The S&P 500 and also the Nasdaq have declined for five consecutive days, indicating that traders still reduce contact with dangerous assets. Bitcoin’s (BTC) close correlation with U . s . States equity markets has led to its cost remaining pressurized.

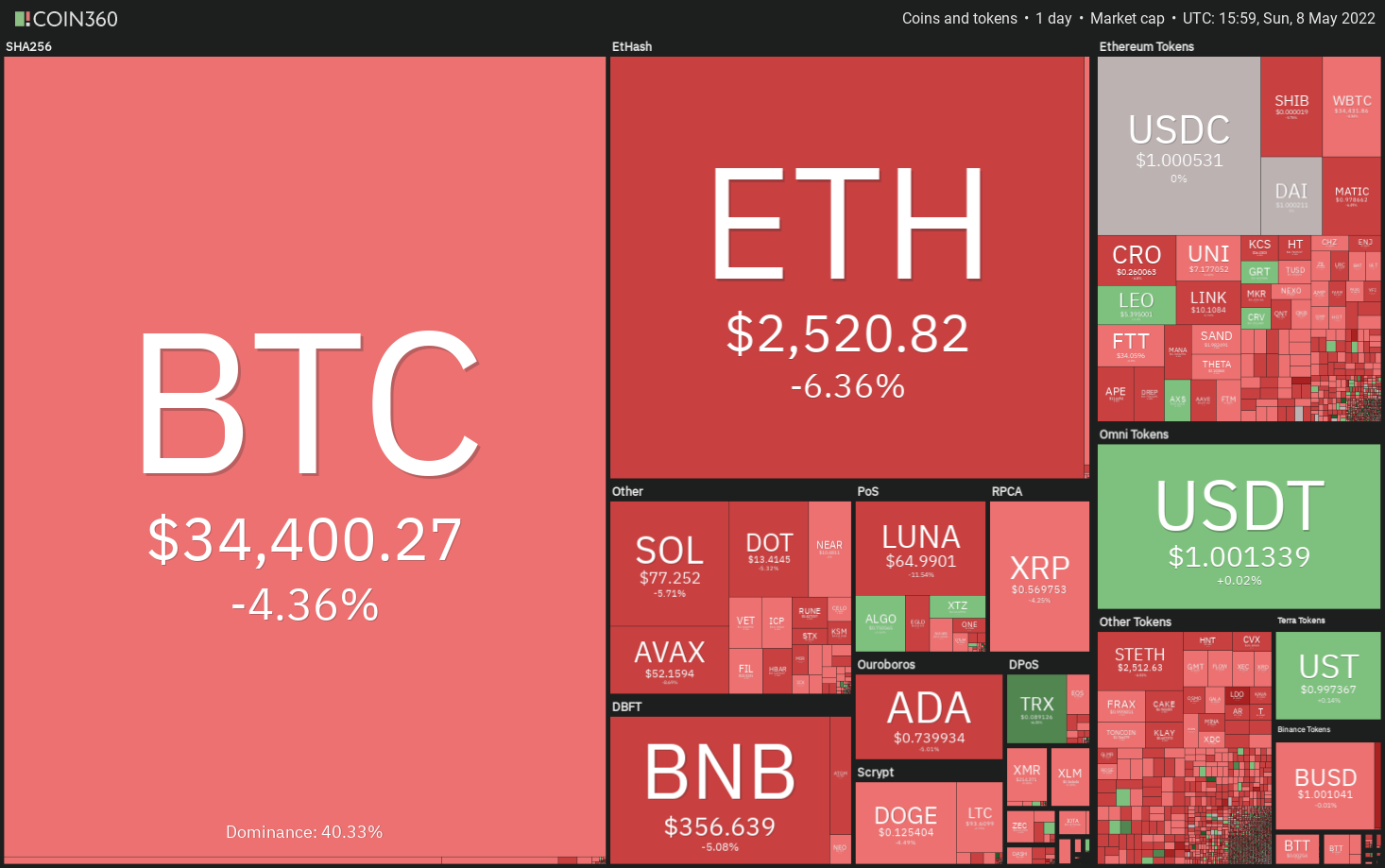

Bitcoin has extended its decline throughout the weekend and it is now on the right track because of its sixth successive weekly loss, the very first such occurrence since 2014. The weakness in Bitcoin has pulled lower the whole crypto markets, whose market capital has dipped below $1.6 trillion.

Once the sentiment is bearish, traders sell on every negative news. The de-peg of Terra’s U. S. dollar stablecoin TerraUSD (UST) also seems to become growing sell pressure over the crypto market.

After Bitcoin’s six consecutive weekly closes at a negative balance, are you ready for any recovery? Let’s read the charts from the top-5 cryptocurrencies which are showing indications of stabilizing soon.

BTC/USDT

Bitcoin switched lower in the 20-day exponential moving average (EMA) of $38,268 on May 5 and plummeted underneath the support type of the climbing funnel. This move also invalidated the positive divergence around the relative strength index (RSI).

The moving averages have began to show lower and also the RSI is nearing the oversold zone, signaling that bears have been in control.

The BTC/Tether (USDT) pair includes a minor support at $34,322 but when bulls neglect to defend this level, the decline could include $32,917. This can be a crucial level to keep close track of if it cracks, the happy couple could witness panic selling and subsequently stop might be $28,805.

When the cost appears from $34,322, the recovery could face selling close to the 20-day EMA. When the cost turns lower out of this level, it’ll claim that the sentiment remains negative and traders can sell on rallies. That may boost the prospects of the resumption from the downtrend.

This negative view could invalidate for the short term when the bulls push and sustain the cost over the 20-day EMA. In the event that happens, the happy couple could rise towards the 50-day simple moving average (SMA) of $41,466.

The downsloping moving averages indicate that bears have been in command however the oversold levels around the RSI claim that a relief rally or perhaps a consolidation can be done soon. When the recovery does not go above the 20-EMA, the bears may keep up with the selling pressure and also the pair could drop to $32,917.

On the other hand, a rest and shut over the 20-EMA could signal the beginning of a powerful relief rally. The happy couple could then rise towards the 50-SMA. The buyers will need to push and sustain the cost above $40,000 to signal the downtrend might be over.

ALGO/USDT

Algorand (ALGO) continues to be buying and selling in the climbing down funnel pattern within the last couple of days. The cost bounced from the support type of the funnel on May 1 and also the bulls have removed the hurdle in the 20-day EMA of $.69, indicating the selling pressure might be reducing.

If buyers sustain the cost over the 50-day SMA of $.76, the ALGO/USDT pair could rally towards the resistance type of the funnel. It is really an important level for that bulls to beat. When they manage to achieve that, it’ll suggest the beginning of a brand new up-move. The happy couple could first rise to $1.10 and then to $1.25.

However, when the cost turns lower in the resistance line, it’ll claim that the happy couple may extend its stay within the funnel for any couple of more days. The bears will need to sink and sustain the cost underneath the funnel to point the resumption from the downtrend.

The 20-EMA has switched up and also the RSI is incorporated in the positive territory, indicating benefit to buyers. There’s a small resistance at $.80 and when bulls obvious this hurdle, the happy couple could rise towards the resistance type of the funnel.

Around the downside, the 20-EMA may be the critical level to keep close track of. When the cost rebounds off this level, it’ll claim that the sentiment has switched in support of buyers. That may increase the probability of a rest above $.80. Alternatively, when the cost slips underneath the 20-EMA, the following stop may be the 50-SMA.

XMR/USDT

Monero (XMR) continues to be finding support near mental support at $200 within the last couple of days. The buyers haven’t permitted the cost to interrupt underneath the downtrend line, suggesting that they’re trying to switch the amount into support.

The bulls will need to push and sustain the cost over the 20-day EMA of $223 to point out the corrective phase might be over. There’s a small resistance at $240 but when bulls obvious this hurdle, the XMR/USDT pair could rally to $289.

On the other hand, when the cost turns lower in the current level or even the 20-day EMA, it’ll claim that the bears haven’t yet quit. That may increase the probability of a rest below $200. In the event that happens, the selling could intensify and also the pair may drop to $150.

The happy couple has created a symmetrical triangular pattern suggesting indecision one of the bulls and also the bears. If bulls drive the cost over the resistance type of the triangular, it’ll claim that the downtrend might be over. The happy couple could then rally towards the 200-SMA and then rise toward the pattern target at $252.

On the other hand, when the uncertainty from the triangular resolves towards the downside, it’ll claim that the triangular had acted like a continuation pattern. That may signal the resumption from the downward move. The pattern target on however $164.

Related: LUNA drops 20% per day as whale dumps Terra’s UST stablecoin — selloff risks ahead?

XTZ/USDT

Tezos (XTZ) broke underneath the lengthy-term upward trend line on April 29 and also the bears effectively defended the breakdown level on May 5. The bears attempted to begin the downtrend but they are battling to sustain the low levels.

If bulls push and sustain the cost over the upward trend line, it’ll claim that the markets have rejected the breakdown. The XTZ/USDT pair will then chance a rally towards the overhead zone between your 50-day SMA of $3.18 and $3.40.

This positive view could invalidate when the cost once more turns lower in the upward trend line. In the event that happens, it’ll claim that bears have flipped the upward trend line into resistance. A rest and shut below $2.39 could begin a new downtrend that could achieve $2.00.

The 20-EMA has flattened out and also the RSI has created a bullish divergence around the 4-hour chart suggesting the negative momentum is weakening. The happy couple could now chance a rally to $2.90 in which the bears offer a powerful resistance. A rest and shut above this level could open the doorways for any possible up-proceed to $3.00 and then to $3.30.

Alternatively, when the cost turns lower in the current level or even the overhead resistance, it’ll claim that bears can sell on rallies. That may keep your pair range-bound between $2.90 and $2.39. The downtrend could accelerate if bears sink the cost below $2.39.

THETA/USDT

Theta Network (THETA) have been buying and selling between $2.27 and $4.40 within the last several days. This range resolved towards the downside on May 6, indicating that bears had top of the hands.

Even though the 20-day EMA of $2.57 is sloping lower, the RSI is trying to form a bullish divergence, indicating the selling momentum is weakening. If bulls push the cost back over the breakdown degree of $2.27, it might trap several aggressive bears and also require initiated short positions around the break underneath the range.

The THETA/USDT pair could then rise towards the 20-day EMA. It is really an important level to keep close track of if bulls overcome this barrier, the happy couple could rally towards the 50-day SMA of $3.10.

This positive view could invalidate when the cost turns lower in the current level or even the breakdown level at $2.27 and plummets below $2.00.

The bulls are purchasing the dips near to the mental level at $2.00. If buyers drive the cost over the downtrend line, it’ll claim that the bears might be losing their grip. The happy couple could then rally towards the overhead resistance at $2.64. This level may again behave as a powerful resistance but when buyers obvious this hurdle, the bullish momentum may get.

Unlike this assumption, when the cost turns lower in the 20-EMA or even the downtrend line, it’ll claim that bears still sell on rallies. That may increase the potential of a rest below $2.00 and also the resumption from the downtrend.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.