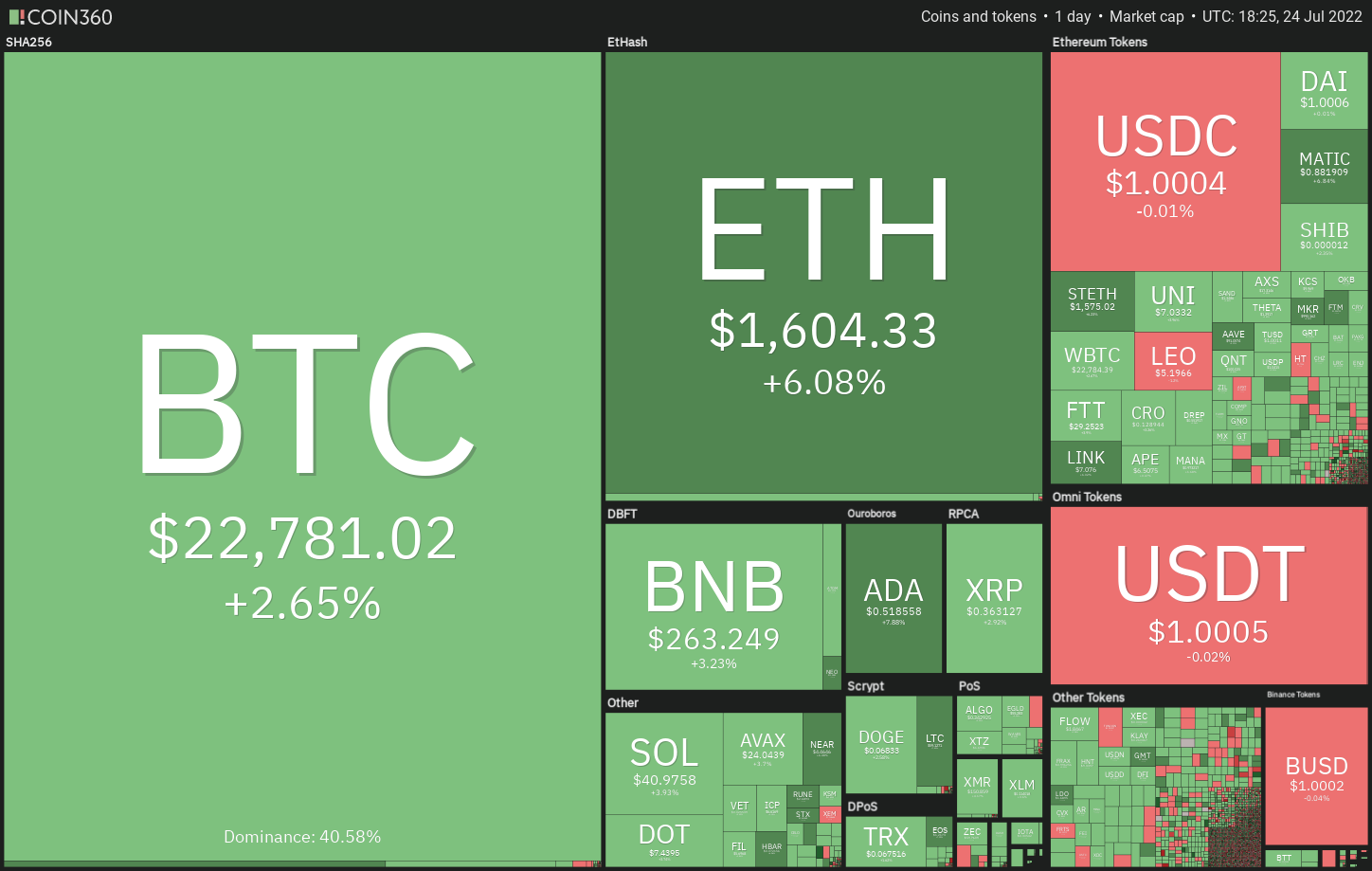

The bulls are trying to acquire a strong weekly close for Bitcoin (BTC), as the bears are trying to get back their advantage. Analysts are carefully watching the 200-week moving average, that is at $22,705, and BTC’s current setup shows that a decisive move is imminent.

Many analysts expect an every week close over the 200-week moving average (MA) to draw in further buying, however a break below it might signal that bears are during the game. Even though the short-term picture looks uncertain, analyst Caleb Franzen stated that Bitcoin has been around a build up zone since May.

Meanwhile, on-chain analytics firm CryptoQuant highlighted growing outflows of Ether (ETH) from major exchanges, totaling $1.87 million coins on This summer 22. Usually, outflows from crypto exchanges claim that traders are bullish for that lengthy-term, hence they might be moving their coins to more powerful crypto wallets for safety.

Could Bitcoin resume its recovery, attracting buying in select altcoins? Let’s read the charts from the top-5 cryptocurrencies that appear to be strong around the charts.

BTC/USDT

The bears attempted to sink Bitcoin into the symmetrical triangular on This summer 23, however the bulls had other plans. The rebound from the breakout level in the triangular signifies that buyers are protecting the amount strongly.

The progressively rising 20-day exponential moving average (EMA) of $21,865 and also the relative strength index (RSI) within the positive territory indicate a benefit to buyers.

If bulls sustain the cost over the 50-day simple moving average of $22,384, the BTC/Tether (USDT) pair could rally towards the overhead resistance zone between $23,363 and $24,276. A rest and shut above this level could open the gates for any rally towards the pattern target at $28,171 after which to $30,000.

On the other hand, when the cost slips underneath the 20-day EMA, the happy couple could decline to another support at $20,500.

The happy couple has created a falling wedge pattern around the 4-hour chart. If buyers drive the cost over the wedge, the happy couple could retest $24,276. A rest and shut above this level could signal the resumption from the upward trend.

The 20-EMA is flat and also the RSI is close to the midpoint, indicating an account balance between demand and supply. When the cost turns lower and breaks underneath the 50-SMA, the happy couple could drop towards the support type of the wedge.

ETH/USDT

Ether is facing stiff resistance at $1,700 however a positive sign is the fact that buyers haven’t quit much ground. A good consolidation close to the overhead resistance increases the probability of a rest above it.

The upsloping 20-day EMA of $1,384 and also the RSI within the positive territory indicate that bulls possess the upper hands. If buyers drive the cost above $1,700, the bullish momentum could get, and also the ETH/USDT pair could rise to $2,000, adopted with a rally to $2,200.

Unlike this assumption, when the cost turns lower from $1,700, the bears will attempt to drag the happy couple underneath the 20-day EMA. When they succeed, the happy couple could drop to $1,280. A bounce off this level can keep the happy couple stuck between $1,280 and $1,700 for any couple of days.

The happy couple bounced from the 50-SMA, indicating that bulls are purchasing on dips. The buyers will endeavour to push the cost towards the overhead resistance at $1,700. Both moving averages are sloping up and also the RSI is incorporated in the positive territory, suggesting the road to least resistance would be to the upside.

If bulls push the cost over the $1,650 to $1,700 resistance zone, the momentum could get and also the pair could resume its upward trend. To invalidate this positive view, the bears will need to sink the happy couple below $1,450.

BCH/USDT

Bitcoin Cash (BCH) is trying to form a bottom after a long downtrend. The cost switched lower in the $135 overhead resistance on This summer 20, however a positive sign would be that the bulls defended the 20-day EMA of $117 strongly.

The cost action of history couple of days has created a rounding bottom pattern, that will complete away and shut above $135. In the event that happens, it’ll claim that the BCH/USDT pair might have bottomed out at $95. The happy couple could then rise towards the pattern target at $175 and then to $200.

Another possibility would be that the pair may consolidate between your 20-day EMA and $135 for a while. A rest underneath the 20-day EMA could tilt the benefit in support of the bears.

The bulls have pressed the cost over the resistance line around the 4-hour chart, opening the doorways for any possible retest of $135. The upsloping moving averages and also the RSI within the positive territory indicate the road to least resistance would be to the upside. If buyers drive the cost above $135, the happy couple could get momentum and rally toward $157.

Unlike this assumption, when the cost slips underneath the 20-EMA, the happy couple could drop towards the 50-SMA and then to $117. A rest below this level could tilt the benefit in support of the bears.

Related: Axie Infinity is painting a huge bearish pattern — will AXS cost crash another 95%?

AXS/USDT

Axie Infinity (AXS) continues to be consolidating inside a downtrend. This means the bulls are trying to form a bottom.

The 20-day EMA of $15.55 has flattened out and also the RSI is incorporated in the positive zone, indicating an account balance between demand and supply. This balance could tilt in support of the buyers when they propel the cost over the overhead resistance at $18.53. In the event that happens, the AXS/USDT pair could begin a rally toward $25.21 after which to $28.20.

Alternatively, when the cost turns lower from $18.53 and breaks underneath the moving averages, it’ll indicate the pair may take the additional time within the range. The bears will need to sink the cost below $11.85 to achieve top of the hands.

Some-hour chart implies that the cost switched lower dramatically in the overhead resistance at $18.53, indicating aggressive selling through the bears. The sellers will attempt to pull the happy couple towards the 20-EMA. When the cost rebounds off this level, the buyers will again make an effort to obvious the overhead resistance. When they manage to achieve that, it’ll indicate the beginning of a brand new up-move.

On the other hand, when the cost breaks underneath the 20-EMA, the happy couple could slide towards the 50-SMA. It is really an important level to keep close track of if it cracks, the bullish momentum may weaken.

EOS/USDT

EOS (EOS) broke over the moving averages on This summer 18 and completed a effective retest from the 20-day EMA of $1.05 on This summer 21.

The moving averages have finished a bullish crossover and also the RSI is close to the overbought territory, indicating that bulls possess the upper hands. The cost could rise to $1.46 in which the bears may mount a powerful defense.

When the EOS/USDT pair doesn’t quit much ground from $1.46, it’ll claim that traders aren’t dumping their positions. That may enhance the prospects of the rally above $1.46. This type of move will advise a potential alternation in trend.

This positive view could invalidate when the cost turns lower in the current level and breaks underneath the moving averages.

Both moving averages are sloping on some-hour chart and also the RSI is close to the overbought zone, indicating the pair is within an upward trend.

The happy couple is facing resistance near $1.26, however the buyers haven’t quit much ground. This means the bullish momentum remains strong. When the cost appears and breaks above $1.26, the rally could achieve $1.33 after which $1.46.

Unlike this assumption, when the cost slips below $1.20, the following stop might be in the 20-EMA. If the support also cracks, the decline could include the 50-SMA.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.