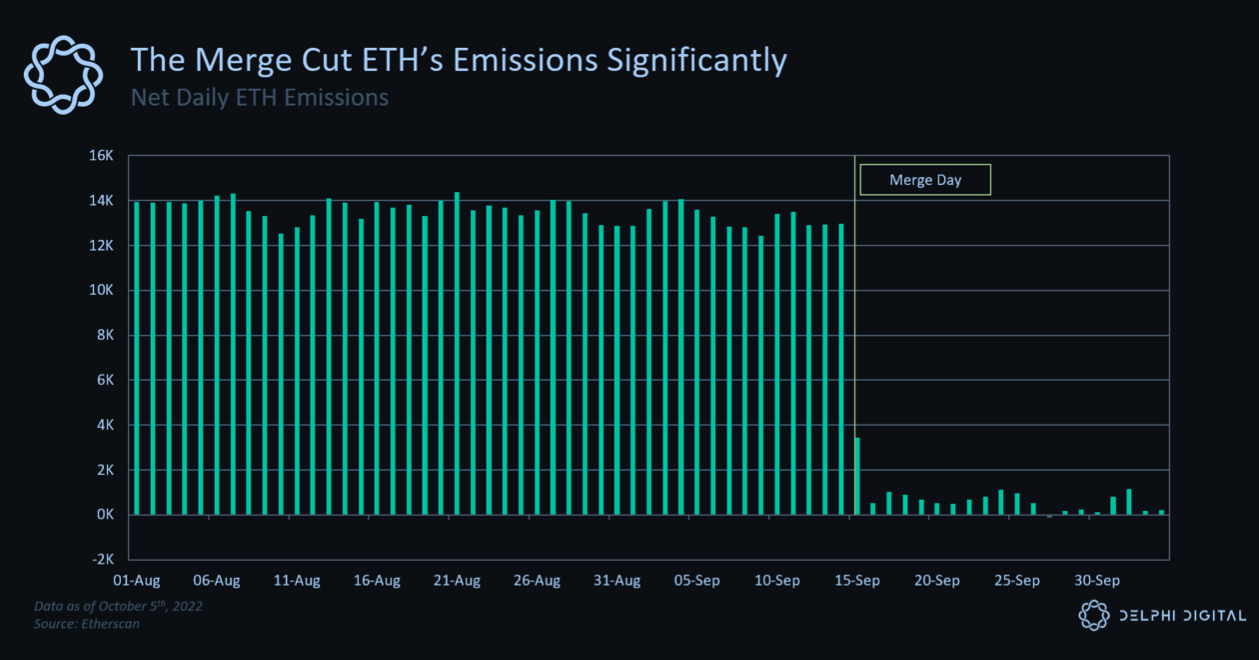

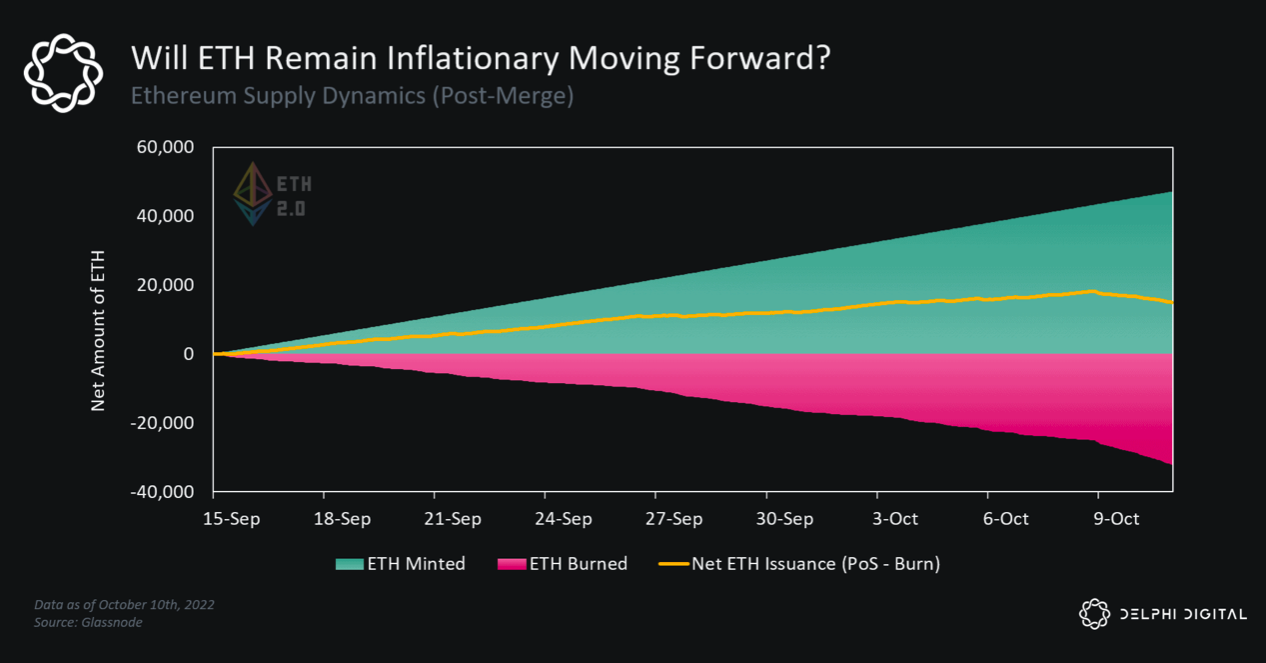

Because the Ethereum Merge, Ether emissions have came by 97%, even though the cost has retracted considerably, within the coming several weeks, investors might keep close track of Ethereum network activity, developments with ETH staking across decentralized finance (DeFi) and institutional products, together with any spikes in gas (linked to network activity).

As the cost could succumb to bearish pressure for the short term, when the market starts to change if new trends trigger elevated utilization of DeFi products, it’s entirely possible that ETH’s cost could react positively to individuals developments.

Publish-Merge, BTC cost action will probably remain king

While new trends across various altcoins may emerge, it’s remember this the broader context by which crypto assets exist. Global economies take presctiption the rocks, and persistently high inflation remains an trouble in the U . s . States and lots of other nations. Bond costs are whipsawing, along with a looming debt crisis makes its presence known every day. Risk-on assets like cryptocurrencies are really volatile, as well as the most powerful cost trends in crypto (whether supported by fundamentals or otherwise) are susceptible to the whimsy of macro factors for example equities markets, geopolitics along with other market occasions that impact investors’ sentiment.

Keeping this in your mind, Bitcoin continues to be the largest asset by market capital inside the crypto sector, and then any sharp moves from BTC’s cost will likely support or suppress the micro trends that could be gaining traction on the market. There’s still the potential of a clear, crisp downside in Bitcoin’s cost, so traders ought to calculate investment size according to their personal appetite for risk, even though multiple metrics might support opening lengthy positions in a variety of crypto assets, still it appears too soon to completely ape in.

This e-newsletter was compiled by Big Smokey, the writer from the Humble Pontificator Substack and resident e-newsletter author at Cointelegraph. Each Friday, Big Smokey will write market insights, trending how-tos, analyses and early-bird research on potential emerging trends inside the crypto market.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.