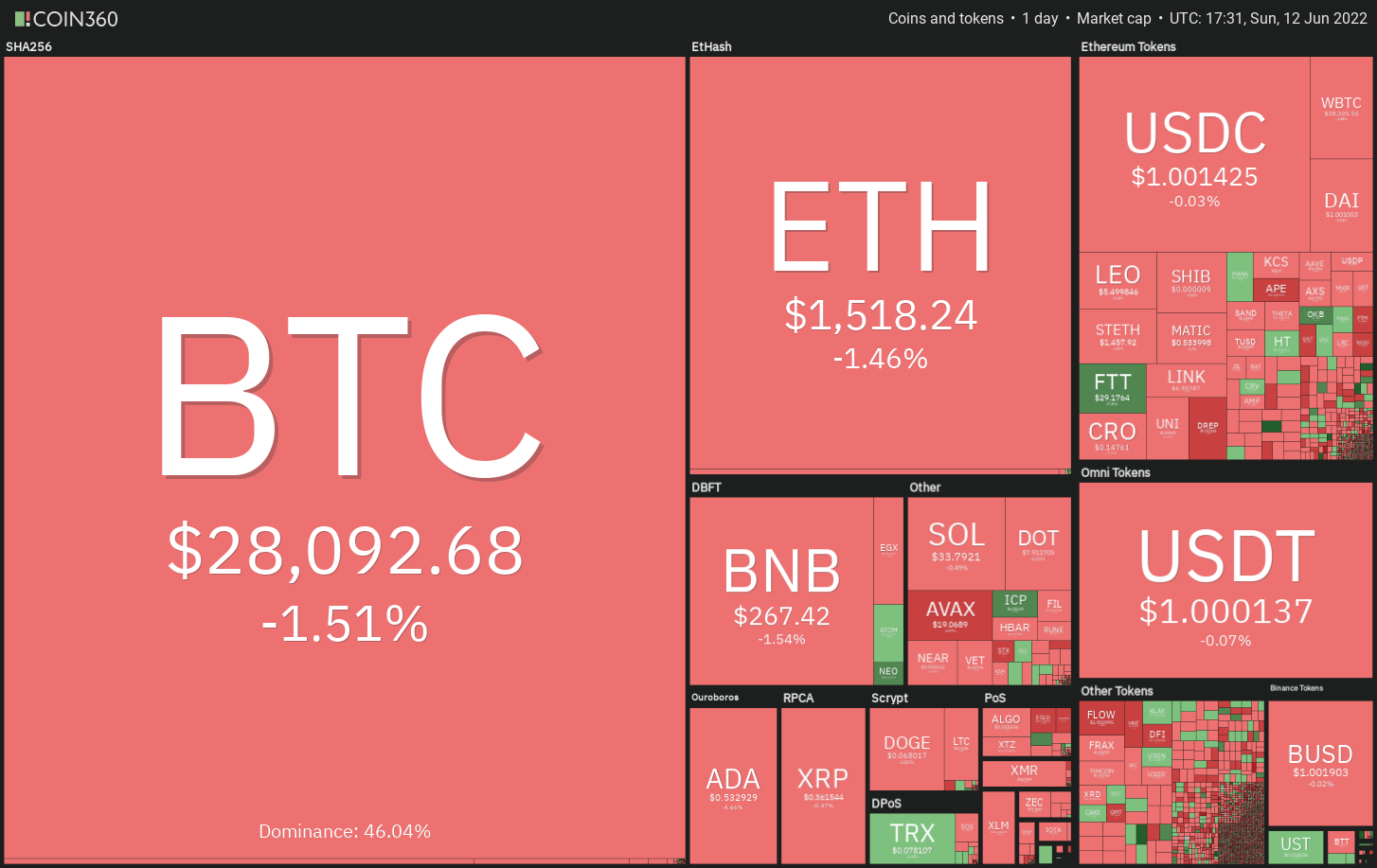

Bitcoin (BTC) is threatening to decrease to the worst weekly close since December of 2020. The crypto financial markets are in are held firmly inside a vice grip, and also the selling faster carrying out a greater-than-expected inflation report in the U . s . States on June 10.

It isn’t just the crypto markets which are facing the brunt, even U . s . States equities markets finished a few days ending June 10 with sharp losses. Dangerous assets may remain volatile soon as traders await the end result from the U.S. Federal Open Market Committee meeting on June 14 and June 15.

Bloomberg Intelligence senior goods strategist Mike McGlone cautioned when the stock markets still drop, it will signal that many assets might have seen their peak exuberance previously 2 yrs.

Could Bitcoin find support at ‘abnormal’ amounts and can that attract buying in select altcoins? Let’s read the charts from the top-5 cryptocurrencies that will probably progress when the sentiment improves.

BTC/USDT

Bitcoin broke underneath the trendline on June 10, which negated the developing climbing triangular pattern. The bears maintained their selling pressure and pulled the cost underneath the strong support of $28,630 on June 11.

The lengthy tail around the June 12 candlepower unit implies that bulls are trying to defend the support at $26,700. If buyers propel the cost back over the breakdown degree of $28,630, it’ll claim that the BTC/Tether (USDT) pair may remain range-bound between $32,659 and $26,700 for a while.

However, when the cost turns lower from $28,630, it’ll claim that bears have flipped the amount into resistance. That may increase the potential of a rest below $26,700. In the event that happens, the selling could intensify, and also the pair may drop to $22,000 and then to $20,000.

The happy couple rebounded dramatically from $26,890, indicating aggressive buying close to the crucial degree of $26,700. The bulls will endeavour to push the cost back over the breakdown degree of $28,630. In the event that happens, the following stop may be the 50-simple moving average (SMA). A rest and shut above this level could obvious the road for any possible rally to $32,000.

The downsloping 20-exponential moving average (EMA) and also the RSI within the negative zone indicate that bears possess the upper hands. When the cost turns lower from $28,630, the bears can make yet another make an effort to sink the happy couple below $26,700 and resume the downtrend.

FTT/USDT

FTX Token (FTT) has been around a downtrend within the last several several weeks, however the RSI has created an optimistic divergence, indicating the bearish momentum might be weakening.

The bulls pressed the cost over the 20-day EMA of $29 on June 9 but tend to not sustain the greater levels. The bears pulled the cost back underneath the 20-day EMA, however the bulls didn’t quit much ground. Sustained buying through the bulls has pressed the cost over the resistance on June 12.

The FTT/USDT pair could rally towards the 50-day SMA of $32 and when this level is entered, the up-move may achieve $35. This positive view could invalidate when the cost turns lower and breaks below $25. This type of move will suggest the beginning of the following leg from the downtrend.

Some-hour chart shows the development of the inverse mind and shoulders pattern which will complete away and shut over the neckline. In the event that happens, the happy couple could begin a new up-move toward the pattern target of $34.

On the other hand, when the cost does not sustain over the neckline, it’ll claim that bears will not forget about their advantage. The sellers will attempt to pull the cost below $26. When they succeed, the happy couple could slide to $25.

XTZ/USDT

Tezos (XTZ) rose over the 50-day SMA of $2.14 on June 9, however the bulls couldn’t build this strength. This means the bears are active at greater levels.

Strong selling through the bears pulled the cost underneath the moving averages and also the XTZ/USDT pair dropped towards the crucial support zone of $1.61 to $1.45. When the cost rebounds off this zone, the bulls will again attempt to push the happy couple over the 50-day SMA and challenge the overhead resistance at $2.36.

This positive view could invalidate when the cost continues lower and slips underneath the support zone. In the event that happens, the happy couple could resume its downtrend and drop toward the mental degree of $1.00.

Some-hour chart shows the cost is stuck within the range from $2.30 and $1.61. Usually, once the cost consolidates inside a range, traders buy close to the support then sell near to the resistance. It is exactly what happened, as seen in the rebound off $1.61.

The bears may sell on rallies towards the 20-EMA, but when bulls obvious this hurdle, the probability of the happy couple rising to $2.30 increases. To invalidate this view, bears will need to sink and sustain the cost below $1.61. In the event that happens, the happy couple may drop to $1.45.

Related: Ethereum cost enters ‘oversold’ zone the very first time since November 2018

KCS/USDT

KuCoin Token (KCS) rallied dramatically from the May 12 intraday low of $9.50 and arrived at $18 on May 31. This sharp up-move might have enticed short-term traders to reserve profits, which began the present correction.

The buyers will attempt to protect the zone between your 50% Fibonacci retracement degree of $13.75 and also the 61.8% retracement degree of $12.75. When the cost rebounds off this zone, the bulls will endeavour to push the KCS/USDT pair over the moving averages.

When they manage to achieve that, it’ll claim that the correction might be over. The happy couple could then retest the critical resistance at $18.

Alternatively, when the cost continues lower and breaks below $12.75, it’ll claim that traders might be hurrying towards the exit. That may increase the potential of one hundredPercent retracement to $9.50.

The bulls tried to stall the decline near $15 however the bears ongoing their selling and pulled the cost underneath the support. Even though the cost is buying and selling below $15, a small positive would be that the bulls haven’t permitted the bears to increase the decline.

The buyers will endeavour to push the cost back above $15 and also the 20-EMA. When they succeed, it’ll claim that ‘abnormal’ amounts still attract strong buying. That may push the cost to $16.30 and then to $17.

On the other hand, when the cost turns lower from $15, it’ll claim that bears have flipped the amount into resistance. That may open the doorways for any further decline towards the $14 to $13.50 zone.

HNT/USDT

Helium (HNT) has been around a downtrend within the last several several weeks. The buyers attempted a recovery and pressed the cost over the 50-day SMA of $10.86 on June 9, however the bears had other plans.

The bears offered strongly at $12.50 on June 10 and trapped the aggressive bulls. That brought to lengthy liquidation, which pulled the cost back underneath the 20-day EMA of $9.69 on June 11. The bulls will endeavour to stall the decline in the strong support at $8 and form a greater low.

When they manage to achieve that, the HNT/USDT pair will again make an effort to go above the moving averages and challenge the resistance at $12.50.

This positive view could invalidate soon when the cost breaks below $8.00. In the event that happens, the happy couple could slide towards the May 12 intraday low of $6.54. A rest below this level will suggest the resumption from the downtrend.

The break and shut below $11 intensified selling and led to a waterfall decline. The moving averages have finished a bearish crossover, and also the RSI is incorporated in the negative territory, indicating a benefit to bears.

The make an effort to begin a recovery is facing strong resistance near $9.50. If the level is entered, the following hurdle could be the 20-EMA. A rest above this resistance would be the first sign the selling pressure might be reducing.

Alternatively, when the cost turns lower in the overhead resistance and breaks below $8.50, the happy couple could drop towards the strong support at $8.00

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.