XRP (XRP) has made considerable gains in the last month as traders still shower confidence on Ripple’s potential legal win from the U . s . States Registration (SEC).

For example, the XRP cost acquired 25% four weeks after Ripple and also the SEC declared an instantaneous ruling on whether XRP sales violated U.S. securities laws and regulations. Compared, Bitcoin (BTC) and Ether (ETH) are lower 4% and 11% within the same period, correspondingly.

Now, a flurry of indicators, varying from on-chain to technical, hints XRP can continue its upward trend entering 2023.

XRP cost “bull pennant”

Bull pennants are bullish continuation patterns that form because the cost consolidates inside a triangular-like range following a strong upside move. Quite simply, they resolve following the cost breaks out in direction of its previous upward trend.

Around the daily chart, XRP continues to be trending in the similar technical structure since late September, as proven below. While in internet marketing, the token has additionally tried to break over the pennant two times, although to no success. It now eyes another breakout within the future.

Theoretically, a bull pennant breakout boosts the cost up to how big the prior upward trend. Therefore, XRP’s bull pennant breakout can push the cost toward $.63 in Q4 2022.

That will mean a 35% cost rally.

Strong accumulation detected

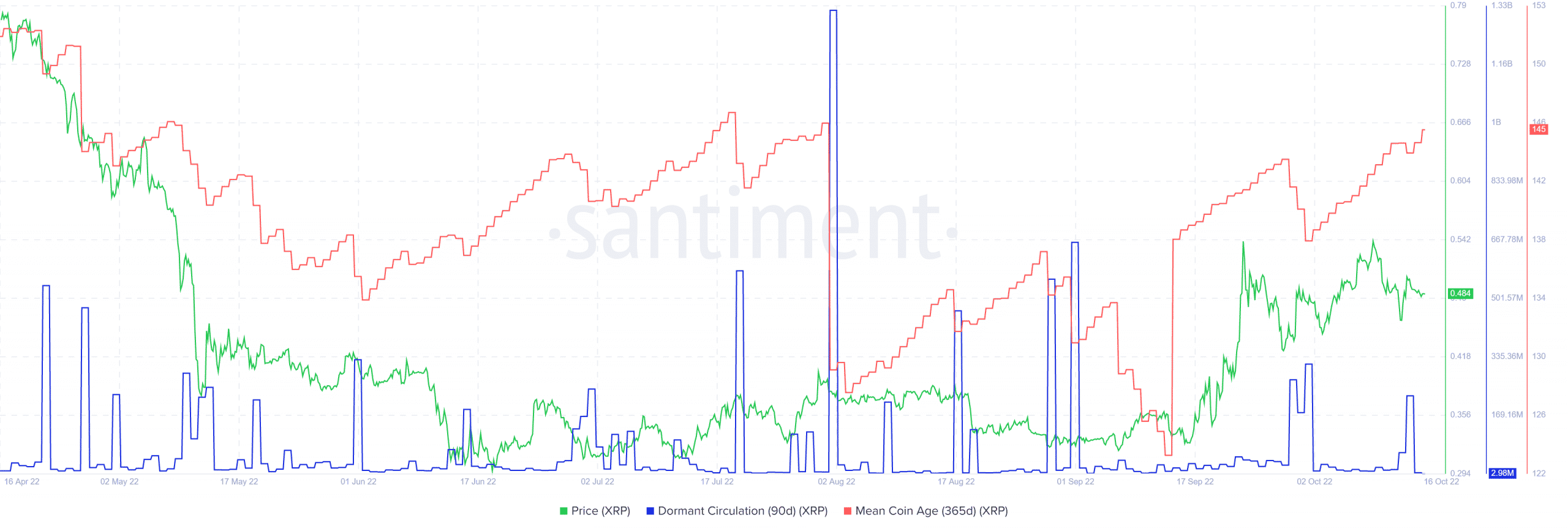

XRP’s bullish technical setup receives further cues from on-chain data, showing accumulation is going ahead.

Particularly, XRP’s mean gold coin age — the typical chronilogical age of all tokens around the blockchain measured through the purchase cost — continues to be rising since September, according to data from Santiment. The metric theoretically shows that XRP users happen to be more and more holding the tokens.

Additionally, data tracker Whale Alert detected huge amount of money price of XRP withdrawals across Bitstamp, Bitso along with other crypto exchanges, lowering the supply that may be potentially offered.

Particularly, investors have moved as many as $126 million price of XRP from exchanges to unknown wallets since March. 14. Compared, $78.99 million price of XRP was deposited in to these exchanges.

65,200,000 #XRP (31,260,398 USD) transferred from #Bitso to unknown wallethttps://t.co/uZcv8p7bcD

— Whale Alert (@whale_alert) October 13, 2022

A legitimate win for Ripple?

The main of bullishness for XRP in the last couple of several weeks is Ripple’s possibility to win from the SEC.

Certainly one of Ripple’s core arguments is really a speech by former SEC director William Hinman at the Yahoo Finance All Markets Summit in 2018. Hinman stated Ethereum wasn’t a burglar despite performing a preliminary gold coin offering (ICO) round to boost funds.

Related: Federal regulators are intending to pass judgment on Ethereum

Ripple’s defense would be that the SEC should treat XRP like Ether. And, many believe the argument guarantees victory for the organization. For instance, Seeking Alpha Contributor Digital Trend mentioned:

“The news the court has rejected SEC’s objection to disclosing more documents associated with Hinman’s 2018 speech brought to some boost in XRP cost on September 30 XRP rallied by 12% in twenty-four hrs […] These publish-hearing rallies could just be an idea of what’s in the future if XRP wins the situation.”

Ripple CEO Brad Garlinghouse anticipates the situation to summarize within the first 1 / 2 of 2023. However, he accepted the outcomes of the situation is difficult to calculate.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.