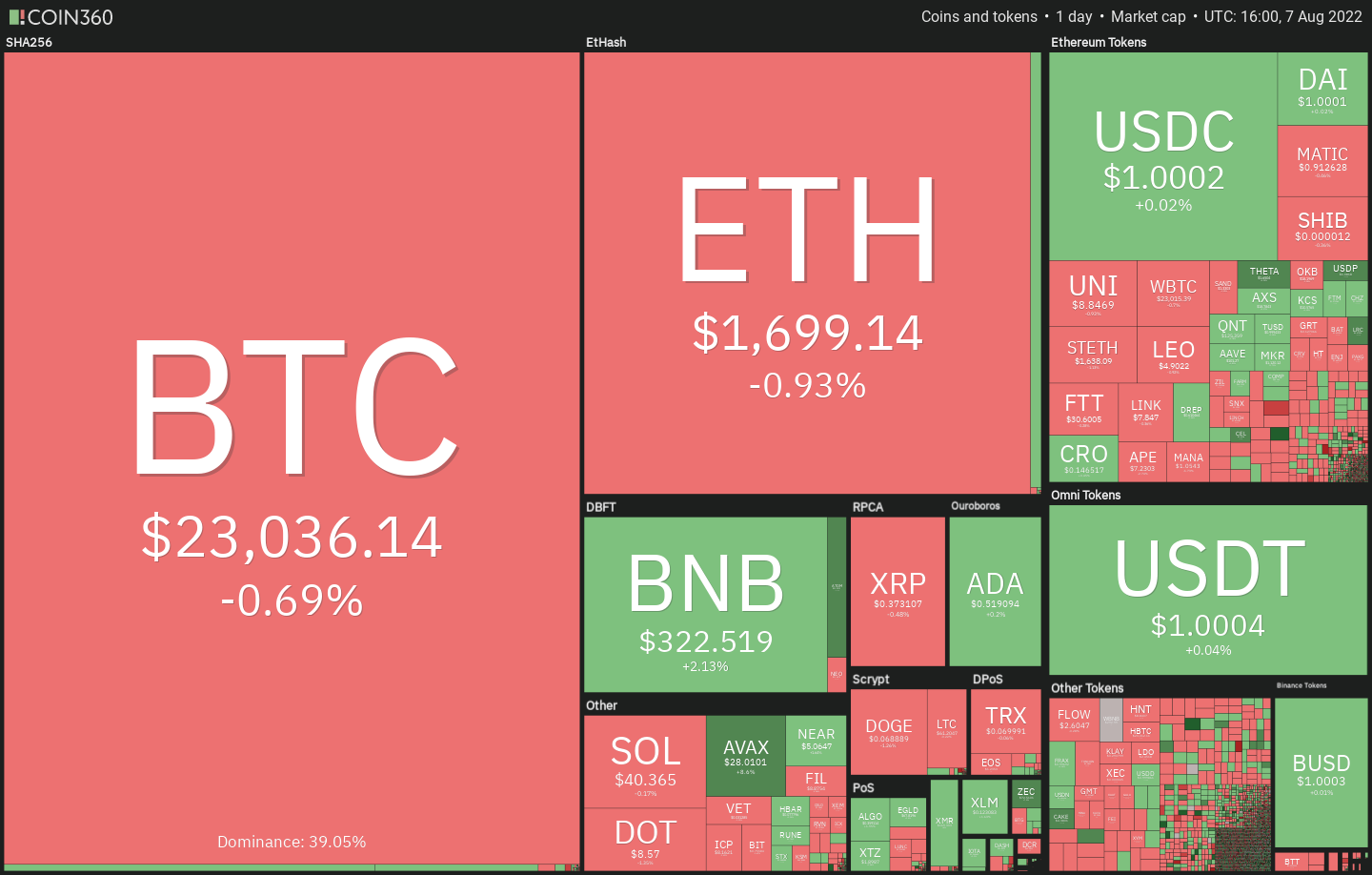

The U . s . States jobs data on August. 5 was above market expectations, indicating that inflation hasn’t cooled lower. The strong figures reduce the chance that the U.S. Fed will slow lower its aggressive pace of rate hikes. Following the release, the probability of a 75 basis points hike in September has risen to 68%, according to CME Group data.

However, analysts at Fundstrat Global Advisors possess a different view. They highlighted that three from six occasions, the S&P 500 bottomed out six several weeks prior to the Fed’s last rate hike. Therefore, the firm anticipates the S&P 500 to witness a powerful rally to 4,800 within the other half of the season.

When the tight correlation between your equities markets and also the cryptocurrency markets maintain, the recovery within the crypto markets might have more room to operate. On-chain monitoring resource Material Indicators stated inside a Twitter on August. 5 when Bitcoin (BTC) increases above $25,000, there’s no major resistance up until the $26,000 to $28,000 range.

Could Bitcoin climb over the overhead resistance and extend its recovery, pulling select altcoins greater? Let’s read the charts from the top-5 cryptocurrencies that could outshine soon.

BTC/USDT

Bitcoin continues to be buying and selling near to the 20-day exponential moving average (EMA) of $22,719 within the last couple of days, indicating a difficult fight between your bulls and also the bears. Even though the bulls have held the amount, they haven’t yet had the ability to acquire a strong rebound off it. This signifies too little demand at greater levels.

Both moving averages have flattened out and also the relative strength index (RSI) is simply over the midpoint, indicating an account balance between consumers. The benefit could tilt in support of the buyers when they push and sustain the cost above $24,668.

When they manage to achieve that, the BTC/Tether (USDT) pair could rally to $28,000 after which to another overhead resistance at $32,000.

Unlike this assumption, if bears pull the cost underneath the 20-day EMA, the happy couple could decline towards the 50-day simple moving average (SMA) of $21,719. If the support also gives way, the following stop may be the upward trend line.

The cost is stuck between $22,400 and $23,648 around the 4-hour chart. Both moving averages have flattened out and also the RSI is close to the midpoint, indicating an account balance between demand and supply. If bulls drive the cost above $23,648, the happy couple could rise towards the overhead resistance at $24,668.

On the other hand, when the cost turns lower and breaks below $22,400, it’ll tilt rapid-term advantage in support of the bears. The happy couple could then decline towards the upward trend line, that could behave as a powerful support.

FLOW/USDT

The tight range buying and selling in Flow (FLOW) resolved towards the upside using the range expansion on August. 4. This signifies accumulation at ‘abnormal’ amounts and the beginning of a brand new up-move.

The bears are trying to stall the up-move near $3.00 however a minor positive would be that the bulls haven’t quit much ground. This signifies that traders aren’t hastening to reserve profits following the recent rally.

The 20-day EMA of $2.07 has began to show up and also the RSI is close to the overbought zone, indicating that bulls possess the upper hands. If buyers drive the cost over the $3.00 to $3.30 resistance zone, the FLOW/USDT pair could get momentum and rally toward $4.60.

The happy couple has switched lower in the overhead resistance near $3.00 but is finding support in the 20-EMA around the 4-hour chart. If bulls push the cost above $2.80, the happy couple could retest the overhead resistance at $2.99. A rest above this level could signal the resumption from the upward trend.

Alternatively, when the cost slips underneath the 20-EMA, the happy couple could drop towards the 50% Fibonacci retracement degree of $2.41, after which towards the 61.8% retracement degree of $2.27. A rest below this level could tilt the benefit in support of the bears and sink the happy couple to $2.00.

THETA/USDT

Theta Network (THETA) broke and closed over the stiff overhead resistance at $1.55 on August. 5, indicating the range had resolved in support of the bulls. The bears attempted to sink the cost back underneath the breakout level on August. 6 however the bulls held their ground.

The 20-day EMA of $1.39 has began to show up and also the RSI is incorporated in the positive territory, indicating benefit to buyers. If bulls sustain the cost above $1.65, the THETA/USDT pair could begin a new upward trend toward the pattern target of $2.10. This level may pose a powerful challenge but when bulls obvious this overhead hurdle, the happy couple could extend its rally to $2.60.

To invalidate this positive view, the bears will need to pull and sustain the cost below $1.55. In the event that happens, the aggressive bulls could get trapped and also the pair could slide towards the moving averages.

Some-hour chart implies that the bulls purchased the dip towards the 20-EMA, indicating buying on dips. Both moving averages around the 4-hour chart are sloping up and also the RSI is close to the overbought territory, indicating the road to least resistance would be to the upside. If bulls keep up with the cost above $1.65, the up-move may resume.

The very first manifestation of weakness is a break and shut underneath the 20-EMA. In the event that happens, the happy couple could drop towards the 50-SMA. The bears will need to sink the cost below this level to signal the upward trend might have ended soon.

Related: What’s Chainlink VRF and just how do you use it?

QNT/USDT

Quant (QNT) designed a strong recovery from the intraday low of $40 made on June 13. The bears attempted to stall the up-move at $115 however the bulls strongly purchased the dip underneath the 20-day EMA of $103 on This summer 26.

The bulls maintained their momentum and pressed the cost over the overhead resistance at $115 on August. 6. This indicated the resumption from the upward trend. The QNT/USDT pair could rally towards the overhead resistance zone between $154 to $162 in which the bears may mount a powerful defense.

Alternatively, when the cost turns lower in the current level, the bulls will endeavour to switch the $115 level into support. In the event that happens, the happy couple could resume its upward trend. The bears will need to sink and sustain the cost underneath the 20-day EMA to achieve top of the hands.

The happy couple is within an upward trend however the RSI around the 4-hour chart leaped in to the overbought territory, indicating the potential of an almost-term correction. The bulls are anticipated to purchase the dips towards the 20-EMA. When they do this, it’ll claim that the sentiment remains positive and traders are purchasing on dips. That will raise the probability of the resumption from the upward trend.

On the other hand, when the cost turns lower in the current level and breaks underneath the 20-EMA, the happy couple could slide towards the 50-SMA. It is really an important level to keep close track of just because a break below it could cause an autumn to $100.

MKR/USDT

Maker’s (MKR) recovery is facing stiff resistance near $1,100 however a positive sign would be that the bulls haven’t permitted the cost to dip underneath the 20-day EMA of $1,044.

The moving averages are sloping up and also the RSI is incorporated in the positive territory, indicating that buyers possess the upper hands.

If bulls push and sustain the cost over the overhead resistance zone between $1,100 and $1,188, the MKR/USDT pair could rally to $1,400 after which towards the pattern target of $1,570. This type of move will claim that the happy couple might have bottomed out.

Unlike this assumption, when the cost turns lower in the overhead resistance and breaks underneath the 20-day EMA, the happy couple could slide towards the trendline. A rest and shut below this level will invalidate the bullish setup.

The happy couple has created a symmetrical triangular around the 4-hour chart. The 20-EMA is sloping up progressively and also the RSI is incorporated in the positive zone, indicating a small benefit to the bulls.

If buyers drive the cost over the resistance line, the happy couple could rally towards the overhead resistance at $1,188. A rest and shut above this level could indicate the resumption from the upward trend.

On the other hand, a rest underneath the support type of the triangular could tilt the benefit in support of the sellers. The happy couple could then decline towards the mental level at $1,000.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.